Tagged: SIP

ATM :: Essentials Young Investors Must Know Before Investing in Mutual Funds via SIP

By SiliconIndia | Tuesday, May 1, 2018

A Systematic Investment Plan (SIP) is the best investment option for many investors – especially if you’re a young person, just beginning your investment journey. A SIP is a low-risk move, ideal for those who are in it for the long haul because else, the returns tend to be low. A steady investment of even Rs.500 per month has the potential to generate decent returns in the long run without putting a major dent in your pocket. But like all other investment options, it’s never wise to put in your money unless you’re well informed. Here are some things you must keep in mind when investing in Mutual Funds via SIPs.

– What exactly is a SIP?

A SIP lets you invest small amounts regularly in equities, debts and other kinds of mutual funds. It involves you buying units of any (or many) Mutual Funds of your choosing by investing a minimum of Rs. 500 per month. It is then up to you to redeem your units at any point in time. A SIP is ideal for younger investors since it practically guarantees good returns with a lower risk of capital loss. It bridges the gap between high-risk options like equities and low-risk options which may not produce returns.

– The Power of Compounding

There is a thumb rule talking about investments. The truth is that the longer you keep your money in a fund, the more money is likely to be generated over time. This is where young investors have an edge over older ones. If you’re 40 and want to begin investing in a retirement fund, you’re 18 years behind those who began at 22. The 22-year olds are likely to generate higher returnsprimarily because of the compounding effect. Start as early as possible.

– Be Informed

No investment option is completely risk-free and investing in the wrong fund may end up being a grave error. You can never be too careful with where to put your money. It’s always better to look at the past performance of any mutual fund you decide to put your money into. Of course, this is not possible if it’s a new mutual fund. Try to ensure that the mutual fund you pick has been around for a few years at the very least before investing your money. You don’t want to be risking letting it all go to waste, do you?

Your fundsare distributed into a set of pre-decided companies from numerous sectors. These companies are usually mentioned in the prospectus, and you’re free to check up on them. In the interest of staying informed, it is advisable to check out all the companies mentioned.After all, it’s your money that will help fund its future endeavors, and you have every right to know what it’s being used for. Read up on the companies, the industries and the sectors that your mutual fund is investing in, and analyze whether they are ones you’re comfortable with, or if they’re ones you’d like your money to be invested into.

– Your Own Goals

Don’t just start investing because it’s the “in” thing and everyone around you is doing it. If you really want to gain from your investment, align it with your goals. Whether that goal is to buy your dream car after 10 years or to generate enough capital to start your own business in 15 years, or even go to the vacation you always wanted – your end goal and the money it’ll require should be fixed in your mind as early as possible. Once that’s settled, you can go about looking at what exactly to invest in and how much to put into it every month. For example, if your goal is to buy a car costing ?30 lakhs in 15 years, you can’t invest in something that’ll give you any less than that at the given time.

– Market Risks

Mutual Funds Schemes can be considered low-risk and safe to the extent that they are regulated by the Securities and Exchange Board of India (SEBI), and the fact that companies must have a minimum net worth to be eligible for mutual fund investments. However, fraud is a very real possibility and the less informed can easily be ensnared. Technicalities are everything here, so always read the terms and conditions thoroughly. Only pick a SEBI registered investment adviser.

– Choosing the Right Scheme

Mutual fund selection depends on the kind of an investor you as an individual, are. If your goals are long-term and you can handle risk, you could invest in equity schemes. If you’re more of a moderate investor with a lower of appetite for risk, you should consider investing in large cap or multi-cap mutual funds (that is, large companies or multiple companies) which tend to have lower exposure to risks. This is because such funds are channeled into companies which are comparatively stable. If you’re more aggressive and don’t mind the risk, invest in small cap or mid cap funds instead.

– Choosing the Right Bank and Date

This may not look very significant, but it’s actually pretty important. The general practice is for the plan to directly take money from your bank account monthly (or at whatever regular interval you have fixed). So, the date you fix should be keeping in mind that the account isn’t low on funds when the money is cut. Keep your balance at a minimum of at least the investment amount, and make sure you set the date of investment as one which is placed after you get your income (salary, rental income, etc.).

Be careful not to use an account that you hardly use otherwise, sincethere’s a higher chance of it running into issues of insufficient funds around the time your SIP debit is due.

Get Started Now

Once you’ve understood these essentials of mutual fund investments, it gets fairly easy to take a plunge as an investor and start crafting your investment goals. Get started now. The sooner you do, the more the returns! Remember the power of compounding?

Source: https://bit.ly/2jq1iEH

Interview :: Worst over for the market, top 10 stocks to bet on in FY19

Interview with Gaurav Jain, Director at Hem Securities.

Uttaresh Venkateshwaran, Sunil Matkar | Apr 06, 2018 03:19 PM IST | Source: Moneycontrol.com

While the market may have fallen around 10 percent from its peak, experts such as Gaurav Jain, Director, Hem Securities believe that the worst may be over now.

“In the next quarter, the market should settle and then a pullback is likely,” Jain told Moneycontrol’s Uttaresh Venkateshwaran & Sunil Shankar Matkar. He expects largecaps to move ahead and midcaps will play catch-up.

He expects a broad-based pick up in the market going ahead. “In the past few days, a few stocks have risen, which have pushed the market. We should start seeing a pick-up in many more stocks. Essentially, people are not in a panic stage, while retail investors have looked to book profits and are not in a hurry to invest,” Jain further added. Edited excerpts:

The market has been trading off the previous high points. What is the outlook for D-Street going ahead?

Over the last quarter, we saw events such as the Union Budget, which introduced taxes on long term capital gains (LTCG). Global markets reacted negatively, while big IPOs also sucked liquidity from the market, among other factors. As such, the market had a good run up in the past two three quarters.

In the next quarter, the market should settle and then there could be a pullback. Next quarter should be of accumulation and positive movement.

So, what kind of returns are you expecting from this market?

We are in an election year. So, the market could behave differently with results coming on. Overall, for FY18 we are looking at 8-10 percent returns.

What can be seen as triggers for this market?

Firstly, many companies’ results were affected in one quarter on the back of Goods and Services Tax (GST). With new GST Bill coming in full flow, it should give positive flow for most sectors. Even as the e-way bill is introduced, some companies could face some issues at the start and then gradually get comfortable with it.

Secondly, look at growth visibility in the Sensex and Nifty. Several managements are hinting at positive cues. Earnings could improve and several companies have done their expansions on their side.

Lastly, we have to wait for how monsoon pans out. So, overall there is positive momentum and investors are quite bullish on India even at this point.

Does that mean we could go back to the record high levels?

Probably…

What are you hearing on private capex plans? Are they willing to spend on that front as well?

Most companies, the big ones especially, have done their share of capital expenditure. One important reason why this is happening is due to change in technology that is erupting. For instance, look at telecom sector. In case Reliance Jio comes up with a new technology, rivals also tend to counter those. In case of textiles, many things have happened and firms are adding up more technology and machines. With changing technology, fast-growing companies need to adapt to it and they are deploying resources in those areas.

Could you throw some light on the state of midcaps? How do you expect them to perform going forward?

Largecaps should start moving first, going forward, followed by midcaps. Investors currently are playing conservative as they saw their stocks bleeding all through the last quarter. Hence, the money is going into largecaps right now.

But what about valuations for several segments in the market…how did the IPO market perform in FY18?

Look at the number of IPOs that came up with multiples of 30 and 40 times. Fund managers that we spoke to are talking about large systematic investment plans (SIPs) that have to be deployed into such stocks and that is probably why such high multiples were seen.

In FY17, we saw around 37 IPOs hitting the market and this figure could be higher this fiscal, looking at the prospectuses filed and information available from merchant bankers. Also, IPO sizes are a lot larger now.

But will investors have the appetite going forward?

Institutional investors will have it. They will always look at beaten down stocks and they also do not have issues with funds.

Currently, retail investors are investing less. If they have Rs 100 with them, they are looking to invest Rs 20 right now. In fact, many retail investors have booked profits in the past quarter.

Is there much downside from the current market levels?

I don’t think so. The worst should already be over. In the past few days, a few stocks have risen, which have pushed the market. We should start seeing a pick-up in many more stocks. Essentially, people are not in a panic stage, while retail investors have looked to book profits and are not in a hurry to invest.

So, what will your advice be to a 35-40-year old investor?

They must invest in mutual funds. But you could also do it making money by directly investing in equity markets as well.

What sectors are you looking at currently?

We expect pharmaceuticals to perform, while it could be a challenge in case of information technology names.

You can look at infrastructure sector as well. These companies are flooded with orders.

On banks, it is clearly not the case that all PSU banks are bad. Right now, people are not trusting PSU banks and private banks are usually considered more transparent.

It is a play on perception and that could be seen in cases of a recent listing such as Bandhan Bank. The IPO came at a very good multiple and still listed at good returns. These are companies with professional management which are growing along with having fast execution and chasing for business. As such, we were seeing a shift to private sector banks, but currently investors also do not know about hidden concerns in PSU banks too.

LTCG tax on equities has become a reality now. Are you getting queries about it and what are you telling them?

I think the sentiment around it has been already digested in the market. People are taking in the transition in stock market. I feel that this is not an issue at this point.

How much of a risk is political scenario for the market?

The market tends to be very volatile on political instability. As soon as there are chances of dent to existing government, it starts reacting. The question is not about which government, but about a stable one. This is important from a foreign investor perspective. These would have regular impact but not larger level…the market will make a comeback once the elections are over.

As we move into end of this year (and closer to general elections), investors may hold for couple of months to understand what is happening (on the political front).

On the global front, any statement from the US with respect to protection of its own trade boundaries is a major risk for the market.

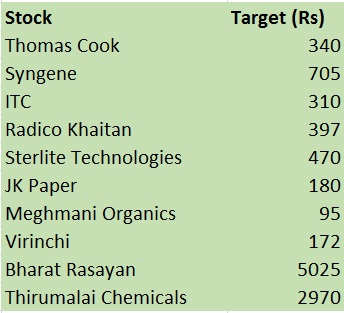

Lastly, what are your top stock picks for FY19?

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

ATM :: Things to know before investing in ELSS

India Infoline News Service | Mumbai | December 30, 2017 18:41 IST

Learn about ELSS investment & answer to all your questions like what is ELSS, how to invest in ELSS, tax benefits in ELSS at Indiainfoline

Equity Linked Savings Scheme or ELSS funds are a type of mutual funds whichbase their returns from the equity market. These funds are tax saving in nature and are eligible for a tax deduction of up to Rs1.50 lakhunder Section 80C of the Income Tax Act. Below are a few things that an investor must know before investing in ELSS funds.

What is ELSS?

ELSS schemes are a category of mutual funds promoted by the government in order to encourage long term equity investments. Under this scheme, most of the fund corpus is invested in equities or equity-related products.

Types of ELSS:

There are two categories in ELSS mutual funds i.e. dividend and growth.

The dividend fund is further divided into Dividend Payout and Dividend Reinvestment. If an investor opts fordividend payout option, he receives the dividend which is also tax-free,however,underthe dividend reinvestment option, the dividend is reinvested as a fresh investment to purchase more shares.

Under the growth option, an investor can look for longterm wealth creation. It works like a cumulative option whose full value is realized on redemption of the fund.

How to invest in ELSS?

One can invest in ELSS via two methods i.e. lumpsum or SIP.

SIP or Systematic Investment Plan, is a process where an investor needs to invest a fixed amount of money every month at a specified date. SIP inculcates a disciplined approach towards investing in an investor. SIP also gives the benefit of rupee cost averaging to an investor.

What is the lock-in period in ELSS?

ELSS funds have a lock-in period of three years. Whencompared to EPF, PPF, NSC and other prevalentinvestments under Section 80C, ELSS has the shortest lock-in period.

What is the benefit of tax in ELSS?

The primary purpose of any investment is to gain deductions under income tax for wealth creation. ELSS funds fit that bill perfectly. An investor gets a doubleedged benefit of tax saving and wealth creation at the same time. Dividends earned from ELSS funds are also exempted from tax. ELSS funds also provide the benefit of long term capital gains as they have a lock-in period of three years.

What is the investment limit of ELSS funds?

One can start investing in ELSS mutual funds with a minimum amount of Rs500, and there is no upper limit on how much a person can invest in ELSS funds. However, the tax saving ceiling is only up to a maximum of Rs1,50,000 a year.

What are the risks involved in ELSS funds?

ELSS mutual funds do not have ironclad guarantee over returns, as theygenerate their earnings from investments in the equity market. Nevertheless, some of the best performing ELSS mutual funds have given consistent and inflationbeating returns in the longrun. This quality is not possessed by the other fixed income tax saving investments like PPF andFD.

Conclusion

ELSS mutual fund investment has now become a popular tax saving investment under Section 80C, and it is also ideal for retirement planning and wealth creation coupled with the benefits of lower lock-in period, SIP method of investment, rupee cost averaging risk and no tax on dividends or the benefit of capital gains. ELSS funds should be taken into account by every investor while planning their investment goals.

Disclaimer: The contents herein is specifically prepared by ‘Dalal Street Investment Journal’, and is for your information & personal consumption only. India Infoline Limited or Dalal Street Investment Journal do not guarantee the accuracy, correctness, completeness or reliability of information contained herein and shall not be held responsible.

Source: https://goo.gl/wGHgDF

ATM :: How to become rich fast at a young age in India: 5 amazing investment strategies to follow before you turn 30

Everyone wants to be financially secure and well off by the age of 35-40. However, when we are in our 20’s, we tend to live life in the moment and forget saving for the future.

By: Sanjeev Sinha | Updated: November 27, 2017 2:25 PM | Financial Express

All of us have various financial goals in life. Everyone wants to be financially secure and well off by the age of 35-40. However, when we are in our 20’s, we tend to live life in the moment and forget saving for the future. This is not the right approach towards creating wealth. Therefore, to ensure that you are financially secure and on the right track with your money, here are 5 important investments that you must make before you hit your 30-year milestone:

1. Investment towards tax saving

Considering that you are working and earning, it is important for you to assess your tax liability and take advantage of tax deductions available under Section 80C of the Income Tax Act. “By proper tax planning, you can not only reduce your tax liability but also save some more to invest towards your other goals. One of the best tax-saving instruments is Equity-Linked Savings Schemes (ELSS). It is a type of open-ended equity mutual fund wherein an investor can avail a deduction u/s 80C up to Rs 1.50 lakh for a financial year,” says Amar Pandit, CFA and Founder & Chief Happiness Officer at HapynessFactory.in.

2. Investment towards emergency corpus

There are various events like accidents, illnesses and other unforeseen events that we may encounter in our lives. These events should never occur, but if they do, one needs to be adequately prepared for the same. In critical cases, such events may hamper one’s ability to work and may even lead to a loss in earnings for a few months or years. Hence, “it is advisable to build a contingency corpus, which is equivalent to at least 5-6 months of living expenses. Further, your emergency fund should be safe and easily accessible (liquid in nature) at short notice, in case of an emergency. Hence, savings bank accounts and liquid mutual funds are two options for setting aside the emergency corpus. However, considering that liquid and ultra-short term mutual funds are more tax efficient in nature, it is advisable to park a major portion of your corpus in the same,” says Pandit.

3. Investment towards long-term goals

It is very important to save and invest towards your long-term goals such as marriage, buying a house, starting your own venture, retirement, and so on. You must start with determining how much each goal will need and the savings required to achieve the goal. Once the corpus is fixed, you can invest towards the goal regularly. As an investment strategy, start fixed monthly investments – SIPs (Systematic Investment Plan) in mutual funds. Always remember, the earlier you start investing towards your goals, the longer time your investments will have to grow and the more you will benefit from the power of compounding. Equity mutual funds which are growth oriented are a preferable investment option for long-term goals.

4. Investment towards short-term goals

There are many short-term goals that are recurring in nature, such annual vacation, buying a car or any asset in the near term and so on. For such goals, you are advised to park your funds in liquid or arbitrage mutual funds rather than a savings account. “Mutual funds are more tax efficient than savings accounts and also there are different funds for different time horizons. For example, for goals to be achieved within a year, you can opt for liquid or ultra-short term funds whereas for goals to be achieved post one year, you can opt for arbitrage funds,” advises Pandit.

5. Investment towards health and life cover

Life and health insurance typically are not supposed to be considered as investments. However, both are very important and must be considered as one of the priority money move to be made before turning 30. If you are earning and have a family dependent on you, you must assess and buy the right life insurance term cover for yourself. Further, with costs of health care and medical on the rise, any untoward illness without sufficient cover will have you dip into capital which is unnecessary. Hence, there cannot be any compromise on health insurance. Thankfully, there are various health covers available in the market today. You should opt for the right cover for yourself, depending on your needs and post considering all the options.

Source: https://goo.gl/Abf7TR

ATM :: The advent of mutual fund SIPs in India

Equity investing have always been associated with high riskiness and the proverbial doom and crash in India

ANUPAM SINGHI | Fri, 16 Jun 2017-07:25am | DNA

Systematic investment plans (SIPs) were first introduced in India about 20 years ago by Franklin Templeton, a global investment firm. SIPs entail recurring disciplined investing via experienced portfolio managers. By necessitating fixed periodic (monthly, quarterly etc.) investments, it makes the timing of the markets, which can be risky, irrelevant, and at the same time, it typically provides above average market returns over a long period. Therefore, SIPs can be relatively less risky and also offer a hedge against inflation risk.

The top SIP funds have consistently given annualised returns of about 20% over the last two decades. The return from SIPs are calculated by a methodology called XIRR, which is a variant of internal rate of return (IRR). In the recent times, SIP fund managers usually tend to invest not more than 2% of the total capital available in a single stock. Portfolios are usually well diversified.

Currently, there are scores and scores of SIP funds to choose from. Different types of SIPs are available to suit an individual’s risk appetite, ROI goals, the time period of investment, and liquidity. Unlike PPF or Ulip, there are no restrictions and penalties on regular SIP payments and withdrawals. Investment can be as low as Rs 500 per month. Retail investors can look to invest in small-cap SIP funds initially, and once their capital builds up significantly, can shift to the less risky large-cap SIPs.

Equity investing have always been associated with high riskiness and the proverbial doom and crash in India. However, the trend is changing in recent times. Increased availability of information about investing, and greater digital marketing, has led to more and more individuals taking the SIP route. The number of SIP accounts has gone up by about 30% in the last 12-15 months alone. SIP monthly inflow volume now stands at about 3,000-3,500 crore, as opposed to about 1,000-1,500 crore in 2013. Retail participation is low India but is bound to increase at an accelerated rate.

Several brokerages are now waking up to the fact that higher P/E ratios are the new normal, as they are warranted by a fundamentally strong economy. Currently, the Indian stock market capitalisation to GDP ratio is approximately 98%, compared to 149% in 2007. With only about 250 Futures and Options (F&O) available out of approximately 4,200 individual securities, shorting opportunities are limited. Increased inflow SIP money could very well drive and support quality stocks in a growing economy.

The writer is COO, William O’Neil India

Source: https://goo.gl/Y5WWs8

Interview :: Invest cautiously, stocks over-valued: Nimesh Shah

Sidhartha | TNN | May 5, 2017, 06.22 AM IST | Times of India

ICICI Prudential Asset Management Company managing director & CEO Nimesh Shah believes in speaking his mind. While most market players are euphoric about the recent rise in stock market indices, Shah cautions investors against chasing high returns, given that the valuations are high. But he is optimistic about the medium term prospects and insists that mutual funds will be the preferred mode of investment, given the “repair work” in real estate. Excerpts:

What should someone looking to enter the stock market either with cash or via SIP do at this time?

On a price-to-earnings basis, market is over-valued at current levels. Because of the persistent flows from both foreign and domestic portfolio investors, the market is currently running a year ahead given that earnings per share (EPS) is expected to improve significantly by 2018-19. This is because we believe that over the next twothree years, capacity utilisation can increase and so can the return on equity . Currently , the macros are strong but Indian companies are facing various pockets of challenges. But consumption across the spectrum is likely to hold strong. Given this expected improvement, it is likely that there could be a consistent flow of investment from institutional investors, thereby lending a reasonable investment experience over next twothree years. But since the market is already slightly over-priced, one cannot expect abnormal returns.

For those investing via SIP , they can continue with their investments because over the next three years, the investment price will average out, thereby yielding better returns. For someone who is coming in when sensex is at 30,000 level, can consider dynamic asset allocation funds which result in lower equity exposure when the equity level is up and vice versa.

But it gives you conservative returns…

Yes, it does. But it is good to opt for conservative returns when sensex is at 30,000 level.Even if the index were to head higher say 33,000 level, the only limitation here would be that the entire upside is not captured. But when market turns volatile at higher levels, this class of funds can limit downside. As we all acknowledge, there is more pain in losing Rs 5 than the joy in gaining Rs 30.

If you are investing in equity MFs, one should consider large-caps because mid-caps are over-valued at present. Continue investing but invest with caution because returns may not be too high from current levels. Just because banking funds as a category has delivered 40% plus returns, it does not mean everyone should invest in it based on past one-year return.

A few years ago, the government was worried about the huge inflows from FIIs and feared the impact post withdrawal. But now mutual funds seem to have emerged as an effective counter-balance. Has the domestic MF industry matured?

To a certain extent domestic institutions have emerged as a strong counterbalance. Over the last few months, mutual funds and foreigners have pumped in money into stock markets, thereby pushing up benchmark indices. However, even if foreign investors were to withdraw tomorrow, Indian MF and insurance industry which is putting in over $3 billion a month, will be able to balance it out, thereby limiting any adverse shocks. Today , people refrain from investing in real estate, gold and bank FDs, which is currently yielding 6-7% return pre-tax. In such an environment, equities are becoming a TINA factor -there is no alternative. So, we believe that steady inflows may continue.

How much of small investor money is coming into the market?

Mutual fund in India is all about small investors; high net worth individuals form a very miniscule portion. We are opening nearly 120 offices across smaller towns such as Nadiad (Gujarat) and Arrah (Bihar) because we believe that MF is a viable business. We have ensured that we are present pan-India, including North East. If we can give a better alternative to unorganised investment avenues, people can invest. While people in Gujarat who are more evolved investors can move to value investing, in the East, money can be moved into mutual funds from unorganized sector, there by giving us an opportunity to show the importance of well-regulated businesses.

Will the recent change in regulations push MFs?

We are in an infinite market as the MF penetration is hardly 4% in the country . The one major challenge now is simplified onboarding process for investors. Today, 85% of our business comes from existing consumers and this shows that the market is not expanding adequately . As a fund house, we receive several queries on our website, but the conversion rate is disheartening. We have come to realize that investors are wary of the entire KYC process. Like insurance, AMCs too should be allowed to use the bank KYC details, thereby eliminating the duplication of paperwork.

The reason why bank KYC should suffice is because entire industry does not deal in cash transactions. MFs receive funds via bank accounts and at the time of redemption the funds are transferred to the same bank account. So there is absolute transparency .

Source : https://goo.gl/y2MtpW

ATM :: Seven steps to your first home

RAJEEB DASH | October 8, 2016 | The Hindu BusinessLine

A property buying guide for millennials by Rajeeb Dash

For a millennial, the decision to buy a home can be a life-altering one.

For young individuals or couples, getting into a long-term debt commitment such as a home loan can be a daunting task.

However, as financial advisors would agree, buying your first home in your 20’s or early 30’s can be one of the smartest moves you can make financially, as it gives you a great head start in more ways than one.

Firstly, unlike rent payments, a mortgage payment (though it may seem overwhelming in the first few years), goes a long way in asset building and increases your home equity.

Secondly, it restricts you from making unnecessary purchases and keeps from accumulating credit card debt. Thirdly, a secured loan such as a home loan early in life and making timely repayments on the same gives your credit score a boost and paves your way for further access of credit when you require it.

Now that we have established the advantages of a millennial attempting purchase of property, here is a comprehensive guide for first-time home buyers:

1. Getting over the initial fear

Those who have just about completed hefty student loans may develop cold feet at the thought of skimping once again and preparing to take a home loan.

At this stage in your lives, it is important to see the bigger picture.

In a few years from now, a roof over your head that you can call your own before you reach your middle years will feel like a great achievement.

2. Invest with a specific goal

If you have firmed up your mind to purchase your first property, the first thing you must do is begin investing with this specific goal in mind.

Set a budget and pick an investment option that will help you meet your goal in a specific number of years.

While setting a budget, do not be too hard on yourself and try to stretch limits.

Your first home need not be your only home and you can always graduate to a bigger place when you can afford one.

While saving for your first home, equities may be your best bet as they offer you the best inflation adjusted returns as compared to other instruments despite the risk factor.

If you do not have the expertise or the time to invest in equities yourself, you can choose the systematic investment plan (SIP) route of mutual funds.

By investing in equities through the SIP option of mutual funds you also get the advantage of compounding, which means your returns are reinvested over the term you choose to remain invested in the fund, thus helping you achieve your financial goal of saving up enough for the down payment of the property.

3. Home loan options

Do enough research before you decide on a lender.

Many lenders want young and dynamic home owners as customers and have specific loan products that make it easier for you to make repayments in your initial years and increase the quantum with the rise in your career.

Checkout such options and read in between the lines to understand each nuance carefully.

4. Begin with clean credit records

One of the most important factors that will decide whether or not you are creditworthy, is your Credit Information Bureau (India) Limited (CIBIL) score.

Your CIBIL score is a three digit numeric between 300-900 that is assigned to you by India’s premier credit bureau.

This score is based on your credit behaviour or how you have serviced your credit lines you have availed of thus far.

In order to maintain a good CIBIL score (750 and above) it is necessary for you to have serviced debt regularly and well before applying for a fresh loan.

One of the best ways to ensure that your CIBIL score remains intact is by making a habit of not building up credit card debt.

Spending very small amount and ensuring that you make a habit of properly repaying your credit card bills before the end of each and every billing cycle is a good way to ensure that you do not get into a debt trap and also maintain a fairly good CIBIL score.

5. The quest for your first home

In this world dominated by the internet, the search for your first home must necessarily begin online.

There are a host of websites such as 99acres.com, magicbricks.com, indiaproperty.com, makaan.com that have made it easy to filter searches according to your requirements, budget and location preferences.

It is a good idea to go through all of these portals and shortlist properties that you would like to see personally.

Besides using such websites, make the best use of the internet and social media to reach out to actual buyers and check the reputation of the builder, the living experiences and the problem areas if any.

A thorough virtual search gives you a firm footing before you start visiting the properties personally and finally zero in on a choice that is best suited to your needs and budget.

6. Be aware of your rights

The real estate market can turn out to be a head spinner when you are out there on a house hunt.

It is important to be mindful of what your requirements are and be aware of your rights when seeking out a home.

7. The final step

Once you have taken possession of your new house, the first thing to do is store all your property documents.

Make a few photocopies and keep them in at least three different locations.

It is a good idea to get all your property documents digitized and locked in an e-safe.

Next, update all your official documents with your new address and finally transfer all property related paperwork such as water and electricity meters, society membership and property tax records in the local municipal body in your name.

Once you have taken possession, the first thing to do is store all your property documents safely.

The author is AVP-Marketing, Tata Housing

Source : https://goo.gl/W6aXJn

ATM :: Got a windfall? Don’t put it in a savings a/c

RAJESHWARI ADAPPA | Tue, 28 Jun 2016-06:55am | dna

Experts advise that you should park the lump sum in avenues such as liquid or ultra-short term funds till you decide where to invest it as putting the money in a savings account not only earns low interest but also tempts you to blow it

Windfalls or coming into large sums of money sure makes you feel rich but if you want to stay rich, then the challenge is to ensure that the money lasts for a really long time.

Incidentally, experts advise that when one does not know what to do with a large sum, the first thing to do is take it off the bank savings account.

“The money lying there not only earns low interest but tempts you to blow it. Hence, park it in short-term avenues such as liquid funds or ultra-short term funds until you decide or get advice on where to invest the money in,” says Vidya Bala, head of mutual fund research, FundsIndia.

If you have a lump sum to invest, it is best to revisit your investment plan, advises certified financial planner Gaurav Mashruwala.

“Firstly, buy adequate health and life insurance. Secondly, if you have any loans, pay up the loans. After that, you can start goal-based investing,” says Mashruwala.

Most people are confused where to invest for the best returns. “Where to invest would depend on whether they have a near-term use for the money,” says Bala.

“If it is retirement money and the investor needs to create an income stream, they could deploy it in a combination of ultra-short and short-term debt funds and do a systematic withdrawal plan to generate their own income. If it is for the long term, a combination of equity and debt funds will work well. So one needs to know the purpose and the time frame before they can decide where to invest,” says Bala.

The most important task is to create a goal for such money and then allocate and invest accordingly. While goals would depend on the individual’s requirements, broadly your goals could include creating funds for a specific purpose such as a retirement fund, an emergency fund, a kids education or a marriage fund or even a fund for personal goals (say a foreign trip), etc.

A retirement fund is a must. HDFC Pension’s CEO Sumit Shukla advises that 20-30% of the sum should be invested for retirement. He suggests investing the lump sum initially in Tier II account of NPS from which some money could be transferred into the Tier I account every month via systematic withdrawal plan. “This would help to ensure that initially the money is invested in debt (Tier II account) and as one invests in the Tier I account, slowly the equity portfolio is also built up,” says Shukla.

“Corporate debt has earned 10.47% while government debt has earned 10.35%. Compared to the 8.8% returns from PF, this difference would work out to be huge over a period of time,” points out Shukla.

Depending on your risk and return profiles, there is a range of avenues. “Investors seeking low to medium risk can examine fixed deposits, debt mutual funds, corporate bonds, tax-free bonds and monthly income plans.

However, investors with higher risk preference can look at balanced & equity funds, direct equities, private equity & real estate funds,” according to a DBS spokesperson.

“Lump Sum investing is fine when it comes to low-risk debt funds. However, when it comes to equity funds, it is important to understand the risk of timing the market by investing in one go. Ability to take near-term falls is a must of one chooses to invest lump sum,” says Bala. A better option is to invest in a phased manner through an SIP (systematic investment plan).

It may be a good idea to take professional advice. “Also, consider the impact of tax on the returns,” says the DBS spokesperson.

The mistake that many people who come into big money suddenly make is that they start living a lavish lifestyle. “Instead, invest in income generating and growth-oriented assets. Use the returns from these assets to enhance your lifestyle,” advises Mashruwala.

The solution is to invest wisely keeping in mind two primary goals: ensuring safety of capital and also growth.

Source : http://goo.gl/4KucZz

ATM :: Should you invest your money or use it to prepay home loan?

By Narendra Nathan, ET Bureau| 9 May, 2016, 12.29PM IST | Economic Times

If you have an outstanding home loan, and happen to have just received an annual bonus or any other lump sum payment, should you use it to prepay your loan? Or, should you invest it to meet some other goals? Assess the following conditions to arrive at the right decision.

The first variable to be considered is psyche: some people may not be comfortable with a large housing loan and to reduce their stress they may want to get rid of the loan burden at the earliest. For them, settling the question of how to use their bonus is simple: just pay off the loan. Gaurav Mashruwala, Sebi-registered investment adviser, categorically states: “You should pay off the home loan at the earliest. Several unfortunate happenings— job loss, death of the earning member, serious illness, etc—can cause trouble during the 10-15 year loan period. Treat it as a mind game and not a numbers game.”

Tax benefit is the next variable. If a home loan does not seem like the sword of Damocles hanging over your head, it makes sense to continue with the regular EMI schedule. This is because of the tax benefits that a home loan offers. The principal component of the EMI is treated as investment under Section 80C. The interest component is also deducted from your taxable income under Section 24. The annual deduction in respect of the interest component of a housing loan, for a self occupied house, is limited to Rs 2 lakh per annum.

You won’t be able to claim deduction on interest paid above Rs 2 lakh. So, if your annual interest outgo is higher than Rs 2 lakh, it makes sense to prepay the loan, and save on future interest payment. For example, the annual interest on a Rs 70 lakh outstanding loan, at 9.5%, comes out to be Rs 6.65 lakh. After taking into account the Rs 2 lakh deduction under Section 24C, the interest component will fall to Rs 4.65 lakh, and bring down the effective cost of interest from 9.5% to 8.64%, even for the people in the 30% tax bracket.

You can, however, optimise the tax benefits if the loan has been taken jointly, say, with your spouse. “If joint holders share the EMIs, both can claim Rs 2 lakh each in interest deduction,” says Harsh Roongta, Sebi-registered investment adviser. In case of joint holders share the EMIs, both can claim Rs 2 lakh each in interest deduction,” says Harsh Roongta, Sebi-registered investment adviser. In case of joint holders, there is no need to prepay if the outstanding amount is less than Rs 40 lakh.

There is no cap on deduction in lieu of interest paid on home loan, if the property is not self-occupied. “Since there is no cap for interest on loan against second or rented out homes, there is no need to prepay it,” says Naveen Kukreja, CEO and Co-founder, Paisa Bazaar. Bear in mind, by prepaying your loan, you may also forego future tax benefits. For instance, if by prepayment, you bring down your outstanding loan amount to Rs 20 lakh, your annual interest outgo for subsequent years may fall below Rs 2 lakh. Thus, you won’t be able to avail of the entire tax-deductible limit and, in such a scenario, prepayment may not be a good strategy. Also, building an emergency fund, if you don’t have one, should take a priority over prepaying the housing loan: “Make sure that you have a contingency fund in place before opt for prepaying your home loan,” says Roongta.

The third key variable is returns from investment of the lump sum at hand. As a thumb rule, you should go for investment, instead of prepayment, only when the post-tax return from the investment is likely to be higher than the effective cost of the housing loan. For investors in the 30% tax bracket, and whose outstanding home loan balance is less than Rs 20 lakh, the effective cost of loan is only 6.65%. Since there are several risk-free, tax-free debt options such as PPF, Sukanya Samruddhi Yojana and listed tax-free bonds, which offer higher annualised return than this, it makes sense to invest in them.

All the debt products mentioned above are long-duration products. If your risk-taking ability is higher and time horizon is longer, you can consider investing in equities, which can generate better returns “It’s sensible for long-term investors (five year-plus holding period) to go for equities, provided they are savvy and understand the risks involved there,” says Kukreja.

There are some home loan products that provide an overdraft facility of sorts and help you maintain liquidity. All you have to do is to park the surplus money in these products and not bother with whether it’s a prepayment or not. It’s like prepayment with the option of taking out that money, in case you need it in future for personal use or for investment purpose. The strategy of maintaining the housing loan interest close to Rs 2 lakh per annum can also be managed by these special loan products. And even if you are going to invest, the SIPs can go from this account.

“I park my bonus and do SIPs in equity from the loan account,” says Kukreja. Most banks charge more for these special loan products. “Though the stack rate differential is more, you can bring it down by bargaining with the banks,” he adds.

Source : http://goo.gl/3ce3eL

ATM :: Stick with SIPs through markets’ ups & downs

K V Vardhan | Aug 11, 2015, 06.07 AM IST | Times of India

I’m 40 years old and work as an insurance adviser . I want to build a Rs 1 crore corpus through SIP in equity mutual funds over the next 20 years.Kindly guide me about how much I have to invest monthly and the type of funds I should invest in. –Sathish Kumar D, Chennai

K V VARDHAN REPLIES

The first step to wealth creation comes from planning and one needs to have the conviction to stick to the plan through the journey. Like the ups and downs associated with investing in the stock market, SIP investments using the mutual fund route is also expected to give you volatility . However, investors who have the conviction to remain invested and continue with their SIP investments through these ups and downs, are bound to achieve their financial goals.

In the past decade, the average yearly sensex return was 13.9%, while well performing mutual fund schemes have returned between 13.4% and 22.7%, and SIPs in the same funds returned between and 13.7% and 25.3%. Hence SIP ,a rupee cost averaging method in a volatile market, has the potential to deliver better return than lump sum investments.

Case 1: Let us considering you require of Rs 1 crore equivalent to today’s value, after 20 years.At 6% per annum rate of inflation, on an inflation-adjusted basis, after 20 years you will require approximately Rs 3.20 crore. To achieve this corpus size, you may consider investing Rs 35,000 per month in equity mutual fund SIPs with an expected annual return of 12%.Alternately , you can invest Rs 24,000 per month in mutual fund SIPs with an expected annual return of 15%. If we have to do asset allocation and create a financial plan for the above case with 70% of your investments going into equity funds and 30% nto debt funds, you may have o invest Rs 44,000 per month. In case you plan to have a 50%-50% ratio with equity and debt mu tual funds, you may have to invest Rs 50,000 per month.

Case 2: Let us considering you require of Rs 1 crore at the end of 20 years. In that case you may consider investing Rs 11,000 per month per month in equity mutual fund SIPs with an expected annual return of 12%. Alternately , you can consider investing Rs 7,500 per month in equity mutual fund SIPs with an expected annual return of 15%. With asset allocation of 70% equity and 30% debt you may have to invest Rs 14,000 per month, while with a 50%-50% equity and debt allocation, you have to invest Rs 15,500 per month.

Here, we assume that annually SIPs in debt funds would return 6% post tax, and equity returns are expected at 12%, also post tax. For an equity investor who is aggressive and has higher risk taking ability , 40% of the corpus should be in midand small-cap funds, 30% in multi-cap funds and the balance in large cap investments.For moderate risk taking ability, the combination should be 30% in midand small-cap funds, 35% in multi-cap funds and the balance in large cap investments. And for a conservative investor, with low risk-taking ability, it should be 20% in midand small-cap funds, 30% multicap funds and the balance in large cap investments.

K V Vardhan is CEO, Ultimate Wealth Managers, Bengaluru

Source : http://goo.gl/FILYlm

ATM :: Get rich without real estate

AARATI KRISHNAN | April 26, 2015 | Hindu BusinessLine

It’s a myth that real estate guarantees pots of money. If you’re young, here’s why equity funds may suit you better

There’s an abiding belief among Indians that the only investment that can make you rich is real estate. Such is the allure of getting rich through property that many people in their twenties and thirties want to take on a large home loan and sign up for their first apartment as soon as they receive their first pay cheque.

But if you’re in your twenties or thirties, it makes more sense to invest in equity or balanced mutual funds instead. Not convinced? Here’s why.

EMIs are compulsory savings. Without it, I will just spend the money.

The Equated Monthly Instalment (EMI) on your home loan is not an investment. It is a loan repayment where the lender earns interest off you. Let’s say you have booked a ₹50-lakh apartment and taken a 10-year home loan at 10.5 per cent to fund it. The EMI will amount to ₹67,467. At the end of 10 years, you would have paid a total of ₹80.96 lakh to the bank, of which ₹30.96 lakh will be the interest component alone!

For the apartment to be a truly good investment, it will have to generate a return over and above the ₹80.96 lakh you paid for (not the ₹50 lakh that most people assume). Instead, investing the same money in good equity or balanced funds will earn you a return on your capital, without incurring interest costs.

But I get to create an asset. With equities, after ten years, I may be left with nothing.

If this is your first home and you are actually living in it, it is not an asset at all, because it does not earn you any return. There has been no ten-year period in Indian stock market history when SIPs in equity or balanced funds have delivered nothing.

Between June 1992 and June 2002, which was among the worst ten-year periods for Indian markets, an SIP investment in an equity fund like UTI Mastershare delivered a 13 per cent annualised return. Again between September 1994 and 2004, a flattish period for the markets, SIPs in Franklin India Bluechip earned over 20 per cent CAGR.

That’s not enough. My friends say their property investments have gone up five or six-fold in the last seven years.

Translate that into compounded annual returns, and you will find that the returns aren’t much higher than that earned by good equity funds. To give you an example, Annanagar has been a booming locality in Chennai in the last ten years.

If you bought an apartment there at ₹40 lakh in 2001 (the previous real estate downturn), it is now worth ₹2.4 crore. That’s only a 13.6 per cent CAGR (compound annual growth rate). This is true across markets.

Data from the National Housing Board show that of 26 cities tracked, Chennai delivered maximum appreciation between 2007 and 2014, with the Residex for the city going up 3.55 times.

That’s a CAGR of 19.8 per cent. Markets such as Pune (241 per cent), Mumbai (233 per cent), Bhopal (229 per cent) and Ahmedabad (213 per cent) were other top ones. Their effective returns were 11.4 to 13.3 per cent.

Doing an SIP with a middle-of-the-road equity fund like the Sundaram Growth Fund for the same period would have fetched you a return of over 17 per cent; top performers would have earned you 20 per cent plus.

That’s all-India data. Some localities would have delivered bumper returns.

True, but how would you identify those localities in advance? This is the disadvantage of investing in real estate.

To make sufficient gains, you have to know not just the right state to invest in, but also the right city and locality within it. The same NHB data, for instance, shows that property prices in Hyderabad and Kochi have declined in seven years. Even in a locality, different transactions may yield different prices. To be sure, selecting the right mutual fund to invest in is difficult too. But with funds, you can invest based on the fund’s three-year, five-year or 10-year track record and can be assured that the price you are paying is right.

If you could diversify your property investments across many markets, your results would be better.

But given the large ticket sizes of property investments, most people end up betting much of their monthly pay cheque on just one piece of property. That’s concentration risk.

But I’ve never heard of anyone who became a millionaire by investing in equity funds.

Because mutual fund NAVs are available to you on a daily basis, there’s a temptation to over-trade. Most people who haven’t made money on equity funds are those who haven’t stayed on for ten years or more. They’ve bought funds, sold them and bought them again trying to time markets.

If you did the same with property investments (they have cycles too) you would lose money. Even long-term investors in equity funds invest too little in them.

A 15 or 20 per cent return from equity funds will seem small if only a fraction of your wealth is invested in it. While EMI commitments typically run into ₹30,000-₹70,000 a month, most people don’t venture beyond ₹1,000 or ₹5,000 SIPs.

We’re not recommending that you commit half or three-fourths of your monthly pay to SIPs in equity funds. But if you are in your twenties or thirties, you can certainly afford to commit 20 per cent.

Remember, once you sign up for a home loan, you can’t vary your EMI or stop paying it, if the property doesn’t appreciate or if you quit your job.

With an SIP, you can take a rain check in an emergency.

Source : http://goo.gl/NNgy6P

ATM :: Yearly bonus can help create long-term wealth

TNN | Apr 7, 2015, 06.55AM IST | Times of India

It’s the start of the financial year 2015-16. This is also the time when every investor should put in place a plan for investing and saving on taxes using all the options that the government has given to them. However, according to financial planners and advisors, while putting in place a long-term financial plan, the main aim should not be tax savings. The main aim should be to build the required corpus for the goal for which you are investing. Here are some tricks that will help you build wealth in the long run without much thought…

Use your bonus wisely

This is the time lot of people get a bonus. According to top of ficials at mutual fund houses and financial advisors, rather than spending on things that may not be an absolute necessity, you can invest the whole or a major part of the bonus in an equity mutual fund. Let us assume that you get a bonus of Rs 3 lakh this year and you put the whole amount in an equity mutual fund.

Now let us also assume that every year your bonus increases by 10% while the equity fund you are investing in, over a 10 year period, gives you a return of 12% per annum.At the start of the second year, your bonus is Rs 3.3 lakh and at the start of the third year it is at about Rs 3.6 lakh. At this rate, at the start of the 10th year, your yearly bonus will be about Rs 5.7 lakh. But if you have invested your yearly bonus every year in the equity fund that gave an annual return of 12%, your total corpus at the end of the 10th year will be a little over Rs 80 lakh. This looks like a staggering amount, but there is no magic in it.

Make good use of ELSS

According to financial planners and advisers, equity-linked savings plans (ELSS) floated by mutual fund houses are one of the best tax saving options for investors. This is because in the long term they have the potential to generate an average annual return of 12%, saves on taxes under section 80C of Income Tax Act and has a lock-in of just three years.

The returns from all ELSS are also tax free while the costs are around 2.5% per annum, one of the lowest for similar products. In comparison, most of the other tax-saving options cannot generate as high a return, costs are higher and returns are taxed on redemption. A combination of some of these factors makes such products unattractive in comparison to ELSS. So suppose after taking care of your contributions to provident fund, home loans, etc, you are still left with about Rs 60,000 to invest to save taxes under section 80C, go for one or more SIPs aggregating Rs 5,000 per month so that your yearly contribution is Rs 60,000.At about 12% average annual return, in 10 years, this can grow to be a Rs 11.6 lakh corpus.

Use excess cash intelligently

If you keep your excess cash that you need at a short notice, you probably keep it in your savings bank account. However, a better alternative is to keep it in a liquid fund of a good mutual fund house. Compared to 4-6% annual return that you can get in your savings bank account, liquid funds on an average has given a return of over 7.5% in the last five years while some of the best liquid schemes have returned over 8.6%. This higher return comes at a slightly higher risk and slightly less liquidity , that is about 24 hours, compared to money at call in case of savings bank accounts. So, if you can manage your cash inflows and outflows well, you can put your extra money in liquid schemes and earn much higher returns. There’s alternative to FDs Fixed maturity plans (FMPs) are a good alternative to fixed deposits (FDs). If you are keeping your money in FDs for three years or more, FMPs of similar maturities can give you a much better return as FMPs enjoy long-term capital gains tax advantages if the money is kept for more than three years. FDs do not enjoy similar benefits.

Source : http://goo.gl/KowGgd

ATM :: Don’t Let Your Money Be Footloose And Fancy Free

Rajiv Raj | Dec 9, 2014, 04.49 PM | Business Insider

Earning your first salary is undiluted pleasure. It is all too easy to get soaked in its headiness and go a bit haywire in your expenses. However, this is a curial period of your life to build it financially. Decisions made in these initial years will affect your financial status throughout the life.

So if you are young and have just started earning, here is some important money advice that will serve you well for life.

1. Start with a small fixed saving every month

When we first start earning, money always seems short. We are perpetually overdrawing from a credit card or waiting for the next salary to come in. Even so, it is essential to start saving early. Even a small amount grows fast if invested early, much faster than a larger amount invested a few years later. The power of compounding helps money grow in multiples over a longer period of time. To ensure that there is a compulsory saving, invest in an instrument like Systematic Investment Plan (SIP) or a recurring deposit, and instruct your bank to directly debit your account at the beginning of the month.

2. Start building your Cibil credit score

Your borrowing and repayments is what builds up your credit score. Borrowing could be spending on a credit card or taking an EMI loan for a car or even a home loan. Importantly, the loans need to be repaid on time to build a positive credit score. Also avoid spending more than 30% of your credit limits. Maxing out on the credit cards will bring down your credit score. At this stage of life, building a good Cibil credit score is of paramount importance as you will soon be in the market for the all important home loan, and a good Cibil credit score can make all the difference.

3. Buy insurance

For most Indians, insurance is a source of investment. Insurance,however should be used only to cover risk. Buy a term policy that is easy on the pocket and serves the purpose of giving you risk cover. The remaining amount must be invested in other areas.

4. Take advantage of the benefits offered by your company

Many company offer reimbursements for health-related expenses. They also help you to structure your salary in the most tax-effective manner. Some companies may also offer group life insurance and medical insurance, where the rates work out to be much cheaper. Become friends with the people in human resources and take advantage of what the company has to offer its employees.

5. Pay attention to taxes

The government of India gives its citizen excellent opportunities to save tax along with encouraging investments. You can get exception under sector 80 C upto Rs 1.5 lakh in taxes every year by simply investing in your Provident Fund account or paying your life insurance premium etc. Also do file your tax returns on time to avoid the heavy penalties.

6. Make a career plan

It is essential to make a career continuity plan. You may have joined a firm as a graduate, but to move ahead an advanced degree is needed. A rough plan must be chalked out. For instance, you might want to study for an MBA degree in 2 years time. So you need to plan out the source of finance to pursue the course along with living expenses for that period. An education loan can be taken, but to avail that loan you must have a good Cibil credit score. It is a full circle which comes back to prudent spending and investments.

About the author: Rajiv Raj is the director and co-founder ofwww.creditvidya.com.

Source : http://goo.gl/zQYyVU

ATM :: First figure out your goals, risk tolerance

Raj Talati | Sep 23, 2014, 06.34AM IST

It is said that the biggest risk to an investor’s returns is the investor himself. This is because, as investors, we take a lot of impulsive decisions and do not follow fundamental rules of investing. Here are some basic rules to get optimal returns on your investments and live a comfortable life:

Have a financial road map: Before you make a financial decision, sit down and take an honest look at your entire financial situation, especially if you have not made a financial plan before. The first step to successful investing is figuring out your goals and risk tolerance, either on your own or with the help of a financial planner.

Evaluate your comfort zone in taking risks: All investments involve some degree of risk. The reward of taking risk is the potential for higher investment returns. If you have a long-term financial goal, you are likely to get better returns by investing in equity funds rather than restricting your investments to less riskier assets like FDs.

Consider risk of inflation & taxes: The biggest concern with less riskier assets is their inherent habit of generating negative real returns. That is, returns after adjusting for inflation and taxes. For example, Rs 100 deducted from your salary towards PF in 2005 is worth just Rs 97 now, even though it is tax-free. The worth of your FDs, which are taxable, is even worse.h Consider appropriate mix of investments: A mix of asset classes like bonds & equity funds, along with cash can help you to optimize your returns and also insulate you from losses during different market conditions. Historically , the market that was poor for one asset class was good for another.h Diversification: Don’t put all your eggs in one basket. Remember to diversify your funds even within an asset class. That should help reduce your overall risk considerably.

Emergency fund: Always have an emergency fund that you can access in case of medical or job loss-related exigencies.h Pay off credit card debt: There is no asset class or investment strategy that can pay you a return that matches what is charged for credit card debt, which could be as high as 36% annually . So get rid of it..

Consider rupee cost averaging: Regular or periodic investments by way of SIP or STP will help you to invest in different market cycles and generate better returns.This strategy can be used especially if you are investing for the long term and in equity funds.

Rebalancing: This helps bring your portfolio back to your original asset allocation plan in case it deviates. This will help you book profit on the assets that have performed well and also buy assets cheap during slowdowns.h Avoid tips, assured and high returns: Every extra amount of return that is above the market return comes with some extra risk. So junk schemes which offer to double your money within a short span of time.Invest only in products from institutions regulated by the government.

Also remember while a financial planner might charge you a fee, heshe will help you avoid the common mistakes to creating wealth, and reach your goals comfortably .

The writer is with ABM Investment

ATM :: SIP mode best suited for investors struggling with tight budgets, EMIs

Priyadarshini Dembla | Dec 10, 2013, 05.54AM IST | Times of India

The importance of saving and investing cannot be overstated. And, it is never too early to start investing. Rather, it is a case of sooner the better. However, with rising costs and tight budgets, the question is how one should go about with investments? In addition, there is the market scenario to consider. For instance, if the equity markets have recently scaled new highs or have corrected sharply, the dilemma is would it make sense to invest or should one hold off for a while?

This is where the systematic investment plan (SIP) method of investing in mutual funds comes into the picture. SIP is a simple and proven investment strategy which can help investors in accumulating wealth in a disciplined manner over a longer time frame. In an SIP, instead of investing a lump sum, a fixed amount (which can be as small as Rs 100) is invested at regular intervals in mutual funds. Some of the key benefits of SIP investing are listed below.

No need to time the market: At no point of time, should the current market level deter a long-term investor from making a beginning. One cannot always be the best buyer or the best seller. Timing the market is a time-consuming and a highly risky strategy for investors. Not many investors can claim to have the ability to consistently time the markets accurately. This is the reason why several investors end up losing out on market opportunities in pursuit of trying to time the market in vain.

Rather, investors should focus on meeting their investment objectives and deciding where they should invest. With an SIP, one does not have to worry about what the market levels are. All one needs to do is to identify the right funds and get invested. In the process, investors do not have to delay their investments either.

A convenient investment mode: The SIP mode of investing is more convenient than making lump sum investments. Typically, an SIP entails investing a smaller sum every month vis-a-vis larger amounts in lump sum investments. This, in turn, makes the SIP mode apt for investors who are struggling with tight budgets and EMIs. Often, lack of adequate funds is an excuse for delaying investments. An SIP enforces discipline in investments by ensuring that a fixed sum is invested every month, and is convenient on account of the small ticket size.

Using rupee-cost averaging: The benefits of investing via an SIP become apparent in times of market volatility. When the net asset value (NAV) of the mutual fund unit drops during a downturn, each SIP installment invested results in more units being credited to the investor. This, in turn, results in averaging out the cost of purchase. In effect, in times of volatility, investing via the SIP route becomes more lucrative. This is further explained through the table given here.

| A disciplined approach to creating wealth | |||

| 2013 | SIP Amt (Rs.) | NAV (Rs.) | N o. Of Units |

| Jan 1 | 1000 | 10 | 100 |

| Feb 1 | 1000 | 12 | 83.3 |

| Mar 1 | 1000 | 14 | 71.4 |

| Apr 1 | 1000 | 16 | 62.5 |

| May 1 | 1000 | 18 | 55.6 |

| Jun 1 | 1000 | 20 | 50 |

| Jul 1 | 1000 | 22 | 45.5 |

| Aug 1 | 1000 | 24 | 41.7 |

| Sep 1 | 1000 | 20 | 50 |

| Oct 1 | 1000 | 22 | 45.5 |

| Total | 10000 | 17.8 | 605.5 |

| Note: Avg Cost = Total cash outflow/Total no of units, i.e. Rs.10000/605.5=Rs.16.5. Whereas, Avg Price=Sum of all NAVs at which you have invested/Number of months of your investment, i.e. Rs.178/10=Rs.17.8. Therefore the Avg Cost is Lower that the Avg Price. | |||

It is also noteworthy that SIP helps an investor avoid a knee jerk reaction of selling his/her investments during a bear market, thereby helping him/her realize the full value of his investments.

(The writer is research associate, Morningstar India)

Source: http://goo.gl/B5UPBn

ATM :: Started saving late? You can still retire rich!

Find out how you can make up for lost time if you haven’t saved enough for retirement.

By Babar Zaidi, ET Bureau | 18 Nov, 2013, 09.41AM IST | Economic Times

Start saving early. Nearly 54% of the retirees in an HSBC survey said this was the best financial advice they had ever got. Not all of us are so lucky, and most Indians get serious about retirement savings only in their 40s. Have you also frittered away the early bird advantage and not saved enough for retirement? There can be several reasons for your nest egg being smaller than that of others your age. Perhaps you didn’t have a high income in your early years. Maybe you made the wrong investment choices or suffered a financial setback, which ended up wiping out all your savings.

Whatever the reason, there is no need to panic. You have lost out on the golden years of compounding, but it’s never too late to start. Our cover story this week is for investors who should have saved more when they were younger, but couldn’t.

You can make up for the lost time and put your retirement back on track if you follow the strategies explained in the following pages. Of course, this will require you to invest in a disciplined manner, make certain lifestyle sacrifices and even tweak your retirement schedule. If you are ready to do all this, you have a fairly good chance of retiring the way you have always dreamt about it.

How to save Rs 1 crore in 15 years

The graphic above shows how disciplined investing can help you amass Rs 1 crore in 15 years. As the risk goes up, the required investment per month goes down. Your choice of the investment option should be guided by your ability to save the required amount and the risk you are willing to take. Insurance policies are low-risk but offer low returns and, therefore, require a very heavy investment. Equity funds have the potential to give high returns but also carry high risk. Instead of concentrating your investments in 1-2 of these options, you should ideally have your retirement savings spread across all these options.

FOCUS ON SAVING, NOT RETURNS

Don’t we all want to earn high returns from our investments? When you are in your 40s, haven’t saved too much, and have only 12-15 years to go for retirement, your focus should not be returns, but the quantum of your savings. Just tighten your belt and start saving aggressively, even if it means cutting down on your lifestyle. Any windfall, tax refund or other gain coming your way should be promptly salted away for your retirement.

Paying yourself first is a key tenet of financial planning. Advisers say you should put away at least 10-15% of your income into retirement savings every month. Given your situation, you might have to put away a bigger portion to reach your target. Do you have the necessary discipline to save month after month? One effective way of ensuring this is by opting for a higher deduction in the Voluntary Provident Fund (VPF). If you are covered under the Employees’ Provident Fund, you can ask your employer to deduct more than the mandatory 12% of your basic income that flows into your PF account every month.

The additional contribution will earn the same 8.5%, be eligible for deduction under Section 80C and will be tax-free on withdrawal. Delhi-based school teacher Rajini Singh (see picture) is contributing Rs 5,000 to the VPF every month over and above the mandatory contribution to the PF. “The money gets deducted from my pay, so there is no question of missing the instalment,” she says. The returns from the PF and PPF are lower than the 9-9.5% that bank deposits offer, but the interest earned on fixed and recurring deposits is taxable, so the post-tax returns are much lower at 6.5-8%, depending on your tax slab.

If you are not covered by the EPF, you can open a PPF account, which has an annual investment limit of Rs 1 lakh. If you need to put away more than this, you could consider the New Pension Scheme (NPS). The government-backed scheme works just like a mutual fund except that you cannot easily withdraw before 60 and must compulsorily use 40% of the corpus to buy an annuity for regular income. The NPS is a better option because it allows the investor to define his asset allocation and gives him a a dash of equities for higher returns.

Some experts might argue that the returns from these debt options will never be able to beat inflation, and if the same amount is invested in equities, the returns would be much higher. Indeed, if you put Rs 10,000 a month in the VPF, your corpus would grow to Rs 18.94 lakh in 10 years. If you put the same in an equity fund that gives 15% annualised returns, it would be significantly higher at Rs 27.86 lakh. However, unlike the PF, the returns of .. an equity fund are not assured but linked to the performance of the stock markets.

Besides, you can’t expect a fund to consistently deliver high returns over the longer term. Over time, even a good fund tends to slip, which means investors will have to keep rejigging their portfolios if they want to invest in the best schemes. Even then, it is impossible to predict how a certain fund will perform in the future. Reliance Vision was among the top-rated diversified funds 8-10 years ago. Today, it is a laggard that has underperformed its benchmark in the past 1, 3 and 5 years.

CUT DOWN ON RISK

When your finances are in a precarious situation, you have to reduce the risk and be content with lower returns. You can’t afford to gamble in order to make up for lost time. Retirement planning is not like a 20-over cricket match, where batsmen must play risky shots if the required run rate is very high. Experts say you should not rely on factors you can’t control. “Interest rates and the stock market’s performance are beyond your control, so don’t lean on them too much. You can control only two things— how much you save and spend—so focus on that,” says Sudipto Roy, business head of Principal Retirement Advisors.

To compensate for the lower returns from a safe option like the VPF, you can increase the quantum of savings. We compared the returns of 5 top-rated equity funds and found that despite the high returns, the value of SIP investments in these funds was lower than that you would get if you simply increased the contribution to the VPF by 10% every year (see table). To be sure, this is not a fair comparison because the VPF investment increased every year while the SIP investment remained static at Rs 10,000 per month. Yet, it shows how you can amass a significant amount without taking on any risk.

Reducing the risk does not mean you shun stocks completely. Equities are a volatile, yet rewarding, asset class, and there should be at least 10-15% allocation to stocks in your retirement portfolio. This allocation should be in good quality, large-cap stocks, not risky mid- and smallcaps. For best results, you can opt for a large-cap diversified fund or go for the low-cost NPS.

CUT DOWN WASTEFUL EXPENSES

Increasing the quantum of savings is not easy if you don’t have an investible surplus. This is where you need to bring in certain lifestyle changes and cut down on wasteful expenses. We don’t mean small savings that come from giving up dining out or putting your electronic gadgets on standby mode to save electricity. Instead, you need to think several times before you upgrade to a new car or buy that sleek smartphone launched last week. Investment guru Warren Buffett, who has a net worth of $40 billion, but leads a life of relative frugality, says that if you buy things you don’t need, you may soon have to sell the things you need (see box).

If you are a spendthrift, here’s a tip: put your credit cards in the locker and use cash when you go to the mall next time. Studies show that when you pay cash, it pinches more than if you were to swipe your card. Though you end up paying the same amount, the very thought of cash going out of your hands reins you in, while the credit card encourages you to spend.

The changes you bring in your lifestyle now might be a tad difficult, but believe us, they will be far less painful than the ones that might be required to in 10-20 years if you don’t do this now. Dropping your wife at the library before you head for the club on a Sunday morning may seem like a dream retirement. However, it can be a nightmare if your wife has been forced to take up part-time job at the library while you work as a temporary accountant at the club to make ends meet.

REVIEW YOUR RETIREMENT PLAN

You may have planned for a certain income level during retirement, but if your savings are not enough, you must scale down your expectations. Delhi-based finance professional Sanjay Goel and his schoolteacher wife Madhu had planned to save Rs 3 crore for their retirement. However, Sanjay has lost his earlier contributions to the PF due to bungling by his former employer. So, the Goels have had to rejig their retirement plan. “We will have to make do with a lower retirement corpus and scale down some of our plans,” says Sanjay. The couple is now looking at saving Rs 2 crore over the next 11 years.

If your retirement goal is still too daunting, you might have to postpone your retirement by a few years. This can make a significant difference because the longer you work, the more you are able to save. Besides, the period of withdrawals shortens, so the required corpus is smaller.

Extending retirement is not always possible and much will depend on whether there is demand for your skills and the condition of your health when the time comes. To ensure gainful employment after retirement, keep in touch with the latest developments in your industry and develop a network of people who matter. Above all, maintain good health so that you can shoulder the burden of work as a senior citizen.

CONSIDER REVERSE MORTGAGE