Tagged: Asset Allocation

NTH :: Should EPFO subscribers hike their ETF investments?

The whole theme of EPFO providing these choices to increase and reduce equity exposure is a case of duplication of effort and design. Financial experts are advising investors to leverage existing options.

Hiral Thanawala | May 02, 2018 11:28 AM IST | Source: Moneycontrol.com

There is good news for over five crore subscribers of retirement fund body EPFO. Soon they may have an option to increase or decrease investments of their provident fund into stocks through exchange-traded funds (ETFs) in the current fiscal. In its last meeting, the Central Board of Trustees decided to explore the possibility of granting an option to increase or reduce equity allocation to subscribers contributing through ETF above the 15% cap.

The Employee Provident Fund Organisation (EPFO) had started investing in ETFs from investible deposits in August 2015. In FY16, it invested five percent of its investible deposits, which was subsequently increased to 10 percent in FY17 and 15 percent in FY18. However, subscribers were not at all pleased with this increase in exposure to equities. There were some who didn’t want to risk their retirement corpus built through the EPF route. While other subscribers were keen to increase exposure to equities for better returns in the long-term.

So, what advice do financial experts have for EPFO subscribers looking to increase their exposure to equities through the ETFs route when the option is opened up?

Who should increase or reduce investments in ETFs?

Several investors are not reasonably patient with their active investments and panic when they see volatility in the market. Chenthil Iyer, a Sebi registered investment adviser and author of ‘Everyone Has an Eye on Your Wallet! Do You?’ said these investors generally invest only in fixed deposits and post office schemes. “For such investors, increasing the equity exposure through EPF route may be a good option as it is a passive mode of investing and ensures a long-term commitment.”

For investors who manage their active investments and have a well-diversified portfolio, Iyer recommends a minimum equity exposure.

Arvind Laddha, Deputy CEO, JLT, Independent Insurance, has a word of caution. “In the past, there have been negative returns for consecutive two-to-three years or even more from equity markets and this could compromise the savings of EPFO subscribers which they are not used to.”

As not all investors understand the risk of equities and their volatile nature of returns, Kalpesh Mehta, Partner at Deloitte India, feels an investor should also consider one’s age, risk appetite, financial obligations and total net worth before increasing exposure to equities through ETFs.

Benefits of increasing investments in ETFs

Here are the benefits of increasing investments in ETFs through EPF contribution as explained by Amit Gopal, Senior Vice President, India Life Capital: 1) Regular monthly SIP because of mandatory contributions; 2) Inexpensive as employees (contributors) don’t have to pay fund management fees in the current model of EPF; and 3) Tax advantages on contributions. To this, Colonel Sanjeev Govila, CEO, Hum Fauji Initiatives lists institutional framework taking care of selection and research of equities while investing.

Drawbacks of increasing investments in ETFs

Gopal highlights drawbacks such as insufficient administrative track record, illiquidity associated with a retirement fund product, absence of choice in fund manager and products.

To this, Iyer cautions, “Putting the responsibility of equity exposure of this fund on the individual may expose it to the vagaries of the individual’s risk perception, leading to possible over-exposure.”

Make EPF more investor friendly

EPF needs to be investor friendly with additional facilities of enhancing and reducing equity allocation which is likely to be made available in the coming two-to-three months. Iyer feels periodic electronic statements should be mailed to the subscribers which clearly mentions the amount and number of units available in ETF.

“Further an automatic mode of distributing the contribution into equity and debt should be made available based on the age of the individual just like NPS.” This, he feels, will ensure minimum manual intervention in decision-making with regard to equity exposure.

According to Goyal, while EPFO have described some methods of passing on returns, nothing concrete has been implemented. “It is unclear how they will ford the system and governance challenges that could arise.”

It would therefore be good if these issues are resolved before increased allocation and employee choices are implemented. An investor needs to keep a track of this developments for their own benefit.

Leverage on existing options instead of duplicating efforts

The whole theme of EPFO providing these choices to increase and reduce equity exposure is a case of duplication of effort and design. Financial experts are advising investors to leverage existing options.

“The NPS already provides the same structure and benefit. Integrating it with the EPFO and permitting portability is a more efficient way of enhancing employee choice. NPS already has the architecture and track record of administering an employee choice model,” Gopal added.

Source: https://bit.ly/2IdyOMu

ATM :: How is your mutual fund performing? Triggers that should alert you to exit

Sarbajeet K Sen | Sep 14, 2017 11:37 AM IST | Source: Moneycontrol.com

Poor performance of a fund must set the investor thinking on whether to continue with the investment.

When did you last review your mutual fund portfolio? Maybe a long time ago. Many investors might feel relaxed after investing in mutual funds with the thought that their money is safe with experts trained in investing and stock selection.

However, the mutual funds landscape is a mixed lot. There are good, high-performing funds and there are laggards who are unable to keep up with performance of the leaders.

Did you check which of these category of fund you have invested? If it is one of the top-performing ones, giving you good returns, you need not worry. But if it is one of the funds that have not performed well in comparison, it might be time to think of a switch to another fund.

So when did you last review your mutual funds investment portfolio to know whether it needs a change? If you do it periodically, well and good, but if you have not reviewed for a long time, you should assess how your various fund investments have been performing.

“Investors should review their mutual fund portfolio at least once in 6 months. They should look at the performance of the fund, the sectoral allocation that they chose and whether there have been any big changes,” S Sridharan, Business Head, Financial Planning, Wealth Ladder Investment Advisors

Sridharan says if the review shows that the fund has performed poorly, it should signal a possible exit and switch to another fund. “Poor performance of a fund must set the investor thinking on whether to continue with the investment. However, exit decision should not be based only on performance of the fund. Investors should look at other parameter like what went wrong and whether the fund manager has the capability of revising the portfolio to the positive side in the near future,” he said.

Vikash Agarwal, CFA & Co-Founder, CAGRfunds, says one should avoid unnecessary churn in portfolio. “The essence of money-making is regular investments in well-managed diversified equity mutual funds. One should avoid unnecessary churns in the portfolio which may enhance cost in terms of exit load and tax implications,” he said.

However, Agarwal says there can be multiple reasons which might merit a review and change of one’s mutual fund holdings. Some of these are:

–Continued underperformance of the fund such that the fund is unable to beat its benchmark

-The fund is able to beat the benchmark but the returns are not commensurate with the levels of risk being taken by the fund

-A particular stock/debt instrument holding which forms a significant holding of the fund is likely to underperform due to a fundamental issue. Example: If a fund has significant exposure to a company which has acquired a loss making company, it might merit a deeper review of the fund

–Change of fund manager: In case there is a change in fund manager, then it is useful to review the fund as the fund style and philosophy might undergo a change and it might not be suitable to investment objective anymore

“If your fund is showing such characteristics then it is ideal for you to exit and switch to a better managed fund,” Agarwal said.

Source: https://goo.gl/dKawWa

ATM :: How much should one invest in debt or equity oriented schemes?

TIMESOFINDIA.COM | Sep 1, 2017, 12:36 IST

You can invest in mutual funds with amount as low as Rs 500. There is no upper limit for investing in mutual funds. Each mutual fund – be it equity or debt – has certain risk due to volatility and uncertainty in market. Ideally, you should be investing 10-20 per cent of your savings in mutual funds through monthly SIP.

Here are few points that you should keep in mind while investing in a debt or equity oriented schemes:

1) Goal

List down all your short-term and long-term goals in future such as holiday, marriage, children, education of children, retairment etc. Invest more into equities for your long-term needs as it is greatly possible to be aggressive in such cases. For your short-term needs, mutual funds with 1 year lock in can be adopted.

2) Risk capacity

The amount of investment risk you are able to take on is generally determined by your financial condition. Sudden financial shocks such as job loss, an accident etc. can affect your investment decisions by altering the amount of risk you’re able to afford. Your financial commitments such as home loan, business loan, car loan, expenditure in kids education etc. may also affect your investment risk capacity.

3) Age

When it comes to investing, age is as big factor as the other two mentioned above. The best time to start investing is when you are young. The best time to learn about the markets and how to deal with its risks is when you’re young. Young investors have decades before they need the money. They have more time for their investments to recover and make up the shortfall. Once you are into your 30s and 40s, allocate a greater fraction of your portfolio to minimal risk funds or long-term funds. Also allocate some money to equity funds for your aggressive goals.

4) Fund selection – debt or equity

Debt funds can give you steady returns but in a constant range. Since debt funds invest money in treasury bonds, there’s much less risk associated with them. Debt funds are good investment option when market is volatile. Equity mutual funds give good returns over the long period to time as compared to debt funds. However, the possibility of losses and negative returns is also higher when market is volatile. Equity funds are good when the markets are booming.

You may also consult financial experts before taking final decisions. Mutual fund agents and distributors can also help you in this regard.

Source: https://goo.gl/S9RnDz

ATM :: Invest cautiously when markets are at all-time highs

NIMESH SHAH | Wed, 12 Jul 2017 – 07:35 am | DNA

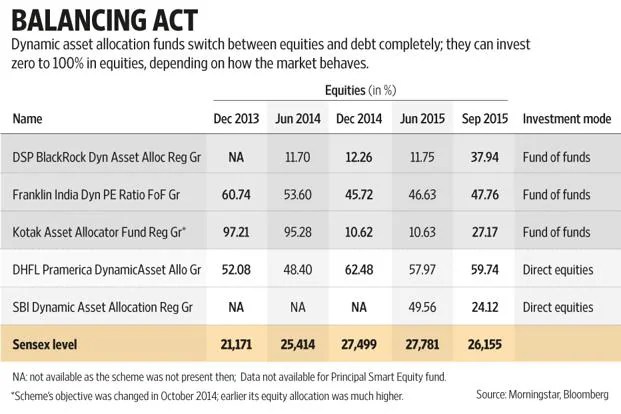

Dynamic asset allocation funds is a smart way to invest in markets without worrying about market highs or lows

The stock markets are at all-time highs, and it’s understandable if you are confused whether to invest or wait for correction. Timing the market is not easy. And while piling up your savings or putting them into traditional investment options seems like an easier option, it lacks the growth opportunities which capital markets could present.

A smart investor would look to participate in the growth of capital markets but in conservative manner. Introduce yourself to dynamic asset allocation funds, a smart way to invest in markets without worrying about market highs or lows.

Investing in mutual funds which follows the principle of dynamic asset allocation gives you the flexibility of investing in both debt and equity depending on market conditions. These funds aim to benefit from growth of equities with a cushion of debt. Such funds work on an automatic mechanism switching from equity or debt, depending on the relative attractiveness of the asset class.

In a scenario when the equity market rallies, the fund is designed such that profits are booked and the allocation would shift towards debt. On the other hand, if the markets correct, the fund will allocate more to equity, in order to tap into the opportunities available. The basis for this allocation is based on certain models which takes into account various market yardsticks like Price to Book Value amongst several others for portfolio re-balancing.

This model based approach negates the anomaly of subjective decision making, thereby ensuring that the investment made is deployed at all times to tap into the opportunities of both debt and equity market. The other added benefit is that one gets to follow the adage – Buy low, sell high. For an equity investor, this is one maxim which is the hardest to execute, but this fund effectively manages to achieve this objective.

Also, investing in such funds renders an added benefit of tax efficiency as 65% of the portfolio is allocated to equities. Since this category of fund is held with a long tern view, capital gains on equity investment (if invested for over one year), are tax free, as per prevailing tax laws.

So, while the markets are soaring high, you can consider investing in dynamic asset allocation fund to keep you well footed in the market, even during volatile times.

The writer is MD & CEO, ICICI Prudential AMC

Source: https://goo.gl/rGto7F

POW :: Franklin India Balanced: Keeps its balance in volatile markets

PARVATHA VARDHINI C | August 28, 2016 | The Hindu Business Line

The fund’s debt exposure offers downside protection to conservative investors

Equity-oriented balanced funds are a good choice to beat the current volatility in the markets. These funds invest up to 35 per cent of their corpus in debt instruments and thus provide good downside protection for risk-averse investors. Franklin India Balanced is a fund that fits the bill in this category.

Performance and strategy

In falling and yo-yoing markets, Franklin Balanced remains resilient. In 2011, when the bellwethers and broader markets lost 25-27 per cent, the fund lost only 13 per cent.

In the see-sawing markets of 2015, the fund emerged on top, gaining about 5 per cent, while the indices fell 1-5 per cent.

Franklin Balanced managed to stay on top in the 2014 rally too, by deft asset allocation. The fund did not latch on too much to riskier mid- and small-cap stocks to ride the bull run and allocated less than 15 per cent of its equity portfolio to the same. It, instead, took advantage of the rally in bond prices, by increasing its holdings in government securities in this period. A sharp up-move in both equity and bond markets saw the fund clock 47 per cent return in 2014, as against the 30-37 per cent clocked by the bellwethers and the BSE/Nifty 500 indices.

Its returns are better than of peers’ such as Canara Robeco Balance and Reliance Regular Savings Balanced. The performance even matches that of diversified equity funds such as SBI Magnum Equity.

Portfolio choices

The fund normally keeps its mid-cap allocations to less than 10 per cent of its equity portfolio, barring occasional spikes up to 15 per cent during market upswings. Its top sectors are typically a combination of cyclicals and defensives. The fund has stepped up its holdings in bank stocks after a breather last year due to multiple headwinds hitting the sector. Barring SBI, its choices lean towards private banks such as HDFC, IndusInd, YES Bank, ICICI and Kotak Mahindra Bank currently.

In the auto sector too, the fund pushed up stake in Mahindra and Mahindra, betting on good monsoon. Other holdings here include Hero MotoCorp, Tata Motors and TVS Motors. Power Grid Corporation, Maruti Suzuki, Mahanagar Gas and Oil India are recent entrants. About 26 per cent is allocated to government securities. In the last couple of months, the fund has been trimming its exposure to corporate bonds. While its exposure to corporate bonds is not significant currently, in the past it has stuck with higher rated bonds — those rated AAA or AA.

Source: http://goo.gl/0OZ5nq

Interview :: All you need is Rs 20,000 a month for 15 yrs to be a crorepati: Nimesh Shah

By Kshitij Anand, ECONOMICTIMES.COM | Aug 10, 2016, 01.51 PM IST

The unique challenges to growth of developed markets make emerging markets, especially India, look attractive. However, a strong upside from current level looks challenging at this point in time, says Nimesh Shah, MD & CEO, ICICI Prudential AMC . In an interview with Kshitij Anand of ETMarkets.com, he shared his views on markets, GST and the behaviour of retail investors. Excerpt-

ETMarkets.com: How significant is GST reform for the economy? It looks like the market has already factored in most of the upside from the reforms? What is your take on the whole equation?

Nimesh Shah: Over the years, the goods and services tax (GST) has become a symbol of reforms in the country for both Indian as well as foreign institutional investors (FIIs). With the passage of the GST bill, sentiments have surely improved, but it is imperative to understand that the GST is unlikely to change things overnight.

As a country, we will be reaping the benefits of this reform over the next five to seven years, and not in next five months. Now the size of the organised sector in several industries is bound to go up, thanks to the improved compliance of taxation because of the nature of GST and its benefits for the economy.

At current valuation, the market seems to have fully factored in the positives of the bill. One must take cognisance of the fact that a rerating of the Indian market is likely to happen over the long run. However, if there is an immediate re-rating, solely based on the expected positives, the market is likely to see some correction.

ETMarkets.com: The domestic market is already trading at valuations that are above historic highs. Is there potential for more upside or should investors brace for a sharp fall? Some experts even call this a new normal. What is your take?

Nimesh Shah: It is premature to say high valuation is the new normal for the Indian equity market. There is a plethora of factors in the form of good monsoon, repressed oil price, bottoming of earnings de-growth, which are currently supporting market valuations.

Adding to this is the unique growth challenges of the developed markets, which make emerging markets, especially India, look attractive. However, a sharp upside from current level looks challenging at this point of time.

At the same time, one cannot completely turn a blind eye to the possibility of volatile times arising due to negative global news flow.

Historically, it has been observed that negatives on the global front have managed to trump the positives on the local front. But prudent action in times of volatility would be to use that as an opportunity.

ETMarkets.com: Has the retail investor matured in the way he invests in equities now?

Nimesh Shah: There has been a remarkable improvement over the past few years in the way retail investors invest in equities. Over the past couple of years, retail investors have preferred to approach stock market via the mutual fund route, rather than investing directly in stocks.

We see this as an acknowledgement of mutual fund industry’s robust track record, well designed and very well regulated product line and transparency.

Within the mutual fund route, the heartening feature is that increasingly funds are coming through the SIP route. As an industry, we have witnessed the SIP book swell from Rs 1,800 crore in March 2015 to nearly Rs 3,000 crore per month and growing. Other than this, the other major positive is the change in investment behaviour.

There was a time when investors used to enter at market highs and would sell in case of a correction, leading to negative investor experience. However, this has changed now, thanks to the relentless investor education initiatives by the media, distributors and fund houses. Now, the mantra is to stay invested and not be swayed by market swings.

ETMarkets.com: Can a retail investor become a crorepati by just following the SIP approach? If yes, on an average how much he needs to set aside every month to achieve that goal?

Nimesh Shah: Yes, if a retail investor invests in a diversified equity fund through a systematic investment plan over the long term, she/he can become a crorepati. For example, Rs 20,000 invested through a monthly SIP for about 15 years can grow to over Rs 1 crore, if you assume a rate of return of 12 per cent.

ETMarkets.com: Is the big bull run intact in in the domestic market? The Indian market is already up 20 per cent from its 52-week low. Do you think the current bull run is driven by liquidity rather than fundamentals? If yes, are we staring at a big slide as soon as the liquidity tap dries up?

Nimesh Shah: The current rally is fuelled by both domestic as well as global factors. One has to take into account that the current rally in emerging markets is happening after 3-4 years of underperformance vis-a-vis developed markets.

At a time when almost all the developed nations of the world are facing a zero or sub-zero interest rates coupled with muted growth, India is emerging as an oasis of growth.

Going forward, gradual improvement in demand and strong operating leverage will drive earnings in the upcoming quarters, rendering the much-required earnings support.

All these factors are likely to support the equity markets, even at a time when liquidity starts to taper down.

ETMarkets.com: What is your call on the bond market? Should investors go for debt funds?

Nimesh Shah: The Indian bond market has been an attractive bet for global investors thus far. The four factors that have worked in favour of India are a) a well-managed current account deficit (CAD), b) benign global commodity prices, c) favourable credit growth trajectory and d) non-inflationary Government policies.

Thanks to the prevailing interest rate scenario in global markets, the Reserve Bank of India (RBI) is likely to maintain an accommodative policy stance given the uncertainties on account of international factors.

We are of the view that yields will head lower in the days ahead. Therefore, we would recommend short to medium duration or accrual funds for incremental allocation.

ETMarkets.com: Fitch said the global bond market is at risk of losing $3.8 trillion. How are we placed in the global equation?

Nimesh Shah: India is far better placed in the context of international fixed income markets. In the developed markets, interest rates are at a historic low while in the case of India, interest rates are still elevated. The focus of monetary policy now is more towards managing inflation and globally it is on renewing growth.

Over the last three years, GOI and the RBI have managed to get current account deficit and domestic inflation under control, along with moderate growth and political stability. As long as this equation is not juggled with, India is well placed in the global equation.

ETMarkets.com: Can you name five stocks that you think could fetch multibagger return over the next 2-3 years. And why?

Nimesh Shah: In the current market, construction, auto ancillaries, pharma and healthcare services are the pockets that are in a position to generate attractive returns in the medium term.

ETMarkets.com: ICICI Prudential AMC has become the largest asset management company in the country. What are your five key takeaways from your journey so far?

Nimesh Shah: Our journey to the top (as the largest asset management company) has been accompanied by much learning. Primarily, as an industry, we realise when a product is transparent and is beneficial to the investor, the industry is bound to multiply several folds, with time.

Our experience shows that a fund house with a proven track record of managing investor money is bound to attract more investments.

As for investment experience, it is a noted phenomenon that investors shy away from investing in equities when valuations are cheap. Therefore, we have products like balanced, dynamic asset allocation funds that aim to benefit out of volatility and provide a better investment experience.

Lastly, one of the inherent challenges has always been simplifying the process of investing. As of now, the inflows into mutual fund schemes are limited through banking channels, thereby missing on the cash payment channel.

Once Sebi’s uniform KYC regulation is implemented, these processes are likely to be simpler, thereby aiding larger participation across financial class.

Source: http://goo.gl/04HWjP

POW :: How to fit Sovereign Gold Bonds in your financial plan

By Sunil Dhawan | ECONOMICTIMES.COM | Jul 20, 2016, 02.53 PM IST

Gold in its physical form — jewellery or ornaments — has always been popular among Indians, especially women. Unlike in the past when gold was only considered a hedge against inflation and held entirely in physical form, today it finds its place even in an investor’s portfolio and largely as paper gold. Earlier as gold exchange traded funds (Gold ETFs) and now as Sovereign Gold Bonds (SGBs), paper gold offers many advantages to Indian investors now.

The Series I of SGB 2016-17 is currently open for subscription from July 18 to 22. The fourth tranche of SGB, its price has been fixed at Rs 3,119 per gram.

However, before you buy SGBs, you need to be clear about why you need to invest in gold. Is it to meet a financial goal or for pure investment purposes? If it is for the former, then most financial planners will suggest not having more than 10 per cent of the total portfolio in gold. Aniruddha Bose, Director & Business Head, FinEdge Advisory, says, “In our view, investors shouldn’t overexpose themselves to SGBs. They may form 5-10 per cent of the overall asset allocation of an investor.”

Window of opportunity

The bonds will not be available all year round. The government will keep coming out with primary issue of different tranches of SGBs for open purchase. This could typically happen every 2-3 months and the window will remain open for about a week. For investors looking to purchase SGBs between two such primary issues, the only way out is to buy earlier issues (at market value) which are listed in the secondary market.

Tax advantage

The biggest advantage of SGBs is clearly on the tax front. The 2016-17 Budget had proposed that the redemption of the bonds by an individual be exempt from the capital gains tax. Therefore, holding till maturity has its tax advantage. Redeeming in stock exchange may, however, result in capital gains or loss and one may have to pay tax accordingly. Interest on the bonds is, however, fully taxable as per the tax rate of an investor. For someone in the 10, 20, or 30 per cent tax bracket, the post-tax return comes to 2.47, 2.18 and 1.9 per cent respectively.

Cost

The initial cost of owning physical gold in the form of bars, coins is around 10 per cent and even higher for jewellery. SGBs and Gold ETFs are cost-effective as there is no entry cost in either. In the latter, the expense ratio could be around 1 per cent. Still, owning gold in paper form is cost-effective than owning physical gold.

Suitability

The returns from gold can be highly volatile, especially over the short term. Therefore, link a long term goal to your gold investments. Goals that are at least 7-8 years away are ideal as SGBs mature after 8 years. The investor could be given an option to roll over his holdings for an additional period. However, one may withdraw prematurely five years from the issue date on interest payment dates. Although one can exit in the secondary market anytime, the liquidity and price risk may exist. There may not be enough buyers for the quantity offered by you and even the market price may be low. These are the concerns when one wants to exit from an investment in a hurry. Goals such a children’s education, marriage, or your own retirement, which are eight years away or more, may be linked to investment in SGBs.

Approach

Identify a long term goal and estimate its inflated cost. Calculate the amount you need to save towards it. Similarly, find out the investment required towards other long term goals. Earmark not more than 10 per cent of the total monthly investments towards all your long term goals into SGBs. Bose says, “From a financial planning standpoint, it makes sense to take a larger exposure to more aggressive assets such as equities (as opposed to gold) for the fulfilment of long term goals.”

Treat investment in every tranche (primary issue by government) of SGBs as SIP. Alternatively, Bose suggests, “SGBs are actively traded on the exchanges, so one could always buy more of them at a later stage, from a portfolio balance standpoint.” But remember, not to invest in them when the linked-goal remains 2-3 years away. Let the existing investments in SGBs continue and make sure to redeem them at least a year before the goal to ensure the volatility in gold portfolio is minimal.

Returns

Returns in SGBs are market-linked and will depend on gold prices prevalent on maturity after eight years. “Buy SGBs keeping your overall asset allocation in mind, rather than just buying them blindly. Also, understand the risks – gold prices have already gone up sharply in the past year,” says Bose.

Rather than owning gold in physical form and not earning anything on it, SGBs mean owning gold and also earning interest on it. The government has fixed interest of 2.75 per cent per annum on the investment, with no compounding of interest. The interest shall be paid in half-yearly rests and the last one shall be payable on maturity along with the principal.

It will also be important to re-invest the half-yearly interest as the amount could be low and used up unnecessary. To put the interest amount in perspective, on an investment of Rs 1 lakh, Rs 2,750 received yearly yields Rs 22,000 after 8 years.

Conclusion

Gold ETFs provide much better liquidity than SGBs. Owning units is much easier than SGBs as it’s entirely online in the case of ETFs. The risk of owning and holding doesn’t exist in both. The only disadvantage of ETFs is that it won’t help you earn the additional interest of around 2 per cent per annum. So depending on how comfortable you are managing your investments online, choose either ETFs or SGBs.

Source : http://goo.gl/xBb4pN

ATM :: How Sunny Leone manages her money

Vivina Vishwanathan | First Published: Mon, Jul 11 2016. 04 03 AM IST | Live MInt

Actor Sunny Leone’s current business interests include perfumes and online gaming. Personal investments, too, are made with a long-term intent

Sunny Leone is not an ordinary Bollywood star. The 35-year-old has been the most searched person on the Internet in India for four years in a row. The adult movie star-turned-actress was always fascinated with business and was a control freak when it came to finances. But that was before she met husband, Daniel Weber.

“I was 8 or 10 years old when I used to go to the street with my brother and a neighbour in Canada, and shovel snow in the driveways and earn a dollar a piece. But the snow was two-feet high and we thought we should charge more because it was double the work,” says Leone, who was born in Canada and lived there as a child. In fact, as a child, she routinely put up lemonade stands during summers and shovelled snow in the winters to earn money. “I was the girl who sold things for my basketball team and soccer team. That was before I even went to high school.”

Her interest in business continued in high school. “When I went to high school in California, I joined a club called Future Business Leaders of America. That is when I started learning a lot of things about marketing, and supply and demand. I took different classes around business and economics. We would go to young entrepreneurial conferences in that area and that’s kind of where everything started.”

Even at a young age, Leone wanted to start her own venture. “When I became an adult, I realised that (adult content) was a business. But more than that, I wanted to own a website and run my own company.” She used to handle everything. “If I have to be in this industry, I want to make all the money—every dollar. After all, it is my body, my image and my brand.”

So, she learnt to manage her website, learning HTML, video editing, photography, and how to build thumb gallery posts (TGP). “I would do everything from start to finish. That was when I learnt about website traffic. In a digital world, traffic is the best thing you can have. I learnt where to send this traffic and how to capitalise all of it.”

Leone says a business should be grown slowly and steadily. “Believe me, it takes at least a year to three years for a business to turn profitable. I don’t believe in any business that is fast paced. If it is moving very fast, it doesn’t seem right to me. I like the idea of growing slowly and steadily and making the roots of the company strong.”

Move to India

Moving to India was a calculated risk for Leone. When she got an offer to participate in the prime time reality show Bigg Boss in India, Leone initially declined. “I thought it was absolutely insane because I’d got so many hate mails from the Indian community. Because I had got so much hatred, I said I don’t want to go through it again.” But then her husband, Weber, went to her with a PowerPoint presentation and armed with statistics. “We had the viewership and the reach details. We started doing further research. I think at that time Bigg Boss was watched by 25 million people in 10 different countries or something. It was huge. By the time I finished researching, we both came to the conclusion that if we didn’t take this chance, it might be one of the biggest regrets we would ever have.”

She was taking a chance, and she was scared. “There was a lot of negativity and backlash for Viacom, Bigg Boss, and Colors for bringing me here because it was the first time someone from that (adult content) industry was coming to mainstream television. Meanwhile, I thought if I work for a couple of weeks, make money and then come home, I could put a down payment on a house and go back to living in my bubble. I didn’t think anything was going to come from it.”

But when she started working in Bigg Boss, she realised she was breaking into a market that she has been trying to enter for years. “Our research showed that majority of the traffic that came to my website or different social media sites was from India. We were not capitalising the traffic. Nobody made it to the ‘join’ page or purchased anything. Bigg Boss was my chance to break into a market that I had never been able to tap into.” She says people knew her and were at her website but were not spending. “There is definitely a disconnect that happens when you are someone from abroad. Living here is being a part of the Indian culture and there is a connect that happens. Hence, moving to India was very calculated.”

Taking plans further

After Bigg Boss, Leone bagged some Bollywood movies and debuted with Jism-2. She has also done a song for Shah Rukh Khan-starrer Raees, which is expected to hit the screens next year.

While Leone may be getting more and more films now, she knows that her role in the entertainment industry will not last forever. “It can end like tomorrow,” she says. Therefore, she is always thinking of branching out. “Once we got a handle of how it works in India, after signing a bunch of movies and doing different brand endorsements, we have tried to think of ways to branch out.” She considers movies as only a small piece of the puzzle. Among her other ventures are TV shows. Apart from movies, she does a show every year. At present, she co-hosts MTV Splitsvilla.

As part of the expansion plan, she has launched a perfume line—The Lust. “It is manufactured by me. Taking the Kardashian model, and some of the other artists out there in the US, the goal is to keep growing. When the movies or something else ends, I know that we have created something here above, beyond, and bigger than us.”

After perfumes, Leone plans to venture into women’s cosmetics. “I plan to create products for women such as nail polish, skin care, lipsticks…. I’m not sure about clothing right now but it is something we keep talking about,” says Leone. “We have invested a lot of time and money in it. I personally would like to invest more money in merchandising and branding because it is something that can continue forever.”

Recently, Leone wrote a collection of short-stories for the mobile-first digital publishing house Juggernaut. Titled Sweet Dreams, the stories, as defined by Juggernaut, are “fictional stories of power… emotions… desires”. “It was a little bit more difficult than I anticipated. It takes a lot of work to be a good writer.” She is also into online gaming with Teen Patti with Sunny Leone.

The next step, says Leone, may be producing movies in India. “But I am in no rush because there is a shift happening in the entertainment industry and if you don’t have great content and dialogues, usually it doesn’t work.”

Leone has stopped working in the adult content industry. Her focus now is on building her brand. “I stopped working in that industry long time ago. But we have a lot of traffic and we don’t know what to do with it. Now we have a reach of around 100 million people. Hence, let’s say, there is a company that wants me to tweet about something or put it on Facebook, I use this traffic to monetise now.” The same strategy works when she wants to raise money for charity. “We also found that the traffic is now monetised because those people are donating or spreading the word. We are able to do so many things now, which we were just not able to do earlier.”

Leone has over 1.5 million followers on Twitter; a reach she uses for promotions and branding. “Every day, we use social media to get across something that we want to say. A brand will call and say we want you to tweet about our brand once, which we do.” But she says she doesn’t like spamming. “For instance, we do movie promotions. There have been some directors who come and say ‘I want you to keep tweeting every 20 minutes the same thing over and over’. I say it is not going to happen because you are not going to get traction with this. It is not going to work. You are not even letting it get absorbed before having me tweet again. We don’t want to block them (the followers) or get them to unfollow.”

Savvy investments

Like her business ventures, in investments, too, Leone has only what she understands. Her investment portfolio has a mix of stocks, mutual funds, real estate, and retirement funds. “In the US, we have invested some of our money in very stable stocks and some mutual funds. We also have some IRAs (Individual Retirement Accounts).” An IRA offers various tax breaks. It’s a basket in which you keep stocks, bonds, mutual funds, and other assets. “We have bought our home there. We have invested a lot of our money in real estate. We do love the idea of getting into real estate a bit more. We are also interested in investment homes. And we obviously save a lot of money.”

When it comes to stocks too, she remains updated. “When this whole Brexit happened, we lost some money, which was not fun. But I do believe that it will steadily go back up and back to normal. This is just a shock to everybody. I didn’t think that this would affect us, but it did.”

The Indian stock market, however, is not part of her portfolio yet. “It is difficult for Overseas Citizens of India and people from outside of India to invest in India. You have to follow the whole process, which is crazy.”

The Indian real estate market, too, is not in her view. “It is really difficult to invest in Indian realty. When there are so many people involved, money just goes away. And then trying to sell the house and transfer the money into our bank account out of India is another huge issue. I think buying stocks and mutual funds is probably little easier with the right people in India, than buying real estate.”

She is not interested in start-ups due to the way their valuations work. “I have been hearing a lot of information about start-ups and how they are getting evaluated. Personally, I think it is a very interesting business model that I don’t think is going to last very long. My husband might think completely opposite. I think it is great if it is a start-up that stays true to what it is, instead of getting evaluated and getting into selling some big dream to somebody else.”

Leone doesn’t look at gold as an investment choice. “I know that there are a lot of families in India that buy gold. I like wearing them—gold, diamond, jewels—rather than looking at them as an investment option.”

Daniel: the financial guru

Before Leone was married, she took care of all her finances. “As far as finances were concerned, I used to put a lot of my money back into my company. But at some point I did have to branch out. You can’t micro manage everything. Before I met Daniel (her husband), I was in control of everything.” Initially she had doubts about doing business with her husband. “When we started doing business together, it was really difficult mentally to bring someone into my inner financial and business circle. But he has a great business mind as well. So when we started discussing all these different things, it was very natural for us to come together and form a company together.” Now she thinks it is the best thing that has ever happened to her. “His business background and mine are totally different. And he just completely streamlined everything and helped me organise things because I was growing faster than I could manage. You need help at that point. You can’t think of doing everything. You will stop growing, since you don’t have the time in a day to do everything.” She says her husband manages everything, ensuring that she and her staff work every day and their money is allocated in the right places in multiple countries. However, financial decisions are always taken after weighing the pros and cons.

Being financially independent

Leone always wanted to be independent. “I wanted to be on my own ever since I was really little. Also my parents would tell me over and over again that you have to be independent. That stuck with me.” Besides financial independence, her parents always tried to tell her to save money. “I grew up in a lower middle-class family, so we didn’t have a lot of money. As I got older, I realised I should save money. She doesn’t have any money regrets. “I am pretty calculated. If I am not 100% convinced that this is going to be financially viable, I won’t take the risk. If I know that it is a risk and if it doesn’t work, I am okay with what is lost too. I think I am realistic when it comes to investments.”

Source : http://goo.gl/u5y8sE

ATM :: When should you break some financial rules? Find out

By Chandralekha Mukerji | ET Bureau|Jul 04, 2016, 09.25 AM IST | Economic Times

BENGALURU: A rulebook guides the inexperienced to make rational decisions. This is true for money management too. Money rules help you keep your finances on track. But rule of thumb that do not fit your situation can be a waste of time, or worse, actually worsen your finances. They may be oversimplifying a complex issue which can harm long-term prospects and be a poor substitute for analysis. Here are five personal finance rules that based on your circumstances, you can consider breaking.

Rule 1: Young should have equity-heavy portfolio

Risk appetite is independent of age. A young person usually has higher risk tolerance and a longer investment horizon and therefore advised to keep a heavier chunk of portfolio in equities. However, historical data shows that equity investment requires a commitment of four to five years for good returns. Even if you are 20-something, equities are not for you if you have a lot of debt and many dependents or are saving for short-term (read: 2-3 years) goals.

If there is an ailing family member and a medical emergency can arise unannounced, you should have your savings in debt as chances of capital corrosion are less while the penalty for early exit is not high. On the other hand, you may be 60 and retired, but have enough liquidity to manage your short-term expenses. Then, you must consider allocating a portion towards equities. “The first step to asset allocation is therefore knowing your risk appetite through a risk profiling exercise, step two is understanding the constraints in life and decide your equity-debt investment ratio,” says Vivek Rege, CEO, VR Wealth Advisors.

Rule 2: The key to financial success is cutting expenses

The key to financial success is not in cutting your expenses. It is in creating a surplus that can be invested, which can be done by reducing your costs or increasing your income.

While budgeting is a must, however, some costs can’t be snipped beyond a point. Your financial planner may then advise you to either reduce your goals or push back the target dates or re-prioritise your financial needs. However, what if the financial need can’t be compromised. Take the case of 35-year-old Pravin Kumar, who works for an IT company.

“Although his earnings were enough to meet his present needs, he wanted an overseas education for his 10-year-old daughter, which was not possible considering he had already taken a huge home loan,” says Mimi Partha Sarathy, MD, Sinhasi Consultants and Kumar’s financial planner. One of the constraints for Kumar to earn more was his qualification, so he decided to take up an executive MBA in marketing from a top B-school. “With this new addition to his resume, he negotiated not only a promotion but a 40% increase in his salary with an increased role,” Partha Sarathy. It was then easy to allocate the necessary funds for the child’s future needs.

Rule 3: Debt is bad. Try to avoid debt at all cost

Debt is not always bad but you shouldn’t borrow beyond your repayment limits. Loans can help you lead a lifestyle that you desire by drawing from current and future income. “While in the previous generation, our parents had to wait till they saved up enough to buy a house, we are able to do that easily today through a home loan. Loans give us a lot of flexibility to enjoy a lifestyle today rather than in the future,” says Priya Sunder, director, PeakAlpha Investment Services. However, in case of financial distress, you lose all flexibility since EMIs will have to be paid, with very adverse consequences in case of default.

“Hence it is prudent to create a Plan B in case of a loan default such as hrough insurance covers or collaterals,” adds Sunder. Having an open credit card limit with sufficient insurances is a great emergency planning. “It is a much better idea than building huge emergency corpus,”adds Bhuvana Shreeram, a Mumbai-based Certified Financial Planner. If you are a good borrower, even credit cards are not bad. “Apart from using credit wisely, you can use debt to create appreciating assets like a home not only to gain through appreciation but also tax savings,” says Manish Shah, CEO, Bigdecisions.com.

Rule 4: Realty is the best asset

Too much of anything is bad, especially an unpredictable and illiquid asset like real estate. However, most Indians have a portfolio terribly skewed towards real estate. “They overestimate the returns real estate gives. If they did the math, they would know better,” says says Shreeram. “Even when real estate had a good bull run in the last 10-12 years (2002 to 2014), most investors have made about 9% to 10% after accounting for interest repayment on loans, tax benefit, cost of maintenance etc., which may be better than bank deposit but not worth taking 20-year loans at 10%,”adds Shreeram. Also, the bull run does not last long. So, the investment is not as safe or liquid as bank deposits. The time during 2011 to mid-2014 was a very challenging time for those who had invested in the stock markets. “Many HNIs moved to real estate during this time and at high levels which is now close to impossible to liquidate,” says Partha Sarathy. Sunder of PeakAlpha Investments doesn’t recommend holding more than 60% of portfolio in real estate.

Rule 5: Re-evaluate your portfolio regularly

Yes, there is a need to regularly rebalance and evaluate your portfolio. However, too much tinkering is not good either. “There are people who have long-term goals but have a habit of tracking their investments on a daily basis and get carried away by the emotions of the market,” says Anil Rego,CEO, Right Horizons. Tinkering is either motivated by the need to earn more (greed) or by the need to save whatever is there (fear). “Jumping in and out of investments is the single-most wealth destroyer, followed by waiting in the sidelines and losing precious time,” says the expert. Every investment has a time horizon for it to achieve its expected returns and this must be respected and adhered to.

Source: http://goo.gl/YtV8bL

ATM :: Got a windfall? Don’t put it in a savings a/c

RAJESHWARI ADAPPA | Tue, 28 Jun 2016-06:55am | dna

Experts advise that you should park the lump sum in avenues such as liquid or ultra-short term funds till you decide where to invest it as putting the money in a savings account not only earns low interest but also tempts you to blow it

Windfalls or coming into large sums of money sure makes you feel rich but if you want to stay rich, then the challenge is to ensure that the money lasts for a really long time.

Incidentally, experts advise that when one does not know what to do with a large sum, the first thing to do is take it off the bank savings account.

“The money lying there not only earns low interest but tempts you to blow it. Hence, park it in short-term avenues such as liquid funds or ultra-short term funds until you decide or get advice on where to invest the money in,” says Vidya Bala, head of mutual fund research, FundsIndia.

If you have a lump sum to invest, it is best to revisit your investment plan, advises certified financial planner Gaurav Mashruwala.

“Firstly, buy adequate health and life insurance. Secondly, if you have any loans, pay up the loans. After that, you can start goal-based investing,” says Mashruwala.

Most people are confused where to invest for the best returns. “Where to invest would depend on whether they have a near-term use for the money,” says Bala.

“If it is retirement money and the investor needs to create an income stream, they could deploy it in a combination of ultra-short and short-term debt funds and do a systematic withdrawal plan to generate their own income. If it is for the long term, a combination of equity and debt funds will work well. So one needs to know the purpose and the time frame before they can decide where to invest,” says Bala.

The most important task is to create a goal for such money and then allocate and invest accordingly. While goals would depend on the individual’s requirements, broadly your goals could include creating funds for a specific purpose such as a retirement fund, an emergency fund, a kids education or a marriage fund or even a fund for personal goals (say a foreign trip), etc.

A retirement fund is a must. HDFC Pension’s CEO Sumit Shukla advises that 20-30% of the sum should be invested for retirement. He suggests investing the lump sum initially in Tier II account of NPS from which some money could be transferred into the Tier I account every month via systematic withdrawal plan. “This would help to ensure that initially the money is invested in debt (Tier II account) and as one invests in the Tier I account, slowly the equity portfolio is also built up,” says Shukla.

“Corporate debt has earned 10.47% while government debt has earned 10.35%. Compared to the 8.8% returns from PF, this difference would work out to be huge over a period of time,” points out Shukla.

Depending on your risk and return profiles, there is a range of avenues. “Investors seeking low to medium risk can examine fixed deposits, debt mutual funds, corporate bonds, tax-free bonds and monthly income plans.

However, investors with higher risk preference can look at balanced & equity funds, direct equities, private equity & real estate funds,” according to a DBS spokesperson.

“Lump Sum investing is fine when it comes to low-risk debt funds. However, when it comes to equity funds, it is important to understand the risk of timing the market by investing in one go. Ability to take near-term falls is a must of one chooses to invest lump sum,” says Bala. A better option is to invest in a phased manner through an SIP (systematic investment plan).

It may be a good idea to take professional advice. “Also, consider the impact of tax on the returns,” says the DBS spokesperson.

The mistake that many people who come into big money suddenly make is that they start living a lavish lifestyle. “Instead, invest in income generating and growth-oriented assets. Use the returns from these assets to enhance your lifestyle,” advises Mashruwala.

The solution is to invest wisely keeping in mind two primary goals: ensuring safety of capital and also growth.

Source : http://goo.gl/4KucZz

ATM :: Should young earners take their parents’ advice while investing?

By Jayant Pai | Jun 20, 2016, 07.00 AM IST | Economic Times

Every parent fondly looks forward to the day when children will begin earning a steady income. However, for Indian parents, it is difficult to sever the metaphorical umbilical cord even after their child secures financial independence.

There are various reasons parents do not shy away from advising their children on money matters. One, they feel that their naive children will be parted from their money if left to their own devices. Hence, right from the first payday, they will tell you about the virtues of saving and warn against reckless spending. Two, they do not want their children to make the same mistakes they made, be it a failed investment or a loan to a friend which was never returned. Three, errors of commission committed by close family members also play a part in conditioning parents’ thought process.

Why such advice may be less effective today: The previous generation was brought up on the belief that the collective wisdom of elders was indispensable. Today’s generation is a bundle of contradictions. On the one hand, they are avowedly individualistic. On the other, they are swear by the opinions of peers in social media on every topic, be it fashion, electronics or money. Hence, parental influence is waning.

While every generation thinks it knows best when it comes to finance and investments, today’s youngsters have more educational and decision-making tools at their disposal. These may be in the form of blogs, apps, portals and even robo-advisers/algorithms. In fact, they face a glut, rather than a drought, of information. Hence, parents may often be behind the curve.

Today, wealth managers are increasingly viewing such youngsters as an economically viable segment. Hand-holding newbies, with the hope of growing with them as they uptrade, is a strategic choice.

Should children listen to their parents? In most cases, the advice received from parents is well-meaning. That may not necessarily be true in case of advice from outsiders. However, good intentions alone are not sufficient to render it suitable. While certain home truths like avoiding borrowing for consumption or maintaining a high savings rate are worth heeding, others are better ignored.

For instance, many parents dissuade their children from investing in stocks and suggest they opt for fixed deposits or gold. This may stem either from their own poor experience in the stock market or a belief that stocks are risky and another form of gambling. However, by blindly heeding such advice, youngsters may do themselves a great disservice since they forego the power of compounding that equities offer.

Similarly, parents may consider real estate as a great investment option even if they have to avail of a heavy mortgage. Children should follow such advice only after considering the repercussions of paying EMIs for long tenures of 25-30 years. Also, some parents are averse to their children purchasing insurance policies, fearing that this is an invitation to disaster. Such superstitions should not stand in the way of protecting life, limb and health. In a nutshell, when it comes to parental advice, trust them, but verify the advice.

(By Jayant Pai, CFP & Head, Marketing at PPFAS Mutual Fund)

Source : http://goo.gl/iECSwU

ATM :: Young earner? Five financial mistakes you may regret later

By Sanjiv Singhal | Jun 20, 2016, 07.00 AM IST | Economic Times

Interact with a lot of young earners on a daily basis. These are men and women in the first 5-6 years of their working lives, with dreams and hopes that require money to achieve. Some of them are already saving, while others are not, but all are full of questions and want to know how to do it better. It doesn’t matter what job they have and how much they earn; there are mistakes that run through all their stories. Here are some of the most common ones:

“I bought a life insurance policy to save tax.”

The good thing about this confession is that the person understands he made a mistake. For most, it starts at the end of the year when they needed to submit their investment proof to the HR. They scramble around to figure out how and blindly buy an insurance policy (after all, insurance is a good thing to have, no?). Almost every other tax-saving option is better than life insurance. Tax-saving (ELSS) funds are the best option for young earners.

“I wasn’t sure where to invest, so I didn’t.”

When you don’t set aside money regularly, it sits in your bank account and often gets spent. This hurts in two ways. One, it doesn’t create wealth for you, which investing early does. Second, it forms unsustainable spending habits. Start by setting aside 5-10% of your salary every month in a debt fund or in a recurring deposit if you don’t know enough about mutual funds.

“I bought stocks to double my money because my friend did.”

This is a mistake often made due to lack of understanding about how stock investment works and a false sense of knowledge. Greed and stories of exceptional returns also spur one on. The best way to resist this is to check with friends and colleagues about how many actually earned such fantastic returns and how many lost money. Stock investing requires deep knowledge and time. As a young professional, you are better off committing this time to your job.

“I change jobs every year to increase my salary.”

This is not an investing mistake, but one of not investing in yourself. Sticking with a job gives you the opportunity to develop your skills in a specific area. It also gives you the time to learn softer skills – of working with people and managing them. This leads to better career prospects and more wealth.

“I forgot about my education loan.”

A lot of young earners are starting their financial lives with an education loan taken for an MBA or MTech. As they mostly work away from home, they may not get the communication from the bank, or choose to ignore it. The interest mounts up and they are left with a bigger repayment amount. Focus on education loan repayment in a disciplined manner. When you are done with the with the repayment, direct this amount to long-term investments. Avoiding these common mistakes is easy once you know about them. Spending time learning about the principles of money and investing is a good investment to begin with.

(The author is Founder & Head, Product Strategy at Scripbox)

Source: http://goo.gl/O7HPqf

ATM :: How can one invest in global equities

SHREYASH DEVALKAR | Tue, 14 Jun 2016-06:40am | dna

Today investors are spoiled for choice when it comes to avenues available for allocating fund and investing money. They can choose from fixed income products, domestic equities, global equities, derivative products, currencies and much more. With the freedom of options comes the responsibility of choice. Hence, it becomes important that we as informed investors study the advantage and risks associated with such asset classes and invest our money judiciously.

Great strides in technology have seriously shrunk the world, making every corner of the earth accessible to humans. Our daily lives are surrounded by evidence of the global economy. The phones we use are manufactured in Korea, our televisions are made in Japan, our cars are from different pockets of the world and our favourite Lebanese food is just a phone call away. In such an environment it is important to consider investment options beyond the domestic boundaries. Global equities are slowly emerging as a good investment option for domestic investors. The benefits of investing in global equities are myriad.

A fundamental reason to consider international investing and in particular global equities is diversification. Investment in global equities helps in spreading out the risk associated with equity investing as it entails investing in different markets which may not be highly correlated with each other. What this means for the average investor is that since all markets do not move in tandem, losses in one equity market can be offset by gains in another.

By diversifying into global equities the investor may be able to earn the same kind of returns as with a non-diversified portfolio, but with lesser risk, or be able to achieve higher returns, but with the same amount of risk.

International investments have shown an ability to improve risk-adjusted returns. The historical volatility of returns (as measured by standard deviation) for the global portfolio was almost 10% lower.

The MSCI World Index, which captures large and mid-cap companies’ across developed markets and covers approximately 85% of the free-float adjusted market capitalization in each country, the five year and ten year annualised Sharpe ratio is at 0.53 and 0.28, respectively. The corresponding numbers for the MSCI Emerging market index is at -0.15 and 0.18, respectively. In addition to diversification, global equities have the advantage of offering an investor exposure to faster growing economies and provide access to some of the world’s most successful companies.

Some of the world’s top performing markets in CY2015 were Argentina, Hungary, Denmark, Iceland and China while on the other hand the worst performing ones were Colombia, Peru and Bermuda. India’s returns figured in the bottom 50% of the returns computed for 74 of the top stock markets in the world. Quantitative easing might have pushed the European and US markets to multi year highs. However, flow of funds is likely to be directed towards countries which are showing better prospects of growth and fiscal discipline. Excluding India, markets like Taiwan, Vietnam and South Korea are expected to give good risk adjusted returns. Some funds can also be allocated to European equities.

Since the level of expertise and knowledge required in investing in global equities is quite high, the best option for an individual investor is to seek guidance from experts or fund managers of professionally managed funds.

Mutual funds offer various schemes where a portion or the entire fund may be exposed to global equities. In this case, professional fund managers study global markets and allocate the fund’s corpus to the countries where they expect good growth and returns.

The writer is fund manager with BNP Paribas

Source : http://goo.gl/7oMOxr

ATM :: How to save Rs 10 crore

Babar Zaidi | TNN | Jun 13, 2016, 06.53 AM IST | Times of India

NEW DELHI: The first time Arjun Amlani used an online calculator to assess his retirement needs, he was shocked. The Mumbai-based finance professional, whose gross income was around Rs 10 lakh a year then, needed more than Rs 8 crore to fund his retirement needs. “The eight-digit number was too scary,” he says.

Figures thrown up by excel sheets and online retirement calculators can be intimidating. Here’s an example: if your current monthly expenses are Rs 60,000, even a conservative inflation rate of 7% will push up that requirement to over Rs 4.6 lakh in 30 years. To sustain those expenses for 20 years in retirement, you need a corpus of Rs 9 crore. To some investors, such enormous figures seem so unattainable that they just stop bothering about retirement. That’s a mistake.Retirement cannot be wished away. The paycheques will stop coming, and your living expenses won’t end but keep rising due to inflation. Worse, critical expenses like healthcare will be growing faster than overall inflation. The sooner you start saving for that phase of life, the more comfortable retirement will be.

The big question is: how can one build a nine-figure nest egg when the monthly surplus is Rs 15,000-20,000? Mutual fund sellers claim that an SIP of Rs 15,000 can grow to Rs 10 crore in 30 years. But this calculation assumes compounded annual returns of 15% for the next 30 years.It’s not advisable to base your retirement plan on such over-optimistic assumptions. Life insurance agents will offer plans that will give you an assured sum on retirement. But the returns they will generate are too low and the amount required will be too high. An endowment policy that gives Rs 10 crore after 30 years will have an annual premium of roughly Rs 12 lakh — or Rs 1 lakh per month.

Increasing the investment

When Amlani used the calculator, his monthly income was around Rs 85,000 and he needed to invest almost 20% of this for his retirement. A year later, his income has gone up and so have expectations. The calculator now says he needs to save over Rs 10 crore in the next 27 years, but Amlani is not worried. If he continues putting money in his PF, PPF and equity funds as planned, it won’t be difficult for him to reach the target.

All Amlani has to do is increase the quantum of investment every year. If a 30-year-old with a monthly salary of Rs 50,000 starts saving 10% (Rs 5,000) for his retirement every month in an option that earns 9% per year, he will accumulate Rs 92 lakh by the time he is 60. But if he raises his investment by 10% every year (in line with assumed increase in income), he would have saved Rs 2.76 crore.

It’s surprising that not many investors follow this simple strategy even though their income rises every year.Sure, the annual increment in salary is nullified to some extent by the increase in cost of living. Yet, even when there is a marked increase in investible surplus, people don’t match investments with the increase in income. The silver lining is that contributions to the Provident Fund are linked to income and automatically increase after every annual increment.

The right investment mix

We looked at three types of investors: risk-averse individuals who stay away from equities, moderate investors who have some exposure to stocks and aggressive investors who are willing to take risks. Each starts with a monthly investment of Rs 15,000 spread across different retirement saving options, and increases the investment amount by 10% every year. Unfortunately for the risk-averse investor, his nest egg is considerably smaller than those of the moderate and aggressive investors.

This is because apart from PF and investments in small savings schemes, he has invested in low-yield life insurance policies and pension plans. Life insurance policies offer assured returns and a tax-free corpus. But the returns are very low–even a long-term plan of 25-30 years will not be able to generate more than 6-7%. Pension plans from life insurance companies are also high-cost instruments. While this shows that equity investments are critical for a long-term goal, the other two haven’t taken too much risk either.

The equity exposure of the moderate investor does not exceed 53% while the aggressive investor has a marginally higher allocation to stocks. The moderate investor comes close to the Rs 10-crore mark, while the aggressive investor manages to reach the nine digit figure.

Investing discipline needed

The big problem, however, is the lack of investing discipline. Though our calculations do not allocate too much to equity, we have assumed regular investments for 30 years. In reality, data from AMFI shows small investors withdraw 47% of investments in equity funds and 54% of investments in non-equity funds within two years. In fact, 27% of equity fund investments are withdrawn within a year. “Small investors just don’t have the patience or the long-term vision required to make money from equity investments,” says a senior fund manager. It’s futile to imagine a nest egg of Rs 10 crore if your investment term is only 1-2 years.

The trajectory of equity investments is never a straight line. It will have ups and down, which is an inherent feature of this asset class. However, in the long-term, these investments will prove more rewarding than fixed income options. Although equity funds have churned out much higher returns in the past 15 years, we have assumed a conservative 12% returns from equity investments.

Source : http://goo.gl/qYLTb0

ATM :: The best NPS funds to buy now

Babar Zaidi | May 16, 2016, 03.14 AM IST | Times of India

When Avinash Chandnani invested in the National Pension System (NPS) last year, he planned to put money in five different pension funds.However, when he was putting the second tranche of `10,000 in another fund, he realised that NPS investors can’t opt for two pension fund managers. He also couldn’t switch to another pension fund for a year.

Our story examines the performance of Tier I funds of the NPS and identifies the best pension funds. The performance of individual schemes does not give an accurate picture because investors put money in a combination of funds. So we looked at blended returns of four combinations of the equity, corporate debt and gilt funds.

Chandnani, for instance, is an aggressive investor, with 50% of his corpus in the equity fund, 30% in the corporate bond fund and 20% in the gilt fund. A balanced allocation would put 33.3% in each of the three funds. A conservative investor would put only 20% in stocks, 30% in corporate bonds and 50% in gilts. The ultra-safe investor would not invest in equities, put 40% in corporate bond fund and 60% in gilt.

The past 9-12 months have not been kind to aggressive investors. While bond prices have risen, the 50% allocated to equities has dragged down returns. But ultra-safe investors who stayed away from stocks or conservative investors who put only 20% in equity funds have earned good returns.

Playing safe has also helped NPS funds for government employees. These funds can invest up to 15% in equities but most have 8-10% allocated to stocks. They have given double-digit returns, thanks to interest rate cuts that have enhanced the value of long-term bonds.

Should you switch from EPF to NPS?

The healthy returns from the NPS come at a time when the interest rate of the EPF is being debated and the interest rate for PPF has been pruned to 8.1%. So, should you shift your retirement savings to the NPS?

A legislation to amend the Employees’ Provident Fund & Miscellaneous Provisions Act has been framed. The amendment allows EPF subscribers to make a switch to the NPS. Once he shifts to NPS, the employee will have a onetime chance to return to the EPF fold. The amendment also seeks to ensure that employers don’t force a scheme down the throats of employees.

However, the tax treatment of the NPS may prove a hurdle. While the EPF corpus is tax-free, this year’s Budget has proposed to make 40% of the NPS corpus tax-free. There is another problem. At least 40% of the NPS maturity corpus has to be put in an annuity to earn a monthly pension. Annuity rates in India are very low compared to what other options can offer. However, investors will face that issue much later. Right now, we identify the best performing funds for various types of investors.

ULTRA SAFE INVESTORS

Whether they invested through SIPs or a lump sum, risk-averse individuals have earned the highest returns. They stayed away from stocks and divided their NPS corpus between gilt funds and corporate debt funds. On average, gilt funds have given 9.75% annualised returns while corporate debt funds have churned out more than 11% in the past five years. Even in the short term, safe investors have been the biggest gainers.

Will the good times continue? The gilt funds of NPS are holding long-term bonds with an average maturity of over 19 years and a modified duration of about nine years. These funds have done well because interest rate cuts have pushed down bond yields. But experts say this trend will not stay forever. “Over a longer period, the portfolios will deliver returns similar to the yieldto-maturity of bonds in the portfolios,” says Manoj Nagpal of Outlook Asia Capital. The average yield-to-maturity of the bonds is 8%, which is higher than the PPF rate but lower than EPF. The average yield-to-maturity of corporate debt funds is higher at 8.25%, and their average tenure is also shorter at seven years. Ultra-safe investors should consider higher allocation to these funds.

CONSERVATIVE INVESTORS

Investors who allocated a small portion of their corpus to equity funds have also earned good returns. The best performing ICICI Prudential Pension Fund has given double-digit returns over 5 years.

Including 15-20% equity in your retirement portfolio is a sound strategy as an ultra-safe portfolio won’t be able to beat inflation in the very long-term. NPS funds for government employees also follow a conservative allocation, with a 15% cap on equity exposure.

These funds have also done fairly well. However, younger investors should not play too safe. They can afford to have a larger portion of their NPS corpus in equity funds. Also, it shouldn’t be assumed that bond funds won’t lose money. If interest rates rise, the NAVs of gilt funds holding long term bonds will slip.

BALANCED INVESTORS

Investors who spread their money across all three types of funds have not done too badly. Here again, the shortterm picture is rather bleak. But the medium- and long-term returns are reasonably attractive. ICICI Prudential Pension Fund is again the best performing fund for this allocation, with returns of 9.85% in the past five years.

The balanced approach, which puts 33.3% in each of the three classes of funds, suits most investors. It has the potential to give reasonably good returns in the long term without taking too much of a risk. The investor will need to change his allocation as retirement nears. There are several theories about how much the allocation to equities should be at different ages. Some planners say that it should be 100 minus your age. But the maximum equity allocation in the NPS is 50%. Besides, you might also have invested in other instruments for your retirement.

Investors who can’t take a decision should opt for the lifecycle fund of the NPS. Under this option, the investor’s age decides the equity exposure. The 50% allocation to the equity fund is reduced every year by 2% after the investor turns 35, till it comes down to 10%. The rebalancing happens every year. The PFRDA is considering more asset mix options for these lifecycle funds.

AGGRESSIVE INVESTORS

Equity funds of the NPS have not done too well. They have lost money in the past year and delivered lower returns than corporate debt and gilt funds in the past five years. This has dragged down the returns of aggressive investors who allocated 50% to equity funds. But this should not make investors ban this critical asset class from portfolios.

Till last year, equity funds were mirroring the returns of the index because pension funds were supposed to invest in proportion to their weight in the index. But from September 2015, fund managers have been allowed to invest in a larger universe of stocks and follow an active investment strategy that does not mirror the index.

Experts see this as a positive development because a predominantly largecap orientation would have prevented the NPS equity funds from beating the market. More importantly, poor quality index stocks can now be dropped.

source: http://goo.gl/fCPlMK

ATM :: Balanced funds, right way to invest

Prashant Mahesh, ET Bureau | May 12, 2016, 06.45AM IST | Economic Times

Timing the market or deciding how much to allocate to debt or equity at any point of time is a difficult decision for most investors to make. Investors not willing to invest in a basket of products, could choose balanced funds which automatically rebalances your portfolio .

1. What are balanced funds?

Balanced funds, as the name suggests, are hybrid funds which typically invest in equities and debt instruments. There could be equity oriented as well as debt oriented hybrid plans.

Typically, equity-oriented balanced funds have a 65%-75% exposure to equities with the balanced 25-35% being invested in debt-oriented instruments. Many financial planners suggest firsttime investors into mutual funds begin their journey by investing in balanced funds.

2. What is the advantage of investing in a balanced fund?

Balanced funds offer benefits of asset allocation model in a single structure. The equity component seeks to deliver long-term returns, while the debt component provides stability to the portfolio.