Tagged: Diversified Mutual Fund

ATM :: Best balanced funds to invest in for medium-term financial goals

By Babar Zaidi | ET Bureau | Aug 22, 2016, 01.56 PM IST

Investors saving for goals that are 4-6 years away are advised to go for balanced funds. These funds invest in a mix of equities and debt, giving the investor the best of both worlds. The fund gains from a healthy dose of equities but the debt portion fortifies it against any downturn. They are suitable for a medium-term horizon. Mumbai-based Koyel Ghosh has been investing in a balanced scheme for the past two years for funding her entrepreneurial dream. She will need the money in about 2-3 years from now.

“I want to save enough to be able to start my own business in 2-3 years.”

What she has done

She has been investing in an equity-oriented balanced fund for the past two years. She should redirect future SIPs in a debt-oriented scheme to reduce the risk.

Balanced funds are of two types. Equity-oriented have a larger portion of their corpus (at least 65%) invested in stocks and qualify for the same tax treatment as equity funds. This means any gains are tax-free if the investment is held for more than one year. These schemes are more volatile due to the higher allocation to stocks.

On the other hand, debt-oriented balanced funds are less volatile and suit those with a lower risk appetite. However, the price of this relative safety is that they offer lower returns and the gains are not eligible for tax exemption. If the investment is held for less than three years, the gains will be added to your income and taxed at the normal rate. The tax is lower if the holding period exceeds three years. The gains are then taxed at 20% after indexation benefit, which can significantly reduce the tax.

Balanced funds have done very well in recent months because both the equity and debt markets have rallied in tandem. But this performance might not sustain, so investors should tone down their expectations. Also, investors might note that the one-year returns of debt-oriented balanced funds are more than those from equity-oriented schemes. But this changes when we look at the medium- and long-term returns. The five-year returns of the top five equity-oriented balanced funds are significantly higher than those of debt-oriented balanced schemes. This statistic should be kept in mind if the investor plans to remain invested for 4-6 years.

Beware of dividends

Balanced funds have attracted huge inflows in recent months, but some of this is for the wrong reasons. Some fund houses are pushing balanced schemes that offer a monthly dividend. This might sound attractive because dividends are tax-free, but in reality this is your money coming back to you. Unlike the dividend of a stock, the NAV of the fund reduces to the extent of the dividend paid out.

Also, experts view this as an unhealthy practice and point out that the dividend payout might not be sustainable. “The dividend is not guaranteed, and the fund is under no obligation to continue paying a dividend,” points out Amol Joshi, Founder, PlanRupee Investment Services. “If the market declines, the chances of dividend payout and the quantum of dividend will be lower.”

Even so, several fund houses are using this gimmick to attract investors. In some cases, fund houses have even told distributors to alert clients about future dividend announcements and reel them in. This is also an unhealthy practice aimed at garnering AUM by mutual funds.

What the investor wants

*Moderate risk to capital

*Higher returns than debt

*Flexibility of withdrawal

*Favourable tax treatment

Source: https://goo.gl/xdvMoG

ATM :: Concentrated equity schemes delivered better returns

AASHISH SOMAIYAA | Tue, 5 Jul 2016-06:35am | dna

Do you know why technology giant Apple has been able to earn the numero uno position among its peers and scale new peaks every year? It was a result of a small change which won big results for the company.

When Steve Jobs took over reins the second time around, he shrunk the company’s product basket to five core products as he felt that lighter the product bouquet the faster the company would be able to sprint.

Critics would claim that a limited product basket increases the chances of heavy losses if even one product fails to click with buyers. But Jobs proved them wrong and he wasn’t the only one to follow a focused approach.

Legendary tales of the focused approach are often recounted in the world of equity investments too. Celebrated equity investor Warren Buffett has demonstrated the miracle of betting on few horses than is usually advocated.

The top five investments made up nearly 65% of his total portfolio.

But aren’t lay investors incessantly nudged not to put all eggs in one basket? Well, results thrown up by our research concludes that splitting the eggs in too many baskets – also termed as diversification in – doesn’t always reduce the risk.

Putting all your eggs in the same basket means you should have identified the right basket and you should work overtime to ensure that basket is safe. On the other hand, putting your eggs into too many baskets in the name of diversification puts an onus on you to identify many more baskets.

The study of risk associated with open-ended equity schemes measured using standard deviation strongly points out that a broader portfolio doesn’t reduce risk. Standard deviation captures the performance swings of a scheme. The higher the fluctuations in a fund’s returns the greater will be its standard deviation. So, if a fund has an average return of 15% with a standard deviation of 4% then most of the times the returns of the fund would be between 11% (15%-4%) and 19% (15% +4%).

For the ease of comprehension, we call the schemes that held less than 25 stocks as focused, the ones that held 25-50 stocks as diversified and those beyond 50 stocks as over-diversified (they should be really called “spray-and-pray” because no one can profess to thoroughly conduct bottom-up research on over 50 companies at the same time).

The data shows that focused or concentrated portfolios (having less than 25 stocks) have generated higher average returns and their standard deviation as a measure of volatility is not significantly higher than the other schemes. On the other hand, there’s nothing to really pick between schemes that were supposedly diversified and had between 25 to 50 and over 50 stocks as two separate groups. In fact, the average return for >50 group is same as the 25-50 group and there is no decline in standard deviation as a measure of volatility.

If we peg this standard deviation against the returns, we realise that there is more to gain by following a focused equity strategy. Concentrated equity schemes delivered better returns and were even able to curtail the downside during the shorter period as compared with the mixed bag schemes. In turn, these mixed bags were able to steer past equity schemes that had a larger universe of stocks.

What is ailing diversified schemes? They are facing what can be termed a problem of plenty. Splitting the apples into too many baskets forces the fund manager to spend more time on monitoring each basket rather than picking up the right apples.

If the fund manager has fewer stocks to scrutinise day-in-day-out and track monthly toplines and quarterly results, he would be able to allocate more time to cherrypick the right horse that would lead him to victory. We all know one cannot change a horse mid-race.

This impact of concentration on portfolio returns has been studied by several analysts. Most recently, Joop Huij and Jeroen Derwall analysed the performance of 536 global equity funds over the period of 1995-2007 and noted their findings in the report ‘Global Equity Fund Performance, Portfolio Concentration, and the Fundamental Law of Active Management.’ They concluded, “Evidence from US equity mutual funds suggests that fund managers who are willing to take big bets and hold more concentrated portfolios display better performance than managers who hold more broadly diversified portfolios.”

It is worth noting here that a fund house widened the cap of 30 stocks held by its focused scheme in 2010 to accommodate 50 stocks. The performance of the scheme among its peers slipped ever since it expanded its portfolio.

The reason is simple. If you have a limited basket to invest you would place your best bets only after doing adequate research as one wrong move could abysmally impact the returns. One can draw similarities between a fund manager and a gardener, who has to choose a handful of plants for the given area. He would always handpicked the most rewarding plants leaving out the rest as he wouldn’t want the fertility and his efforts to be wasted on plants, which merely occupy space.

Similarly, a focused scheme’s fund manager would dive in only if he is convinced about the business. He/she would be privy to superior information about specific market segments and players. He would then invest and nurture for long them to bear the fruits. Unless he sows a higher area (read high concentration in stocks), he won’t be able to multiply the profits well.

As the Oracle of Omaha, who detested diversification, once said, “Wide diversification is only required when investors do not understand what they are doing.”

Now that you are convinced about the focused fund’s strategy, don’t just jump into any scheme. Analyse whether the portfolio is suitably invested across sectors to protect your investment from business-cycle related liquidity issues which could drag your portfolio returns. As Huij and Derwall point out in their report, “Funds with a high tracking-error level outperform only when they are concentrated in multiple market segments simultaneously.”

The writer is CEO of Motilal Oswal AMC

Source: http://goo.gl/D2jfVi

ATM :: Do auto-switch funds give better returns?

While long-term returns of these funds may be subdued compared to diversified equity MFs, they are less volatile

Kayezad E. Adajania | Last Modified: Thu, Oct 15 2015. 08 19 PM IST | LiveMint

How do you make money in a market that goes up, say, 9% (2013) one year, then shoots up 30% (2014) in the next, and then comes crashing down the following year (by 2.42% so far this year)? The tried and tested way is to allocate assets properly; and invest in equities and debt as per your risk profile and market movements. But that’s easier said than done, isn’t it?

Let’s see how balanced funds—these invest across equities and debt—have performed. Between February 2014 and January 2015, the category returned 42% on an average. But since February 2015 till date, the category lost 1.12%.

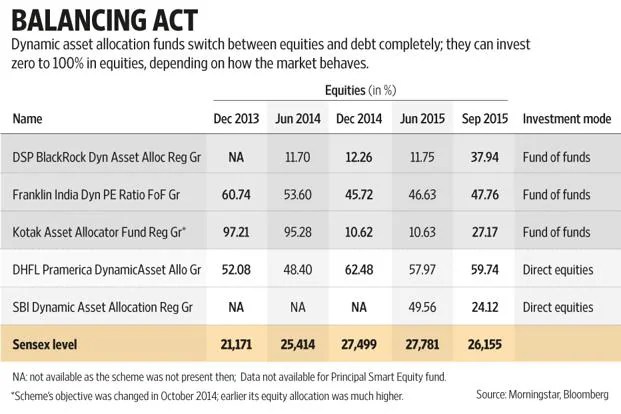

But there’s another animal that does asset allocation more efficiently than balanced funds. They’re called dynamic asset allocation (AA) funds. As against balanced funds, which maintain a steady balance of equity and debt split, or even diversified equity funds, which always remain invested in equities, dynamic AA funds switch between equities and debt completely; they can invest zero to 100% in equities, depending on how markets behave. But does such dynamism help?

Version variety

Although all dynamic AA funds switch between equity and debt, not all behave the same way. Funds such as Franklin India Dynamic PE Ratio Fund of Funds (FDPE) and Principal Smart Equity Fund (PSEF) switch based on the price-equity ratio (P-E) of the CNX Nifty index. A P-E ratio, to put it simply, indicates if equity markets are overvalued or undervalued. Higher the P-E, more the markets are considered overvalued; and lower will be these funds’ equity allocation.

DSP BlackRock Dynamic Asset Allocation Fund (DBDA) looks at the yield gap formula. It is calculated by dividing the 10-year government security’s yield by earnings yield of Nifty. The numerator is a proxy for debt markets, and the denominator is a proxy for equity markets. So, the ratio looks at how cheap or expensive equities are when compared to debt markets. If the number is high, it means expected returns from equities are low, and so a higher allocation to debt is necessary.

While PSEF invests directly in equities and debt, funds such as FDPE and Kotak Asset Allocator Fund (KAAF) are fund of funds (FoFs); they invest in other MF schemes. All these FoFs invest in in-house schemes. In cases like FDPE, the schemes are sacrosanct. But schemes like KAAF have earmarked multiple schemes for their debt and equity allocation. “Once the quant model decides the equity-debt split, the fund management team decides which funds (large-cap, mid-cap and so on) the FoF will invest in,” said Lakshmi Iyer, chief investment officer (debt), Kotak Mahindra Asset Management Co. Ltd.

Have they delivered?

Of all the dynamic AA funds, only three have been around for a significant period of time— FDPE, launched in October 2003; PSEF and DHFL Pramerica Dynamic Asset Allocator Fund (DPDA), both launched in December 2010. In rising markets between February 2014 and January 2015, FDPE and DPDA returned 33.27% and 26.68%, respectively, finishing in the bottom quintile of the moderate allocation category, as per data provided by Morningstar, a global MF research firm and data tracker. Morningstar classifies all schemes where equity allocation is between 30% and 75% in this category.

Fortunes changed in 2015, when markets started to fall. KAAF (3.51%), DBDA (2.06%) and FDPE (1.30%) finished in the top quintile between February 2015 and 12 October 2015. But on an average, the category lost 1.12% in the same period.

“There is a myth that people come to mutual funds for high returns. If that were the case, then so much money wouldn’t be invested in fixed deposits. Investors want a good experience. Returns are important, but if a fund is able to give a solution, like rebalancing, and return decent money over long periods of time, investors are happy,” said Kanak Jain, mentor, Ask Circle Mutual Fund Round Table India, one of the country’s largest MF distributor association.

Most of the funds are new in this space so we don’t have long-term data on whether these models have worked or not.

For instance, DBDA, which uses the yield-gap model, was launched only in February 2014. The good news is that months after its equity allocation being static at about 12% since launch, it moved up to 29% in August earlier this year when markets sank sharply, and to about 38% in September, when the Reserve Bank of India cut interest rates.

“The formula did exactly what it was supposed to do, and at the right time,” said Ajit Menon, head-sales and co-head-marketing, DSP BlackRock Investment Managers Pvt. Ltd. Menon admitted it was unnerving that the formula didn’t budge all of last year and most part of this year as well. “But last year, the equity rally was a ‘hope’ rally; there wasn’t much change on the ground,” he said.

While long-term returns may be subdued as compared to that of diversified equity funds, these funds are less volatile. We looked at standard deviation, a measure of a fund’s volatility.

According to Morningstar, average standard deviation of moderate allocation, flexi-cap and large-cap funds together was 11.94, while that of all dynamic AA funds was between 1.95 and 7.19; which is among the lowest.

“The risk-return combinations are important. These funds help significantly reduce volatility in your portfolio,” said Janakiraman R., portfolio manager-Franklin Equity, Franklin Templeton Investments–India.

Mind the tax gap

One drawback that dynamic AA funds have is in terms of taxation. On account of being FoFs, they are classified as debt funds and taxed accordingly, even if they are equity-oriented.

If you sell your debt funds within three years, you pay taxes as per your income tax rates on your gains. The threshold to claim tax benefit on long-term capital gains is three years, and even then, long-term capital gains tax is 20% (with indexation benefits).

That’s one reason why KAAF changed its objective, in October 2014, from being just an equity FoF to one that dynamically allocates its money to debt and equity, based on a certain formula.

“Earlier, all our investments were going in equity funds and yet KAAF was considered a debt fund. A dynamic asset allocation model, therefore, is superior,” said Iyer, adding that an “unfavourable tax structure” has been one of the biggest impediments to this product becoming popular with investors.

Should you invest?

Not all financial planners recommend dynamic AA funds because they feel it is their prerogative to do their client’s asset allocation. But quite a few planners have warmed up to such funds.

Yogin Sabnis, managing director, VSK Financial Consultancy Services Ltd, is a fee-based planner who still manages a motley group of investors from his early days when he didn’t charge fees. Such investors, he explains, either don’t require much financial planning or hesitate to shift to paying fees. Such clients, he said, are advised to invest in dynamic AA funds. “I don’t recommend this product to my fee-based clients because I do their asset allocation. But if someone wants a one-off advice, this is one of the first recommendations because with these funds, even if the customer doesn’t consult an adviser, the fund automatically does the rebalancing,” said Sabnis.

Jain, who has systematic investment plans going on in some of these funds on behalf of two children, feels advisers and distributors should focus more on the long-term goals of clients and their servicing, and leave rebalancing to such funds. Added Janakiraman, “Usually, we do asset allocation only in extreme situations. We don’t do it all the time, which we are supposed to. These funds monitor asset allocation at all times.”

The category does not have many schemes. And the ones that are there, don’t have long-term track records. But the ones that come with a track record have largely worked so far. The yield gap model, for instance, shows promise though DBDA lacks a long-term track record.

It’s best to stick to larger fund houses and also with those that are FoFs, despite their inherent tax disadvantage. If the underlying funds come with a good track record, then the only thing you need to watch out for is the asset allocation model.

Source : http://goo.gl/dgFHiL

POW :: ICICI Prudential Indo Asia Equity Fund – a review

Nikhil Walavalkar | May 05, 2015, 05.48 PM IST | Source: Moneycontrol.com

Equity investors looking for a solution that invests in both- shares listed in Asia and India with three years time-frame, can consider this scheme as an investment

As Indian equities come under pressure and foreign institutional investors start logging out of India in search of value, the schemes investing overseas appear attractive. But not many individuals can time this move from Indian equities to foreign equities. Also lack of awareness about foreign markets is another challenge for many. Hence it makes sense to go with a scheme that offers to invest in Indian shares as well as shares listed overseas. If such a scheme comes with a good track record, it is a good investment pick. ICICI Prudential Indo Asia Equity Fund (IPIA) fits the bill and can be looked at as a core portfolio holding with a minimum three years view – longer the better.

The scheme

IPIA was launched in October 2007. As on March 31, it has an asset size of Rs 151 crore. The scheme is benchmarked against 65% CNX Nifty + 35% MSCI Asia ex-Japan Index. Sankaran Naren, Atul Patel and Shalya Shah are the fund managers of this scheme.

Asset allocation

The fund intends to invest 65% to 95% of the money in shares listed in India. Up to 35% money can be invested in Asia Equity Fund.

Portfolio composition

IPIA sticks to fund route when it comes to taking ‘Asia’ exposure. As of March 31, 25% money was invested in Eastspring Inv Asian Equity Fund. Remaining money is invested in Indian shares along with 2.7% exposure to short term debt and other current assets. Banking and finance, services and automobiles are the top three sectors with 26.18%, 10.24% and 9.08% respectively. These three sectors account for 45.5% of the scheme. There are 21 stocks in Indian stock portfolio. Hence the portfolio can be termed as concentrated portfolio if compared with other portfolios of the fund house and the industry average.

Investment strategy

Fund managers have built a portfolio that offers exposure to companies of varying sizes. Though this is a concentrated portfolio, sector diversification and focus on quality ensures that investors are not taking undue risks. The fund managers avoid taking exposure to companies that come with highly leveraged balance sheets. Fund managers believe in continuing their Asia exposure as long as they find it attractive.

Performance of the scheme

Over three and five year time period IPIA has given 26.6% and 17.7% returns respectively. The fund has beaten the category average for international funds and Nifty by a good margin. Do refer table for better understanding of the performance numbers.

Source: Moneycontrol.com / All numbers are annualized.

Returns (%)

The scheme did well compared to peers.

Source: Moneycontrol.com /All numbers are annualized.

Scheme has done well across time periods. IPIA also managed to contain downside in bad times like CY2011, when it lost 15.05% as compared to 24.62% loss in Nifty. The scheme is not solely dependent on Indian markets. This diversification has helped the fund post better risk-adjusted returns in the long term.

Risks

As this scheme invests in shares, it must be seen as a high risk investment. Exposure to mid-sized and small sized companies may cause some intermittent volatility due to concentrated bets the fund managers have taken. Sudden fall in stock markets across Asia can lead to loss of capital in this scheme. Also the scheme can underperform broader Indian equity markets in case of euphoric up-move in very short time period.

Should you invest?

For investors keen to take a three year view on Indian equities and looking for some amount of diversification beyond Indian equities, this can be a good investment vehicle. IPIA is treated like an equity fund for the tax purpose as it invests minimum 65% of money in Indian equities. If you hold on to the investments in this scheme for more than one year, capital gains earned on this scheme are tax exempt. It is better to invest through systematic investment plan to benefit from stock market volatility.

Source : http://goo.gl/pw3cfj

ATM :: Get rich without real estate

AARATI KRISHNAN | April 26, 2015 | Hindu BusinessLine

It’s a myth that real estate guarantees pots of money. If you’re young, here’s why equity funds may suit you better

There’s an abiding belief among Indians that the only investment that can make you rich is real estate. Such is the allure of getting rich through property that many people in their twenties and thirties want to take on a large home loan and sign up for their first apartment as soon as they receive their first pay cheque.

But if you’re in your twenties or thirties, it makes more sense to invest in equity or balanced mutual funds instead. Not convinced? Here’s why.

EMIs are compulsory savings. Without it, I will just spend the money.

The Equated Monthly Instalment (EMI) on your home loan is not an investment. It is a loan repayment where the lender earns interest off you. Let’s say you have booked a ₹50-lakh apartment and taken a 10-year home loan at 10.5 per cent to fund it. The EMI will amount to ₹67,467. At the end of 10 years, you would have paid a total of ₹80.96 lakh to the bank, of which ₹30.96 lakh will be the interest component alone!

For the apartment to be a truly good investment, it will have to generate a return over and above the ₹80.96 lakh you paid for (not the ₹50 lakh that most people assume). Instead, investing the same money in good equity or balanced funds will earn you a return on your capital, without incurring interest costs.

But I get to create an asset. With equities, after ten years, I may be left with nothing.

If this is your first home and you are actually living in it, it is not an asset at all, because it does not earn you any return. There has been no ten-year period in Indian stock market history when SIPs in equity or balanced funds have delivered nothing.

Between June 1992 and June 2002, which was among the worst ten-year periods for Indian markets, an SIP investment in an equity fund like UTI Mastershare delivered a 13 per cent annualised return. Again between September 1994 and 2004, a flattish period for the markets, SIPs in Franklin India Bluechip earned over 20 per cent CAGR.

That’s not enough. My friends say their property investments have gone up five or six-fold in the last seven years.

Translate that into compounded annual returns, and you will find that the returns aren’t much higher than that earned by good equity funds. To give you an example, Annanagar has been a booming locality in Chennai in the last ten years.

If you bought an apartment there at ₹40 lakh in 2001 (the previous real estate downturn), it is now worth ₹2.4 crore. That’s only a 13.6 per cent CAGR (compound annual growth rate). This is true across markets.

Data from the National Housing Board show that of 26 cities tracked, Chennai delivered maximum appreciation between 2007 and 2014, with the Residex for the city going up 3.55 times.

That’s a CAGR of 19.8 per cent. Markets such as Pune (241 per cent), Mumbai (233 per cent), Bhopal (229 per cent) and Ahmedabad (213 per cent) were other top ones. Their effective returns were 11.4 to 13.3 per cent.

Doing an SIP with a middle-of-the-road equity fund like the Sundaram Growth Fund for the same period would have fetched you a return of over 17 per cent; top performers would have earned you 20 per cent plus.

That’s all-India data. Some localities would have delivered bumper returns.

True, but how would you identify those localities in advance? This is the disadvantage of investing in real estate.

To make sufficient gains, you have to know not just the right state to invest in, but also the right city and locality within it. The same NHB data, for instance, shows that property prices in Hyderabad and Kochi have declined in seven years. Even in a locality, different transactions may yield different prices. To be sure, selecting the right mutual fund to invest in is difficult too. But with funds, you can invest based on the fund’s three-year, five-year or 10-year track record and can be assured that the price you are paying is right.

If you could diversify your property investments across many markets, your results would be better.

But given the large ticket sizes of property investments, most people end up betting much of their monthly pay cheque on just one piece of property. That’s concentration risk.

But I’ve never heard of anyone who became a millionaire by investing in equity funds.

Because mutual fund NAVs are available to you on a daily basis, there’s a temptation to over-trade. Most people who haven’t made money on equity funds are those who haven’t stayed on for ten years or more. They’ve bought funds, sold them and bought them again trying to time markets.

If you did the same with property investments (they have cycles too) you would lose money. Even long-term investors in equity funds invest too little in them.

A 15 or 20 per cent return from equity funds will seem small if only a fraction of your wealth is invested in it. While EMI commitments typically run into ₹30,000-₹70,000 a month, most people don’t venture beyond ₹1,000 or ₹5,000 SIPs.

We’re not recommending that you commit half or three-fourths of your monthly pay to SIPs in equity funds. But if you are in your twenties or thirties, you can certainly afford to commit 20 per cent.

Remember, once you sign up for a home loan, you can’t vary your EMI or stop paying it, if the property doesn’t appreciate or if you quit your job.

With an SIP, you can take a rain check in an emergency.

Source : http://goo.gl/NNgy6P

ATM :: Warren Buffett’s Success: What You Can Learn From it

Creditvidya.com | Updated On: March 28, 2015 17:56 (IST) | NDTV Profit

Warren Buffett is undeniably the most successful investor in history. His success is attributed by some to his sharp acumen and understanding of business while others call it luck. Numerous books have been written in an attempt to analyse the factors behind his extraordinary success. However, replicating similar results is no cakewalk.

Success at Mr Buffett’s rate is not a result of following a set formula. It was a continuous process which was followed. Discipline, perseverance and effective execution play a pivotal role in his success story.

Here’s a list of key factors which led to Warren Buffett’s coveted success:

Chalk up a plan

While making an investment, it is important to set a goal. Invest in value and be patient. Quoting Buffett’s famous words, “The stock market is a device for transferring money from the impatient to the patient.” So once your homework is done and a choice is made, stick to your plan.

Invest in value

“Price is what you pay, value is what you get,” Mr Buffett has said. Whether it is going in for an investment or making any other purchase, these words ring true. Looking for value is the underlying principal to be followed.

‘Plough back’ to reap benefits

Retain the earnings and invest them back into the business. The idea is to make the business grow and sustain. If earnings are taken home as dividends from a flourishing business, it does not help the very business which helps your earn and grow. Dividends are popular but they shouldn’t be the only thing one must have an eye on. It is important to track the utilisation of funds back into the business to continue growing.

Strategize and execute

When it comes to investments, figure out the cash in hand and the fixed income sources you may invest in. The returns must be enough to sustain your current lifestyle. After this is sorted, money can be invested in other options which have a possibility of high returns against high risk. The strategy adopted must ensure that investment options are balanced. As Mr Buffett has said, do not put all your eggs in the same basket.

‘Time is money’ and has to be managed accordingly

Warren Buffett has said: “The rich invest in time and the poor invest in money.” Time indeed is one commodity equally distributed to everybody. Tasks which were not related to his investment process were either delegated or eliminated. Time and energy spent on trivial tasks can be channelised on the ones topping the priority list.

Develop managerial skills

A manager sets goals for the team and drives them to achieve the goals. Keeping the team motivated, providing appropriate financial incentives and addressing any other concerns to the team’s satisfaction are few things one’s where managerial skills are put to the test. Not everybody is born as a good manager, but these skills can definitely be developed.

Learn, read, think

Warren Buffett has said investing in self is the best thing one can do. Nobody can take away talent from a person. Irrespective of economic conditions, talent will always fetch proportionate returns. The value does not deteriorate. Hence, it is important to invest in developing one’s skills. Staying updated helps one make intelligent decisions. In Mr Buffett’s wise words: “You can’t reach success in investment if you do not think independently.”

Everyday advice

Create more than one source of income. Do not depend on your job alone. Make investments to create a second source of income. Think twice before buying anything. Retail therapy does not really help in the long run. If one continues to buy things that are not needed, there will be a stretch situation someday for making necessary purchases.

Investment advice

Diversify the portfolio. It is important to balance investments on basis of fixed income, returns and risks. Also, tread cautiously while taking risks. In Mr Buffett’s words: “Never test the depth of river with both feet.” This means you should only invest in the businesses you understand completely.

Be your own adviser

Many people make investment decisions based on other people’s opinions. This kind of an investment is the most risky investment irrespective of the option chosen here. The investment option chosen by a friend may be best suited for his/her lifestyle and future plans. But that does not necessarily make that option a good fit for you. So think for yourself, seek clarity on your goals and then make a wise investment choice. Like Mr Buffett has said, “A public-opinion poll is no substitute for thought.”

These rules inspired by Mr Buffett should help you in making your money-related choices. There are two golden rules quotes by Mr Buffett: “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.”

Disclaimer: All information in this article has been provided by Creditvidya.com and NDTV Profit is not responsible for the accuracy and completeness of the same.

Source : http://goo.gl/i9zdpt

ATM :: Best ways to invest for your child’s education

Sanjay Kumar Singh, TNN | Feb 2, 2015, 06.42AM IST | Times of India

Inflation may be down but a major expense of the average Indian household is growing at a fast clip. The cost of higher education is already high and rising at 10-12% a year. Children’s education is one of the biggest cash outflows that families must plan for. A four-year engineering course costs roughly `6 lakh right now.In six years, the cost is likely to touch `12 lakh. By 2027, it would cost `24 lakh to get an engineering degree.

Lifestyle inflation, too, has affected the cost of children’s education. “As your standard of living rises, it affects the decision about where you send your children for higher education,” says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors.

The question worrying Indian parents is: will they be able to fund their children’s higher education? They can, if they plan ahead and take the right steps. We look at the challenges parents face while saving for their child’s education and how they can be overcome.

Be an early bird

One obvious solution is to start saving early. The individual will not only be able to amass a larger sum, but the money will also gain from the power of compounding. A corpus of `1 crore may seem daunting, but it’s possible to save this amount with an SIP of `9,000 for 18 years in an equity fund that gives a 15% return. “Since the rate of education inflation is so high, you need compounding to work for you over a longer period,” says Vidya Bala, Head of Research at Fundsindia.com.

A delayed start not only yields a smaller corpus but can also jeopardise other financial goals. If you start investing for your child’s education in your 40s, you are likely to fall short of the required amount. Often, parents dip into their retirement savings to fill the gap, but this can be a risky move.

Choose the right option

Parents must also invest right to get optimum resturns. Equity mutual funds, for instance, have delivered average annualised returns of 16.5% in the past 10 years. However, equity investment is not everybody’s cup of tea. This year’s DSP BlackRock Investor Pulse survey shows that though Indians have a high propensity to save and invest, they still seek safety. Almost 52% of the 1,500 respondents said they wanted guaranteed returns from investments.

However, if you have 15-18 years left before your child starts college, equity funds should be the preferred invest ment for you. Over such a long period, the volatility in returns is flattened out.If you have the risk appetite, your allocation to equities can be as high as 75%. The balance 25-30% of the portfolio can be in safer options like the PPF, bank deposits and tax-free bonds.

Play it safe in the short term

If you have a time horizon of less than five years, you will have to rely primarily on fixed income instruments, which are likely to offer a lower rate of return. However, these offer guaranteed returns and safety of capital. In the short term, these factors become very important.

| Investment Options Available | ||||

| How much time you have will define your investments and asset allocation | ||||

| Age of Child | Time Available | Instruments to choose from | Cost of Education | Investment Required |

| 0 – 2 years | Over 15 years | 1. Diversified Equity Funds 2. Low cost ULIPS 3. Stocks | MBA Degree to cost 75lacs in 2033 | SIP of 9800 in equity fund will grow to 75lacs |

| 3 – 6 years | 12 – 15 years | 1. Diversified Equity Funds 2. Low cost ULIPS 3. Stocks | Medical course to cost 35lacs in 2030 | SIP of 7550 in equity fund will grow to 38lacs |

| 7 – 10 years | 8 – 11 years | 1. Diversified Equity Funds 2. Equity oriented balanced funds 3. Debt Oriented balanced funds | Law degree to cost 9.3lacs in 2023 | SIP of 6300 in balanced fund will grow to 9.3lacs |

| 11 – 14 years | 4 – 7 years | 1. Debt Oriented balanced funds 2. Debt funds 3. Recurring Deposit | Engineering course to cost 8.8lacs in 2020 | Recurring Deposit of 11600 in balanced fund will grow to 8.8lacs |

| Over 15 years | Less than 3 years | 1. Recurring Deposits 2. Debt funds 3. MIP funds | MBA Degree to cost 20lacs in 2018 | SIP of 48500 in debt fund will grow to 9.3lacs |

Review the portfolio

Once your portfolio is in place, you need to review it at least once a year.You should also check whether the amount required for meeting the goal has changed. “Education goal has two components: tuition fee and cost of living. Any of these could rise faster than anticipated. You need to find out whether the 12% inflation rate that you have assumed is realistic,” says Dhawan.

Next, check whether your portfolio is on track to meet the goal. Bala suggests using step-up SIPs. “Raise the amount invested in line with your salary increments,” she suggests.

If a fund is lagging, do not sell it immediately. Stop your SIP in that fund and start it in another better performing fund. Watch the performance of the laggard for 3-4 quarters and only then decide to sell it. Rebalance your portfolio at the end of each year. Rebalancing essentially entails selling an outperforming asset and investing the proceeds in one that is underperforming. By doing so, you curtail the risk that your portfolio could face due to over-exposure to a particular asset class.

Approaching the goal The investment process is never static.We have suggested equity funds for those with an investment horizon of over 12-15 years. However, five years before your goal, you should start shifting money out of equities to the safety of debt. Start a systematic transfer plan from your equity fund to a short-term debt fund (average maturity of 1-3 years).

Keep in mind that the date of your child’s admission to college is fixed.You can’t let a downturn in the stock markets jeopardize your child’s college education.

Source : http://goo.gl/RnnnlC

POW :: Product Crack: JPMorgan India Economic Resurgence Fund

Kayezad E. Adajania | First Published: Tue, Jan 13 2015. 07 35 PM IST | Live MInt

It will invest in companies and sectors across market capitalizations

The potential of rising economy and equity markets are leading more fund houses to launch new schemes that aim to start from scratch. JPMorgan Asset Management (India) Co. Pvt. Ltd has launched a new scheme called JPMorgan India Economic Resurgence Fund (JER).

What does it do?

JER is an open-ended fund. It will invest in companies and sectors across market capitalizations. The fund aims to invest in companies that it feels would benefit from the introduction of policies and scaling up of the reforms process that the central government aims to undertake in the next few years, including goods and services tax, labour reforms, liberalizing foreign direct investment, building of roads and infrastructure, and so on.

What works…

JER will be aggressively managed compared with the other multi-cap scheme in its bouquet, JPMorgan India Equity Fund. It will be a benchmark agnostic scheme, which means that it won’t necessarily follow the sectoral allocation of its benchmark index, despite having an index as per regulatory requirements. The fund manager may feel bullish about a particular sector, and would be free to allocate more money in that sector, even if the said sector has a modest or low exposure in the benchmark index. In rising markets, this strategy works if the fund manager’s calculations turn out to be right. But if they are wrong, the fund could be affected badly.

The fund house has been steadily building a good track record. After a tough first couple of years, its large-cap-oriented and mid-cap schemes have done well consistently.

…what doesn’t

JER suffers from the same malady that most new fund offers (NFO) suffer from, i.e., lack of track record. Although the fund manager says it would be managed aggressively and a few sectors would be dominant in this portfolio, we need to watch out for the scheme ending up with a long tail. A long tail in mutual funds parlance refers to a scheme having numerous stocks with small or negligible holdings, to lower the risk profile. Of course, how long a fund’s tail should be is subjective; it could be a deliberate strategy and some fund managers play it well. But if JER promises to be aggressively managed, it’s best to first see some evidence of aggression and how it differentiates itself.

What should you do?

JER is not going to follow a focused approach in terms of stocks. Its sectoral allocation could be concentrated but not its stock holdings. Hence, it remains to be seen if, in the name of risk control measures, the fund manager plays safe, or actually takes the aggressive approach as promised. JER is an open-ended fund, so you would be able to invest in it in the future as well. Avoid putting money in JER till the fund accumulates some track record.

Source : http://goo.gl/xX5WcT

ATM :: Should you concentrate or diversify portfolios?

Uma Shashikant | Dec 29, 2014, 06.13AM IST | Times of India

Investors can be adamant. Some of them refuse to accept that it is not easy to get wealthy with equity. Many are simply lucky with equity and fail to see the strategic choices they need to make to be successful equity investors. A diversified portfolio is the simplest way to participate in equity markets and earn average returns, which are not bad. For those seeking more, one critical factor matters: the extent of concentration in the portfolio.

The promoters of a business hold the finest form of a concentrated equity portfolio. The list of the world’s richest people is made up primarily of equity investors, inspiring so many of us to see equity investing as the most democratic and legitimate way to build wealth. But for every entrepreneur that succeeds, there are many that fail. It may be enough to hold the stock of just one company to build a fortune, if the company has built a valuable business. But should that business fail, you may face bankruptcy. That is why concentrated portfolios are most suitable for someone with the orientation to create, build and run a business, than for someone choosing to be a dormant equity shareholder.

The nicest thing happening at present in India is that a large number of youngsters are choosing to create a business than pick up a job. This shows the swing away from fixed income seeking behaviour to preference for a concentrated strategy to build wealth. This significant modification in risk profile of people while choosing careers should bring great benefits to equity investors.

Angel investors, private equity investors and venture capitalists are the next rung of investors with a concentrated investment strategy. They seek high returns and are willing to invest in a small number of businesses to earn that. They are also ‘inside’ investors (as against public shareholders) who seek more information and a more significant role in running the business. Many of them are on the boards of companies they invest in. They mentor the business to achieve scale and size. They have large and significant holdings in a few businesses and take on the risk that some of them may fail. But a few good ones make up for such losses.

It is common for successful entrepreneurs to use their wealth to seed and fund new businesses. The objective is not merely altruistic. There is tremendous business sense in investing significant stakes in a few businesses, without having to actually run them from the front. These investors are only doing what they know to do best, but earning a higher return from being strategic investors. Institutional investors such as sovereign wealth funds, hedge funds, pension funds and endowments also take on strategic investments in growing businesses. This is the institutionalised form of concentrated investing, where the involvement in the business is not as deep as that of the inside investor, but the stakes are significant.

When individual investors choose DIY (do it yourself), they should look at the approach of these professional investors who hold a large stake in a few stocks. The approach is intense and driven by a high level of information and involvement. Institutions invest in research, data and talent to choose and invest strategically. If there is a clear vision about where the business should go, the investor is willing to work towards making it happen in return for a significant stake. If the involvement is as a strategic investor, they work with the management and will be willing to process and analyse information about the business on an ongoing basis.

A concentrated equity portfolio is a choice that lies at the opposite end of the diversified portfolio. I have noticed with amusement how investors eulogise Warren Buffet and then mindlessly buy multiple stocks. Buffet is the world’s most successful investor, because his investing style is concentrated and strategic. He buys stakes in businesses he understands, and holds them with patience. He also specialises in picking them up when the going is not good.

Where does that leave the retail investor who likes DIY? A few with the penchant for business and research do well. They go beyond tips, news and media quips, to understand how a business is doing. They work in groups, analysing businesses thoroughly. They invest after careful selection, in a few stocks, usually not over 15-20, and stay invested for the long term. This is a high-return, high-involvement concentrated investment strategy, not in the mode followed by most investors.

Those who simply buy this and that, hold a large number of stocks, and brag about the few that have done well, might be misleading others. The more a portfolio holds, the more diversified it gets and, therefore, it gets closer to average performance. When it comes to investing, there is nothing right or wrong. There is only risk, return and diversification— or the lack of it, if you will.

Source : http://goo.gl/IvX7Sm

ATM :: Do not over-complicate your investment portfolio

Uma Shashikant, TNN | Oct 13, 2014, 07.11AM IST | Times of India

It is not easy to convince an investor that asset allocation is the best way to build long term wealth. It is really tough to tell even a dear friend that she should not seek out products, but take a more holistic view.There is simply no time to worry about these things, and as long as the product seems good, it should be fine. Whenever she calls, it is about investing some spare money. Sometimes, she provides me with a list of names and asks me to vet them for her. She is actually not interested in any conversation beyond this. Why should it matter?

There are no investors, at least none that I know of, who have all their money in a single product. Even those that buy property have some balance in the bank, their Provident Fund (PF), tax-saving funds and insurance policies, and some gold in the locker. Yes, that is asset allocation for you. Except that it is not to any specific design, but mostly built by default. How much you hold where will affect your financial lives the most–in terms of risk, return and all else that you care for. Investment products are but minor details in this big picture. What is wrong with asset allocation by default?

The assets that we hold should ideally match our needs, and we should know what we intend to do with them. This is the gist of the financial planning framework. Since all money is not earned and consumed today, and since tomorrow might hold needs that require funding, and since some of these needs would be much larger than our small monthly incomes, we all need financial planning. This activity can get as elaborate as you wish, or as simple as the allocation between assets that earn an income and assets that grow in value over time. Why is this distinction important?

Assets that provide an income stream are meant to serve short-term needs. They will typically feature low and steady return, mostly matching inflation rates, and preserve the invested capital. Assets that grow in value are meant to serve long-term needs. They will grow at a rate that beats inflation, but feature higher short-term risks to the invested capital. These are like batsmen and bowlers in a cricket team–and every team needs a combination of both to win. How tough is this to implement?

There are three broad combinations. An investor who primarily needs growth, should have 70% in growth assets and 30% in income assets.Investors, who have a steadily increasing income stream that takes care of most needs, should look at this combination. Investors who primarily need income should have 70% in income assets and 30% in growth assets. Retired investors are classic examples. Without the 30% in growth assets they will lose any edge to fight inflation. Those that are unable to decide one way or the other, or think they need both should do a 50:50 in income and growth assets.

My friend can use equity for growth and debt for income. An equity index fund and two diversified equity funds are more than enough.The index fund is her protection against selecting wrong funds and suffering as a consequence.The diversified equity funds provide the midcap, small-cap, sector stock and all such additional benefits. There is no need to buy one of each kind, assemble them all together and find that the return is about the same as a diversified equity fund. The safest income asset she can buy is debt issued by the government. The Public Provident Fund represents a fairly simple option with a good return. Its limitation is that it is not too liquid. The same is the case with PF. She can add some bank deposits to earn a bit more as interest, and two debt funds to earn any additional market income and enjoy some liquidity . One all-purpose debt fund called dynamic, flexible or any such name should serve her purpose. Any cash she has will be in the bank or in a liquid fund. That makes it five income products. But, my friend feels buying different products is nice, doing a few things over and over again is boring. Why is she wrong? The more the products she piles on, the higher the possibility that her return will be just about average. She now buys a different tax-saving fund each year. She obliges her advisor by buying a few New Fund Offers. Then she gets worried investing in the same thing and seeks new names when she has the money to invest. The end result is that she holds more than 15 different equity mutual funds. It is very likely that her return is just about the return on a broad equity market index, which she could have bought at a fraction of the cost she is paying for all the funds she holds. Investors fail to see how diversification works. If you hold too many choices, you are unlikely to benefit majorly from a good choice–or be hurt badly by a poor choice. You will stay at the average. So what should she do?

She should stick to an investment plan that assigns money to these options every year.There is no need to book profits, time the markets and sweat about what is going wrong. She has to do two things though. First, check, at least once a year, if the products she has chosen are still good. Second, switch from 70:30 to 50:50 and to 30:70 as her needs change. She can do this herself. If she finds that bothersome, she can ask her advisor to do it for her. Every investor’s core portfolio can be constructed in this manner. Rest is pure adventure!

Source : http://goo.gl/5HYbc6

ATM :: Diversified MFs give better returns at lower risk

Partha Sinha, TNN | Sep 30, 2014, 07.25AM IST | Times of India

Among the equity schemes available in the market in India, diversified equity funds are the ones in which the highest amount of funds are deployed.These are the schemes which invest their corpus in stocks from across various sectors.Here, the fund manager takes the call on the portfolio of stocks, irrespective of sector, and invests accordingly . Within diversified equity funds, there could be funds segregated according to market capitalization like largecap, mid-cap and small-cap funds.

In addition, there are sector funds which invest in stocks of a particular sector and thematic funds which invest according to some given themes. There are also passive funds and exchange-traded funds.

According to Ramalingam K, chief financial planner, holisticinvestment.in, a financial planning and wealth management firm, a diversified investment model is put in place with the prime objective of avoiding the risks that come with the single sector investment model.

According to a note by Hena Nagpal, MD, Quantum Leap Wealth Advisors, in the risk reward matrix relating to equity and equity oriented schemes, diversified funds come around the middle. The most risky ones are the thematic funds, then the mid-cap and small-cap funds and then the diversified funds.Funds which are less risky than diversified funds are the tax-saver schemes, large-cap, index and then the balanced funds, in that order, the note said.

“Predominantly , diversified equity funds invest across various sectors and their mandate is more based on the market-capitalization of the companies they invest in,” said Juzer Gabajiwala, director, Ventura Securities. “Even among diversified funds, there are plans which are riskier than others. For example, a small cap fund would be riskier than a large cap fund,” he said.

According to Gabajiwala, in large-cap funds generally the portfolio allocation towards large-cap companies is more than 90%. “Investors prefer these funds as they tend to be relatively stable since a majority of their exposure is to blue-chip stocks, which are well established and rank among the best within their own industry . The main advantage of large-cap funds is that they are considered to be in the low return-low risk segment of diversified equity funds. This ensures that the investments of investors remain relatively safe,” Gabajiwala said.

Another category is the multi-cap funds, also called flexi-cap funds. These funds invest in stocks from across sectors and also in across market capitalizations. “The fund managers of such schemes can follow the strategy of dynamically changing their allocations to stocks or sectors as per prevalent market conditions, with the aim to invest in sectors which are currently doing well,” Gabajiwala said.

According to Gabajiwala, mid-cap and small-cap funds are the other categories among diversified schemes in each of which at least 60% of corpus is invested in mid-cap and small-cap companies. “The mid and small companies are expected to grow at a faster rate than bigger ones. However, investment in mid and small-cap funds should be undertaken with caution since these funds are more prone to volatility than large-cap funds as they are hit harder when markets fall,” he said.

There are several benefits of investing in a diversified scheme. “The key benefits brought in by the diversified equity funds are lower risk because of their diversified nature, broadened and diversified investment options, managed by a professional fund manager so that mistakes are avoided, and easier for the fund manager to move from one sector to another and one industry to another,” said Ramalingam.

Another reason for investing in a diversified equity funds is “under different market conditions and market scenarios, different sectors perform differently”, said Nagpal of Quantum Leap Wealth Advisors. “Since a diversified equity fund has the flexibility to invest across the spectrum, it tends to perform better than thematic funds over the longer horizon,” Nagpal said.

These funds also score on the taxation front. “Dividends received by unit holders of equity-oriented mutual funds are tax free.Short term capital gains tax is 15%, while there is no long term capital gains tax for these schemes. Long term, here, is defined as more than 12 months,” said Nagpal.

Source : http://goo.gl/GMCT65