Tagged: Auto Loans

ATM :: Financial Slavery: Do you really need a loan-free life?

Sukanya Kumar, Founder & Director, RetailLending.com | Aug 12, 2016, 10.28 AM | Source: Moneycontrol.com

The more we become ‘social’, the more we tend to show-off. It leads to more bad loans. It is time to shun bad loans and embrace good loans wherever required.

This is a very sensitive subject. Most of us in the financial broking business will shiver thinking what will happen, if this ever comes to of no one borrowing anymore. But let us overcome this superficial personal gain agenda and see what lies beneath.

A man in his late 20-s or early 30-s is bound to have a couple of small loans like credit cards, personal loans etc. here and there. They may be for shorter periods. As he progresses well in life and gains stability in his profession, he wants to settle himself. A big part of this ‘settlement’ is buying a home. And a home loan is generally taken for 20 years by most.

Given the current property prices across the world, buying a home with your own savings and liquidating your financial papers is not a possibility. You are bound to fall short way beyond the market price. Gone are those days when a man used to build a home with his retirement benefits and borrowing only from his provident fund account. He never used to enjoy the home fully as he has spent his hay-days staying at a rental home/company accommodation which never was his ‘own’.

The more we become ‘social’, the more we tend to show-off. If my colleague has got something which he boasts about, we have to get the better ones to overtake him. Our home-maker (to the true sense) spouse wants to buy a home with more number of bedrooms and amenities, her neighbouring friend could afford. Even our teenage children want to buy better gadgets to make sure they have their friends’ groups flocking around them and think they have the ‘latest’ ones.

There is no end to these needs, no end to loaning to purchase these, and hence the terms ‘financial slavery’. A man pays 70% of his net take home salary to pay off his monthly loan EMI-s and needs to survive with the balance 30% only, and with this lean sum pay for his home rent, children’s education and their extra-curricular activities, day-to-day expenses, food, clothing, entertainment, hobbies and also family trips and shopping.

We are afraid to start our own venture; afraid to opt for a better opportunity, if it requires us to take a study-break for a couple of months, we are even afraid to get married these days (I hear it from many 30-somethings frequently), since we are afraid to take more responsibility, given that we are already under so much debt.

Now, all of it is not that bad. There are two clear groups of loans. The good loans and the bad loans. One needs to let go of the bad loans to relieve himself / herself from being miserable, and continue happily with the good loans and feel good to have them.

Bad loans:

Any item, bought with loan-money, which depreciates in time, is a bad loan. You never recover the sum you paid, plus you pay the interest on that sum too.

For example, you buy clothes or any electronic gadgets via a consumer durable loan or you buy a car with a car loan, or you buy just some books by swiping your credit card…….. The moment you are walking out of the shop, it depreciates by 30-50% to the least. It becomes a ‘second hand’ item. You never regain the price, unless of course your car becomes a vintage one and pays off (pun intended).

So, a loan on credit card, a personal loan, a consumer durable loan, a car loan- all these are bad loans. It only boosts your ego and gifts you a ‘rich’ lifestyle and only brings momentary joy with no permanent effect on yourself.

Good loans:

A loan which enhances the worth of the purchased product over time and even crosses the mark of it, to give a handsome return over the period, also absorbing the interest cost attached to it.

A home and an education loan are in this category. A home always appreciates in price, if bought wisely with proper research in good location, and will supersede the interest cost too. The percentage of people making a true loss while selling their property is negligible.

The added advantage of taking a home loan is also the tax benefit you get under a couple of sections. There are subsidies available on affordable housing too.

An education loan while taken will be with a moratorium so that it is easy on the pocket of the student. This loan enriches you as a person and helps you get a well-paid job or find a business solution for yourself, after getting trained professionally. The return on this is lifelong. You keep reaping the benefit of you educating yourself, till your last day. The interest you pay while taking this loan is negligible, of course.

Strangely enough, the bad loans are the ones which are more expensive too!

So, to avoid enslaving yourself from paying high monthly debts, please relieve yourself of the high-interest rate loans which are eating away your month’s pay and giving no returns other than being depreciated day by day.

One last thing, many people feel themselves under a ‘burden’ of home loan and tends to close that first. Do not make that mistake ever. If you have spare money, invest in retirement plans, SIP and other low-risk debt-funds to reap the benefit when you are old and retired. By foreclosing your home loan early with the liquid cash and hence not having any money left for investment anywhere, will leave you only with a house post-retirement with no money in hand. And, you can’t eat, enjoy and spend the house for next 20-25 years of your retired life. You need money for that.

Be wise. Live a life without any bad loans. No loans at all may not be financially a good choice for the modern generation, since you want to enjoy yourself when you are young. Ultimately, we live longer now than earlier with all the medial attention we get these days.

Happy Good Loaning! Happy Freedom from Bad Loans!!

Source: http://goo.gl/wKmt0d

ATM :: How to keep your CIBIL score of 750+: Top 5 points to know

In order to get a loan at competitive interest rates, it is mandatory to have a CIBIL score of 750 and above.

By: CreditVidya | October 5, 2015 3:32 PM | Financial Express

In order to get a loan at competitive interest rates, it is mandatory to have a CIBIL score of 750 and above. This is a fact that most people are unaware of despite the information overload about credit score and its impact. There are a lot of articles online and offline about how it is mandatory to keep your CIBIL score high. Your CIBIL score is a measure of your credit worthiness. In other words, banks look at your CIBIL score to find out how you have handled your finances and whether or not you have behaved responsibly with the credit you have already availed of in the past. But the fact is, that people are still unclear about what exactly should they do to maintain a high CIBIL score. If you too are among those who are still confused as to what really impacts your CIBIL score, here is the lowdown on what really matters:

1. Make timely payments – The one top trick to pump up your CIBIL score is to make all your payments on time – very basic requirement, indeed. This is applicable to all the credit you already have. This includes credit card outstandings and EMIs on loans. Also make sure you make other payments such as insurance premiums etc on time, though it does not fall under the credit bracket. Even a single late payment on a home loan or an unpaid outstanding on your credit card, will bring your CIBIL score tumbling down and be a blemish on your CIBIL report.

2. The total amount of credit you have availed of – Credit is something that is easily available today. You therefore probably have at least two or three credit cards that you are using simultaneously, along with a home or a vehicle loan. While you are particular about repaying EMIs, you think its OK to pile on the debt on your credit card, because you are far from your credit limit. If you are under any such impression, stop right there! The amount you owe to your lenders makes a large impact on your credit score. The closer you are to your credit limit, the worse its gets! Ideally you should not be using more than 30% of your total credit limit at any given time.

3. For how long you have had credit – “Credit history” as it is called in financial parlance has a large impact on your CIBIL score. If you have availed of credit for a long time and have serviced it well, it certainly fetches you brownie points to increase your CIBIL score. A good credit history gives a prospective lender the confidence to lend to you.

4. Too much credit in a short period of time – If you apply for too many credit cards or loans close to each other, it sets the alarm bell ringing for any bank. As for your CIBIL score, it inches lower each time you apply for a new loan. Every time you apply for a new credit card or loan, there is a “hard enquiry” made on your CIBIL score and CIBIL report, bringing down the score a few notches lower each time.

5. Good and bad debt – Believe it or not, the kind of debt you avail of, makes an impact on your CIBIL score. While home, vehicle and student loans fall under the category of good debt because they are “secured” in nature, “unsecured” loans such as too many credit cards or personal loans spell trouble and bring your CIBIL score down.

Source : http://goo.gl/yqf81M

NTH :: Diwali bonus: SBI takes lead, lowers EMIs after RBI cuts repo rate

Mayur Shetty, TNN | Sep 29, 2015, 03.49PM IST | Times of India

MUMBAI: The country’s largest lender State Bank of India has been the first off the block to lower interest rates with a 40 basis point cut in its base rate to 9.3%. The reduction follows a 50 basis point reduction in the repo rate by Reserve Bank of India on Tuesday.

The rate cut, which is effective October 5, will put pressure on other home loan providers such as HDFC and ICICI. With this rate cut the gap between SBI and it’s rivals has widened. SBI currently extends home loans at 9.7% for women and 9.75% for others. It’s nearest rivals offer loans at 9.85% and 9.9%.

From October 5, the home loan rates will fall to 9.3% and 9.35%.

Unlike most other lenders who extend car loans at fixed rate, the SBI’s auto loans are linked to its base rate. This means that interest for existing borrowers will come down as well.

According to sources, both HDFC and ICICI Bank will announce new rates before the end of the week.

After lowering the interest rate by 50 basis points to boost economy, Reserve Bank governor Raghuram Rajan said the RBI will work with the government to ensure a faster transmission and also hoped that banks will pass on the benefits to customers.

“We believe that some (monetary policy transmission) would take place very soon and more will take place over time,” Rajan said during the customary post policy meeting with the reporters.

Rajan said markets have transmitted the RBI’s past policy actions via commercial paper and corporate bonds, but banks have done so only to a limited extent.

Source: http://goo.gl/mhu7H4

ATM :: Golden rules of borrowing

Neha Pandey Deoras,TNN | Sep 21, 2015, 06.46 AM IST | Times of India

In an ideal world, everybody would have enough money for all his needs. In reality, many of us have little option but to borrow to meet our goals, both real and imagined.For banks and NBFCs, the yawning gap between reality and aspirations is a tremendous opportunity . They are carpet bombing potential customers with loan offers through emails, SMSs and phone calls. Some promise low rates, others offer quick disbursals. Online aggregators help customers zero in on the cheapest loan and banks take less than a minute to approve and disburse loans. However, while technology has altered the way loans are disbursed, the canons of prudent borrowing remain unchanged. It still doesn’t make sense to borrow if you don’t need the money. Or take a long-term loan only to enjoy the tax benefits available on the interest you pay . Our cover story this week lists 6 such rules of borrowing that potential customers must keep in mind. Follow them and you will never find yourself enslaved by debt.

Don’t borrow more than you can repay

Don’t live beyond your means.Take a loan that you can easily repay .”Your monthly outgo towards all your loans should not be more than 50% of your monthly income,” says Rishi Mehra, Founder, Deal4Loans.com.

With banks falling over each other to attract business, taking a loan appears as easy as ABC. But don’t take a loan just because it is available. Make sure that your loan-to-income ratio is within acceptable limits. Take the case of Hyderabad-based Phani Kumar, who has been repaying loans right from the time he started working.

It started with two personal loans of `5 lakh six years ago. Then, he was paying an EMI of `18,000 (or 40% of his take home). Kumar took a car loan of `5.74 lakh in 2012, adding another `12,500 to his monthly outgo. Last year, he took a third personal loan of `8 lakh to retire the other loans and another top-up loan of `4 lakh. Today, he pays an EMI of `49,900, almost 72% of his take-home pay .

If your EMIs gobble up too much of your income, other critical financial goals, like saving for retirement or your kids’ education, might get impacted.Retirement planning is often the first to be sacrificed in such situations.

Keep tenure as short as possible

The maximum home loan tenure offered by all major lenders is 30 years. The longer the tenure, the lower is the EMI, which makes it very tempting to go for a 25-30 year loan. However, it is best to take a loan for the shortest tenure you can afford. In a long-term loan, the interest outgo is too high. In a 10-year loan, the interest paid is 57% of the borrowed amount. This shoots up to 128% if the tenure is 20 years. If you take a `50 lakh loan for 25 years, you will pay `83.5 lakh (or 167%) in interest alone. “Taking a loan is negative compounding. The longer the tenure, the higher is the compound interest the bank earns from you,” warns financial trainer P .V . Subramanyam.

Sometimes, it may be necessary to go for a longer tenure. A young person with a low income won’t be able to borrow enough if the tenure is 10 years. He will have to increase the tenure so that the EMI fits his pocket. For such borrowers, the best option is to increase the EMI amount every year in line with an increase in the income.

Assuming that the borrower’s income will rise 8-10% every year, increasing the EMI in the same proportion should not be difficult. If a person takes a loan of `50 lakh at 10% for 20 years, his EMI will be `48,251. If he increases the EMI every year by 5%, the loan gets paid off in less than 12 years. If he increases the EMI by 10% every year, he would pay off the loan in just nine years and three months.

Ensure regular repayment

It pays to be disciplined. Wheth er it is a short-term debt like a credit card bill or a long-term loan for your house, make sure you don’t miss the payment. Missing an EMI or delaying a payment are among the key factors that can impact your credit profile and hinder your chances of taking a loan for other needs later in life. Never miss a loan EMI. In an emergency , prioritise dues. You must take care never to miss your credit card payments because you will not only be slapped with a non-payment penalty but also be charged a hefty interest on the unpaid amount. If you don’t have the money to pay the entire credit card bill, pay the minimum 5% and roll over the balance.At an interest of 24-36%, credit card debt is the costliest loan you will take.

Don’t borrow to splurge or to invest

Never use borrowed money to invest. Ultra-safe investments like fixed deposits and bonds won’t be able to match the interest you pay on the loan.And investments that offer higher returns are too volatile. If the markets decline, you will not only suffer losses but will be strapped with an EMI as well. There was a time when real estate was a very cost-effective investment. Housing loans were available for 7-8% and real estate prices were rising 1520%. So it made a lot of sense to buy a property with a cheap loan. Now tables have turned. Home loans now cost around 10% while property prices are rising by barely 4-5%. In some pockets they have even declined.

Similarly, avoid taking a loan for discretionary spending. You may be getting SMSs from your credit card company for a travel loan, but such wants are better fulfilled by saving up.”It’s not a good idea to take a personal loan for buying luxury watches and high-end bags,” says Vineet Jain, Founder of LoanStreet.in. If you must go on a holiday, throw a party or indulge in luxury shopping, start saving now.

On the other hand, taking a loan for building an asset makes eminent sense.For instance, Mumbai-based Sandeep Yadav junked plans to go on a foreign holiday and instead used the money for the downpayment of a house, bringing down the overall loan requirement.

Take insurance

If you take a large home or car loan, it is best to take insurance cover as well. Buy a term plan of the same amount to ensure that your family is not saddled with unaffordable debt if something happens to you. The lender will take over the asset (house or car) if your dependents are unable to pay the EMI. A term insurance plan of `50 lakh will not cost you too much.Banks push a reducing cover term plan that offers insurance equal to the outstanding amount. However, a regular term plan is better. It can continue even after the loan is repaid or if you switch lender. Moreover, insurance policies that are linked to a loan are often single premium plans. These are not as cost effective as regular payment plans.

Keep shopping for better rates

A long-term mortgage should never be a sign-and-forget exercise. Keep your eyes and ears open about new rules and changes in interest rates. The RBI is planning to change the base rate formula, which could change the way your bank calibrates its lending rates. Keep shopping around for the best rate and switch to a cheaper loan if possible. However, the difference should be at least 2 percentage points, otherwise the prepayment penalty on the old loan and processing charges of the new loan will eat into the gains from the switch. Also, switching is more beneficial if done early in the loan tenure.

The same applies to prepayment of loans. The earlier you do it, the bigger is the impact on loan tenure. The RBI does not allow banks to levy a prepayment penalty on housing loans but they may levy a penalty on other loans. Some lenders do not charge a prepayment penalty if the amount paid does not exceed 25% of the outstanding amount at the beginning of the year.

Source : http://goo.gl/ocTwU6

NTH :: Why other banks can’t flex muscle like HDFC Bank

Till a few years earlier, HDFC Bank’s benchmark lending rate was about 50 basis points (bps) more than the market leader

Manojit Saha & Nupur Anand | Mumbai | September 2, 2015 Last Updated at 00:20 IST | Business Standard

Till recently, State Bank of India (SBI), the largest public sector bank which controls 17 per cent of the loan market, showed the way and others followed. SBI was the first bank to cut deposit rate in September 2014, much ahead of the rate cycle cut started by the Reserve Bank of India (RBI) in January. It also became the first bank to cut the base rate – the benchmark lending rate to which all loan rates are linked. Others followed suit.

Till a few years earlier, HDFC Bank’s benchmark lending rate was about 50 basis points (bps) more than the market leader. The most valuable bank of the country kept on narrowing the gap. And, from earlier this year, they started to match the largest lender and the largest private sector lender.

Now, with a sharp cut of 35 bps in the base rate, HDFC Bank has ensured that no bank will be able to match them in the near future without bleeding on margins. This was the sharpest move by any bank in this rate cut cycle.

“It is not too clear on what is likely to be the response from other banks as they need to strike a balance between growth and NIM (net interest margin) outcomes… We expect other banks to follow but the quantum may not be the same; it may not be immediate with more action likely on deposit rates,” Kotak Securities said in a research report.

Why other banks can’t flex muscle like HDFC Bank It is the NIMs which gave HDFC Bank the room to cut rates sharply. Its NIM has ranged between 4.1 per cent and 4.5 per cent for many quarters, despite profit growth falling to 20 per cent from 30 per cent in the last four to six quarters. Compare this with other banks, which struggle to maintain NIM at 3.5 per cent. One reason for the high margins is the share of current and savings (Casa) deposits, the low cost ones. HDFC Bank’s share of the Casa ratio was 39.4 per cent as of June-end – one of the highest in the sector, though it fell sharply from 44 per cent a quarter ago.

“We think the ability of corporate banks to take such large base rate cuts is limited without impacting their NIMs as 70-75 per cent of their loans (FY15) are linked to the base rate,” Nomura Securities said in a note to clients.

According to the broking firm, HDFC Bank was able to take such a large base rate cut as only 30-40 per cent of its loan book is linked to the base rate. ICICI Bank, Axis Bank and public sector banks have 65-75 per cent of their loan book linked to the base rate and their NIM impact will be higher due to base rate cuts.

The consensus on the Street is while HDFC Bank will also see pressure on margins, it will still be able to maintain it at over four per cent. HDFC Bank has a significant portion of its loan portfolio consisting of automobile loans and personal loans, those are given at fixed rate. So, its return from existing customers will not be affected by this sharp cut. In addition, the bank doesn’t sell home loans – which are mostly floating loans – directly to the customers.

Suresh Ganpathy from Macquarie Securities explains that HDFC Bank is in a better position to take such a steep cut in their base rate because their entire loan book will not re-price immediately.

“Since they don’t have a home loan book, it is of help because the home loan is mostly floating and therefore the impact for them on margins would be lesser than other lenders which have a big home loan portfolio. I believe that because of this reason other lenders might not be able to reduce base rate in the same quantum at one go.”

Source : http://goo.gl/jjEJSm

ATM :: There’re different types of loans based on secured assets

Ashwini Kumar Sharma | MON, JUN 15 2015. 01 26 AM IST | Live Mint

Use and possession of the secured assets differs depending upon the type of loan

Loans have become an integral part of our lives. Most people either service a home loan, a car loan, or a personal loan, or a combination of these. According to the Reserve Bank of India (RBI), as on 17 April 2015, total outstanding loans to individuals by banks was to the tune of Rs.11.77 trillion. These loans include those taken for consumer durables, housing, auto, education, credit card outstanding, advance against fixed deposits, shares and bonds. Most of these are secured loans (given against an asset). However, use and possession of the secured assets differs depending upon the type of loan.

Pledge

This is the oldest form of a loan. Under this, the lender takes any asset as security in her custody or possession when giving the loan to the borrower. In case of default by the borrower, she has the right to sell the asset under her possession to recover the outstanding dues (principal along with interest). Common examples of loans by pledging assets in current times are gold loans and loans against securities such as shares, mutual funds or bonds. Typically, banks provide loans up to 50% of the value of approved securities.

Hypothecation

Under this method, the lender provides a loan against movable assets. For instance, a vehicle loan (for a car, two-wheeler or any other vehicle). When you borrow from a bank to buy a car, the car gets hypothecated to the bank. The vehicle that is being hypothecated to the bank will remain in the possession and use of the borrower, but in case of default, the lender has the right to seize the vehicle and sell it to recover the unpaid loan amount. The total outstanding vehicle loan to individuals, as on 17 April, was Rs.1.26 trillion, according to RBI.

Another example of hypothecation loan is loan against goods or inventory (stock) and debtors. The borrower hypothecates the stock that she has to the lender and borrows a certain percentage of its value. The borrower has the right to trade the stock, but needs to maintain the minimum agreed value of stock. If the lender finds that the value of stock is less than the agreed value, it has the right to take the stock as pledge till the borrower pays the outstanding dues.

Mortgage

This is an agreement in which the lender provides a loan against immovable assets. A common example is a home loan. Of the total loan to individuals by banks, about 55% (Rs.6.42 trillion) is home loans. Just like hypothecation loan, here, too, the asset that is mortgaged to the lender remains in the possession and use of the borrower. But in case of a default or non-payment of estimated monthly instalment, the lender, say, a bank, can seize the property. The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (Sarfaesi Act), 2002, allows it to do so. If a borrower fails to repay her home loan, the bank can auction the property to recover the outstanding amount.

Source : http://goo.gl/ltYJri

ATM :: Why retail customers end up paying higher interest rates than corporate defaulters

By Anita Bhoir & Atmadip Ray | ET Bureau | 10 Jun, 2015, 04.22AM IST | Economic Times

When Reliance Industries with its triple-A rating goes to a bank for a loan it is sure to get the best terms possible. A company rated many ranks below may end up paying 5 to 6 percentage points more than Reliance. That reflects the difference between good credit and bad credit.

But when it comes to retail individual borrowers, banks do not provide the same benefit on cost of borrowing even if the applicants have a top credit score. More than 15 years after the credit information bureau, CIBIL, was born, neither are individual borrowers benefiting from good behaviour and sound financials, nor are banks treating retail customers the way they do companies, which are charged based on their financials.

Credit bureaus have helped banks in reducing their bad loans from the retail portfolio, and CIBIL assigns scores ranging from 300 to 900 based on the ability to repay with historical financial behaviour. Still, retail borrowers have continued to pay almost similar interest rates whether their score is 600, 890 or even 900.

All that CIBIL, the biggest credit information bureau, says is, “Higher your credit score, higher your chances of loan approval.” Almost four-fifths of bank loans to retailers are for those with a score of more than 750. This is akin to lending only to companies with triple-A to single-A, and not to those with lower ratings.

“Credit score helps retail customers in getting a loan,” says SBI’s Arundhati Bhattacharya. “We don’t give a loan unless a customer has good credit score. At present, we don’t offer an interest rate benefit to retail borrowers for a good credit score.”

Interest rates on home loans, car loans, or loans against property for investments or starting businesses are almost fixed at banks’ discretion. Home loans are charged between 10% and 13%, but within the bank, there is hardly any difference in interest rates between an individual with a credit score of 600 and the one with 890, or even 900.

In developed countries such as the US, credit information bureaus rank customers as prime, sub-prime and Alt A. Banks charge interest rates based on their rating, and do not just use that as a tool to decide on giving a loan.

“In advanced economies customers that are highly rated demand finer interest rates,” says Romesh Sobti, managing director and CEO, IndusInd Bank. “In India, banks run on the basis of portfolio pricing. Credit score has evolved, but it is being used to decide loan eligibility of an individual.” That retail borrowers are not deriving the benefits for good behaviour is partly attributed to the fact that consumer activism is not prevalent unlike in the West and that the regulator has not been pushing the case for banks to end the discriminatory stance between corporates and individual borrowers.

Furthermore, Indian banks, which are saddled with huge bad loans from lending to companies, partly offset their losses by charging more from retail customers. “Retail customers are paying for corporate clients,” says Ashvin Parekh, managing partner of Ashvin Parekh Advisory Services.

Economic slowdown and bad lending decisions on the part of banks has left them saddled with defaults. While the recovery is a long and difficult process, banks tend to offset their losses by charging other customers.

The banking sector has taken a loss of over Rs 50,000 crore as loans given to companies have turned bad at the end of March 2015. The economic slowdown and volatile recovery has taken a toll on corporate balance sheet.

Banks have restructured debt to the tune of Rs 2,86,405 crore at the end of March 2015 which is up 18.22% from Rs 2,42,259 crore last year. Loan defaulters include Bharati Shipyard, ABG Shipyard, GTL, Essar Steel, Sterling Oil Resources, KS Oil, Deccan Chronicle and Kingfisher Airlines among others, and their debt runs into thousands of crores.

Bad credit calls on the part of banks besides postponing the problem of bad loans will ultimately hurt good borrowers, for whom the cost will go up, Reserve Bank of India governor Raghuram Rajan has said.

“I am not worried as much about losses stemming from business risk as I am about the sharing of those losses — because, ultimately, one consequence of skewed and unfair sharing is to make credit costlier and less available.” Rajan said.

These huge bad loans are one of the reasons banks are reluctant to lower their lending rates even after the Reserve Bank of India reduced its policy rates. Indeed, the RBI governor had to publicly criticise banks for not doing so, after which banks reluctantly reduced the rates.

Although big lenders to retail customers such as SBI, ICICI and HDFC Bank may not be deciding on lending rates based on individuals’ credit score but rather, lend on the fixed-ticket rate, smaller banks such as Federal Bank do so to gain market share and boost their presence.

“We use the Cibil TransUnion Score to give retail customers a finer interest rate on loans,” says R Babu, consumer banking head at Federal Bank. “Credit score of 580 onwards get an interest rate advantage which could be around 200 basis points.”

Lenders like Federal may be few and far between to make a meaningful impact on the lives of retail borrowers in the next few years. But the transformation to credit score-related lending rates like in the West may be possible in the distant future.

“Using credit score to give customers an interest rate advantage is work in progress in India,” says Mohan Jayaraman managing director, Experian Indian Credit. “Very few banks are using this as a tool for rate differentiation. Globally, credit scores are used as an interest rate differentiation tool. This would be the natural progression in India as well but it will take time.”

Source: http://goo.gl/btTWxR

ATM :: Top-up car loans can work out cheaper than personal loans

Opt for balloon schemes if you are capable of paying a large instalment upfront

Gaurav Khurana | June 13, 2015 Last Updated at 22:26 IST | Business Standard

In India, 80 per cent of car buyers avail of a loan to buy their dream car. The car loan market is growing at a rapid pace and the leading financial institutions are launching innovative and attractive schemes for the buyers.

Buyers have a variety of offers and repayment schemes to choose from depending on their needs. For elasticity in loan repayment, there are options such as the Tata Balloon Scheme, a bullet scheme. Then, there are external top-up options from HDFC or Tata Capital for those looking for money against their cars.

The balloon scheme

Tata Balloon Scheme is for customers who can periodically repay a larger instalment for their car loan. It allows customers to repay a fixed amount in two different formats 11- 1 and 1-11. For a loan tenure of one year, if the criterion is 11-1, a customer pays 11 smaller installments first and then one larger installment at the end of the year. This plan is especially beneficial for those who expect cash flows at the end of a certain period – for example, salaried employees who expect a bonus during a certain month. The other format allows customer to pay one large instalment followed by 11 smaller instalments.

Let’s take an example to understand this. Thirty-year-old Karan Singh works in an IT company and has availed of a car loan of Rs 1 lakh. If he avails of a normal repayment scheme, he will pay a fixed equated monthly instalment (EMI) of Rs 8,840 for one year. On the other hand, if he avails of a balloon scheme using the first format, he will pay 11 smaller installments of Rs 7,553 and one larger instalment of Rs 23,800. In the second format, he will pay one larger instalment of Rs 22,800 followed by 11 smaller installments of Rs 7,500 each.

As can be seen from the table, the balloon scheme has two sides to it. Depending on the format chosen, either the borrower or the bank will benefit. If you pay the larger EMI first and the smaller later, the borrower stands to gain. If you pay the smaller EMIs first and the larger EMI towards the end, you will end up paying more interest compared to a normal loan scheme. So, borrowers wanting to avail of the Tata Balloon Scheme will do well to choose the 1-11 format.

The top-up option

Those who have taken a car loan but are not able to pay their next EMI, can avail of an external top- up loan from banks. They can get a loan against the financed car to get their engrossment brought to a close. So, the scheme has two benefits: foreclosure of your previous car loan and an additional loan at a rate (about 15 per cent) which is cheaper than a personal loan (17-18 per cent).

HDFC, for example, has a special scheme if you are looking for cash against your car. The bank will foreclose your running car loan and initiate it with the additional amount. HDFC will calculate your eligibility and provide you finance according to your eligibility. To avail this scheme, 18 EMIs of your car loan should be paid and your EMI track record should be clean. The formula to calculate the eligibility is:

EMI amount*tenure paid*multiplier (1.5) = loan amount

This will be your additional loan amount.

Let’s take an example to understand this. Pankaj Rao has a running car loan of Rs 5 lakh from a bank ‘X’. He has repaid Rs 3 lakh to the bank by paying 20 EMIs. Rao requires another Rs 2 lakh to close the loan. According to the eligibility criterion, he can get a top-up of Rs 4.5 lakh. After availing this top-up, HDFC will close his running loan by repaying remaining Rs 2 lakh and also provide him an additional Rs 4.5 lakh. Thus, Rao will become a customer of HDFC by availing a total loan amount of Rs 6.5 lakh. Though the process is a bit lengthier, the top-up scheme can help borrowers purchase their dream car as well as get an additional loan.

NBFCs are more lenient regarding top-up schemes. Tata Capital, for instance, is a recent entrant into the market. If you have not defaulted in paying 18 EMIs for your existing car loan, you can get a funding of 120 per cent against your car from Tata. If you have a clean track record of paying 12 EMIs, you become eligible to get 100 per cent funding.

Final word

By availing such options, one can enjoy a certain amount of flexibility during repayment. Borrowers should, however, acquaint themselves with different aspects of these schemes to ensure that they choose the right option and do not fall into a debt trap. For instance, if you are opting for 11-1 balloon scheme, be certain that you will be able to pay a larger lumpsum at the end of 11 months.

The writer is CEO, Dialabank

Source : http://goo.gl/DMhrvN

ATM :: How to avoid debt traps: All you wanted to know

By: CreditVidya | April 8, 2015 9:12 am | Financial Express

Not all loans are bad. If the loan is used to create an asset and is productive in nature, it can be termed as a good loan. Home, business and educational loans fall in this category.

On the other hand, if the loan creates no asset or is of very little productive use, it can be termed as a bad loan. A personal loan to go on a vacation or a heavy credit card swipe to buy an asset that would depreciate and an auto loan will fall in the bad loan category. They can create debt traps.

Lack of financial knowledge and discipline goes a long way in preventing people from getting into debt traps. It is important to educate people on loans, bad Cibil credit score and other issues in the personal finance space. While personal loan or any other form of non-collateral loan seem to be the most convenient option, not everyone knows the gravity of the problems one might get into.

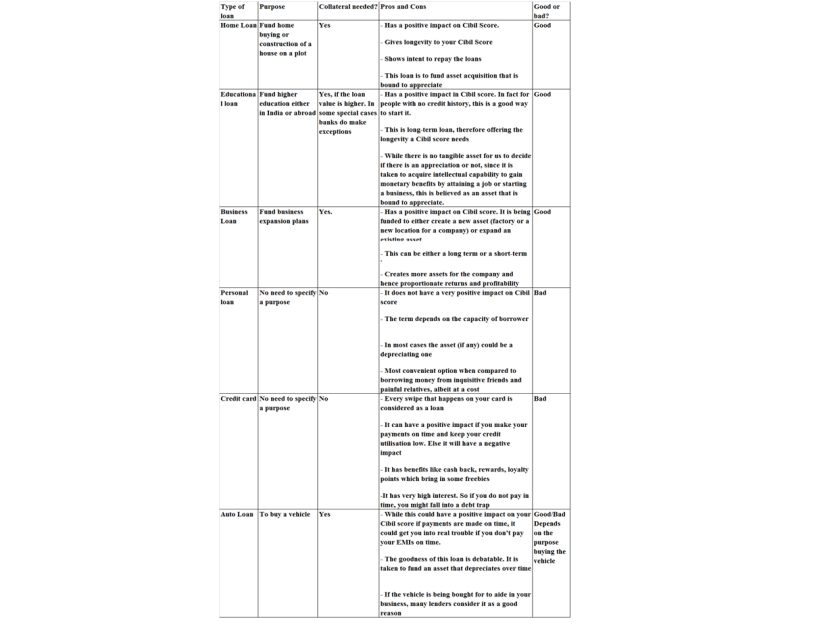

The following table explains the different types of loans and also weighs your pros and cons:

Here are top good practices to manage your finances better:

Save and then splurge: ‘Pay yourself first’, in other words, make the habit of saving a part of your income before spending. This goes a long way in keeping debts at bay.

Budget:If you go into debt, it’s an indication that you are living beyond your means. Without planning, it can be hard to know just when you are overspending. Drafting a budget for short, medium and long term expenses and tracking it allows you to see in black-and-white where your money goes. Trim your expenses so that the total outflow is less than the income.

Use debit cards: Debit cards are tied directly to your bank account. If you don’t have money you can’t spend on your debit card. Since no credit is extended, you can’t go into debt using your debit card.

Pay off balances monthly: One way to avoid overcharging on your credit card is to allocate money from your bank account before you make any charges. As soon as the charges hit, use the reserved money to pay them off.

Invest smartly: A well researched investment can yield great returns. Keeping abreast with the latest happenings in the financial world also helps one to make smart investments.

By following the above steps, people with bad financial habits can get out of debt traps. By constantly educating oneself and by inculcating financial discipline one can successfully prevent falling into debt.

Source : http://goo.gl/WkpvF9

NTH :: SBI, HDFC Bank, ICICI Bank cut lending rate; home, auto loans to get cheaper

Press Trust of India | Apr 07, 2015 at 08:24pm IST | @ibnlive

Mumbai: Nudged by the Reserve Bank of India, leading banks, State Bank of India, ICICI Bank and HDFC Bank, on Tuesday cut their lending rates. While SBI and HDFC Bank cut rates by a token 0.15 per cent, ICICI Bank slashed its lending rate by 0.25 per cent after the central bank maintained status quo on policy rate but termed as “nonsense” lenders’ claim that cost of funds was still high.

The action of the two banks could have a snowballing effect forcing others to follow suit, a move that can bring relief to corporate and retail borrowers including of home and auto loans.

The lowering of the base lending rate the banks was announced hours after a war of words erupted between RBI Governor Raghuram Rajan and the top bankers, who had appeared reluctant to effect a cut.

After two cuts in three months, the RBI kept the repo rate, at which the central bank lends to banks, unchanged at 7.5 per cent on fears of unseasonal rains impacting food prices.

The cash reserve ratio, which is the amount of deposits parked with the central bank, will remain at 4 per cent. Bank rate has also been retained at 8.5 per cent.

“I do not see an environment where credit growth is tepid, banks are sitting on money and their marginal cost of funding (has) fallen, the notion that it hasn’t fallen is nonsense, it has fallen,” Rajan said.

After his announcement and plain-speaking, leading bankers including SBI Chairman Arundhati Bhattacharya initially maintained that it takes time to lower the lending rates, which could happen in two or three months.

Hours later, SBI took the lead in effecting the rate cut, followed soon by HDFC Bank, whose CEO Aditya Puri had also hinted earlier in the day that it would take some time for rates to be cut by the lenders.

Bhattacharya later said she expected other lenders to follow suit by cutting their rates, as it was a competitive market. She also hinted at lowering of deposit rates.

On possibility of more cuts, she said, “I think there is an elbow room, but it all depends on credit growth pick up. We really want to see that happening.”

Promising an “accommodative monetary policy”, Rajan on his part said rate cuts going forward would depend on favourable macro economic data and whether banks pass on the benefits of two rate cuts so far on 2015.

While industry expressed unhappiness over the status quo on rates, Rajan said the market dynamics will force banks to lower their interest rates, while adding that sooner they cut the rates, better it would be for the economy.

“Comfortable liquidity conditions should enable banks to transmit the recent reductions in the policy rate into their lending rates, thereby improving financing conditions for the productive sectors of the economy,” he said.

Bhattacharya replied to this, saying that “it takes a little time for things to pass through. And, it is not only the cost of deposits that determines this.

“The passing through is also determined by the amount of liquidity, the amount of credit demand and competition which also drives rates up or down. There are very many factors and repo is only one of the factors.”

She also said that Indian banks work differently, as compared to the international banks.

Supporting SBI chief, ICICI Bank’s Chanda Kochchar said it is not just the repo rate change that determines the base rate change, it depends on cost of funds, deposit mix, liquidity situation and also on credit off take.

However, Bank of India chairperson Vijaylaxmi Iyer said, “The impact of reduction in cost of deposit experienced during the last quarter will encourage banks to pass on the benefit to customers. Retail borrowers may see lower EMIs.” RBI has surprised the markets with two rate cuts of 0.25 per cent each outside the scheduled review meetings in 2015, but banks have yet to respond to these policy rate cut by lowering their lending rates.

After the policy announcement, bankers said that most of them will have their asset liability committee meeting week to take a call on interest rates which besides repo rate depends on factors like demand for credit, cost of fund and deposit rates.

“We would see rates coming down as we see easing of interest rate cycle,” Bhattacharya said.

On the reluctance of banks to pass on the benefit of 0.50 per cent rate cut announced by the central bank since January, Rajan said, “We are not looking for a specific number (on the bank rate cuts) and saying unless this happens, nothing more will happen. But we want to facilitate the process of transmission.”

“Given that there has been very little transmission from rate cut so far… we are waiting to see transmission take place… I have no doubt that this will happen. If it happens sooner it is better for the economy,” he told reporters after the announcement of first bi-monthly monetary policy.

“The Reserve Bank will await the transmission by banks of its front-loaded rate reductions… into their lending rates,” the central bank said.

HDFC Bank’s Puri said the base rate cut is a function of the deposit cost.

“If the deposit cost goes down, then there will be a base rate cut. If it doesn’t there won’t be any base rate cut. However we feel between now and June, there should be repricing of cost and that will lead to a lower cost of funds for borrowers,” he said.

On the issue of bad loans, bankers lobby IBA chairman and Indian Bank head T M Bhasin said the lenders are optimistic that coming quarters will be better than the past few years, while other bankers refused to specify saying this is the silent period.

Source : http://goo.gl/V1pNkf

ATM :: Why you should understand your needs properly before taking a loan

By Uma Shashikant | 30 Mar, 2015, 08.10AM IST | Economic Times

A common crib against the younger generation has to do with the habit of borrowing. Now pause to consider the most prized asset in the portfolio of the complaining elder. It is likely to be a house, bought, of course, with a housing loan. Without a home loan, most of us would not be able to own property. However, many of us also overdo it when it comes to banishing loans from our lives.

A borrower takes money not from the lender, but from his future income. The risk comes from the unknown future and the change the loan can make in it. A boastful zero-loaner is likely to have a stable income and routine savings which fuel such righteousness. For the rest, borrowing may be unavoidable.

Loans differ based on the need they serve. A loan that is taken to tackle a liquidity crunch is a mere arrangement. When a company borrows from the bank to pay salaries, it is meeting an immediate need for cash, which will flow in once the sales are realised. A hand loan from a friend to contribute to a farewell party is an arrangement of trust, to return that money with the next ATM withdrawal. A loan that is taken for buying a house or any other long-term asset is a charge on future income and is a funding contract. A lender agrees to fund the asset on your behalf and structures a repayment from you keeping the asset as collateral. A loan taken to punt on the future value of a commodity or index is a leveraged speculative position. It can turn either way. So, find out and understand what your need is before taking a loan.

Habitual hand loan borrowers typically lose friends and contacts. Research on the psychology of borrowers points out that they may actually develop a ‘blind spot’ over time, pushing the memories of loan to the background. While lenders resent the loan made to a friend as repayment gets delayed, the borrower either convinces himself that it is not his fault, or feels a sense of relief that the lender will no longer chase him for repayment. People are known to recall what they lent much more than what they borrowed.

Always see hand loans as liquidity arrangements. They come without interest and are based on trust. The faster you repay these loans, the better it is. If you find yourself taking too many hand loans and struggling to repay them, you may not have a liquidity problem, but inadequacy of income. Your spending needs habitually exceed what you earn and unless you find ways to augment your income, you may find yourself in a debt trap, with no friends to bail you out.

Loans to buy assets are long-term formal contracts. Borrowers own the asset even as they repay. The lender is also secure as the asset can be repossessed and sold in the event of a default. In the case of a home loan, borrowers typically pitch in with a substantial amount of their own. This reduces the probability of default even further. That is why providing a loan against property is good business. However, property loans have, over time, turned into speculative bets on housing prices. Thus, asset-based lending has turned into leverage that risk multiplies.

The sub-prime defaults that led to the global financial crisis of 2008 originated with loans that were enabling home ownership, but were sold and bought with the assumption that housing prices would continue to rise.

Consider one of the popular structures, the interest-only loan. The borrower takes a loan to buy property, but pays only interest for the first three years. This makes the loan look inexpensive and affordable to the simple borrower. It is attractively designed for the speculator, who could sell off in three years to repay the loan. The simple borrowers underestimate the repayment burden in later years. They are driven by overconfidence that simply extrapolates the present. If the borrower fails to see the loss of jobs and income, the speculators assume that the prices will only move up. There is an auto feedback cycle in play when assets are funded with borrowing.

Housing prices respond to demand; demand moves up when loans are easy to get; and loans are more and more viable as the asset values go up. An asset bubble is created and leveraged funds push up asset prices. The collateral damage is huge when asset prices fall. The borrower defaults since the asset he bought with the loan has lost value; the lender gets wiped out when he is unable to resell the asset in a falling market to cover the value of the unpaid loan. A leveraged position runs the risk that asset prices may turn unexpectedly, creating a chain of defaults.

The loan to avoid is speculative leverage. One feels smart while borrowing on the margin and betting on the stock market. Few rounds of winning also boost confidence, but one unexpected correction is enough to wipe off a good chunk of capital. Without the emotional intelligence to manage the capital carefully and take losses on the chin, leveraged speculation can be ruinous.

However, not all borrowing is harmful. If the borrowing creates an asset, the asset meets a need or is useful, and if the repayment is well within the stable income of the borrower, there is no problem. Not all loans need to meet the rigid conditionality of creating an economically valuable asset, such as a home or a business. Simple loans for an expensive gift, a holiday or a car, are also fine as long as they do not stretch the repayment capability of the borrower. Such loans have to be evaluated for the opportunity cost since a higher EMI means a lower SIP. Loans, by definition, are restrictive as they are a fixed charge on the future income. Keeping such ‘low value’ loans to less than 20% of the post-tax income is a good thumb rule. Asking if the routine saving is at least equal to the EMI is also a good check.

Between a high stake bet and the perilous hand loan that kills relationships, is a wide space of responsible borrowing that can help build assets, enjoy the perks of a steady income and indulge in some instant gratification. There is no need to be too hung up about borrowing.

The author is Managing Director, Centre for Investment Education and Learning

Source : http://goo.gl/481Sdw

ATM :: Ways to ease your top-up loan burden

By consolidating borrowings, the total EMI burden and interest cost can be reduced

Rahul Soota | January 24, 2015 Last Updated at 20:53 IST | Business Standard

With the Reserve Bank of India cutting the repo rate by 25 basis points last week, borrowers would be happy that the rate cut season is beginning. While most banks haven’t still signalled base rate cuts, it is only a matter of time before they do so.

In such a situation, a potential borrower is likely to get good opportunities. For one, if you have taken a home loan recently, if the banks cut rates significantly, there could be a case for reducing your home loan burden by re-negotiating with the bank or shifting lenders. But if there are only a couple of years remaining for the closure of the home loan, it makes little sense to re-negotiate or shift because you would be paying mostly the principal amount.

Interest rate cuts also throw up other opportunities. For example, you could take a top-up loan – home or personal – at a lower rate. But there are certain things that you should be wary about before taking such loans. A few tips to ease the process.

Consolidation: Many of us have several loans at the same time. These include home loan, auto loan, personal loan, credit card dues and so on. And only the home loan payout gives some tax benefit, the rest are a drain on the finances.

If you already have a property through a home loan and have paid the equated monthly instalment for a few years, taking a top-up could be a good way to leverage the property’s value and reduce the other loans. Non-banking financial institution HDFC offers a top-up loan 12 months after the final disbursement of the property has been made. The rate is 10.15 per cent to 10.50 per cent and the tenure up to 15 years. In case you want the loan while the existing home loan is still on, you can use the loan against property option. In this situation, the rate is higher at 12 per cent to 12.75 per cent.

When you are considering an additional loan of, say, Rs 25 lakh, it is worth prepaying some of your smaller loans like personal loan and consolidating your borrowing against your property. This has a couple of benefits. Home loans or loans against property are long-tenure loans of 15-20 years, so the EMI per lakh of borrowing is the lowest compared to an auto or personal loan, which is of 4-5 year duration. Also, banks consider loans secured against property to be a safer bet and offer the lowest interest rate for such loans compared to other types of loans. So, consolidating your borrowings against your property, assuming the LTV permits, is a sensible option as the aggregate EMI burden as well as the overall interest cost can be minimized.

Eligibility: Banks use the instalment to income ratio (IIR) as a barometer of your ability to borrow. So, the aggregate of existing and prospective EMIs on the loan application under consideration needs to be within a pre-defined level of your current income. Depending on the banks’ internal credit policy, this could vary between 40 per cent and 65 per cent for most lenders. Borrowing against a property introduces the additional element of LTV, as described above. So, these two criteria hold the key to determining the loan amount you can borrow. As you shop for a home loan top up, you might need to consider switching your loan to a bank whose policies allow you to borrow the amount that you need. Here again consolidating your personal and/or auto loan will help improve your eligible loan amount. The bank will prepay these loans on your behalf, out of the top up amount sanctioned.

Interest rate: It is normal for existing borrowers to pay slightly higher interest rates than new borrowers. When you are considering a top up loan, it is a good time to shop for a better deal on your rate of interest. Lenders have special schemes running from time to time and you could take this opportunity to switch to such a bank, assuming you are getting the desired loan amount. You can also bargain with your existing bank to renegotiate the existing interest rate downwards, as they would probably like to retain a client who has been repaying the loan in a timely fashion.

As you will notice in table 2, the power of interest rate, higher tenor, consolidation of loans and your loan advisor’s search for the best deal, allow you to borrow the additional amount of Rs 25 lakh, for a minor change in your aggregate EMI by Rs 507 only.

Paperwork: If you are availing a top up from the same bank where your home loan is currently running, you will need to put together your latest KYC documents, income documents, bank statements and details of other existing facilities. In case you decide to switch to another bank, you will need additional documents, including a foreclosure letter stating current home loan outstanding and list of property documents in custody of your existing bank (LOD). Both these need to be provided by your current lender. Banks normally take 10-15 days to process such requests. They will use the interim period to convince you not to move your loan elsewhere. The foreclosure letter is valid only till your next EMI is paid, as the loan outstanding changes with each monthly repayment. So, you ideally need to make the switch over in the same calendar month as the date of the foreclosure letter.

Conclusion: It is not possible for borrowers to be aware of all the eligibility criteria or prevailing offers from multiple banks. You are probably best served if you avail the services of a loan advisory service. They will not only offer you multiple options, but also help with all your paperwork. Such loan distributors do not charge clients for their services, as the banks pay them for loans referred. You get unbiased advice and the services of a specialist, which should help navigate the entire process seamlessly.

The writer is co-promoter and executive director of mymoneymantra

Source: http://goo.gl/j1DT3F

ATM :: What the RBI rate cut means for investors as well as borrowers

Narendra Nathan | ET Bureau Jan 19, 2015, 08.00AM IST | Economic Times

RBI surprised the street by cutting the repo rate from 8% to 7.75%. Though small, this ‘between-the-meetings cut’ has given the signal that the RBI is confident of achieving its inflation targets and the focus is shifting towards growth. Since the RBI has always wanted policy action to be consistent with long term rate stance, this cut heralds the start of a new ‘rate cut cycle’. Now the only questions are ‘how much’ and ‘by when’ these rate cuts will happen. Since most experts (see box) see measured rate cuts, how is it going to impact you?

Investments: The Sensex and Nifty jumped by 729 and 259 points respectively on 15 January, when the rate cut was announced. Stocks from rate sensitive sectors rallied. While the bank Nifty hit a new high, the realty index jumped more than 8%. A lower rate increases purchasing power and therefore, is good for most other sectors as well.

Debt investments can be classified according to how the impact of this cut will be felt. The first part, where the market forces decide the price of bonds, has already rallied based on the expectations of a rate cut after the budget.

The 10-year yield came down by a further 10 bps on Thursday. Most experts are predicting a further fall in the 10-year yield. Long term gilt funds and long term tax free bonds should generate double digit returns in 2015 as well.

The second part includes bank FDs and RDs, where the rates are fixed by the banks. Since this rate has not yet fallen, it still provides a good opportunity to lock in at higher rates. Go for FD if you have enough liquidity; else start an RD.

Loans: To protect their margins, banks first cut the rates on FDs and RDs before reaching for the loan rates. In the recent past, banks have refused to bring their base rates below the 10% mark, despite significant deceleration in loan growth.

Though banks may do some token cuts to pacify the RBI, no major cut in lending rates are expected. Borrowers may have to wait for a few more months for the arrival of the “achhe din”.

Since demand for automobiles is weak, the first rate war may start in the auto loan segment. This reduction is possible without tinkering with the base rates because the interest rates on most auto loans are at a significant premium to the base rates. Bargain hard to get a better deal on auto loans.

Since home loan rates are only slightly above the base rates, the reduction will be in line with the reduction in base rates. One should not expect more than 25 bps reduction in home loan rates. This reduction will be only for borrowers who have availed the ‘floating rate’.

However, overall home loans rates are going to come down significantly in 2015. Borrowers who can afford to should wait for better rates. The same applies to those who want to shift between lenders now. Wait for a few quarters, let the borrowing rates stabilise at lower levels and then make the move towards the lowest lenders.

Source: http://goo.gl/xFZ1z8

ATM :: How To Pay Off Your Car Loan Faster

RAJIV RAJ | SEP 2, 2014, 11.08 AM | Business Insider

There are many benefits of paying off a car loan ahead of its schedule. You can save up some money and use it towards the fulfilment of your other financial goals. For those who are having some trouble with their credit history, owing to high debts, paying off an auto loan is a great way to resurrect your Cibil score. If you have no idea where to begin, here are some pointers that are likely to help.

Take the case of 32-year-old Debarshi Nag, a diligent employee in a Mumbai-headquartered construction firm who has recently been promoted to with a 10% increase in his salary. Debarshi, who is planning to apply for a home loan in the near future is aware of the fact that he needs to maintain, and if possible, improve his Cibil score above 750 in order to have his home loan approved in a hassle free manner. Towards this goal, he wants to pay off his car loan with a tenure of five years that had applied for in 2012. Here are a few things the likes of Debarshi can do:

Make one extra payment in a year

Making a payment of one extra EMI in a year may through your budget haywire, but stretching the same payment over a year will help you achieve this goal with ease. For instance, if your EMI is Rs 12,000, you divide that by 12. The result is Rs 1000. Add this Rs 1000 to each month’s payment and you will have paid one whole payment in a year, without feeling the pinch of making one large payment all together.

Rounding up your payment

You can also cheat yourself in making a higher payment towards your car loan by rounding off your payments, depending upon what your budget allows. For instance, if your loan amount is Rs 11, 540 you can round it off to Rs 12,000 each month. This means you are making an extra payment of Rs 460 per month.This may seem like a small amount, but in a matter of 12 months you will have paid Rs 5520 in the year, thus taking slow and steady step closer towards the repayment of your auto loan.

Out of turn payments

Most banks and financial institutions are a little more flexible with car loans and can give you the opportunity to make out of turn repayments whenever you have some extra money to spare. Banks call it the “special tie ups” and may offer it if you are an existing customer or you approach them with a good Cibil score. You can use the extra cash that you get from yearly bonuses etc to make such payments on your auto loan. However, it is best to discuss such repayment option possibilities beforehand with your lender, to ensure that there are no penalties for such pre-payment opportunities.

Take on some extra work

Ever thought of earning some more money by milking your talent? For instance, if you are a great web designer and have done it for friends for free earlier why not do it professionally in your leisure to earn some extra cash that you can use to make your loan prepayment. With so many opportunities for freelancers and social media forums, you can definitely try and use your talent to earn this extra cash! It may seem a little daunting at first, but you will soon discover that it is an incredibly satisfying experience!

Having a vehicle of your own is no longer a luxury but a necessity these days, and when you can own it without having to bother about monthly EMI payouts, the drive ahead becomes even more enjoyable! Now that’s a good enough reason to start planning for a prepayment of your auto loan! Don’t you think?

Rajiv Raj is the director and co-founder of http://www.creditvidya.com

Source : http://goo.gl/TTNVxW

ATM :: Foreclosure charge on loan unfair practice, says consumer forum

K. C. GOPAKUMAR | July 14, 2014 11:55 IST | THE HINDU

A consumer forum here has held that collection of foreclosure charges from housing loan borrowers amounts not only to deficiency in service but also unfair trade practice.

The Ernakulam Consumer Disputes Redressal Forum headed by its president, A. Rajesh, made the ruling while directing Federal Bank to refund the foreclosure charges collected from Biju Joseph of Kakkanad, a borrower.

Panel’s view

The forum said the Committee on Customer Service in Banks had opined that foreclosure charge levied by banks on prepayment of home loans was seen as a restrictive practice, deterring borrowers from switching over to cheaper available source. The committee was of the view that levying of foreclosure charges amounted to restrictive practice on the part of banks. The Reserve Bank, through a circular in 2012, had asked banks not to charge foreclosure charges/prepayment penalties on home loans on floating interest rate basis with immediate effect.

Need for uniformity

Though many banks had in the recent past voluntarily abolished prepayment penalties on floating rate home loans, there was a need to ensure uniformity across the banking system, the circular said.

According to the complainant, while executing the loan agreement, the bank had specifically stated that it would not charge any amount at the time of foreclosure of loan account. However, the bank had vehemently argued that it was entitled to levy prepayment charges.

The forum pointed out that the person taking loan had no other go but to sign on the dotted line.

The levying of pre-closure charges contending that it was a condition in the agreement was not at all justifiable, it said. The above condition in the loan agreement “cannot be said to be with the consent of the complainant.”

Source : http://goo.gl/s7Qbjq

NTH :: Don’t let penalties stop you from pre-paying loans

By Preeti Kulkarni, ET Bureau | 18 Apr, 2014, 02.56AM IST | Economic Times

In its annual monetary policy announced on April 1, the Reserve Bank of India (RBI) issued an advisory to banks asking them to consider abolishing pre-payment penalty on floating rate loans. The regulator has also indicated that if banks failed to implement the advisory, it might make it mandatory. If implemented, the move will benefit borrowers of auto, personal, education loans, who are unable to switch over to cheaper loans due to the stiff prepayment penalty of 0.5% to 4%.

Earlier, the RBI had scrapped the pre-payment penalty on floating rate housing loans. The regulator’s working committee’s draft report on credit pricing also calls for more transparency, fairer pricing and penalty structures. Clearly, it indicates the path the RBI wants banks to follow.

“In spirit, the advisory’s objective is to promote transparency in pricing. Often, we have seen that the interest burden on car loans or personal loans never goes down, as rate cut benefits are rarely passed on to the customers. An option to switch or pre-pay without any obstacles could force banks to treat their existing customers on par with the newer ones,” says Harshvardhan Roongta, CEO, Roongta Securities.

In the absence of this penalty, the customer can shift the loan to another bank that offers a cheaper rate. “The process (of transferring loan) will be easier if pre-payment penalty is abolished. At the same time, the pricing of loans by banks will also be competitive to ensure that good customers remain with the bank,” adds VN Kulkarni, chief credit counsellor with the Bank of India-backed Abhay Credit Counselling Centre.

Clean Your Portfolio

Experts say borrowers shouldn’t hold on to their existing “unproductive” loans like auto and personal loans in anticipation of an abolition in penalty for pre-payment of loan. They advise individuals to clear them with higher interest rate, even if it means paying the penalty. Credit counsellors call for full pre-payment of car, personal and credit card dues. “Prepaying a loan which has no benefit for holding on to is always advised.

Credit card or personal loans should be closed as soon as the requirement is over, and with the first available cash in hand,” says Sukanya Kumar, founder and director, RetailLending.com, a loan aggregator and advisory portal.

In the months of April and May, corporates hand out annual increments and bonuses to their employees. You can use the lump-sum amount to repay your loans. However, before that, set aside an amount equal to six months’ expenses for a contingency fund, and buy life and health policies if you do not have adequate insurance cover.

Home loans and education loans, meanwhile, are considered ‘good’. It necessitates a cost-benefit analysis before taking a call on full pre-payment.

Both the loans lead to creation of assets — tangible and intangible respectively — apart from yielding considerable tax benefits. Hence, they are considered ‘good’ loans. The pre-payment of such loans, therefore, will depend on your assessment of actual savings, which is not the case with personal, credit cards or car loans.

Points to Bear in Mind

If you do decide to go ahead with full pre-payment, ensure that you see the procedure through till the end. Don’t assume that your loan will be considered closed once you deposit the required funds into the loan account. “Borrowers need to inform banks when they pre-close. If you just make the payment, the loan may still remain open and incur an annual fee,” points out Kumar.

Then, there are other aspects to be taken care of.

“Enquire about the exact amount of outstanding balance for the actual date of closure. For example, if you enquire today and go for a closure after three days, the bank may have not factored these three days’ interest. So, even after you pay, this amount could be treated as ‘balance due’, though you believe you have closed the loan,” she adds. Also, take back all blank cheques you would have given to the bank during loan disbursal.

Source : http://goo.gl/P20GHn

ATM :: Does it make sense to avail December discounts on cars?

By Prashant Mahesh, ET Bureau | 18 Dec, 2013, 06.56AM IST | Economic Times

Balancing discounts, resale values and launches is a complicated equation and you need to give it a serious think before buying a new car, feels ET…

Motor enthusiasts always wait for December to upgrade their cars. Car manufacturers and dealers offer a host of exciting offers and attractive discounts to clear the inventory before the New Year to make space for new models with higher prices in the showrooms. With passenger car sales falling by 8% in November, the discounts are even better this year as dealers are trying their very best to clear the stock.

For example, Nissan Motors is offering as much as 5.6 lakh off on the Teana and a discount of 40,000 on Micra. MarutiBSE 1.13 % is offering a discount of 66,000 plus with four year free warranty on the A-star. Hyundai is offering savings of up to 48,500 on the diesel i20. Dealers are also pitching in with a few accessories or free insurance to further sweetening the deal.

“A car depreciates in value by 10-12% every year. The extra discount would work in your favour if you plan to use the car for at least seven to eight years. If you change your car every two to three years, its better you wait for the new year,” says Roshun Povaiah, of cartoq, an automobile website.

Does it make sense to upgrade now?

Well, the answer is a tricky one. It depends on factors like the discount offered, how long do you plan to retain the car, resale value of the car at at that time (cars value depreciate by around 10-12% every year), among other things.

Let us work with an example of Maruti A-star which is available for 4.71 lakh (on road price) in Mumbai. Currently, you could get a discount plus exchange bonus worth 66,000 as per dealers, which brings down the effective price to 4.05 lakh. If you sell this car in 2020, this 2013 model would approximately fetch a resale value of 1.94 lakh.

Now, let us see what will happen if you wait for a few months to buy a 2014 model. The car will definitely command a better resale value of 2.50 lakh in 2020. However, despite the better resale value ( 56,000 more) it makes sense to buy the car in December because of the attractive discount ( 66,000).

Nonetheless, if you plan to sell the in two or three years, this mathBSE -0.04 % may not work. Supposed you buy a Maruti A-star in December and sell it after three years. You will get 2.9 lakh for the car. If you buy the same car in 2014 and sell it in 2016, you may get 3.81 lakh. Here the difference is 86,000. So buying the car now is not a great idea.

However, please note that it is not so simple to arrive at the resale value of your car. “The resale value is a combination of various factors, such as how much a car has run, the year of manufacture, fuel used, how well it has been maintained, how popular the car model is and the fuel efficiency,” says Kunal Khattar, MD of Carnation Auto.

Will prices go up in January?

Most car manufacturers hike prices and launch new models in January. With consumer price inflation touching a high of 11.24%, there are chances that interest rates could go up further.

However, experts believe companies may not be in position to go for steep hikes because of a sluggish economy and higher interest rates.

“With the rupee depreciating by as much as 14% in calendar year 2013, manufactures are left with little choice other than hiking price,” says Vinay Sanghi, managing director of Cartrade, an automobile portal.

Volkswagen has already announced it will hike prices by 2.5% from January.

So, if you are planning to buy a car next year, factor in a marginal increase in car prices.

Source : http://goo.gl/gl1avq

ATM :: Financial planning: Blunders to avoid after marriage

Adhil Shetty | Updated: Nov 29 2013, 15:38 IST

Financial planning is necessary as marriage changes an individual’s life in many ways.

Marriage changes an individual’s life in many ways, bringing a lot of joys, additional responsibilities and worries in small measures as we try to adjust to the new person in our lives. After marriage, both of you might be working or either one of you. This will determine your income source and as for expenses, it is largely based on the standard of living that one maintains. There are a lot of things that a couple must clarify right at the onset of their marriage such as life goals and financial aims. In fact, keeping in mind the rate of inflation, it is sensible to start planning for children’s education, marriage and retirement right from the first day of marriage.

Managing money and family planning

Mostly, in India, people begin any serious investments such as gold or property only after marriage. Money management takes serious undertones as family planning also enters the picture. Many couples make the mistake of paying greater importance to either money management or family planning, whereas both must be managed simultaneously. Expenses towards children begin right from their delivery, schooling to higher studies. There is an argument both for and against starting a family early in life; on one hand, it means that you will be through with all the big responsibilities of your life by the time you retire; and on the other, it means more financial stability before you take on the responsibility of a child.

Changing percepts

Contrary to the previous era when the majority of the weddings went unregistered, most of the urban marriages are registered formally, often in the marriage hall itself where the wedding is conducted. There are numerous legal rights and obligations that come into action once a marriage has been legally formalised. There are a few age old financial precepts of marriage which hold true even today such as: Have at least one bank account which is held jointly by the couple. This is very helpful especially when you are making investments or taking a loan jointly.

As far as possible, apply for home loans jointly, as the chances of sanction rise.

Also, in case both the partners are working, then both can enjoy tax concessions. Register all real estate property in both your names for administrative as well as loan purposes. Change the wife’s name on all legal documents including bank accounts, PAN card, passport etc. Have a budget to keep track of your monthly expenses and how to manage them.

Financial planning for the newlyweds

As is the case of all personal financial planning, it is essential to have short-term, medium-term and long-term financial plans which can be used as a definite plan or as a yardstick by which you can measure your financial success and also keep a tab of the roadmap you have set for achieving your joint goals. These goals may be further categorised into needs and wants to mark their importance.

Financial planning is a dynamic process that will evolve as the years pass and the couple assumes new roles and responsibilities. However, it is essential to have a shared vision and attitude towards expenses as this financial stability is highly essential for a stable future.

The writer is CEO, BankBazaar.com

Source: http://goo.gl/Tf3tTp

NTH :: SBI slashes interest rates on car, consumer goods loans

PTI | Oct 9, 2013, 02.20PM IST | Times of India

NEW DELHI: State Bank of India (SBI) on Wednesday reduced interest rates on loans for car and consumer durables and also decided to lower processing charges to cash in on the festival season demand.

SBI is the fourth bank after PNB, OBC and IDBI Bank to offer special interest rates for loans to buy automobiles and consumer durables like televisions, air conditioners and refrigerators.

The decision to cut interest rates on auto and consumer durable loans comes nearly a week after the government decided to pump in funds in PSU banks so that they can lower rates to stimulate demand in the targeted sector.

According to the country’s largest bank, interest rate on car loan has been slashed by 0.20 per cent to 10.55 per cent against the earlier 10.75 per cent.

“Processing charge has also been cut from 0.51 per cent of the loan amount with a minimum of Rs 1,020 to a flat rate of Rs 500,” it said.

The bank has also launched a special festival loan for its salary account holders for purchase of consumer durables and two-wheelers.

Attractive discounts are available under this offer resulting in effective interest rates starting from 12.05 per cent, it said.