Interview with Gaurav Jain, Director at Hem Securities.

Uttaresh Venkateshwaran, Sunil Matkar | Apr 06, 2018 03:19 PM IST | Source: Moneycontrol.com

While the market may have fallen around 10 percent from its peak, experts such as Gaurav Jain, Director, Hem Securities believe that the worst may be over now.

“In the next quarter, the market should settle and then a pullback is likely,” Jain told Moneycontrol’s Uttaresh Venkateshwaran & Sunil Shankar Matkar. He expects largecaps to move ahead and midcaps will play catch-up.

He expects a broad-based pick up in the market going ahead. “In the past few days, a few stocks have risen, which have pushed the market. We should start seeing a pick-up in many more stocks. Essentially, people are not in a panic stage, while retail investors have looked to book profits and are not in a hurry to invest,” Jain further added. Edited excerpts:

The market has been trading off the previous high points. What is the outlook for D-Street going ahead?

Over the last quarter, we saw events such as the Union Budget, which introduced taxes on long term capital gains (LTCG). Global markets reacted negatively, while big IPOs also sucked liquidity from the market, among other factors. As such, the market had a good run up in the past two three quarters.

In the next quarter, the market should settle and then there could be a pullback. Next quarter should be of accumulation and positive movement.

So, what kind of returns are you expecting from this market?

We are in an election year. So, the market could behave differently with results coming on. Overall, for FY18 we are looking at 8-10 percent returns.

What can be seen as triggers for this market?

Firstly, many companies’ results were affected in one quarter on the back of Goods and Services Tax (GST). With new GST Bill coming in full flow, it should give positive flow for most sectors. Even as the e-way bill is introduced, some companies could face some issues at the start and then gradually get comfortable with it.

Secondly, look at growth visibility in the Sensex and Nifty. Several managements are hinting at positive cues. Earnings could improve and several companies have done their expansions on their side.

Lastly, we have to wait for how monsoon pans out. So, overall there is positive momentum and investors are quite bullish on India even at this point.

Does that mean we could go back to the record high levels?

Probably…

What are you hearing on private capex plans? Are they willing to spend on that front as well?

Most companies, the big ones especially, have done their share of capital expenditure. One important reason why this is happening is due to change in technology that is erupting. For instance, look at telecom sector. In case Reliance Jio comes up with a new technology, rivals also tend to counter those. In case of textiles, many things have happened and firms are adding up more technology and machines. With changing technology, fast-growing companies need to adapt to it and they are deploying resources in those areas.

Could you throw some light on the state of midcaps? How do you expect them to perform going forward?

Largecaps should start moving first, going forward, followed by midcaps. Investors currently are playing conservative as they saw their stocks bleeding all through the last quarter. Hence, the money is going into largecaps right now.

But what about valuations for several segments in the market…how did the IPO market perform in FY18?

Look at the number of IPOs that came up with multiples of 30 and 40 times. Fund managers that we spoke to are talking about large systematic investment plans (SIPs) that have to be deployed into such stocks and that is probably why such high multiples were seen.

In FY17, we saw around 37 IPOs hitting the market and this figure could be higher this fiscal, looking at the prospectuses filed and information available from merchant bankers. Also, IPO sizes are a lot larger now.

But will investors have the appetite going forward?

Institutional investors will have it. They will always look at beaten down stocks and they also do not have issues with funds.

Currently, retail investors are investing less. If they have Rs 100 with them, they are looking to invest Rs 20 right now. In fact, many retail investors have booked profits in the past quarter.

Is there much downside from the current market levels?

I don’t think so. The worst should already be over. In the past few days, a few stocks have risen, which have pushed the market. We should start seeing a pick-up in many more stocks. Essentially, people are not in a panic stage, while retail investors have looked to book profits and are not in a hurry to invest.

So, what will your advice be to a 35-40-year old investor?

They must invest in mutual funds. But you could also do it making money by directly investing in equity markets as well.

What sectors are you looking at currently?

We expect pharmaceuticals to perform, while it could be a challenge in case of information technology names.

You can look at infrastructure sector as well. These companies are flooded with orders.

On banks, it is clearly not the case that all PSU banks are bad. Right now, people are not trusting PSU banks and private banks are usually considered more transparent.

It is a play on perception and that could be seen in cases of a recent listing such as Bandhan Bank. The IPO came at a very good multiple and still listed at good returns. These are companies with professional management which are growing along with having fast execution and chasing for business. As such, we were seeing a shift to private sector banks, but currently investors also do not know about hidden concerns in PSU banks too.

LTCG tax on equities has become a reality now. Are you getting queries about it and what are you telling them?

I think the sentiment around it has been already digested in the market. People are taking in the transition in stock market. I feel that this is not an issue at this point.

How much of a risk is political scenario for the market?

The market tends to be very volatile on political instability. As soon as there are chances of dent to existing government, it starts reacting. The question is not about which government, but about a stable one. This is important from a foreign investor perspective. These would have regular impact but not larger level…the market will make a comeback once the elections are over.

As we move into end of this year (and closer to general elections), investors may hold for couple of months to understand what is happening (on the political front).

On the global front, any statement from the US with respect to protection of its own trade boundaries is a major risk for the market.

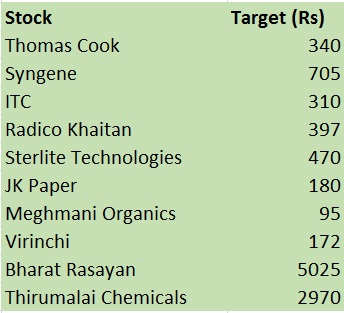

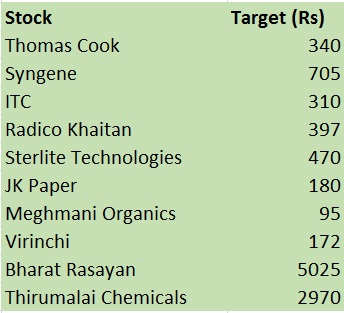

Lastly, what are your top stock picks for FY19?

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.