Tagged: SEBI

NTH :: Have they changed the name of your favourite mutual fund scheme? Here’s what you should do

To ensure that all schemes launched by mutual funds are distinct in terms of asset allocation and investment strategy, SEBI proposed categorisation and rationalisation of mutual fund schemes.

Nikhil Walavalkar | Mar 16, 2018 02:24 PM IST | Source: Moneycontrol.com

Mutual funds are busy changing the names of their schemes. Securities Exchange Board of India’s (Sebi) directive on the rationalisation and categorisation of mutual fund schemes has made mutual funds to drop the fancy names and fall in line. The idea is to simplify the process of understanding the mutual fund offerings and choosing schemes for investments by investors. But as the names change, there are some investors who may start worrying about their investments. If the investment you have invested into has disappeared or renamed do not get worked up. Do read on to understand how it impacts you.

What happened?

To ensure that all schemes launched by mutual funds are distinct in terms of asset allocation and investment strategy, SEBI proposed categorisation and rationalisation of mutual fund schemes. The SEBI prescription allows fund houses to offer schemes in 10 types of equity funds, 16 categories of bond funds and 6 categories of hybrid funds. Fund houses are also allowed to launch index funds, fund of funds and solution oriented schemes.

“SEBI has clearly defined norms and the asset allocation and the norms that will specify each category,” says Rupesh Bhansali, head of mutual funds, GEPL Capital. For example, a large cap fund must invest at least 80% of the money in large cap stocks. Large cap stocks are defined as top 100 companies in terms of full market capitalisation. “By introducing these norms the regulator has ensured that the apple to apple comparison of mutual fund schemes is possible,” says Bhansali.

The mutual fund houses too have started responding with change in names and investment strategy of the schemes, wherever applicable. For example, DSP Blackrock Focus 25 Fund is renamed as DSP Blackrock Focus Fund. Analysts used to treat it as a large cap fund so far. However, going ahead it will be placed in Focused Fund category.

The process of aligning with the SEBI norms will go on for a while and more fund houses will make necessary changes. The process however should not stop you from investing in mutual funds.

“Investors should first understand the category of mutual funds as each one of these has distinct characteristics,” says Swarup Mohanty, CEO of Mirae Asset Mutual Fund. Find out where your scheme is going to be placed and see what kind of investment strategy it will employ.

“If the scheme’s investment strategy and portfolio construction changes, then there is a very high possibility of changes in risks and returns associated with investing in that scheme,” Renu Pothen, head of research, FundSuperMart.com. For example, if a fund that was a primarily large cap scheme is shifted to a large and mid-cap scheme, then the risk associated with the scheme goes up as the fund manager invests minimum 35% of the money in mid cap companies. Possible higher returns come on the back of higher risks.

“The investor must assess the risk-reward in the light of his financial goals and his risk appetite before investing in that scheme. If there is a mismatch between the investor’s risk profile and the risk-reward offered by the scheme, the investor will be better off selling out his existing investments. He can look for better options elsewhere,” says Renu Pothen. While exiting a mutual fund scheme, there are implications such as exit loads and capital gains, which investors should not ignore.

“When there is a change in fundamental attribute of the scheme, the investors are given exit option without any exit load,” points out Bhansali. This exit option is not at all compulsory and should be availed if and only if there is a mismatch between your expectations and the offering. However, the capital gains will be payable in case of redemption in bond funds. Though the exits in current financial year from equity funds will lead to no tax on long term capital gains, the same will attract 10% tax after April 1, in case the gains exceed Rs 1 lakh.

Changes in regulatory framework and volatile markets may add to worries of mutual fund investors. However, mutual fund investors must take this opportunity to relook at their investment plans, say experts. If you do not understand the fine nuances of equity funds, better stick to multicap funds and let the fund manager decide what asset allocation should be within equity as an asset class.

“It is time to reassess your risk profile. Do not get carried away with high returns over last couple of years. Instead be realistic with your return expectation while building your financial plans and use short term volatility to your advantage by investing through systematic investment plan,” advises Mohanty.

Source: https://goo.gl/6FXbMV

Interviews :: Alpha generation in large-cap funds would compress going ahead

Mahesh Patil, Co-CIO, Aditya Birla Sun Life AMC on how he is creating alpha in the large cap space, his contra calls and more.

By Morningstar Analysts | 27-12-17 |

The asset size of Aditya Birla Sun Life Frontline Equity Fund has crossed Rs 20,000 crore. Do you see size posing an issue to manage this fund going forward?

We maintain a good diversification in this fund by having exposure across sectors. We aim to beat the benchmark consistently and incrementally rather than taking very large sectoral bets. Given that the fund invests at least 80% of its assets in large cap stocks, we don’t see size posing as a challenge. Besides, the core of the portfolio has very long term holdings. That said, as the fund size increases it becomes slightly more difficult to build or unwind positions in stocks and needs more effort. But it is part of the process and does not affect the performance significantly.

We have a large number of stocks (60-70) in the portfolio as compared to other similar funds in the industry. Before deciding the quantum of exposure warranted in any stock, we take a close look at the liquidity of the stocks. This strategy allows us to manage large size.

It is becoming difficult for managers to generate alpha in the large cap space. How do you overcome this challenge?

We are seeing a huge rally in the mid and small cap stocks and large cap funds obviously can’t take exposure to such stocks. So multi-cap funds have been able to generate decent alpha by maneuvering where the opportunities are.

As markets mature and price discovery happens across stocks its going to become difficult to generate alpha in large caps. The alpha generation which we saw in the last three to four years would compress going ahead. This is because the alpha was high as compared to the historical average, especially during calendar year 2014-16.

We never target to generate superlative alpha in large cap funds. Instead, we endeavor to find some new stock ideas every year which keeps the portfolio fresh. If there is a serious underperformance, we are nimble enough to take corrective action. While everything is fairly priced in the market at this juncture, we try to continuously look out for undervalued companies. Some amount of contrarian investing and moving away from the crowd helps to spot early turning points in stocks/sectors. Similarly, we maintain a discipline to trim exposure in certain stocks that have overshot their valuation target. This strategy enables us to buy stocks which are relatively cheap in terms of valuation. So some amount of active management is also required at this juncture to generate alpha in the large cap space.

In which sectors/themes are you deploying the steady inflows coming in equity and balanced funds?

We have been overweight on banking and financial services. Financial services sector has had a good run and the valuations have moved up. Hence we are more discrete now in choosing the right segments that offer better growth. While we prefer private retail banks, we are slowly warming up to corporate banks because of some clarity emerging on resolutions of bad debts and a cyclical recovery in economy.

Besides, we are positive on consumer discretionary space. We are seeing a higher demand for discretionary consumption as the per capita income is moving up in India. Further, the implementation of GST will benefit players in the building material, consumer durables and retail space. Rural consumption is also starting to improve with normal monsoons and government focus on stepping up rural spending.

We are fairly overweight on metals. Metal prices are steady as China is cutting down capacity on the back of environmental issues which is supporting price. Indian companies are also deleveraging which will increase their equity value.

Another sector where we are taking a contrarian call is telecom. We are seeing consolidation happening faster than we expected in this sector. While there is still some pain for a few quarters, over a three-year time frame it could be a good time to look at some leading telecom companies.

We are selective in the infrastructure space. Road, railways and urban transport are some pockets where there is significant traction. Companies positioned in this sector are expected to see good increase in their order books.

Post SEBI’s diktat on scheme categorization, how are you restructuring your funds? Are you planning to merge smaller schemes?

Fortunately, we have been working on consolidating schemes much before the SEBI circular came out. Most of our equity funds are aligned as per SEBI categorization. We would look to merge some thematic funds.

Overseas fund of funds category is seeing continuous outflows. What are the reasons for the waning demand for this category.

The awareness level about this category is low. Domestic market has been doing well so people are preferring to invest in India. Overseas fund of funds have done well though.

As markets mature and you see enough ownership of domestic funds, people would look to invest outside India. There are a lot of new generation companies which investors can take exposure through these funds.

Though taxation of this category is an issue, you need to realize that if you are making good returns it should not be a problem. HNIs who already have a high exposure to India can look at these funds. Also, those wish to send their children overseas for education can consider these funds because the underlying returns are dollar based. To some extent, you are taking the currency hedge through these funds.

When do you see private-sector investment picking up?

Private sector investment has been elusive. But there are a couple of factors which indicate that investment will pick up one year down the line. Firstly, capacity utilization has bottomed out and is showing early signs of improving. Secondly, while a lot of large corporates in metals and infra space are saddled with high debt were are seeing the deleveraging cycle has started for some companies. Corporate debt to GDP which peaked out in 2016 is starting to come off. Finally, bank recapitalization would enable corporates to re-leverage and begin the next capex cycle. Sectors like Steel, Oil and Gas, fertilizer and auto are the first to see a revival.

During every budget we get to hear about suggestions to reinstate long-term capital gains (LTCG) tax on equity investments. Some say that exemption of LTCGT can lead to market manipulation. What are your views? If the government introduces LTCGT what would be the impact on markets?

The exemption of LTCGT has helped attract investors in equities. But that’s not the only reason why people invest in equities. They invest because they expect better returns. If there is money to be made in markets, I don’t think it would deter investors from this asset class. So introduction of LTCGT would not have an impact on long term investors. However, it could hurt the sentiments in the short run. We could see some curb in short term speculative money moving in stocks having weak fundamentals.

How has your investment philosophy evolved over the years?

While our broad philosophy has remained the same, we have started giving more attention to management quality while evaluating companies. Our time horizon of owning stocks has also increased and we are evaluating companies with a three-year perspective. There is a larger focus on how companies are generating free cash flows and how it is being utilized. These factors impact the PE multiples. So we are willing to pay a premium if these factors are favorable. To sum up, we have been incorporating these factors in our philosophy.

Your favorite book

One book which I found interesting is ‘Good to Great’ authored by Jim Collins. The book gives good insights into building an organization and focuses on what really matters to not only to survive and endure but to excel.

Source: https://goo.gl/i9ro1V

NTH :: 6 ways new classification of mutual fund schemes will impact the investor

By Sanket Dhanorkar, ET Bureau|Updated: Oct 16, 2017, 11.20 AM IST

The Securities and Exchange Board of India (Sebi) has asked fund houses to classify their schemes into clearly defined categories. For long, there were no clear guidelines to categorise mutual funds. Fund houses even launched multiple schemes under each category, making scheme selection a confusing exercise for investors. To introduce clarity, Sebi has now asked fund houses to have just one scheme per category, with the exception of index funds, fund of funds and sector or thematic schemes.Mutual funds which have multiple products in a category will have to merge, wind up, or change the fundamental attributes of their products.

Simplification of choice, fewer options

At the broadest level, mutual funds will now be classified as equity, debt, hybrid, solution-oriented, and ‘other’. Equity schemes will have 10 sub-categories, including multicap, large-cap, mid-cap, large- and mid-cap, and small-cap, among others. The stocks of the top 100 companies by market value will be classified as large-caps. Those of companies ranked between 101 and 250 will be termed mid-caps, and stocks of firms beyond the top 250 by market cap will be categorised as small-caps. Debt and hybrid schemes will similarly be grouped into 16 and six sub-categories respectively.

In particular, people interested in debt and hybrid schemes will now be better placed to identify the right schemes. For instance, duration funds have been segregated into four sub-categories, based on the maturity profile of the instruments they invest in. Debt funds belonging to the broader ‘income funds’ category will now be identified as dynamic bond fund, credit risk fund, corporate bond fund, and banking and PSU fund, based on their unique characteristics. Similarly, segregation of hybrid funds—based on their equity exposure—as aggressive hybrid, conservative hybrid and balanced hybrid, will allow investors to better identify the type of hybrid fund they want to invest in.

“Now that scheme labelling is clearly linked to a fund’s strategy, the investor will clearly know what he is getting into. The fund category will define the scheme, and not its name,” says Kunal Bajaj, CEO, Clearfunds. Fund houses will also not be allowed to name schemes in a way that only highlights the return aspect of the schemes— credit opportunities, high yield, income advantage, etc.

Adherence to fund mandate

With strict classification of schemes, fund houses may not be able to alter the investing style or focus of their schemes, as they did earlier. For instance, mid-cap funds stray into the large-cap territory or across market caps, in response to market conditions, which dramatically alters their risk profile. Now, funds will be forced to maintain their investing focus. Any drastic change in style will constitute a change in the fundamentalattributes of the scheme, which would have to be communicated to the investors. For investors, this means they won’t have to worry about their chosen schemes altering mandates to something which doesn’t suit their needs or risk profile.

Better comparison with peers

Distinct categorisation of schemes will also enable a better comparison of funds within the same category. While the earlier largecap funds category had schemes with pure large-cap focus as well those with a sizeable mid-cap exposure, now such distinctly varied schemes won’t be clubbed together. This will further help investors identify the right schemes by facilitating a like-for-like comparison of funds. “All schemes of different AMCs within a similar category will have similar characteristics, which will enable customers to make a better ‘apples to apples’ comparison,” says Stephan Groening, Director, Investment Solutions, Sharekhan, BNP Paribas.

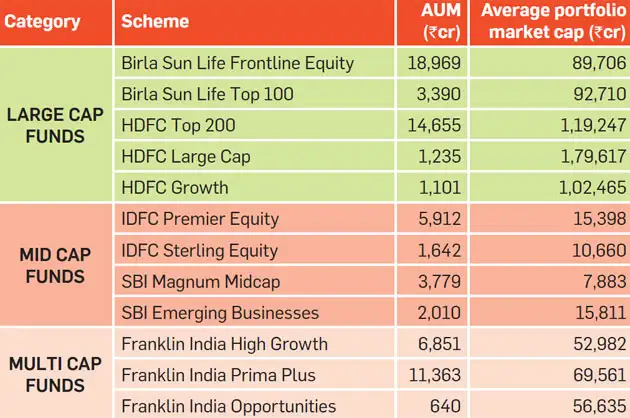

These schemes may be reclassified or merged

The new Sebi norms require funds to have only one scheme per category.

Note: This is only an indicative list. All schemes mentioned may be retained by the respective fund house. There may be other duplicate schemes from other fund houses also. Source: Value Research.

Sharp rise in fund corpus

Since fund houses will now be forced to merge duplicate schemes within the same categories, it may sharply increase the size of certain funds. This could hurt the scheme’s performance. “Some larger fund houses with multiple schemes will have to opt for mergers. This may lead to a sudden, sharp rise in the corpus of schemes, which could dent the fund’s returns,” says Vidya Bala, Head, Mutual Fund Research, FundsIndia. “There could also be an impact cost on the investor, as fund may rebalance or churn the portfolio to ensure the fund aligns with the category norms,” adds Bala. For instance, both HDFC Balanced and HDFC Prudence are aggressive hybrid funds, with a corpus of Rs 14,767 and Rs 30,304 crore. Merging the two will create a Rs 45,000 crore fund. However, it is more likely that the fund house may instead reposition one of the schemes in another category.

Possible fall in outperformance

While the new norms are likely to lead to better adherence to the fund style and mandate, it may result in reduction in alpha—outperformance compared to the index—for some schemes. Funds often tend to stray away from their chosen mandate in the pursuit of generating excess return over the benchmark index. Now, with limited flexibility to stray into another segment, some funds may find alpha generation more difficult than before, reckons Bala.

Need for portfolio review

Since fund houses will now have to align their product suite with these norms, there is likely to be a flurry of activity related to recategorisation of funds. In order to avoid merging certain duplicate schemes, these are likely to be renamed or reclassified into another fund category. Some funds may witness a change in scheme attributes to facilitate its repositioning. As such, over the next 5-6 months, several schemes may change colours. Investors would then have to undertake a thorough portfolio review to ensure their funds continue to meet their requirements, insists Bajaj.

Source: https://goo.gl/kEwrFg

ATM :: Mutual funds can grow 10-fold in 5 years: Anil Ambani

The business leader said said investing in mutual funds should be as easy as buying smartphones on Internet.

PTI | MUMBAI, JUN 29, 2017 | The Hindu Business Line

Urging regulator Securities and Exchange Board of India (SEBI) to simplify investment and advertisement norms for mutual funds, business leader Anil Ambani today said investing in them should be as easy as buying smartphones on Internet.

He said only one in 25 Indians invests in these products at present, but the investor base can be expanded 10-fold to 60 crore in five years. “India’s mutual fund industry is today poised for its Jan Dhan moment,” Ambani said here at an event of the Association of Mutual Funds in India (AMFI).

Reeling out figures, the Reliance Group chief said while 9 out of 10 Indians have a mobile connection and 3 out of 10 have a smartphone, only 1 in 25 Indians has an investment in a mutual fund. “The comparisons in a global context are even more staggering. There are as many as 58 asset management companies in the world which manage more money than India’s entire MF industry put together,” said Ambani whose group firm Reliance Capital runs one of the biggest fund houses of the country.

He said India’s mutual fund industry is a relatively young industry. “In fact, I would claim it has barely moved out of its teens!” he added.

Recalling that the erstwhile UTI started India’s first mutual fund way back in 1964, Ambani said no private player was there for the next 30 years. “And it is fitting that the man who is widely regarded as the father of capital markets and the equity cult in India — my late visionary father, Dhirubhai Ambani — was among the first to sense the potential that lay ahead.

“We at Reliance, together with my late brother-in-law, Shyam Kothari, shared the exclusive privilege of launching India’s first-ever private sector mutual fund in 1993 — Kothari Pioneer Mutual Fund. Our own offering followed soon afterwards with the launch of Reliance Mutual Fund in 1995,” he said.

“From an AUM of under Rs. 60 crore in 1995, and Rs. 2,200 crore in 2002, we have grown our asset base over 100 times to reach Rs. 2.25 lakh crore. As an AMC, we currently manage Rs. 3.58 lakh crore. In the same timeframe, India’s mutual fund industry, with 5.7 crore individual accounts, has expanded its AUM to reach Rs. 20 lakh crore,” Ambani said.

The industrialist said SEBI has historically played a hugely important and proactive role in the development of the capital markets while safeguarding the interest of the small investor. “It is to our regulator’s immense credit that India is today widely perceived as among the most efficiently run markets in the developing world.

“Going forward, we in the industry need to work closely with you (SEBI) to further simplify the on-boarding process for new investors,” Ambani said while suggesting some steps for the the next 100 days.

His suggestions included making MF investment even simpler, allowing anyone with a legitimate bank account to invest in financial products since their bank KYC is already in place and ensuring better utilisation of technology to improve penetration and facilitate faster transactions.

He also urged SEBI to simplify advertising norms to help communicate the value proposition of mutual funds better. “These steps will bring in a new class of investors to the mutual fund industry,” he added.

Ambani urged the industry to give the nation an increase in the number of individual investor folios from 6 crore currently to 60 crore in five years when India will celebrate 75 years of Independence.

He also termed the GST (Goods and Services Tax) as India’s ‘economic freedom’ while noting that it would make “a borderless world of 1.3 billion people — producers and consumers engaged in a seamless exchange of goods and services, skill sets and capital, labour and ideas”.

He said the world has seen nothing like this before as “in less than 48 hours, India will emerge as the biggest free and democratic market in the history of humankind”.

“In tandem with its policy precursor — demonetisation — GST will forever change the ground rules of doing any kind of trade, commerce or business in India,” he added.

(This article was published on June 29, 2017)

Source : https://goo.gl/z2jxjo

NTH :: You can redeem only Rs 2 lakh from MF scheme if your fund house faces systemic crisis

By ET Bureau | 1 Jun, 2016, 10.40AM IST | Economic Times

MUMBAI: Investors will be able to redeem only up to Rs 2 lakh from a mutual fund scheme if the fund house faces systemic crisis, and the market regulator on Tuesday said that fund houses can impose restrictions on redemptions only if there is a systemic crisis or an event that severely constricts market liquidity.

The Securities and Exchange Board of India’s ( Sebi ) move comes after the redemption crisis faced by JP Morgan in two of its schemes involving Amtek Auto in September 2015.

The regulator’s latest note, that is effective immediately, stipulates that an AMC can impose restriction only in case of broad liquidity issues that affect “almost all securities reather than any issuer specific security,” in the event of market failures or exchange closures or under exceptional operational problems.

Asset management companies can impose restrictions only for a maximum 10 working days with prior approval from its board and trustees.

If the redemption requests are above Rs 2 lakh then fund houses would have to redeem the first Rs 2 lakh without any restrictions and only the remaining part would be subject to the restriction.

The new rules would be with immediate effect for all new schemes launched from now onwards while it would be applicable for existing ones from July 1.

Source : http://goo.gl/A0QUju

NTH :: Seven macro triggers that may move your market today

Nandini Sanyal | May 16, 2016, 08.38AM IST | ECONOMICTIMES.COM

News about progress of monsoon, next batch of quarterly earnings , wholesale inflation data along with outcome of assembly polls in five states and will be key driving factor for the stock market this week.

Here’s a look at seven triggers that may move the market today

Under Mauritius pact, no tax exemption for quasi equity investments: There will be no free ride for those wanting to invest in India through quasi equity investments such as convertible debentures via Mauritius under the recently amended treaty between the two countries, officials said. Those holding such instruments would do well to convert them into shares before April 1, 2017, to enjoy the exemption on capital gains tax, or grandfathering, that’s available until then. There has been some confusion over whether entities making an investment in such instruments before April 1, 2017, can enjoy grandfathering with the full capital gains tax exemption benefit even after the amended India-Mauritius Double Taxation Avoidance Convention comes into effect.

Shareholder base for private banks may be broadened: Wealthy individuals and finance companies can pick up more equity in private banks while non-state lenders struggling to make money could emerge as acquisition targets for those on the hunt, following the Reserve Bank of India’s recent relaxation of rules aimed at shoring up capital and encouraging consolidation. Analysts said lenders of interest may include IndusInd Bank , Yes Bank , Kotak Mahindra Bank , Karur Vysya Bank , Lakshmi Vilas Bank , Tamilnad Mercantile Bank and Dhanlaxmi Bank.

Monsoon over Kerala may be delayed by a week: The onset of the southwest monsoon over Kerala is likely to be delayed from the normal date of June 1, the weather office said, the first negative signal since it forecast above-normal rainfall this season after two years of drought. “The statistical model used by IMD for predicting the onset of monsoon indicates that the southwest monsoon is likely to set over Kerala on June 7, with a model error of ± 4 days,” the India Meteorological Department said on Sunday . Last year, the monsoon arrived six days late on June 5, compared with the forecast onset date of May 30.

FSSAI plans comprehensive recall policy: Almost after a year of no food product being pulled out of the market, The Food Safety and Standards Authority of India (FSSAI) has decided to bring a comprehensive recall policy this financial year. The last big food recall was in June 2015, of Nestle India’s Maggi noodles. In the making for five years, the draft procedure for a food product’s recall was put up for public comment on the body’s website last year by FSSAI. Its latest newsletter lists “final notification of recall regulations” as among the 12 important things it plans for 2016-17.

EPFO may invest over Rs 6,000 cr in equity market in 2016-17: Union Labour Minister Bandaru Dattatreya has said the Employees Provident Fund Organisation (EPFO) may invest more than Rs 6,000 crore in equity market during the current financial year. The minister, however, said a final decision will be taken by the Central Board of Trustees at the next meeting. Last year, EPFO had invested about Rs 6,000 crore through SBI Mutual Fund’s two index-linked ETFs (exchange-traded funds) — one to BSE’s Sensex and the other NSE’s Nifty.

Sebi planning to tighten listing norms: The Securities and Exchange Board of India (Sebi) is planning to attach bank accounts and properties of promoters who repeatedly flout listing and disclosure norms and fail to take corrective steps. The penalty structure may also be changed to deter publicly traded firms from taking listing regulations casually.Sebi’s latest proposals come amid widespread violations of listing and disclosure norms

Employees’ rights to be foremost in Bankruptcy law: The new Bankruptcy Law will fast- track recovery of dues from defaulters and employees will be first in line to get their share from liquidation of assets if a company goes belly-up, says Union Minister Jayant Sinha. Besides, it would also bring down drastically the time taken to wind up a sick company while making the entire process much easier, the Minister of State for Finance said.

Rupee down: The rupee ended weak by 15 paise at 66.77 due to increased demand for the us dollar from importers amid a weak domestic equity market. Rupee sentiment was also hit as the IIP growth plunged to 0.1 per cent in March and retail inflation soared to 5.39 per cent in April.

Bonds: The 7.88 per cent government securities maturing in CG2030 traded value at Rs 300.00 crore at weighted yield of 7.75 per cent, the 7.59 per cent government securities maturing in CG2026 traded value at Rs 225 crore at weighted yield of 7.45 per cent and the 7.72 per cent government securities maturing in CG2025 traded value at Rs. 100 crore at weighted yield of 7.63 per cent. The weighted yield on government securities with a maturity period of 0-3 years, 3-7 years, 7-10 years and more than 10 years was quoted at 7.11 per cent, 7.51 per cent, 7.52 per cent and 7.76 per cent, respectively.

NSE bond auction on May 16: The National Stock Exchange (NSE) will auction investment limits for overseas investors on May 16, for the purchase of government debt securities worth Rs. 3,340 crore. The auction will be conducted on NSE’s ebid platform from 3.30 pm to 5.30 pm, after the close of market hours, the exchange said in a circular today.

Source : http://goo.gl/ntxH8X

Interview :: Investors feel confident to invest when they see a firm customer-focused

K. RAGHAVENDRA RAO | July 8, 2013| Business Line

The MF industry grows only when pension money comes in. For capital formation, the Government has to incentivise equity investing. NIMESH SHAH, MD and CEO, ICICI PRUDENTIAL ASSET MANAGEMENT COMPANY

Asset Managers need to consistently show fund performance to be in business, says Nimesh Shah, Managing Director and Chief Executive Officer, ICICI Prudential Asset Management Company.

In an interview to Business Line, Shah provides insights on how better fund performance, well-defined products and a customer-centric approach draw investors to a fund house.

You have been consistent in terms of profitability. How?

If you consistently do normal things in India you will do well. Don’t try to be a super hero. The mutual fund industry is quite sanitised now. Only those whose funds perform will remain in business.

Can you elaborate?

It is all about giving regular returns over five years, 10 years and 15 years consistently.

The products should be well-defined and marketed consistently. At the end of the day, you sell track record. Our funds have a nine-year track record.

We also have the best of compliance and corporate governance standards. Ninety per cent of the mutual fund distribution network is mapped to us.

When investors see that the company is customer-focused they feel confident of investing in our schemes for 3-5 year horizons. Ninety seven per cent of our funds are outperforming the benchmark on a three-year horizon.

What is your wish list for the mutual fund industry?

There is no wish list. The ball is in our court. We are working for the end customer. When markets turn, retail investors will be back.

The mutual fund industry grows only when pension money comes in and foreign pension money is already coming into India. For capital formation, the Government has to incentivise equity investing. Growth does not come by push, ultimately, it is pull.

Your take on the SEBI directive to set aside two basis points of assets under management (AUM) for investor education?

It is well-thought through and a bold step. A lot of education is required. Advertisements have started. We we will be working in-depth in small towns over the next three months. We will invest serious money to promote mutual fund more. We have to use these budgets efficiently.

How are your other business verticals (PMS, Real estate and International Advisory) doing?

They are doing well. We have absolute return on PMS products for HNIs who understand the risk return payoffs of such products.

On our real estate PMS business, we never found it difficult to raise funds. We have raised Rs 300 crore as a first tranche of our Rs 1,000 crore fund from individuals and institutions. The next fund would be Rs 1,500-2,000 crore.

The international advisory is an integral part of our mutual fund business. We have clients from Japan Taiwan, Korea, West Asia and Europe.

People are coming to us as our fund performance is good. Nordea has launched the ICICI Prudential Dynamic Fund in Europe.

With real estate being considered a risky bet, how do you manage?

Land and building in India are appreciating assets. We are very conservative. We do not invest in real estate, we do mezzanine funding.

We have restricted our Rs 1,000-crore fund to 10-12 developers in six cities. We have strong relationships in the real estate business and also have a separate investment team for real estate.

It is all about selecting the partner, project and security. We have developed this well and it is a great business to be in.

Many fund houses had closed down their branches in beyond top 15 cities in the last few years. What did you do?

We did not close down our branches as it sends a wrong signal. We are opening 10-15 branches this fiscal and also increasing our coverage in existing geographies.

We have the capability to service walk-in customers. However, we have no intention of reaching out to them. We will work through distributors.

Is being a mutual fund distributor remunerative today?

For cities beyond the top 15, it is a good to be in if one has a retail client base. However, for a distributor in the top 15 cities, volumes are important.

Source : http://goo.gl/q0vHP

ATM :: Ways to enhance investors participation in equity market

Jul 01, 2013, 11.38 AM IST| moneycontrol.com|Ajit Manjure, Central Depository Services (India) Limited

The introduction of depositories in India has changed the market mechanism drastically. The National Securities Depository Limited was formed in the year 1996 while Central Depository Services (India) Limited came to existence in 1999.

The introduction of depositories in India has changed the market mechanism drastically. The National Securities Depository Limited (NSDL) was formed in the year 1996 while Central Depository Services (India) Limited (CDSL) came to existence in 1999. It has brought transparency in the market for traders as well as investors. Both the depositories are working through it’s Depository Participants (DPs). The DPs include public and private sector banks, Co-op Banks and big brokers who assist general investors in opening demat and trading accounts.

However, in spite of large network of banks operating throughout the country, the number of demat accounts have not been increased and large number of investors are yet to be part of the stock market. There are several reasons for the low growth of demat accounts across the country.

Securities and Exchange Board of India (SEBI) has taken several measures to improve the retail investors’ participation. The measures taken by the regulator will yield the expected results only with the change of mind set of the investors towards stock market. Herein, the role of Investor education is very important in order to educate the retail investors about the various dynamics of the stock market.

Overall, against the population of 121 crores, both the depositories could open hardly 2.15 crore accounts, which is a minuscule percentage, who can invest directly in stock market.

The reasons are many for the poor participation of the investors in the stock market. There are some remedial measures to improve the retail investors’ participation in our capital market. The lengthy documentation is a major hurdle in opening the demat account. In order to open a demat account along with trading accounts, customers are required to sign four agreements – Demat, National Stock Exchange (NSE), Bombay Stock Exchange (BSE) and power of attorney (for debiting the shares). Earlier, approximately 52 signatures were required for signing these agreements. SEBI has combined all these terms and conditions in the recent past and the investors now need to sign around 20 signatures to open demat and trading account.

SEBI has introduced Know Your Customer (KYC) norms where the investors need to give documents only once for opening the demat or trading account or if they wish to invest in Mutual Funds. Earlier, it was required to be given separately for opening above accounts.

Normally, investors come to the market via two routes i.e. through primary market and then through secondary market. However, after COAL India Public Issue, which came in November 2010 and yielded good returns for retail investors after listing, there is hardly any good IPO that has entered into Indian stock market since then. However, since the market conditions are also not very attractive; companies are reluctant to come out with IPOs.

There is not much market information available to the investors after opening the accounts. It has been observed that the intermediaries chase clients till the demat and trading account is opened. However, the investors are neither offered post opening account services nor the required information on the stock market. This leads to the account becoming dormant. The free newsletters through email by the market players is one of the remedy which can fill up this gap. Since this is a cost effective method, the investors having email addresses can be sent information about market by the bank DPs which will assist them opening more number of demat accounts.

It is observed that PSU banks have not set targets for the demat business. Like other banking products like CASA deposits, fixed deposits, Insurance policies and mutual funds investments, banks have not set the targets for opening demat accounts through their branches for their employees. Neither any incentives are offered to these employees who can open a large number of demat accounts. The knowledge level of bank staff is also very limited in sphere of stock market which is one of hurdle for promoting demat business through a strong network of bank branches in the country.

The investor education seminars conducted by depositories in association with various DPs get good response only when promoted through popular newspapers. However, there is a heavy cost attached for doing such programs, which is not affordable for most of the DPs.

The programs done without newspaper tie up can not gather sizeable audience and thus purpose of reaching to masses is defeated.

In order to promote stock market knowledge among the retail investors, there is a need for promotional activities like TV shows, AD campaigns, documentaries providing information about scheme such as Rajiv Gandhi Equity Savings Schemes (RGESS) wherein new investors can be attracted towards the capital market. However, depositories and exchanges have to take the lead now to prepare such promotional material which can be seen by general investors across India.

Now, SEBI has directed all the exchanges and depositories to spend a good percentage of their profits on Investor Education Activities. Though exchanges and depositories are not profit making centres, however, whatever profit they would earn, one fourth of the same is required to be spent on the Investor education activities. Thus, good amount of literature can now be made available for retail investors which can increase their participation in Indian Capital Market.

Holding of trade fairs for promoting capital markets in tier II & tier III cities is required. This is another method wherein most of the banks, Non-Banking Financial Corporations (NBFC) and broking companies can put up their stalls and large number of investors can be attracted for such fairs through media campaigns.

The social media platforms specially Face Book, Twitter, Linkedin along with e-groups and websites can spread awareness about various options available for the investors in the present market situation. The investor education can play a vital role in improving the active participation of the investors in the market which can help them in the informed investment and in getting good returns.

The author is part of Investor Education Cell of CDSL and has organized more than 500 investor awareness seminars across the country. The views expressed here are his personal.

Source: http://goo.gl/fN2LO

Calling all corporate leaders and employees, Integra FinServe in association with Reliance Securities Ltd. arranges Investor Education Sessions either at the corporate or at RSL office in Goregaon East, Mumbai, on confirmed participation of 15 employees of any corporate. Call +919322286765 for booking.

ATM :: Click to complain. Regulators get active

Deepti Bhaskaran|Kayezad E. Adajania|Vivina Vishwanathan|First Published: Fri, Jun 14 2013. 07 08 PM IST| Livemint.com|

As you climb the stairs of Parisrama Bhavan in Basheer Bagh to reach the Insurance Regulatory and Development Authority (Irda) office in Hyderabad, you are greeted by a billboard in the stairwell that asks: Is your insurance company listening to you? If not, the billboard goes on, you can register your complaints online and track their status through Integrated Grievance Management System, IGMS, or call at 155255.

This in fact is the first board you see before you enter the office. Its placement is indicative of the regulator’s focus and its effort to reach out to aggrieved customers directly. And Irda is not alone in this regard. Capital markets regulator Securities and Exchange Board of India, Sebi, too has taken some institutional measures in the form of Sebi Complaints Redress System or SCORES to effect speedy disposal of complaints. In fact, SCORES is a step ahead because it also claims that it adjudicates on a case to case basis to ensure fair settlement. The mandate for IGMS, however, is to ensure speedy settlement of complaints and not adjudication. This is true even for the Standardised Public Grievance Redress System or SPGRS, that the ministry of finance has put in place only for the public sector banks (PSBs) for now.

With regulators taking a keen interest, consumer grievance management seems to be getting institutionalized and companies are beginning to create dedicated departments to have a focused approach towards consumer complaints. But given the fact that it’s still early days and the systems are yet to become popular, it maybe too early to judge their efficacy. But if the regulators are using the help of technology to reach out to you, you should also know how to reach out to them with your complaints. Read on to understand the processes of consumer grievance redressal set up recently in the financial sector.

Capital markets and mutual funds

Sebi set up SCORES in June 2011. So if you have a grievance with your investments that come under Sebi’s jurisdiction, such as mutual funds (MF), equity shares, depository participants (DP) and brokers, you can complain directly to Sebi through SCORES.

Visit Sebi’s website (www.sebi.gov.in) or http://www.scores.gov.in, fill in your basic details like your name, address, email id, register your complaint, submit any documents that you may have as evidence and sit back. Sebi, then, forwards your complaint to the firm and keeps a track of it. You could, alternatively, send your complaint to Sebi by post.

To ensure that the company against whom the complaint is filed actually receives the complaint, Sebi has made it mandatory for every listed company, MF, stock exchange, depository and so on, to nominate one person in charge of investor complaints. When Sebi gets a complaint, it sends an alert message to this official within seven days; he is then mandated to look into it. Though Sebi has not specified a fixed time limit within which the firm must respond, it mandates the company to send its first response within seven days of receiving the complaint and then about another 30 days generally to resolve the complaint. If the firm fails to respond, Sebi sends one to two reminders to the firm. If you have submitted the complaint online (on Sebi’s website), your firm will email you the response and will also update Sebi. If you complain by post, the firm sends you its reply by post, and it is mandated to mark a copy to Sebi.

If you are unhappy with the company’s response, you can go back to Sebi and tell them to take a relook at it. Further, there have been instances where Sebi, on its part, is not particularly satisfied with the firm’s response. In such cases, Sebi gets back to the company itself. “There was an instance where the investor did not get dividends for the shares he held of a bank. When the firm said that it sent duplicate dividend warrants, we got back to the company and told them to send this investor, two more reminders with a gap of seven days. We did this to ensure that if an investor misses one response from the company, the follow-up reminders should catch his attention,” says a senior Sebi official who did not want to be named.

Wait for about 30 days after you complain. If you don’t hear anything, you can quote your Unique Complaint Registration Number (UCRN)—a number you get after you first lodge your complaint on Sebi’s website—and send Sebi a reminder. Sebi penalizes those who fail to respond. The penalty varies and is subject to Sebi’s decision. Such actions taken against firms are also periodically listed on Sebi’s website here (http://tinyurl.com/mblgx3n).

While Sebi claims that its process is robust, an investor association we spoke to, is not impressed. “Over all it is very unsatisfactory. There are areas of concern. Firstly, the communication between Sebi and the complainant, after the complaint has been filed, is absent. At best, the investor gets a response “in process” when he gets in touch with Sebi to check the progress, but that sort of reply is not enough. These are automated responses and don’t mean much. Secondly, if grievances are just not resolved, despite Sebi’s intervention, nobody knows what happens to such complaints. In such cases, where Sebi can’t can’t do anything, they still should be able to take some action. Which they don’t do. I raised this query and asked them what they do in such cases. They didn’t have any answer to that,” says Virendra Jain, founder and president, Midas Touch Investors Association.

Insurance

IGMS was set up by Irda in 2011. It works like a central repository of all the consumer complaints received by life insurance and non-life insurance firms. In that sense it’s a handshake between Irda’s grievance management system and the insurer’s individual grievance management system. The way it works is like this. You can register a complaint either through mail, phone or even verbally with an insurance company and the insurer will register that complaint in its grievance management system. In fact it is mandated that every insurer must have a grievance redressal policy approved by Irda and a grievance cell that will be presided over by a nominated person from the board.

Once your complaint gets registered, it will automatically flow in the IGMS which is monitored by Irda. Irda gives the insurer 15 days to settle the complaint. “Regardless of the nature of grievance, insurers have 15 days to settle the matter. However, 15 days start from the day of receiving all the necessary documents and proof,” says Yateesh Srivastava, chief operating officer, Aegon Religare Life Insurance Co. Ltd. If your complaint is not settled within 15 days, the system will raise a red flag so that Irda can take note of the delay and direct the insurer to settle the complaint. You can also approach IGMS by logging into http://www.igms.irda.gov.in or calling up the toll free number 155255. However, Irda encourages you to approach the insurer first.

The mandate of IGMS is restrictive because through it, Irda does not adjudicate on individual complaints. The basic idea of IGMS is to effect speedy disposal of complaints and have a repository that would help Irda track the nature of complaints in order to make systemic corrections. “We used to submit data on complaints even earlier but it was post-facto. So, the idea of IGMS was to track complaints and the effectiveness and timeliness of response on a real time basis. The regulator, however, depending upon the trends that complaints throw up, can always question the insurer,” says T.R. Ramachandran, CEO and managing director, Aviva Life Insurance Co. India Ltd.

In other words, Irda could go beyond the mandate. “Even as the regulator’s role remains directive, it can track complaints and even penalize the insurer for a glaring mistake,” says Srivastava. Irda also publishes data on complaints on its consumer awareness website http://www.policyholder.gov.in. According to this website, Irda in FY12 logged in about a lakh complaints on unfair business practice in the life insurance industry. This is 32% of all the complaints received. Irda on its website, http://www.irda.gov.in, also warns companies who violate regulations to fall in line. For instance in March, based on various compliants, Irda issued 15 warnings to Oriental General Insurance Co. Ltd and National Insurance Co. Ltd.

The industry feels that IGMS has led to speedy disposal of complaints. However, some feel more needs to be done. “Customer complaints are definitely being taken more seriously since Irda has a constant watch but what action the insurer takes is still work in progress. Irda should also think about taking action on complaints because approaching the ombudsman is very time consuming and they are short staffed,” says Kapil Mehta, founder, Securenow.in.

So if you want arbitration on the complaint, you will still need to go to the insurance ombudsman. Ombudsman are divided according to the regions and you will need to approach the one in your area. The verdict of the ombudsman is usually binding on the insurers and the ombudsman is supposed to issue a verdict within three months from the receipt of the complaint.

Banking services

Except for PSBs, the banking sector lacks a similar integrated redressal system. In case of the PSBs, the department of financial services under the ministry of finance has put in place an online complaint redressal facility and inked guidelines on SPGRS last year. This SPGRS forms needs to be uploaded on the website of the PSBs. For instance, in the Bank of Baroda website you can find the form at http://tinyurl.com/kda93kl.

The idea was to meet the rising expectations of customers for prompt redress of their grievances. This system again works like a repository in the sense it integrates complaints received from multiple channels into a common digital platform. The bank in question is expected to solve grievances within three weeks or 21 days. The system has an inbuilt management information system for analysing performance. Says V.N. Kulkarni, chief counsellor, Abhay Credit Counselling Centre, “The SPGRS is one of the new ways to send complaints. However, the issue of resolving consumer complaints faster still remains. The move is in the right direction, but number of days to resolve the grievance should have been reduced further.” He adds that, “Only banking related issues can be addressed through the existing system. For complaints related to third party products such as insurance and MFs sold through a bank, you will have to approach the respective industry and regulators. This is because banks only acts as an agent while selling the third party products.” SPGRS is still being introduced in the banking system. We will have to wait and watch to see how it works out. You should remember that if the grievance is not solved via SPGRS, you can then approach the banking ombudsman.

Banking ombudsman is one of the last recourses to address banking related complaints. The ombudsman will look into complaints against all banks. As a customer you can approach the ombudsman only after he has exhausted all the options of customer redressal services of his bank in 30 days. For approaching the banking ombudsman, you need to first check under which jurisdiction you fall (see http://tinyurl.com/aqkhmwc). Usually, the banking ombudsman gives ruling within 30 days. If you are not satisfied with the ruling of the banking ombudsman and you have been unable to get your money back, the next thing is to approach the appellate authority, who is Reserve Bank of India’s deputy governor; currently, K.C. Chakrabarty.

The second layer of consumer redress is being put in place, although with some restrictions, but it seems like it still has to cover some ground. You as a customer should, however, actively make use of these systems to get your complaints settled in a timely manner.

Source : http://goo.gl/7Gdli