Tagged: Reward Points

ATM :: How many credit cards you should have?

RAJIV RAJ Founder & Director, Creditvidya.com | May 15, 2015, 10.01 AM IST | Source: Moneycontrol.com

Many individuals do carry stack of credit cards, which they may never use or may overuse all of them leading to repayment issues. It is better to analyse one’s needs and decide the right number.

The other day, while a friend was paying the bill at the mall counter, he said, “I hardly carry cash anymore you know. Just some loose change maybe. It’s all on my cards.” While I looked at his fat wallet which was stashed with so many cards, I wondered. How many credit cards are too many or too less?

Many people and specially the youth have already declared that this is the age of plastic money. Credit card companies took it upon themselves to ensure that it indeed is! Every day we are bombarded with advertisements and lucrative offers. Credit cards are just a call away. The documentation and application process is made simple and hassle-free to attract more customers. Effectively companies are flocking to lend you money! So what do you do? How does your decision affect your CIBIL score?

Too many cards, too many outlets for money!

If you have hoarded many credit cards, it also means you have multiple options for swiping. To encourage customers to gather reward points, card companies are constantly coming up with offers. Now, it’s difficult to ignore these deals. Many a time, the deal seems so enticing that we end up swiping the card for it. Which basically means, that you ended up making a purchase because you had a card with an offer on it! That is definitely less than a wise way of spending money.

So what should you do?

Nobody understands your requirements better than you do! Over the weekend spread out all your cards on the table and sit with a cup of green tea. With a calm mind, evaluate the need for having each card independently. There may be cards which you purchased because somebody asked you to or a card bought for the reward point’s scheme on it, etc. Segregate those from the cards which you use often. Now calculate the cumulative credit limit you have. Cross check that with your expenses. Ensure you add up some amount for emergency expenses or large expenses which you foresee in the near future. That would basically be all the credit limit you need on the card. Add on a buffer for feeling safer and that’s about it.

Pick and choose!

It’s time to make smart choices. Check up on annual fees on the credit card, interest rates applicable, reward point schemes, etc against the credit limit offered. Select the ones which best suits your needs. You already have an idea of the total credit limit you need. That’s it. You will arrive at your own magical number. Discard rest of the cards and have a lighter wallet and a clearer mind.

How does this impact my CIBIL score?

CIBIL score reflects your credit history and financial discipline. That means, first of all you need to have a credit history. That’s where credit cards can help you. Availing a credit card gives you a credit history. This can help you while applying for a loan. Next up is the financial discipline bit which basically means tracking your payments due. If you have been making your payments on time and not having a defaults history then your CIBIL score would be shining. Another factor which is considered while preparing the CIBIL report is the utilization. Only having a credit limit is not enough. You should be utilizing it optimally as well. Exceeding 30% credit utilization ratio during a billing cycle could do damage.

Play your cards by the rules!

There is no better way to influence your CIBIL score than imbibing financial discipline. Make sure you pay off your credit card due amount every month. This will not only shield you from high interest rates applicable on credit card money but also impact the CIBIL scores positively. Obviously, the more the number of credit cards, the more discipline you require. Tracking and paying off on time is important. Secondly, keeping a check on the credit utilization ratio with too many cards in the hand is difficult. With fewer cards and planned spending this tracking can be a cake walk. And of course, one that will ensure sweet CIBIL scores.

So what’s the magical number?

That is up to each one of us to figure out after considering all the factors mentioned above. If we had to give a number, it should be something between three to five. Two card which you can use regularly and an additional one for emergencies will do just fine. Also, managing 3 cards is relatively simple. All you have to do is establish the 30% spending limit and use the cards accordingly. Needless to say while making timely payments. Two additional cards can be availed if you travel for work or have a particular expense on which you spend frequently like flights, fuel etc. These cards can be specifically used for the determined purpose.

Now that you are equipped with all the insights on credit cards, it’s time to say goodbye to the stack and hello to fewer cards and effectively utilization. Use plastic money to make your life easier and your bank balance heavier. Planning and discipline is the key.

Source:http://goo.gl/XQDMeg

ATM :: 4 ways to use Credit card rewards for vacationing!

Rajiv Raj | Apr 7, 2015, 05.14 PM | Business Insider

The temperatures are soaring and mangoes have made an appearance in the market place. Summer is officially here. It’s time to pull out the large hat, put on those shades, pack that bag and head to some cooler place. If the hot summer sun isn’t an excuse enough, then well your credit card rewards definitely are! Make the most of summer and your reward points while planning your vacation this time around.

If you do not own a credit card currently, don’t worry. Reading this article will help you decide which one you need to apply for to avail maximum benefits as per your lifestyle. However, one must keep a track of the CIBIL score and work on maintaining a satisfactory score. The reason being, credit card companies do factor in the data in your CIBIL report and check your CIBIL score while issuing credit cards. Using a credit card regularly and smartly helps accumulate reward points which can be planned and used resulting in direct savings! Vacations are a great opportunity to reap the benefits of reward points as well accumulate further points. Let’s see how that works.

1. Signing up is a good idea sirji!

If you are indeed considering signing up for the credit card and availing benefits during this year’s summer vacation, it is a bit late. But, it is never too late to join the party. While it would have been ideal if reward points were accumulated by now, there are few credit cards which offer miles, points or hotel stays while signing up. For example, the Standard Chartered Emirates Platinum Credit Card offers 27,500 bonus skyward miles on enrollment. Air accident insurance is complimentary with this card, which is worth Rs 10 million. If you fancy airport lounges, then priority pass for over 600 lounges comes with this card. Benefits from some cards can actually translate in getting a ticket or two free! For example signing up for the Jet Privilege HDFC Bank World credit card can waive off the base fare for one domestic Jet Airways ticket. Also, they offer 10,000 bonus jpmiles as welcome benefit. The New American Express MakemyTrip credit card is offering welcome vouchers worth Rs 9,000 that can be redeemed on the travel website. What’s not to love? A joining fee may be charged while signing up for a credit card. However, many companies are now waiving that charge if customers sign up online. Do check on that while you sign up for a credit card.

2. Reward yourself wisely

Gaining reward points is not enough. One needs to plan wisely for spending the reward points to gain maximum benefits. After you have a vacation plan ready, decide which parts of the vacation you would like to cover using the reward points. Broadly it is divided into travel fare, hotel stays and dining out. Now assuming you decide to book the flights using your credit card. Check on how many miles would it take to avail the reward. While doing so, don’t ignore the airline service and other things which can potentially spoil your vacation mood. For booking stays, check on the properties around your vacation spot. Once shortlisted check on how many points would it take to book the stay reward. It is difficult to cover the entire vacation expense through reward benefits. But using it wisely will definitely help in saving a handsome sum of money.

3. Let the card pay for luxury

If you believe in travelling with style and living life king size, then there are a couple of credit cards that will interest you. For example, the Citi Prestige credit card gives away vouchers worth Rs 10,000 from the Taj group or ITC hotels every year. Complimentary stays at exquisite properties around the world and benefits from an elevated status on the loyalty programs of global partner’s opens doors to special treatment and additional luxury. Bonus airmiles and unlimited complimentary priority pass lounge access at over 700 airports are among the other benefits. Premium cards like these do come with an annual membership fee, which is slightly on the higher side. The Citi Prestige credit card annual fee is Rs 20,000. If luxury is on your mind, then the card member ship fee is comparatively a small price to pay.

4. Make your trip, make your choice

Rewards earned can be maximized by choosing the right credit card to pay for your travels. For example Air India SBI Signature card can enable you to earn up to 1,30,000 Air Miles every year. 20 Air Miles for every Rs 100 spent on Air India tickets. Whereas, HDFC Banks All Miles credit card offers 3 reward points per Rs 150. While the former charges an annual fee of Rs 5,000 plus taxes, the latter is life time free if applied through website. Foreign transaction charges are another factor to be considered before spending, if you are on a holiday abroad. Credit card companies charge anywhere between 2.5% to 3.5% of the total transaction amount as foreign transaction charges. Look out for credit cards, which do not impose these charges or go with the one with minimum charges.

While reward benefits definitely help you make a choice, other factors like travel insurance benefits, travel accident insurance, lost baggage insurance, etc. must also be considered. With so many credit card options available in the market to choose from, one must not ignore the importance of maintaining a credible CIBIL score so that availing the best credit card option becomes a cake walk. With so many benefits listed, using a credit card is a lucrative option. Needless to say spending wisely and repaying responsibly is very important to continue saving and availing amazing offers in the future as well. Happy vacations!

About the author: Rajiv Raj is the director and co-founder ofwww.creditvidya.com.

Source : http://goo.gl/J7aD31

ATM :: Why Credit Card Wins Over Cash?

RAJIV RAJ | OCT 28, 2014, 04.20 PM | BusinessInsider.in

Many Indians just hate credit cards. Just because a few people they know used it in all the wrong ways and got into trouble, doesn’t mean that any person who uses a credit card is irresponsible. It is important to understand that the credit card straight away wins over cash in many aspects. This article illustrates how.

Ease in travelling: Imagine you are travelling abroad. You want to buy an expensive gift for your wife, let’s say a diamond ring, which could run into some $1000, which is around Rs 60,000. Would you carry that much cash in a foreign country? If you had planned to withdraw cash from your bank account, think again. Does your debit card allow you to withdraw that much cash? No. Every bank sets limit over debit card swipes and withdrawal limits in a single day. A credit card is a clear winner in this case.

After you lose it? What will you do after you lose money or it is stolen? Do you think it can be replaced? Your credit card can be replaced after it is lost or stolen. Yes, it comes at a nominal cost, but still there is scope to replace it, but when it comes to cash? No way!

Build or repair your credit score: No, it is not like what you thought. Cash transactions and debit card transactions are not reported to Credit Information Bureau of India Limit (CIBIL) and other credit bureaus. So, you cannot build your CIBIL credit score based on debit card usage. A credit card is any day a convenient way to build your CIBIL score or repair your damaged score. Credit card usage is a manifestation of your credit behavior and also your credit card repayment pattern shows you financial disciplining.

Rewards: If used wisely, using a credit card can prove to be rewarding. Credit card companies or banks issuing these cards have tie-ups with top retailers, e-commerce websites, e-ticketing websites, malls, restaurants, cinema houses, etc. The more you spend on your credit cards, the more points you can collect, that can be later redeemed from a wide range of offerings. However, just to collect points one must not spend an amount one can’t repay to the lender. Can you think of any such rewards or freebies by spending cash?

Anything else? These days credit limit on credit cards easily touch Rs 50,000 to 1,00,000. That is how much you can buy from your credit card. Imagine carrying around that much cash? Moreover, sometime when you are extremely cash strapped you can just pay the minimum amount due on your credit card and keep sailing. Please make sure that you chose this option as one off instance and not a regular practice.

Hence, it is important to understand that the only advantage, cash offers is controlling spends. If you are one of those who do not overspend, we advise you to get yourself a credit card. It will open up a whole new world of benefits.

About the author: Rajiv Raj is the director and co-founder ofwww.creditvidya.com.

Source : http://goo.gl/ve4jU9

ATM :: Now, open a savings account and earn reward points

Preeti Kulkarni, ET Bureau Jun 17, 2013, 08.00AM IST

The big spenders are expectedly pampered, with credit card issuers and merchant outlets showering them with discounts and freebies. In recent months, however, two private-sector majors ICICI Bank and Axis Bank have expanded their scope of offerings to cover the savers as well. The banks are promising to reward customers having savings bank accounts with loyalty points for carrying out a variety of transactions.

While a plethora of freebies is being offered on a platter, on the flip side, there is the tedium of keeping tabs on the reward points and redeeming them. If you want to make the most of the loyalty programmes, you need to understand how they work and avoid the peril of over-spending.

How does it work?

The savings account holders in banks that offer reward point programmes do not have to make an effort to sign up for it since they are enrolled by default as soon as they open an account. “Our MySavings Rewards Program and credit card programmes are designed to reward and encourage customers to carry out more transactions with us. These help them accumulate points for almost every transaction,” says Rajiv Sabharwal, executive director, ICICI Bank.

The transactions include simple ones like activating Internet or mobile banking, opening a recurring deposit account, updating your mobile number through an ATM, or registering for an e-statement. Then there are more complex activities like taking a loan or paying utility bills using the online payment platform, even making an EMI (equated monthly instalment) payment on time.

To be eligible for the reward points, the retail customer needs to fulfil certain conditions. For instance, in the case of ICICI Bank, the account holders are required to maintain a minimum monthly average balance of Rs 15,000, while the NRI customers are not eligible at all. Similarly, you become eligible for the Axis Bank’s eDGE Loyalty Rewards Points programme when you open a savings account, use its debit or credit cards, and online channels of shopping. However, to qualify, you should have no outstanding dues and the eligibility criteria are open to review from time to time.

The public-sector banks, however, are not rewarding their savings account holders and have largely limited themselves to card spends for now. “Banks are increasingly using loyalty programmes to induce consumers to use debit/credit cards, as well as Internet and mobile banking.

The objective is to incentivise them to use their cards instead of withdrawing cash from the branch or ATM. Once consumers have accumulated points, they can redeem these in return for free goods or services,” says Bijaei Jayaraj, CEO, Loylty Rewardz, which manages loyalty programmes for several PSU banks, including the State Bank of India.

How to redeem reward points

You earn different reward points depending on the kind of transaction and card type. So while you earn 1 point for every Rs 100 you spend online through Net or mobile banking with the ICICI Bank, you can get 100 points for just activating the Net or mobile banking. In the case of Axis Bank, you can earn 25 points for ordering a new chequebook online or via an ATM, but get 500 points one time when you open a Wealth or Privee account.

How do you keep track of your reward points? Since the ICICI Bank’s points are managed by PAYBACK, the multi-brand loyalty programme, you can either get in touch with its contact centre/website, through the bank’s website, or even via your account statement. To redeem points, you have to choose from the list of products or services up on the bank’s website and call up the bank to communicate your decision. You can also redeem the points directly through the Internet channel by clicking on ‘redeem’ at the bank site. You’ll be taken to the PAYBACK website, where you can pick your product/service.

You can also shop at PAYBACK’s online partner sites, or directly at specified merchant outlets by swiping your card. As for the Axis Bank, you can pick from 500 rewards from a range of lifestyle and entertainment products and services, provided that you have accumulated a minimum of 300 points.

Rewards on card spends

A high-end credit card is bound to offer a better spend-to-reward point conversion ratio compared with a no-frills card. However, such cards typically entail a huge membership fee. Plain-vanilla cards may not levy a big fee, but could require you to make substantial purchases to be eligible for worthwhile rewards. Availing of cash-back offers is relatively easy as you have to simply swipe your card at the merchant outlets or make an online purchase and the applicable amount will either be credited to your account or the discount factored into the bill.

While both cash-back and reward point programmes seem attractive, it requires you to choose your bank or card, as well as rewards, carefully. “So, if you watch movies or dine out often, pick a lifestyle card that offers additional points on such spending. If you are a frequent flier, look for a card that converts points into miles and entitles you to concessional fares,” says Harsh Roongta, CEO of Roongta Securities. Another popular category is the one that offers points on refuelling.

On the other hand, cards or savings accounts that entitle you to, say, 5% cash-back on payment of utility bills will be useful for all segments as it is an unavoidable expense.

Ensure that you exercise caution while choosing cards for the cash-back benefits as banks and card issuers routinely revise their offerings. Besides, your spending pattern should justify the membership fee. The last thing you should do is to sign up for a card only to avail of the reward points or cashback offers. Moreover, your bank or card issuer could levy an ad-hoc handling fee for delivering your product at your doorstep, reducing the actual value of the benefit.

Many credit card users believe that hoarding a large number of points for months or years will help them buy an expensive TV or a high-end refrigerator. However, you need to ascertain whether the bank or card issuer has specified a validity period for redeeming the points. Otherwise, you may end up waiting for months only to find out that the offer period has expired.

Source : http://goo.gl/YwNHM

ATM :: How net banking helps you save on time, effort and money

By Amit Shanbaug, ET Bureau | 10 Jun, 2013, 08.00AM IST13 comments |Economic Times |

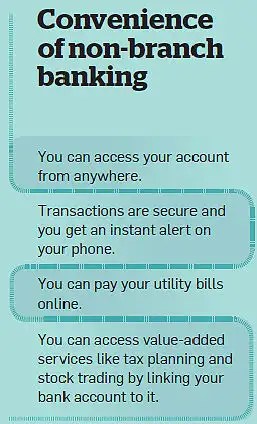

Did you know that approaching a bank branch to get a duplicate account statement can cost you around Rs 100, while the same could be had at half the price through online banking? Similarly, a stop payment request that costs upwards of Rs 50 through traditional banking channels is a free service for those who opt for Net banking.

There are many other banking services where you can save money by opting for Net banking (see table). However, most people, especially those who prefer branch banking, don’t even realise they are paying for these services or that their costs are adding up unless they peruse their quarterly bank statements carefully.

Why is Net banking cheaper?

According to Ram Sangapure, general manager, Central Bank of India, facilities like online and mobile banking drastically cut down the cost of providing a service. This saving is passed on to customers who are willing to go beyond the traditional banking channels. “A bank branch has to employ people, incur cost for stationery and in setting up the office. Moreover, paperwork eats up valuable man hours. If the customer uses the online option, a bank hardly incurs any cost, which benefits the former,” he adds.

According to industry experts, a bank spends an average of Rs 40 for each transaction conducted at a branch. If a customer uses the ATM facility, the cost drops to Rs 18-20 per transaction, but it is still much higher than the cost involved in online banking. “In order to promote Net banking, the financial institutions offer certain services for free or charge a nominal amount,” says Sangapure.

Why the cost differential

According to Harsh Roongta, chief executive officer of Apnapaisa.com, banks across the world are within their rights to charge for any service for which they incur a cost. Now, this is being practised by Indian banks as well. Says Rajiv Raj, co-founder and director at CreditVidya.com: “Only if a bank doesn’t incur any cost in completing a transaction will it refrain from charging the customer,” he adds.

In fact, the RBI has not restricted any bank from charging a fee for such transactions. “If you deposit a physical cheque from another bank and it is credited to your account, both banks incur a cost, but you are not charged anything. In the long run, the banks need to recover this amount to sustain themselves,” explains Roongta. “The RBI restricts unreasonable charges. If the fee is within permissible limits and the bank can justify it, it can deduct this from their customers’ account,” adds Roongta.

To keep abreast of the paid services and differential pricing, all you need to do is to visit your bank’s website. Moreover, the details of services and respective fees will be posted on the notice board in every bank branch.

Indirect savings

Net banking also helps save money in other ways. For instance, if you have opted for the facility to pay bills online, you can skip the late payment fee.

In addition, there are service providers like credit card issuers, who charge a fee for branch payments. Some banks also offer bonus points for online services, which can then be redeemed for online shopping through the bank’s partner. Consider the ICICI Bank’s Payback facility and State Bank of India’s Loyalty Rewards programme.

Safety vs savings

The benefits of Net banking notwithstanding, a lot of people balk at availing of this option because of the concerns about the security of online transactions, especially in an age where phishing and online fraud is on the rise.

Raj, however, counters this, saying that Internet banking is probably safer than physical transactions. “Banks have introduced a double authentication system, which makes Net banking much safer,” he says. According to him, each customer is given a unique password to log into his account.

To complete any transaction, he needs to key in an ID sent via SMS to his registered mobile number. “So it is not possible to go wrong. It’s highly unlikely that any other person, even a fraudster, could have both the unique log in/password and the registered mobile number,” he adds. Incidentally, you don’t get any security assurances while transacting physically at the bank.

Source: http://goo.gl/rLl5g

ATM :: Choosing between cashback offers and reward points

Neha Pandey Deoras | Bangalore April 7, 2013 Last Updated at 22:29 IST| Business Standard|

It makes sense to go for a cashback card only if you are a big spender, otherwise the benefits are almost equal

“One for everyone. Pick the card that suits you the best! It’s good to have a credit card that’s like you!” reads a promotional mailer from Standard Chartered Bank. It further reads, “5 per cent cashback on all fuel spends, all phone bills, all utility bills on Titanium Card.” Platinum card offers five times rewards on dining, hotels and fuel and so on.

If you see such an offer, will you apply for the cards? Likely; who does not like discounts and freebies? This is why many own multiple credit cards, with multiple benefits. Some go to the extent of saying these benefits help counter the high prices to some extent.

If you pay, for instance, an electricity bill of Rs 1,000 using a cash-back card, the card will offer you five per cent of your bill amount, that is Rs 50. You pay only Rs 950 on your card.

Reward offers on credit cards work differently. You get cash benefits in the form of coupons or vouchers for a certain number of points collected on purchase through the credit card. For instance, for every purchase through Standard Chartered’s Platinum Rewards Card, you collect 3,000 points, which earn you Big Bazaar coupons worth Rs 1,000.

Which of these works better for a cardholder? “Collecting and redeeming reward points for lifestyle or other expenses works out better for card holders. Once a customer has collected enough points, s/he can use those for specified expenses at their will.” says a senior official of HDFC Bank. It might not always be different cards that offer cashback and rewards benefits. Sometimes, the same card offers both these.

According to an SBI official, banks discourage customers from cashback cards, as banks have to pay in cash to the customer. With rewards points, banks have nothing to lose. Also, those who really take advantage of such offers are high spenders, making it an expensive proposition for banks.

Let’s see which option works out better for cardholders. We take the example of Standard Chartered’s Super Value Titanium (cashback card) and Platinum Rewards card. You spend, say, Rs 60,000 a year on fuel for your car. With the cashback card, you will get a five per cent cashback, according to the Standard Chartered bank’s mailer. However, the actual cashback works out to be 2.5 per cent. Reason: The five per cent cashback offered by Standard Chartered’s Super Value Titanium is in fact 2.50 per cent cashback and 2.50 per cent fuel waiver surcharge. This means by spending Rs 60,000, you will get back Rs 1,500 in a year. The fuel surcharge is offered by the rewards card as well.

In contrast, the rewards card will give you 3,000 points, which means Rs 1,000 worth of Big Bazaar coupons for spending. This means the cashback card offers a better deal. However, the reward card does not levy any joining or annual charges on the cardholder. However, the cashback card levies an annual fee of Rs 750, which brings down the saving on the card to Rs 750. This makes the total earning on reward cards higher by Rs 250.

“For small spenders, both these cards offer almost the same deal. However, for big spenders, the cashback card is a better deal between the two,” says certified financial planner Malhar Majumder, executive director of Kolkata-based Fine Advice. If the annual fuel spend is doubled to Rs 1.20 lakh, then the cashback would be Rs 3,000 and rewards would be worth Rs 2,000. Even if you take into account the annual fee levied by the cashback card, you would get a total cashback of Rs 2,250, higher than the offer on rewards card.

“Rewards tend to be more when you are opting for lifestyle and related expenses, less when you are looking at regular needs, like Big Bazaar coupons. Also, money is spent first and rewards come later. In the case of cashback cards, you get direct discounts on items you have to buy regularly like fuel or electricity. A 2.50 per cent discount saves on immediate cash outflow. Cash discount frees up cash. Reward points are connected to spending programmes, usually lifestyle-related, which you may not need immediately,” adds Majumder.

A cashback card helps you in two ways. One, it brings home the direct benefit of discounts. Two, it saves you the pain of choosing an item to buy from the reward catalogues, which might not be really worth the price shown. Of course, the benefits of both cashback and rewards are available at select merchant outlets with which the card manufacturer has a tie-up. Hence, you might not have too many options to shop. Many times, discounts/rewards for fuel purchase are available only when you swipe your card on the card issuer’s machine.

Finally, credit cards should be used judiciously. Keep a record of your estimated monthly expenses that may get cashback. Calculate how much you save if you go with the card. Remember to check on joining if there are any annual fees. Go for it only if you save a decent amount after paying for fees. Do not spend just because there is a cashback offer as you have to pay the outstanding amount lest you’ll land in a debt trap.

Source: http://goo.gl/E8qME