Tagged: Debt

ATM :: Pick the best NPS funds

Babar Zaidi | May 8, 2017, 03.15 AM IST | Times of India

Though it was thrown open to the public eight years ago, investors started showing interest in the National Pension System (NPS) only two years ago. Almost 80% of the 4.39 lakh voluntary subscribers joined the scheme only in the past two years. Also, 75% of the 5.85 lakh corporate sector investors joined NPS in the past four years. Clearly, these investors have been attracted by the tax benefits offered on the scheme. Four years ago, it was announced that up to 10% of the basic salary put in the NPS would be tax free. The benefit under Section 80CCD(2d) led to a jump in the corporate NPS registrations. The number of subscribers shot up 83%: from 1.43 lakh in 2012-13 to 2.62 lakh in 2013-14.

Two years ago, the government announced an additional tax deduction of `50,000 under Sec 80CCD(1b). The number of voluntary contributors shot up 148% from 86,774 to 2.15 lakh. It turned into a deluge after the 2016 Budget made 40% of the NPS corpus tax free, with the number of subscribers in the unorganised sector more than doubling to 4.39 lakh. This indicates that tax savings, define the flow of investments in India. However, many investors are unable to decide which pension fund they should invest in. The problem is further compounded by the fact that the NPS investments are spread across 2-3 fund classes.

So, we studied the blended returns of four different combinations of the equity, corporate debt and gilt funds. Ultrasafe investors are assumed to have put 60% in gilt funds, 40% in corporate bond funds and nothing in equity funds. A conservative investor would put 20% in stocks, 30% in corporate bonds and 50% in gilts. A balanced allocation would put 33.3% in each class of funds, while an aggressive investor would invest the maximum 50% in the equity fund, 30% in corporate bonds and 20% in gilts.

Ultra safe investors

Bond funds of the NPS have generated over 12% returns in the past one year, but the performance has not been good in recent months. The average G class gilt fund of the NPS has given 0.55% returns in the past six months. The change in the RBI stance on interest rates pushed up bond yields significantly in February, which led to a sharp decline in bond fund NAVs.

Before they hit a speed bump, gilt and corporate bond funds had been on a roll. Rate cuts in 2015-16 were followed by demonetisation, which boosted the returns of gilt and corporate bond funds. Risk-averse investors who stayed away from equity funds and put their corpus in gilt and corporate bond funds have earned rich rewards.

Unsurprisingly, the LIC Pension Fund is the best performing pension fund for this allocation. “Team LIC has rich experience in the bond market and is perhaps the best suited to handle bond funds,” says a financial planner.

The gilt funds of NPS usually invest in long-term bonds and are therefore very sensitive to interest rate changes. Going forward, the returns from gilt and corporate bond funds will be muted compared to the high returns in the past.

Conservative investors

In the long term, a 100% debt allocation is unlikely to beat inflation. This is why financial planners advise that at least some portion of the retirement corpus should be deployed in equities. Conservative investors in the NPS, who put 20% in equity funds and the rest in debt funds, have also earned good returns. Though the short-term performance has been pulled down by the debt portion, the medium- and long-term performances are quite attractive.

Here too, LIC Pension Fund is the best performer because 80% of the corpus is in debt. It has generated SIP returns of 10.25% in the past 3 years. NPS funds for government employees also follow a conservative allocation, with a 15% cap on equity exposure.

These funds have also done fairly well, beating the 100% debt-based EPF by almost 200-225 basis points in the past five years. Incidentally, the LIC Pension Fund for Central Government employees is the best performer in that category. Debt-oriented hybrid mutual funds, also known as monthly income plans, have given similar returns.

However, this performance may not be sustained in future. The equity markets could correct and the debt investments might also give muted returns.

Balanced investors

Balanced investors who spread their investments equally across all three fund classes have done better than the ultra-safe and conservative investors. The twin rallies in bonds and equities have helped balanced portfolios churn out impressive returns. Though debt funds slipped in the short term, the spectacular performance of equity funds pulled up the overall returns. Reliance Capital Pension Fund is the best performer in the past six months with 4.03% returns, but it is Kotak Pension Fund that has delivered the most impressive numbers over the long term. Its three-year SIP returns are 10.39% while five-year SIP returns are 11.22%. For investors above 40, the balanced allocation closely mirrors the Moderate Lifecycle Fund. This fund puts 50% of the corpus in equities and reduces the equity exposure by 2% every year after the investor turns 35. By the age of 43, the allocation to equities is down to 34%. However, some financial planners argue that since retirement is still 15-16 years away, a 42-43-year olds should not reduce the equity exposure to 34-35%. But it is prudent to start reducing the risk in the portfolio as one grows older.

Aggressive investors

Aggressive investors, who put the maximum 50% in equity funds and the rest in gilt and corporate bond funds have earned the highest returns, with stock markets touching their all-time highs. Kotak Pension Fund gave 16.3% returns in the past year. The best performing UTI Retirement Solutions has given SIP returns of 11.78% in five years. Though equity exposure has been capped at 50%, young investors can put in up to 75% of the corpus in equities if they opt for the Aggressive Lifecycle Fund. It was introduced late last year, (along with a Conservative Lifecycle Fund that put only 25% in equities), and investors who opted for it earned an average 10.8% in the past 6 months.

But the equity allocation of the Aggressive Lifecycle Fund starts reducing by 4% after the investor turns 35. The reduction slows down to 3% a year after he turns 45. Even so, by the late 40s, his allocation to equities is not very different from the Moderate Lifecycle Fund. Critics say investors should be allowed to invest more in equities if they want.

Source: https://goo.gl/oUp9FP

ATM :: Got a windfall? Don’t put it in a savings a/c

RAJESHWARI ADAPPA | Tue, 28 Jun 2016-06:55am | dna

Experts advise that you should park the lump sum in avenues such as liquid or ultra-short term funds till you decide where to invest it as putting the money in a savings account not only earns low interest but also tempts you to blow it

Windfalls or coming into large sums of money sure makes you feel rich but if you want to stay rich, then the challenge is to ensure that the money lasts for a really long time.

Incidentally, experts advise that when one does not know what to do with a large sum, the first thing to do is take it off the bank savings account.

“The money lying there not only earns low interest but tempts you to blow it. Hence, park it in short-term avenues such as liquid funds or ultra-short term funds until you decide or get advice on where to invest the money in,” says Vidya Bala, head of mutual fund research, FundsIndia.

If you have a lump sum to invest, it is best to revisit your investment plan, advises certified financial planner Gaurav Mashruwala.

“Firstly, buy adequate health and life insurance. Secondly, if you have any loans, pay up the loans. After that, you can start goal-based investing,” says Mashruwala.

Most people are confused where to invest for the best returns. “Where to invest would depend on whether they have a near-term use for the money,” says Bala.

“If it is retirement money and the investor needs to create an income stream, they could deploy it in a combination of ultra-short and short-term debt funds and do a systematic withdrawal plan to generate their own income. If it is for the long term, a combination of equity and debt funds will work well. So one needs to know the purpose and the time frame before they can decide where to invest,” says Bala.

The most important task is to create a goal for such money and then allocate and invest accordingly. While goals would depend on the individual’s requirements, broadly your goals could include creating funds for a specific purpose such as a retirement fund, an emergency fund, a kids education or a marriage fund or even a fund for personal goals (say a foreign trip), etc.

A retirement fund is a must. HDFC Pension’s CEO Sumit Shukla advises that 20-30% of the sum should be invested for retirement. He suggests investing the lump sum initially in Tier II account of NPS from which some money could be transferred into the Tier I account every month via systematic withdrawal plan. “This would help to ensure that initially the money is invested in debt (Tier II account) and as one invests in the Tier I account, slowly the equity portfolio is also built up,” says Shukla.

“Corporate debt has earned 10.47% while government debt has earned 10.35%. Compared to the 8.8% returns from PF, this difference would work out to be huge over a period of time,” points out Shukla.

Depending on your risk and return profiles, there is a range of avenues. “Investors seeking low to medium risk can examine fixed deposits, debt mutual funds, corporate bonds, tax-free bonds and monthly income plans.

However, investors with higher risk preference can look at balanced & equity funds, direct equities, private equity & real estate funds,” according to a DBS spokesperson.

“Lump Sum investing is fine when it comes to low-risk debt funds. However, when it comes to equity funds, it is important to understand the risk of timing the market by investing in one go. Ability to take near-term falls is a must of one chooses to invest lump sum,” says Bala. A better option is to invest in a phased manner through an SIP (systematic investment plan).

It may be a good idea to take professional advice. “Also, consider the impact of tax on the returns,” says the DBS spokesperson.

The mistake that many people who come into big money suddenly make is that they start living a lavish lifestyle. “Instead, invest in income generating and growth-oriented assets. Use the returns from these assets to enhance your lifestyle,” advises Mashruwala.

The solution is to invest wisely keeping in mind two primary goals: ensuring safety of capital and also growth.

Source : http://goo.gl/4KucZz

ATM :: How to save and invest for your child’s education

By Sanket Dhanorkar, ET Bureau | 25 Apr, 2016, 08.00AM IST | Economic Times

The class of 2018 of the Indian Institute of Management-Ahmedabad will pay Rs 19.5 lakh for the two-year course. This is 400% higher than what the premier B-school charged in 2007. If the fees of the two-year management course continues to rise by an average 20% every year, it will cost roughly Rs 95 lakh in 2025.

Even undergraduate courses have not been spared. The tuition fee for engineering courses in the Indian Institute of Technology (IIT) has been hiked from Rs 90,000 to Rs 2 lakh per annum. This is just the tuition fee—the total cost is much higher. At an average running inflation rate of 10%, a four-year engineering course that costs Rs 8 lakh today is likely to set you back by Rs 17 lakh in another eight years’ time.

By 2030, the same would cost more than Rs 30 lakh. If you have not planned well, you could get a rude shock, falling way short of the required corpus when your kid is ready for college. In fact, for engineering and medical aspirants, the costs start even while the student is in high school. Coaching institutes charge anywhere between Rs 80,000-1 lakh a year for preparing the student for the entrance exam.

This sharp spike in fees is a wakeup call for parents saving for the higher education of their children. “Higher education costs have the highest inflation rates in the country. Parents need to realise it is going to be an expensive affair,” asserts Nitin Vyakaranam, CEO, Arthayantra.

This week’s cover story is aimed at parents who are saving for their children’s education. The investment options before them will depend on the age of the child. If the child is 3-4 years old, the investment choices and strategy will be different than for a parent whose child is 15-16 years old. Our story lists the most appropriate investment options for three broad age groups and the strategies to be followed at each stage. Choose the one that fits your situation to achieve your dreams for your child’s higher education.

Higher education costs may be rising at a fast clip, but Delhi-based Balbir Kaur is not perturbed by the projections of future costs. Balbir and her husband Puneet are saving for their son Jivvraj’s higher education. They started small last year with SIPs totalling Rs 5,000 in three mid-cap equity funds.

If they continue with that amount and their funds earn 12% a year, the couple would have roughly Rs 20 lakh by the time 4-year-old Jivvraj is ready for college in 2029. But Balbir has a neat strategy in place. “From this year, I have increased my SIP amount to Rs 10,000 a month. We plan to keep increasing this every year as our income goes up,” she says. If they hike the SIP amount by 20% every year, they will accumulate over Rs 1 crore in 13 years.

The benefits of an early start cannot be stressed enough when you are saving for a long-term goal. If your child is 3-4 years old, you have a good 13-14 years to save. Starting early helps you amass larger sums that may not be possible later in life. Tanwir Alam, MD, Fincart, points out, “The multiplier effect in the power of compounding comes from the investing time horizon; longer time horizons have a higher multiplier effect.”

Starting early also put lesser burden on your finances because it requires a smaller outflow. For instance, if your target is Rs 25 lakh, you need to save only Rs 5,004 a month if you start now. But if you wait for six years, you will have to invest Rs 9,195 a month to reach the target. Wait for three more years and the required amount jumps to Rs 23,875. Worse, you may not be able to invest in certain assets if the time horizon is too short. “If you delay investing, not only do you have to invest a higher amount every month, but it also reduces your ability to take risks,” says Vidya Bala, Head-Mutual Fund Research, FundsIndia.

The investment strategy changes if your child is a little older. Since you have only 5-9 years to save, the risk will have to be lowered. The ideal asset mix at this stage is 50% in stocks and 50% in debt. Instead of equity funds that invest the entire corpus in stocks, go for balanced funds that invest in a mix of stocks and bonds.

If your risk appetite is lower, monthly income plans (MIPs) from mutual funds can be a good alternative. These funds put only 15-20% of their corpus in equities and are therefore less volatile than equity or balanced funds. However, the returns are also lower than those of equity funds. In the past five years, equity funds have delivered compounded annual returns of almost 12%, while balanced funds have given 10.5% and MIPs have given around 8.85%. Investors should also note that the returns from equity and balanced funds are tax free after a year, while the gains from MIPs are taxed at 20% after indexation benefit.

For the debt portion, start a recurring deposit that would mature around the time your child is scheduled to apply for college. If you are in the highest 30% tax bracket, avoid recurring deposits and start an SIP in a short-term debt fund. These funds will give nearly the same returns as fixed deposits but are more tax efficient if the holding period is over three years.

It is also important to review the progress of your investment plan. “You should check every year if you need to step up your contribution towards the higher education kitty,” says Bala. “At times, you may put in a lump sum investment even if you have a SIP running.” Keep monitoring the cost of education on a yearly basis and accordingly adjust your investment requirement.

For parents of teenaged children, the investment strategy should focus on capital protection. With the goal barely 1-4 years away, you cannot afford to take risks with the money accumulated for your child’s education. The equity exposure at this stage should not be more than 10-15%. Kolkata-based Sanat Bharadwaj started investing in a mix of mutual funds and bank deposits for his son Siddhant’s college education almost 12 years ago. But now that the goal is just one year away, he has shifted 75% of the corpus to the safety of a bank deposit.

This shift from growth to capital protection is critical. The 3-4 percentage points that equity investments can potentially give is not worth the risk. A sudden downturn in the equity markets can reduce your corpus by 5-6% and upset your plans. “As you come closer to your target, you should stop SIPs in equity funds and shift to a short-term debt fund,” says Kalpesh Ashar, CFP, Full Circle Financial Planners & Advisors.

As mentioned earlier, the cost of higher education is shooting up. Many parents who started late or chose the wrong investment vehicles may find themselves woefully short of the target. If you face a shortfall, don’t be tempted to dip into your retirement corpus to fill the gap. This is a mistake. “Your retirement should be given priority over your kids’ education,” says Rohit Shah, CEO of Getting You Rich. Instead, you should take an education loan with the child as a co-borrower.

Apart from keeping your retirement savings intact, it will inculcate a savings discipline in your child after she takes up a job. The repayment starts after a 6-12 month moratorium when she completes her education. Banks offer loans of up to Rs 20 lakh for courses in Indian institutes. If your child is keen on a foreign degree, it would require a larger corpus. While banks are willing to lend up to Rs 1.5 crore for foreign courses, they insist on part funding in the form of scholarship or assistance.

When saving for your child’s education, do remember that the whole fianncial plan depends on regular contributions by you. But what if something untoward happens to you? The entire plan can crash. The only way to guard against this is by taking adequate life insurance. A term plan does not cost too much. For a 30-35 year old person, a cover of Rs 1 crore will cost barely Rs 10,000-12,000 per year. That is too small a price for something that safeguards your biggest dream.

Source : http://goo.gl/uTf5qh

ATM :: Best ways to use your bonus

Chandralekha Mukerji | Apr 25, 2016, 05.13 AM IST | Times of India

It is the time for annual appraisal letters and the bonus. Many of you might have got your tax refunds too.

While you may be happy to have some extra cash, handling it can be tricky. You need to juggle multiple aims and concerns to maximize your yearly perk. Here are suggestions for getting the most from that extra money .

OPTION 1: Reduce your debt burden

Before you start investing your surplus, pay off your debt. It could be outstanding credit card payments, car loan, personal loan, etc. Start settling your debt in the order of interest rates. The ones with no tax benefits and higher interest cost should be paid off first. Loans that offer tax benefits should be the last on your list.

OPTION 2: Invest in National Pension Scheme (NPS)

Upto Rs. 50,000 invested in the NPS, under Section 80CCD (1b), can be claimed as deduction, over and above the Rs1.5 lakh investment deduction limit under Section 80C. At the highest tax bracket of 30%, this could mean a savings of Rs 15,000 on your next tax bill. Under NPS, it is mandatory to buy an annuity plan with 40% of the corpus at maturity . The remaining 60% can be withdrawn. The Finance Minister has made withdrawals up to 40% of the corpus tax exempt, adding to NPS’ appeal.

OPTION 3: Increase equity exposure

The Sensex has fallen around 12% in the past year, and this provides an opportunity for long-term buyers. You can invest your lump sum in a debt fund and use a systematic transfer plan to move the money into equity funds. You could also earmark this corpus for a goal that is 5-10 years away. For instance, you can use the money towards increasing your down payment for an asset purchase and reduce your future loan burden.

OPTION 4: Invest for your daughter

If your daughter is less than 10 years old, Sukanya Samriddhi Yojana (SSY) is the best debt option to invest in for her future. At 8.6% yearly compounded rate, this is among the highest paying small savings schemes. Investment in SSY is tax deductible under Section 80C, and you can invest up to Rs1.5 lakh per financial year. The principal invested, the interest accumulated and the payout are all tax-free. However, you have to stay invested till your child turns 21.

OPTION 5: Build corpus to buy a house

An extra Rs. 50,000 in tax break has been introduced for first-time home buyers where loan amount is less than Rs 35 lakh and the property’s worth is not more than Rs 50 lakh. Use the bonus to increase the size of your down payment. It will bring down your loan requirement, which means lower EMIs and, if it falls below Rs 35 lakh, there’s the extra tax benefit as well. Put the bonus in an income fund if purchase is less than a year away.

OPTION 6: Build an emergency corpus

If you do not have an emergency fund, you should use your bonus to build one.You should invest the money in highly liquid options such as short-term debt funds. The corpus will help you manage sudden, unplanned expenses.

Source : http://goo.gl/QPXcFx

ATM :: Financial planning in new year: Start it now

Don’t tinker with your long-term investment plan. But it is always better to make some critical changes, based on new tax laws and instruments

Sanjay Kumar Singh | April 3, 2016 Last Updated at 22:10 IST | Business Standard

The start of a new financial year is a good time to review your financial plan and take stock of where you stand in relation to your goals. If new goals have emerged, this is the time to make fresh investments for these. While having a steady approach is a virtue here, make some adjustments in the light of developments that have occurred over the past year.

Equity funds

Large-cap funds have fared worse than mid-cap and small-cap ones over the past one year (see table). Over this period at least, the conventional wisdom that large-cap funds tend to be more resilient than mid-cap and small-cap ones in a declining market was overturned. Nilesh Shah, managing director, Kotak Mahindra AMC, offers three reasons. “For the bulk of the previous year, FIIs were sellers of large-cap stocks, whereas domestic institutional investors (DIIs) were buyers of mid- and small-caps. Large-cap stocks are also more linked to global sectors like metal and oil, whereas mid- and small-caps are linked to domestic sectors. The latter has done better than the former, leading to stronger performance by mid- and small-cap stocks. Large-cap stocks’ earning growth decelerated or remained subdued throughout last year while mid- and small-caps delivered better growth,” he says.

Despite last year’s anomalous performance, investors should continue to have the bulk of their core portfolio, 70-75 per cent, in large-cap funds for stability, and only 20-25 per cent in mid-cap and small-cap funds. Large-caps could also fare better in the near future. Says Ashish Shankar, head of investment advisory, Motilal Oswal Private Wealth Management: “IT, pharma and private banks, whose earnings have been growing, will continue to do so. Public sector banks and commodity companies, whose earnings have been bleeding, will not bleed as much. Many might even turn profitable. FII flows turned positive this month and FIIs prefer large-caps. With the US Fed saying it won’t hike interest rates aggressively, global liquidity should improve. If FII flows continue to be stable, large-caps should do better.” Valuations of large-caps are also more attractive.

Debt funds

Among debt funds, the category average return of income funds and dynamic bond funds was lower than that of short-term, ultra short-term and liquid funds (see table). Explains Shah: “Last year, while Reserve Bank of India (RBI) cut policy rates, market yields didn’t soften as much. The yield curve became steeper. The short end of the curve came down more than the long end, which is why shorter-term bonds did better than longer-term gilts.”

Stick to funds that invest in high-quality debt paper, in view of the worsening credit environment. Shankar suggests investing in triple ‘A’ corporate bond funds. “Today, you can build a triple ‘A’ corporate bond portfolio with an expected return of 8.5 per cent. Many of these have expense ratios of 40-50 basis points, so you can expect annual return of around eight per cent. If bond yields come down, you could end up with returns of 8.5-9 per cent. If you redeem in April 2019, you will get three indexation benefits, lowering the tax incidence considerably.” Investors who have invested in dynamic bond funds should hold on to these. “A rate cut is expected in April. Yields will drop and there may be a rally in the bond market,” says Arvind Rao, Certified Financial Planner (CFP), Arvind Rao Associates.

CHANGES YOU NEED TO MAKE

Investment

- Fixed deposit rates from banks will be better than returns from the post office deposits in the new financial year

- Choose your tenure first and then, do a comparison of bank fixed deposit rates before making the final choice

- Invest in the yellow metal via gold bonds

Insurance

- If your liabilities have increased, revise term cover upward

- Revise health cover every three-five years to deal with medical and lifestyle inflation

- Revise sum assured on home insurance if you have added to household assets

Tax planning

- Conservative investors should invest in PPF at the earliest

- Those who can take some risk should bet on ELSS funds via SIP

- Invest Rs 50,000 in NPS

Traditional fixed income

The recent cut in small savings has jolted conservative investors. The rates on these have been linked to the average 10-year bond yield for the past three months. These will be revised every quarter now, make them more volatile. “People who want to invest in debt and want sovereign security should continue to invest in Public Provident Fund (PPF). No other instrument gives a tax-free return of 8.1 per cent with government security,” says Rao.

As for time deposits, financial planner Arnav Pandya suggests, “From April, fixed deposits of banks will give better returns than those of the post office. Decide on your investment tenure, see which bank is offering the best rate for that tenure, and invest in its deposit.” Lock into current rates fast, as even banks are expected to cut their deposit rates.

Tax-free bonds are another good option. Nabard’s recent issue carried a coupon of 7.29 per cent for 10 years and 7.64 per cent for 15 years. Beside getting tax-free income, investors stand to get the benefit of capital appreciation if interest rates are cut.

“People who have some risk appetite may also look at debt mutual funds and fixed deposits of stable companies,” adds Rao.

Gold

The sharp run-up in gold prices over three months, owing to the rise in risk aversion globally, took most people by surprise. The sudden spurt emphasises the need to stay diversified and have a 10 per cent allocation to the yellow metal in your portfolio. However, instead of using gold Exchange-traded funds (ETFs), which carry an expense ratio of 0.75-1 per cent, invest via gold bonds, which offer an annual interest rate of 2.75 per cent. The Budget made gold bonds more attractive by exempting these from capital gains tax at redemption.

Tax planning

Start investing in tax-saving instruments from the beginning of the year. “Don’t leave tax planning for the end of the year, otherwise you may have to scramble for funds,” says financial planner Ankur Kapur of ankurkapur.in. For those with the money, Pandya suggests: “Invest the entire amount you need to in PPF before the April 5. That will take care of tax planning for the year and you will also earn interest on your investment.”

Investors with a higher risk appetite could start a Systematic Investment Plan (SIP) in an Equity Linked Savings Schemes (ELSS) fund, which can give higher returns. “If you invest early in the year via an SIP, you will reap the benefit of rupee cost averaging,” says Dinesh Rohira, founder and Chief Executive Officer, 5nance.com. Pankaj Mathpal, MD, Optima Money Managers suggests linking all tax-related investments to financial goals.

If you live in your parents’ house and pay rent to them to claim House Rent Allowance benefits, which is perfectly legal, get a rent agreement prepared.

With 40 per cent of the National Pension System (NPS) corpus having been made tax-free at withdrawal in this Budget (the entire corpus was taxed earlier), this has become more attractive. “Open an NPS account if you have not done so already and enjoy the additional tax deduction of Rs 50,000,” says Anil Rego, CEO & founder, Right Horizons. In view of the low returns from annuities, into which 60 per cent of the final corpus must be compulsorily invested, don’t invest more than Rs 50,000.

Tax deduction under Section 24 is available on the interest repaid on a home loan. “Buying a property to avail of the benefit is not advisable if the family has a primary residence,” says Rego.

Insurance

While reviewing your financial plan, check if the term cover is adequate. A family’s insurance cover should be able to replace the breadwinner’s income stream. Financial planners take into account household expenses, goals like children’s education and marriage, and liabilities like home loans when deciding on a person’s insurance requirement. “If goals have changed or liabilities have increased, raise the amount of cover,” suggests Mathpal. Kapur says the premium rate is likely to be lower if you buy the term plan before your birthday.

Your health insurance cover might also need to be raised to take care of medical inflation. The same holds true for household insurance if you have reconstructed your house and the structure has become more expensive, or if you have added expensive assets. Rohira suggests buying add-on covers like accidental insurance and critical health insurance for comprehensive protection.

Source: http://goo.gl/iZ3KSx

ATM :: How to know if you need help with your debt

By Rishi Mehra | 20 Jan, 2016, 10.17AM IST | Economic Times

It is common to have debt in some form or the other and it is not bad to have them. However, there may come a time when runaway debt may cause problems and you may need professional help. A look at some scenarios that can indicate you need help to tackle your debt.

Caught in minimum payments – This is especially true for credit cards. When your credit card is generated there are two payment terms in that statement. One would be total amount due, while the other is the minimum amount, which is about 1 % of the principal amount outstanding. Minimum amount, being a small percentage of the total amount due, largely consists of interest and fees. This would mean if a person pays only the minimum amount outstanding on the card every month, it would take him decades to pay the entire amount. If you find yourself caught in the trap of minimum payments, it may be time to get professional help to get out of the situation.

Over reliance on credit cards – Being caught in the minimum payment trap may not be the only indicator that your finances may be off track. When debt increases, servicing it may lead to over reliance on your credit card. Having to use the credit card for daily expenses may be proof that your finances are not in shape. However, paying by credit card because you chose to and not because you have cash crunch is okay. Similarly, if you are making payments by credit cards to earn points, rewards or cash back, it makes perfect sense. However, when you start feeling your cash drying up and having to resort to credit cards to fund your monthly need, it may be time to talk to a financial advisor to get your finances in order.

Getting a loan to tackle debt – Unless it’s a credit card debt, or the new loan has substantially lower interest rates, taking a loan to settle another loan defeats the purpose. This can be very counterproductive, especially in cases when you increase the tenure of the loan to ensure you pay lower EMIs. The very idea of taking a loan should be to reduce your debt at the earliest and most frugal manner. By increasing the tenure you may be making things easier for yourself, but the interest outgo will be much higher. You also run the risk of being under debt for a longer time. If you have any debt, your first priority should be to pay them off at the earliest. If you find yourself in a situation where you think you may need a loan to settle another loan, it is best you consult an expert first to get an opinion.

Little or no savings – When your entire income goes on servicing your debt and catering to your daily expenses, it may be time to get help. When you start your career you may not be able to save immediately, but as you progress in life, you should start having some form of saving. What products appeal and suit you can differ, but it is imperative to save money, especially for periods after retirement. However, if your savings are negligible or you have no products that help you save money, you may be in a tricky situation. Get help on what products will be ideal for you and start saving diligently. Failure to do so may be painful when you grow old or during an emergency.

Difficulty in drawing or sticking to a budget – To build some sort of order and responsibility between what you earn, what you spend and what you need to set aside to cater to your debt, it is important to draw up a monthly budget. This helps you come to grips with the regular expenses every month and the special ones that may creep in. This also helps you realize when you are overspending and the need to put money aside as savings. When you have difficulty in drawing a monthly budget or sticking to it despite having one, you may need to get help to figure out ways to correct your situation.

Consistently overshoot payment deadlines – This may be an early and a potentially important indicator to know if you are having problem with your finances. If you miss payment deadlines on your bills because you do not have the requisite money and have to wait for your next payday, things may be tight for you. Servicing your existing debt may be taking its toll and you should get help to see what can be done to address your financial situation.

(The author is co-founder of deal4loans.com)

Source : http://goo.gl/vehEzi

ATM :: Do auto-switch funds give better returns?

While long-term returns of these funds may be subdued compared to diversified equity MFs, they are less volatile

Kayezad E. Adajania | Last Modified: Thu, Oct 15 2015. 08 19 PM IST | LiveMint

How do you make money in a market that goes up, say, 9% (2013) one year, then shoots up 30% (2014) in the next, and then comes crashing down the following year (by 2.42% so far this year)? The tried and tested way is to allocate assets properly; and invest in equities and debt as per your risk profile and market movements. But that’s easier said than done, isn’t it?

Let’s see how balanced funds—these invest across equities and debt—have performed. Between February 2014 and January 2015, the category returned 42% on an average. But since February 2015 till date, the category lost 1.12%.

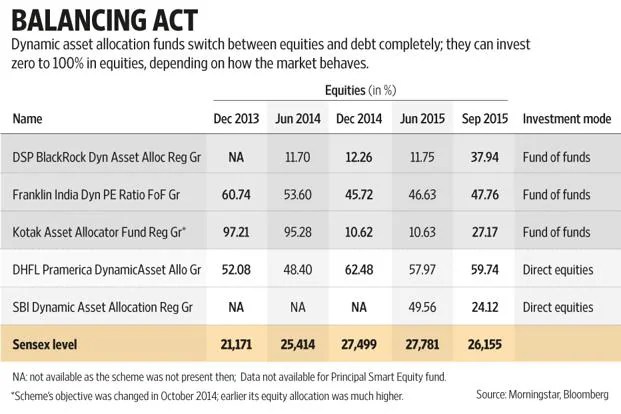

But there’s another animal that does asset allocation more efficiently than balanced funds. They’re called dynamic asset allocation (AA) funds. As against balanced funds, which maintain a steady balance of equity and debt split, or even diversified equity funds, which always remain invested in equities, dynamic AA funds switch between equities and debt completely; they can invest zero to 100% in equities, depending on how markets behave. But does such dynamism help?

Version variety

Although all dynamic AA funds switch between equity and debt, not all behave the same way. Funds such as Franklin India Dynamic PE Ratio Fund of Funds (FDPE) and Principal Smart Equity Fund (PSEF) switch based on the price-equity ratio (P-E) of the CNX Nifty index. A P-E ratio, to put it simply, indicates if equity markets are overvalued or undervalued. Higher the P-E, more the markets are considered overvalued; and lower will be these funds’ equity allocation.

DSP BlackRock Dynamic Asset Allocation Fund (DBDA) looks at the yield gap formula. It is calculated by dividing the 10-year government security’s yield by earnings yield of Nifty. The numerator is a proxy for debt markets, and the denominator is a proxy for equity markets. So, the ratio looks at how cheap or expensive equities are when compared to debt markets. If the number is high, it means expected returns from equities are low, and so a higher allocation to debt is necessary.

While PSEF invests directly in equities and debt, funds such as FDPE and Kotak Asset Allocator Fund (KAAF) are fund of funds (FoFs); they invest in other MF schemes. All these FoFs invest in in-house schemes. In cases like FDPE, the schemes are sacrosanct. But schemes like KAAF have earmarked multiple schemes for their debt and equity allocation. “Once the quant model decides the equity-debt split, the fund management team decides which funds (large-cap, mid-cap and so on) the FoF will invest in,” said Lakshmi Iyer, chief investment officer (debt), Kotak Mahindra Asset Management Co. Ltd.

Have they delivered?

Of all the dynamic AA funds, only three have been around for a significant period of time— FDPE, launched in October 2003; PSEF and DHFL Pramerica Dynamic Asset Allocator Fund (DPDA), both launched in December 2010. In rising markets between February 2014 and January 2015, FDPE and DPDA returned 33.27% and 26.68%, respectively, finishing in the bottom quintile of the moderate allocation category, as per data provided by Morningstar, a global MF research firm and data tracker. Morningstar classifies all schemes where equity allocation is between 30% and 75% in this category.

Fortunes changed in 2015, when markets started to fall. KAAF (3.51%), DBDA (2.06%) and FDPE (1.30%) finished in the top quintile between February 2015 and 12 October 2015. But on an average, the category lost 1.12% in the same period.

“There is a myth that people come to mutual funds for high returns. If that were the case, then so much money wouldn’t be invested in fixed deposits. Investors want a good experience. Returns are important, but if a fund is able to give a solution, like rebalancing, and return decent money over long periods of time, investors are happy,” said Kanak Jain, mentor, Ask Circle Mutual Fund Round Table India, one of the country’s largest MF distributor association.

Most of the funds are new in this space so we don’t have long-term data on whether these models have worked or not.

For instance, DBDA, which uses the yield-gap model, was launched only in February 2014. The good news is that months after its equity allocation being static at about 12% since launch, it moved up to 29% in August earlier this year when markets sank sharply, and to about 38% in September, when the Reserve Bank of India cut interest rates.

“The formula did exactly what it was supposed to do, and at the right time,” said Ajit Menon, head-sales and co-head-marketing, DSP BlackRock Investment Managers Pvt. Ltd. Menon admitted it was unnerving that the formula didn’t budge all of last year and most part of this year as well. “But last year, the equity rally was a ‘hope’ rally; there wasn’t much change on the ground,” he said.

While long-term returns may be subdued as compared to that of diversified equity funds, these funds are less volatile. We looked at standard deviation, a measure of a fund’s volatility.

According to Morningstar, average standard deviation of moderate allocation, flexi-cap and large-cap funds together was 11.94, while that of all dynamic AA funds was between 1.95 and 7.19; which is among the lowest.

“The risk-return combinations are important. These funds help significantly reduce volatility in your portfolio,” said Janakiraman R., portfolio manager-Franklin Equity, Franklin Templeton Investments–India.

Mind the tax gap

One drawback that dynamic AA funds have is in terms of taxation. On account of being FoFs, they are classified as debt funds and taxed accordingly, even if they are equity-oriented.

If you sell your debt funds within three years, you pay taxes as per your income tax rates on your gains. The threshold to claim tax benefit on long-term capital gains is three years, and even then, long-term capital gains tax is 20% (with indexation benefits).

That’s one reason why KAAF changed its objective, in October 2014, from being just an equity FoF to one that dynamically allocates its money to debt and equity, based on a certain formula.

“Earlier, all our investments were going in equity funds and yet KAAF was considered a debt fund. A dynamic asset allocation model, therefore, is superior,” said Iyer, adding that an “unfavourable tax structure” has been one of the biggest impediments to this product becoming popular with investors.

Should you invest?

Not all financial planners recommend dynamic AA funds because they feel it is their prerogative to do their client’s asset allocation. But quite a few planners have warmed up to such funds.

Yogin Sabnis, managing director, VSK Financial Consultancy Services Ltd, is a fee-based planner who still manages a motley group of investors from his early days when he didn’t charge fees. Such investors, he explains, either don’t require much financial planning or hesitate to shift to paying fees. Such clients, he said, are advised to invest in dynamic AA funds. “I don’t recommend this product to my fee-based clients because I do their asset allocation. But if someone wants a one-off advice, this is one of the first recommendations because with these funds, even if the customer doesn’t consult an adviser, the fund automatically does the rebalancing,” said Sabnis.

Jain, who has systematic investment plans going on in some of these funds on behalf of two children, feels advisers and distributors should focus more on the long-term goals of clients and their servicing, and leave rebalancing to such funds. Added Janakiraman, “Usually, we do asset allocation only in extreme situations. We don’t do it all the time, which we are supposed to. These funds monitor asset allocation at all times.”

The category does not have many schemes. And the ones that are there, don’t have long-term track records. But the ones that come with a track record have largely worked so far. The yield gap model, for instance, shows promise though DBDA lacks a long-term track record.

It’s best to stick to larger fund houses and also with those that are FoFs, despite their inherent tax disadvantage. If the underlying funds come with a good track record, then the only thing you need to watch out for is the asset allocation model.

Source : http://goo.gl/dgFHiL

ATM :: Mutual Funds: Keeping an exit strategy ready is as crucial as making the investment

Written by Adhil Shetty | Published:Sep 18, 2015, 2:59 | Indian Express

The important factor in judging the performance of a mutual fund is the investment horizon. One needs to look at longer periods to assess the performance.

Investment literature is full of ‘how to buy’, ‘how to invest’, and ‘when to buy’ theories. However, very little focus, if at all, is given to the selling part of the investment cycle. After all, you make money only when you sell. This makes selling as important as making the investment, if not more.

There are four major aspects that help one decide when to sell your mutual funds.

Analyse the past returns of the mutual fund.

The performance of a mutual fund is the most important criteria of an investment decision. If the mutual fund does not perform well, it is time to sell. However, one should be realistic about assessing the performance. The most important way to judge a fund on its performance is to compare it with similar types of funds. For example, a midcap equity fund should be compared with other midcap equity funds. A sectoral fund from a fund house should be compared with other similar sector funds. Similarly, a bond fund or balanced fund should be judged against the performance of other bond funds or balanced funds.

The other important factor in judging the performance of a mutual fund is the investment horizon. One needs to look at longer periods to assess the performance. For example, many investors invest based on just the one-year performance of mutual funds. Even fund houses and brokers focus on the previous year’s performance. A fund’s supernormal returns in the previous year might have been supported by macro-economic factors that may not reoccur this year. A fund must be evaluated based on 5-10 years’ CAGR. Longer investment horizon minimises the impact of external factors and presents a better picture.

Study the market levels

When the market is at a high, it is time to liquidate an equity mutual fund. One can find out how sustainable future growth is by looking at the overall Price-to-Earning (PE) ratio of the market. PE ratio is a fairly good indicator of the market’s position.

A PE ratio of 22 or higher is a sign that market may not sustain its upward momentum for much longer.

At the same time, it is very difficult to say when the market will start falling from the high. Hence, instead of waiting for the market to touch its peak and get a few rupees more, one should make an exit. It is impossible to time the market.

Many fund houses offer dynamic funds that work on a similar principle. When the market is high, they reduce the equity holding and increase the bond holding. Similarly when market PE is low, the equity holding increases and bond holding decreases.

Monitor the interest rate before taking a decision on bond funds

Bond funds are funds that invest in fixed income securities such as government bonds, corporate bonds, and bank deposit schemes. Return on bond funds is inversely proportional to the prevailing interest rate. When the rates go down, the bonds prices appreciate and vice versa. Hence, in cases where the interest rates have already bottomed out, one should redeem bond funds and find other investment choices unless one is very risk-averse.

Determine whether the portfolio still supports one’s investment needs

Over time, the portfolio may no more be right for one’s investment needs. This happens when the expectation from investment changes and the current mutual fund does not serve one’s purpose anymore. For example, suppose you had invested heavily in equity funds in your 30s. The investment may have given fabulous returns in your 40s too. However, is it wise to remain heavily invested in equity in your 40s? This is a question you have to answer, especially if you cannot afford to take much risk. Hence, this could be the time to sell a few of your equity mutual funds and divert the proceeds to debt or balanced funds.

Careful and systematic investments in mutual funds can yield high returns. However, one must be canny not just while selecting the right time and type of fund to invest in, but also while choosing the right time to exit the investment to get maximum benefits.

The writer is the founder and CEO of BankBazaar.com

Source: http://goo.gl/GeaxUA

ATM :: Stick with SIPs through markets’ ups & downs

K V Vardhan | Aug 11, 2015, 06.07 AM IST | Times of India

I’m 40 years old and work as an insurance adviser . I want to build a Rs 1 crore corpus through SIP in equity mutual funds over the next 20 years.Kindly guide me about how much I have to invest monthly and the type of funds I should invest in. –Sathish Kumar D, Chennai

K V VARDHAN REPLIES

The first step to wealth creation comes from planning and one needs to have the conviction to stick to the plan through the journey. Like the ups and downs associated with investing in the stock market, SIP investments using the mutual fund route is also expected to give you volatility . However, investors who have the conviction to remain invested and continue with their SIP investments through these ups and downs, are bound to achieve their financial goals.

In the past decade, the average yearly sensex return was 13.9%, while well performing mutual fund schemes have returned between 13.4% and 22.7%, and SIPs in the same funds returned between and 13.7% and 25.3%. Hence SIP ,a rupee cost averaging method in a volatile market, has the potential to deliver better return than lump sum investments.

Case 1: Let us considering you require of Rs 1 crore equivalent to today’s value, after 20 years.At 6% per annum rate of inflation, on an inflation-adjusted basis, after 20 years you will require approximately Rs 3.20 crore. To achieve this corpus size, you may consider investing Rs 35,000 per month in equity mutual fund SIPs with an expected annual return of 12%.Alternately , you can invest Rs 24,000 per month in mutual fund SIPs with an expected annual return of 15%. If we have to do asset allocation and create a financial plan for the above case with 70% of your investments going into equity funds and 30% nto debt funds, you may have o invest Rs 44,000 per month. In case you plan to have a 50%-50% ratio with equity and debt mu tual funds, you may have to invest Rs 50,000 per month.

Case 2: Let us considering you require of Rs 1 crore at the end of 20 years. In that case you may consider investing Rs 11,000 per month per month in equity mutual fund SIPs with an expected annual return of 12%. Alternately , you can consider investing Rs 7,500 per month in equity mutual fund SIPs with an expected annual return of 15%. With asset allocation of 70% equity and 30% debt you may have to invest Rs 14,000 per month, while with a 50%-50% equity and debt allocation, you have to invest Rs 15,500 per month.

Here, we assume that annually SIPs in debt funds would return 6% post tax, and equity returns are expected at 12%, also post tax. For an equity investor who is aggressive and has higher risk taking ability , 40% of the corpus should be in midand small-cap funds, 30% in multi-cap funds and the balance in large cap investments.For moderate risk taking ability, the combination should be 30% in midand small-cap funds, 35% in multi-cap funds and the balance in large cap investments. And for a conservative investor, with low risk-taking ability, it should be 20% in midand small-cap funds, 30% multicap funds and the balance in large cap investments.

K V Vardhan is CEO, Ultimate Wealth Managers, Bengaluru

Source : http://goo.gl/FILYlm

ATM :: Six best investment avenues in the current scenario

By Sanjeev Sinha | 7 Jul, 2015, 12.38PM IST | ECONOMICTIMES.COM

Markets in 2014-2015 have been rife with fluctuations. The run up to the elections and its aftermath were great for the stock market. There was new optimism about the economy, industry, and business. Oil prices went down and inflation subsided.

A year later, there are prospects of less than normal monsoon, a world economy belabouring its way to marginal growth, and industrial production showing sluggish to incrementally better performance month by month. Markets too have reacted similarly and have gone down by around 6% from their record high hit in March. In such a situation, investors tend to get confused about how and where to invest. In this article, we will look at 6 avenues of investment that can still give you good returns. Here they go:

1. Equity mutual funds (especially comprising blue chip companies)

Though the market has gone down, there is not much downside in blue chip companies and mutual funds comprising of these companies. The government is clear about manufacturing and is providing faster clearances for factories to be set up, production to start, and energy to be given to the industry.

“This may take a few months to operationalize, but the trend is clear. The projects that were in limbo for the last couple of years have started getting approved. This will create significant momentum and wealth for large firms and their investors. Blue chip equity funds are offered by HDFC Mutual Fund, Birla Sun Life, Reliance and many more,” says Adhil Shetty, founder & CEO of BankBazaar.com.

2. Balanced fund (funds made up of equity and debt)

Many investors are not comfortable with pure equity funds because of high risk associated with the fund. Hence, they look for an avenue that is less risky and also takes advantage of market movements partially. Balanced fund is a good choice for such investors.

“Balanced funds invest a part in equity and a part in debt. The equity part moves up and down as per the market and the companies they represent, while the debt part is relatively consistent in returns. The overall return is determined by the weighted average return of equity part and debt part,” informs Shetty.

3. EPF (Employee Provident Fund) and PPF (Public Provident Fund)

EPF and PPF are risk-free investments offering returns of about 9%. There are many advantages of investing in EPF and PPF. They are risk free because they are backed by the Government of India. Moreover, the interest earned is also tax free. You can also save taxes on PPF and EPF investment, subjected to the limit of Rs 1.5 lakh under 80C.

Generally, EPF is done by your employer, and you and your employer both pay equal amount towards your EPF account.

Apart from the post office, PPF account can now be opened in any bank. Walk down to the nearest branch of BoI, Bank of Baroda, ICICI Bank or any other bank to open your PPF account. The maximum amount that can be invested in PPF in a year is Rs 1,50,000. This can be done in a maximum of 12 deposits in a year, and not necessarily each month. The minimum amount required is Rs 500. PPF has a tenure of 15 years, though you can withdraw it before 15 years, subject to certain conditions.

According to financial experts, conservative investors can still bank on EPF for creating their retirement corpus, but for investors with low or moderate risk profile and limited or no other retirement benefits, PPF currently appears to be the best option as returns are to a large extent guaranteed and the withdrawals after the mandatory holding period are tax-free.

4. Bonds offered by the Government and Corporates

Bonds are another avenue that is risk free. The bonds offered by the government are risk free because the government usually doesn’t default on the payment. If everything fails, they can always print new notes and pay the bond holder (at the cost of inflation though).

As far as corporate bonds are concerned, bonds offered by large firms with sound business models are preferable. There is a small risk in corporate bonds in case the company goes bankrupt. However, bonds by Tata, Mahindra, Reliance, L&T etc. are almost risk free.

“The best way to identify a good bond offering is to look at the rating. All the bonds offerings have to go through a mandatory rating by a rating agency. The rating agency decides the rating based on the company’s ability to honour its obligations to bondholders, i.e. whether it can pay the interest and principal on time. A high rating is an indication that the risk is low,” says Shetty.

5. Real Estate

For the last couple of years, the real estate sector has disappointed investors. The market is not showing any discernible trend in this sector. Additionally, the real estate sector is mired in many controversies, corruption, and injurious practices. However, the main contributing reason for the prevailing widespread scepticism was low economic growth and even lower expectation of future growth.

However, with the new government focused on economic growth, the real estate sector will bounce with the first hint of an uptick in growth. Moreover, projects such as smart cities will provide ample opportunities to investors in the real estate sector. But investors should be careful of a few companies which are embroiled in controversies and legal battles with the government and consumers.

6. Foreign or overseas mutual fund

This is another area that investors usually don’t consider due to minimal or zero awareness about foreign companies and markets. However, many mutual fund companies such as DSP Black Rock, Franklin Templeton and others offer mutual funds focused on foreign countries.

These funds invest in many countries based on the nature of the fund. For example, an emerging market fund may invest in China, Indonesia, Vietnam and Brazil, while a fund focused on oil exploration may invest in US shale oil companies, Saudi oil field companies, among others.

A brief overview of returns offered by the above-mentioned entities:

Important points to consider

While investing is important, assessing your investment periodically is vital for your wealth. Even if you don’t check stock prices or mutual fund NAVs every week or every month, it is vital to take a comprehensive look at all your investments every 6 months or a year. During such assessments, it is important to avoid impulsive decisions to sell or buy. The purpose of assessing your investment is to find new avenues of investment and discard an existing one if things have gone bad.

“You also need to know a few key parameters of any asset that you want to invest in. For example, if you are considering a particular mutual fund, look for annualized returns for the last 5 – 10 years instead of just the previous year’s returns. Look for the expense ratio, which is the percentage of investment charged to you. Look for sectors and companies where the mutual fund is investing. All these data is available on any of the numerous financial websites that give out such information,” says the CEO of BankBazaar.com.

Finally, don’t wait for the right time. The most important thing in investing is to start it, no matter how small your investment is. Begin with a small amount and grow the investment, thereby gaining in experience about the markets.

Source:http://goo.gl/75mJZx

ATM :: How to avoid debt traps: All you wanted to know

By: CreditVidya | April 8, 2015 9:12 am | Financial Express

Not all loans are bad. If the loan is used to create an asset and is productive in nature, it can be termed as a good loan. Home, business and educational loans fall in this category.

On the other hand, if the loan creates no asset or is of very little productive use, it can be termed as a bad loan. A personal loan to go on a vacation or a heavy credit card swipe to buy an asset that would depreciate and an auto loan will fall in the bad loan category. They can create debt traps.

Lack of financial knowledge and discipline goes a long way in preventing people from getting into debt traps. It is important to educate people on loans, bad Cibil credit score and other issues in the personal finance space. While personal loan or any other form of non-collateral loan seem to be the most convenient option, not everyone knows the gravity of the problems one might get into.

The following table explains the different types of loans and also weighs your pros and cons:

Here are top good practices to manage your finances better:

Save and then splurge: ‘Pay yourself first’, in other words, make the habit of saving a part of your income before spending. This goes a long way in keeping debts at bay.

Budget:If you go into debt, it’s an indication that you are living beyond your means. Without planning, it can be hard to know just when you are overspending. Drafting a budget for short, medium and long term expenses and tracking it allows you to see in black-and-white where your money goes. Trim your expenses so that the total outflow is less than the income.

Use debit cards: Debit cards are tied directly to your bank account. If you don’t have money you can’t spend on your debit card. Since no credit is extended, you can’t go into debt using your debit card.

Pay off balances monthly: One way to avoid overcharging on your credit card is to allocate money from your bank account before you make any charges. As soon as the charges hit, use the reserved money to pay them off.

Invest smartly: A well researched investment can yield great returns. Keeping abreast with the latest happenings in the financial world also helps one to make smart investments.

By following the above steps, people with bad financial habits can get out of debt traps. By constantly educating oneself and by inculcating financial discipline one can successfully prevent falling into debt.

Source : http://goo.gl/WkpvF9

ATM :: Use mutual funds to diversify with small amounts

TNN | Mar 23, 2015, 03.17PM IST | Times of India

Investors and even some of the financial advisers often talk of a mutual fund as an investment product, as if that is an asset class in itself. They hardly realize the fact that mutual fund schemes are actually tools to invest in several other asset classes. So on a standalone basis, a mutual fund scheme is never an asset class.

For example, shares are an asset class. So are bonds, gold, real estate, commodities, etc. Now if you want to invest in shares, you can directly invest in the market through a broker and after opening a demat account. An almost similar process is followed if you want to invest in bonds and commodities. And different approaches are taken when one wants to invest in gold or property.

While investing in stocks, rather than investing directly through a broker, you can also invest through the mutual fund route by buying units of equity mutual funds.

Similarly, to invest in bonds and other debt instruments, you can buy units of debt funds, and for gold you can buy into gold funds or gold exchange traded funds (ETFs). Even if you want the liquidity that cash offers, you can avail of the same by investing in liquid funds or ultra short-term funds. Although not yet available in India, but in most of the developed countries you can also invest in real estate and commodities through the mutual fund route.

So you can see that a mutual fund scheme can work as a bridge to investing in various asset classes. This is because such a scheme is more like a pass-through vehicle for your investment in an asset class, but that scheme itself is not an independent asset. This characteristic also brings in flexibility for investor to diversify even with a small amount of money. “Mutual funds offer simplicity, affordability, risk diversification along with professional management,” says Sanjay Mehta, associate financial planner, Sanjay Mehta Financial Services.

In short, according to Mehta, for cash you can use liquid and/or ultra short-term funds which are very close to bank deposits. For investing in debt, you can use medium- and long-term debt funds, income funds or fixed maturity plans. They give you a steady income and tax efficiency too. For investing in gold, you can go through a gold fund of funds or take the ETF route. And for investing in stocks, depending upon your risk-taking ability, you can invest in diversified equity funds, or large-, mid- or a small-cap fund and also in sectoral funds or index ETFs.

Financial planners and advisers also say that other than just being an investment vehicle, mutual funds also offer a variety and choice to investors. As an investor, one can choose to invest his/ her money in funds from over thousands of funds managed by about 40 fund houses. “When an investor chooses to go with equities, he/she can opt for a growth fund or a value fund or even a fund which combines both. For those who prefer dividends, he/she can select income funds. The opportunities are limitless,” says a financial planner.

One can also use mutual fund schemes for asset allocation. For example, allocation funds include equity funds and debt funds simultaneously by investing in equity and fixed income instruments in different proportions. And since Indian investors have a fascination for gold, fund houses have smartly tapped into this long-standing fascination by introducing funds that can simultaneously invest in equity, fixed income and gold (via the ETF route), the financial planner added. Although here the fund manager decides in what proportion the allocations would be made to various assets while remaining within the broad contours of the scheme, “in effect, such funds are a one-stop shop for asset allocation”, the financial planner says.

The last but not the least is the tax efficiency that mutual funds offer. If one invests in debt instruments directly, he/ she may not enjoy all the tax benefits that can (indirectly) come to him/her if he/she takes the mutual fund route. In equity funds, however, the scope for tax advantage is limited compared to direct investing.

Source : http://goo.gl/bzbkl3

ATM :: Best ways to invest for your child’s education

Sanjay Kumar Singh, TNN | Feb 2, 2015, 06.42AM IST | Times of India

Inflation may be down but a major expense of the average Indian household is growing at a fast clip. The cost of higher education is already high and rising at 10-12% a year. Children’s education is one of the biggest cash outflows that families must plan for. A four-year engineering course costs roughly `6 lakh right now.In six years, the cost is likely to touch `12 lakh. By 2027, it would cost `24 lakh to get an engineering degree.

Lifestyle inflation, too, has affected the cost of children’s education. “As your standard of living rises, it affects the decision about where you send your children for higher education,” says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors.

The question worrying Indian parents is: will they be able to fund their children’s higher education? They can, if they plan ahead and take the right steps. We look at the challenges parents face while saving for their child’s education and how they can be overcome.

Be an early bird

One obvious solution is to start saving early. The individual will not only be able to amass a larger sum, but the money will also gain from the power of compounding. A corpus of `1 crore may seem daunting, but it’s possible to save this amount with an SIP of `9,000 for 18 years in an equity fund that gives a 15% return. “Since the rate of education inflation is so high, you need compounding to work for you over a longer period,” says Vidya Bala, Head of Research at Fundsindia.com.

A delayed start not only yields a smaller corpus but can also jeopardise other financial goals. If you start investing for your child’s education in your 40s, you are likely to fall short of the required amount. Often, parents dip into their retirement savings to fill the gap, but this can be a risky move.

Choose the right option

Parents must also invest right to get optimum resturns. Equity mutual funds, for instance, have delivered average annualised returns of 16.5% in the past 10 years. However, equity investment is not everybody’s cup of tea. This year’s DSP BlackRock Investor Pulse survey shows that though Indians have a high propensity to save and invest, they still seek safety. Almost 52% of the 1,500 respondents said they wanted guaranteed returns from investments.

However, if you have 15-18 years left before your child starts college, equity funds should be the preferred invest ment for you. Over such a long period, the volatility in returns is flattened out.If you have the risk appetite, your allocation to equities can be as high as 75%. The balance 25-30% of the portfolio can be in safer options like the PPF, bank deposits and tax-free bonds.

Play it safe in the short term

If you have a time horizon of less than five years, you will have to rely primarily on fixed income instruments, which are likely to offer a lower rate of return. However, these offer guaranteed returns and safety of capital. In the short term, these factors become very important.

| Investment Options Available | ||||

| How much time you have will define your investments and asset allocation | ||||

| Age of Child | Time Available | Instruments to choose from | Cost of Education | Investment Required |

| 0 – 2 years | Over 15 years | 1. Diversified Equity Funds 2. Low cost ULIPS 3. Stocks | MBA Degree to cost 75lacs in 2033 | SIP of 9800 in equity fund will grow to 75lacs |

| 3 – 6 years | 12 – 15 years | 1. Diversified Equity Funds 2. Low cost ULIPS 3. Stocks | Medical course to cost 35lacs in 2030 | SIP of 7550 in equity fund will grow to 38lacs |

| 7 – 10 years | 8 – 11 years | 1. Diversified Equity Funds 2. Equity oriented balanced funds 3. Debt Oriented balanced funds | Law degree to cost 9.3lacs in 2023 | SIP of 6300 in balanced fund will grow to 9.3lacs |

| 11 – 14 years | 4 – 7 years | 1. Debt Oriented balanced funds 2. Debt funds 3. Recurring Deposit | Engineering course to cost 8.8lacs in 2020 | Recurring Deposit of 11600 in balanced fund will grow to 8.8lacs |

| Over 15 years | Less than 3 years | 1. Recurring Deposits 2. Debt funds 3. MIP funds | MBA Degree to cost 20lacs in 2018 | SIP of 48500 in debt fund will grow to 9.3lacs |

Review the portfolio

Once your portfolio is in place, you need to review it at least once a year.You should also check whether the amount required for meeting the goal has changed. “Education goal has two components: tuition fee and cost of living. Any of these could rise faster than anticipated. You need to find out whether the 12% inflation rate that you have assumed is realistic,” says Dhawan.

Next, check whether your portfolio is on track to meet the goal. Bala suggests using step-up SIPs. “Raise the amount invested in line with your salary increments,” she suggests.

If a fund is lagging, do not sell it immediately. Stop your SIP in that fund and start it in another better performing fund. Watch the performance of the laggard for 3-4 quarters and only then decide to sell it. Rebalance your portfolio at the end of each year. Rebalancing essentially entails selling an outperforming asset and investing the proceeds in one that is underperforming. By doing so, you curtail the risk that your portfolio could face due to over-exposure to a particular asset class.

Approaching the goal The investment process is never static.We have suggested equity funds for those with an investment horizon of over 12-15 years. However, five years before your goal, you should start shifting money out of equities to the safety of debt. Start a systematic transfer plan from your equity fund to a short-term debt fund (average maturity of 1-3 years).

Keep in mind that the date of your child’s admission to college is fixed.You can’t let a downturn in the stock markets jeopardize your child’s college education.

Source : http://goo.gl/RnnnlC

Interviews :: ‘India to witness lower rate cycle, equities to benefit’

January 22, 2015 11:52 pm | Financial Express

Despite equity markets touching new high valuations of many stocks turning expensive, A Balasubramanian, CEO, Birla Sun Life Asset Management Company (AMC) says that one should stay invested in equities and even conservative investors should have some exposure to equity mutual funds. In an interview with Chirag Madia, Balasubramanian also says India will enter a lower interest rate regime driven largely by falling inflation and fiscal consolidation. Excerpts:

We saw a surprise cut in interest rates recently by the Reserve Bank of India (RBI). What is your outlook on debt market? Do you think we may see a ‘secular bull run’ in debt funds going forward?

We believe that directionally we will see a lower interest rate regime driven largely by falling inflation and fiscal consolidation. As a result, the bond market will continue to do well and we stay bullish on actively managed debt funds. While one cannot call this as a secular bull run,it is for certain that we are in a good period in the interest rate regime.

What are your expectations from the next RBI policy?

Bond yields and bond derivatives do reflect a significant rate cut as we move forward. We believe RBI will cut rates in a phased manner, as there are too many moving variables to track including developments in the global economy. But macro variables are favourable now for a continuous rate cut.

Where do you think the benchmark bond yield, currently close to 7.7%, will settle?

Our house view on benchmark bond yields is positive. We see intermittent volatility and movement in the range of 7.35-7.85%.

What are the key risks for debt funds in 2015?

The first risk could be a lack of improvement in the fiscal situation, second is that crude prices again start rising. In the past few months we have seen a crude price high of $110 and a low of $45, so there are chances that it might spike going forward. I don’t think there will be any major impact of hike in interest rates in the US. If that happens we might see some minimal outflows from Indian markets. But overall I don’t see any major risks which can have a big negative impact on Indian debt funds going forward.

What is your advice to investors now? Should they start investing in long term bond funds?

Investors should continue to have large exposure to debt mutual funds as they offer better returns than bank fixed deposits over time. While it offers better tax adjusted return, liquidity of such investments is also far superior. Having said so, debt mutual funds capture the real market yields on a continuous basis to provide return to investors. In terms of asset allocation, even the most conservative investor should have some exposure to equity mutual funds. I don’t think this is a time to ignore equity as it is an asset class which will help investors beat inflation over the longer period. A lot of investors have invested in chit funds for high returns. I advise them not to make the same mistake, and invest instead in equity (mutual funds) and debt mutual funds.

Birla Sun Life MF is launching an equity fund known as Manufacturing Fund. What is the basis premise of this funds? What will be the investment strategy?

The focus of this fund is investing in companies that only cater to demand in India, especially where there is supply-demand gap. Contribution of the manufacturing sector globally is around 25-28% of gross domestic product (GDP), but in India the sector still contributes only 16% of GDP. The govt is looking at a contribution of 22-25% from the manufacturing sector to GDP over the next five years. Our investment strategy will be fundamentals driven, because most of the manufacturing investments are largely driven by their own balance sheet strength. We will adopt a bottom-up approach while picking stocks for this fund. We will follow multi-cap strategy, across market capitalisation and have a diversified portfolio. I think manufacturing as a theme is a continuous one. While there may be ups and downs in domestic manufacturing, as a base it is a very sustainable theme. Given its potential to generate employment, this sector has to get a boost from the government’s point of view. There are after all over 20-22 sectors which fall within the purview of manufacturing in India.

Do you think this fund will add value to investor’s portfolio?

Birla Sun Life Manufacturing Equity Fund is a diversified equity fund and can certainly add value to the investor’s portfolio. Any investor – existing or new, should have some equity exposure. This scheme gives investors a diversified portfolio with a focus solely on the manufacturing sector. The investment principle remains the same – delivering better returns than the index. With a strong focus on this robust, sustainable manufacturing theme, this scheme provides investors a fairly sound and attractive vehicle for long term wealth creation.

Source : http://goo.gl/B4DNKi

ATM :: Dual advantage

– Make equity and debt your big bets this investing season, says A. Balasubramanian

A. Balasubramanian | 12th Jan 2015 | The Telegraph India

The election results in May last year brought about a lot of change in the capital markets and India Inc’s expectations. The outlook towards India is now of hope and optimism, which not only drives everyone to deliver the best, but also helps to improve the situation. And whenever the hope of economic revival rises combined with optimism, equity as an asset class does well.

Ultimately, it is the consumer sentiment that fuels economic growth. This along with the focus on stepping up capital allocation towards building infrastructure helps to create opportunities for jobs, more demand for raw materials, increased labour activities and so on.

Such factors drive the profitability of companies operating in the market, which in turn improves the confidence of companies to either reward the shareholders or look at making fresh commitments to expand to the next level. India Inc today is at the cusp of such a level. I would imagine a phase of consolidation where we should prepare ourselves for greater growth as we move forward.

Mood upbeat

There is a widespread belief that Indian companies will do far better than the last few years. It’s generally being said India had grown despite the challenges. Now, with the focus back on reforms and their execution, there will be a greater need to believe in a strong outcome.

The probability of an earnings upgrade for Indian firms is very high. Under such circumstances, the markets remain firm with less volatility combined with higher predictability.

If government finances improve on the back of a moderation in inflation, the overall growth momentum will further get a fillip through monetary policy action in the form of interest rate cuts. In such a situation, it is necessary to allocate capital in various asset classes.

Asset watch