Tagged: Mutual Fund

ATM :: Markets closed, but that need not stop you from investing!

Imagine a platform for investments where you do not need to worry about whether the market or the MF office is still open.

Rohit Ambosta | May 01, 2018 09:28 AM IST | Source: Moneycontrol.com

What are the trading timings for the stock markets in India? When can you walk into a mutual fund office and invest in mutual funds? Obviously, you can only trade when the market is functioning between 9 am and 3.30 pm. Similarly, you can only walk into a mutual fund office and execute transactions when the office is functioning, which is typically between 10 am to 5 pm. What if you want to invest in mutual fund because you just got a credit amount into your bank account at 6 pm on Friday? You will typically have to wait till Monday morning, talk to your advisor and then walk into the mutual fund office and submit your application for an equity fund along with your cheque for the amount. But, what if all these timings could really cease to matter very soon? Here is how…

Welcome to the anywhere and anytime financial market

The legendary investor Warren Buffett rightly said that to be successful you have to work hard for your money but if you really want to be wealthy then you have to make the money work hard for you. Imagine a platform for investments where you do not need to worry about whether the market or the MF office is still open. You just log into an online platform on your computer and execute the buy or sell trade. Of course, the actual execution may happen on the next day but as far as you are concerned you have done your job. You have transcended the constraints of time and place and managed to execute your financial transaction at the time and place of your choice.

This is a dual advantage for you. Firstly, you can execute the transaction at the time of your choice; that is whenever you are free. You do not really have to worry about whether the mutual fund office is open or whether the market is functioning. You just open your system, punch in the details and the order is logged into the system. Execution is then just a matter of formality. You can also execute anywhere. It is immaterial whether you are at home or office or attending a wedding. You do not even need access to a computer or laptop since these days you could download this entire platform on an App and execute all your transactions from your smart phone itself.

How to make an informed decision anytime and anywhere?

That is the logical next question. You obviously cannot talk to your advisor in the midst of the melee. Also, you do not have access to all your existing investment documents. There is a solution which the platform can offer. Imagine that the platform assists you at two levels. Your entire financial plan and the details of investments held by you are clearly documented and stored in the platform itself. That means you can access your portfolio and your plan 24X7 from any part of the world. So, your portfolio reference point is always available with you. Now the bigger challenge is getting the right advice before investing.

That is where machine intelligence comes into play. Did you know that there is a way of getting advice that is entirely free of emotional bias? That is called algorithm driven advisory. This is not some black box program throwing up esoteric solutions based on a methodology you do not understand. The algorithms are designed to help you make an informed decision. It is based on the use of big data and many years of expert research to tabulate all the investment opportunities on one side and then again use big data to mine and create a picture perfect investment-needs profile of yours. When you combine the two you have a neat solution. All that you have to do is to click a button to say OK. That is surely a lot simpler.

Monitoring and rebalancing my portfolio when required…

So you have managed to get advice at the place of your choice and invested at the time of your choice. Can you also monitor your investments at the place and time of your choice? The answer is an emphatic “Yes”. When we talk of monitoring, we not only refer to the portfolio evaluation but also whether the portfolio of investments is in tune with the original financial plan. Has any sector outperformed? Has any sector underperformed? Have valuations become too steep. The beauty of having such a big data driven platform is that it not only helps you with such analytics but also gives you the answers. What should you do if you are overinvested in a sector? Which funds can you shift out of and which funds can you shift into? How to rebalance your entire portfolio mix and then execute with the click of a button? All these can be done from the comfort of your chair!

The big question, therefore, is can this kind of a platform do everything which can be managed by human advisors? The difference could lie in the use of big data. That could be well be the future of investing!

(The writer is CIO, Angel Broking)

Source: https://bit.ly/2FDKW3W

ATM :: What should you do if your fund gets a new name and strategy?

Existing mutual fund investors would need to evaluate their schemes if they change their strategies substantially in order to ensure they are still in sync with their financial goals and asset allocation

Kayezad E. Adajania | Last Published: Tue, May 01 2018. 10 30 PM IST | LiveMint

HDFC Prudence Fund (HPF), the country’s largest equity-oriented mutual fund scheme with assets close to Rs37,000 crore, will now be known as HDFC Balanced Advantage Fund and can switch entirely between equities and debt. Until now, it could invest only 40-75% in equities. On 25 April, HDFC Asset Management Co. Ltd announced plans for many of its schemes, as part of the ongoing merger and re-categorisation exercise.

Most other fund houses, too, have announced their plans to re-categorise their schemes. If you don’t agree with your schemes’ new form, you have a chance to exit without paying an exit load. Here’s how you should decide what to do.

Your scheme could change…

If there is no change to your scheme, you have nothing to worry about. But if your scheme is about to change, check how big or small it is. For instance, if you own a large-cap fund that is set to become a large- and mid-cap fund or a multi-cap fund, it won’t matter much. In fact, this particular move is good, said Prateek Pant, head of product & solutions at Sanctum Wealth Management. “Going ahead, it will get difficult for large-cap funds to outperform their benchmark indices. The definition of large-cap fund has narrowed down and benchmarking performances against total returns index would make things tougher for large-cap funds,” he said. Read more here.

If your scheme undergoes a big change, evaluate. For instance, SBI Treasury Advantage Fund, which will be known as SBI Banking and PSU Fund, was meant for short-term investments. Now, its strategy would be to invest in debt scrips of state-owned companies and banks. “If the risk profile of a scheme changes, look at it again. If it no longer meets your purpose, leave it,” said Vidya Bala, head-mutual fund research, Fundsindia.com.

…but do not jump the gun

Don’t blindly go by the change in your fund category. Mirae Asset Emerging Bluechip Fund (MEBF)—an erstwhile mid-cap fund—has become a large- and mid-cap fund. The name remains the same, and, what’s more, the fund remains the same too.

On the face of it, a shift from a mid-cap to a large- and mid-cap fund is a big change. But dig a little deeper and you might not want to worry about it. According to capital markets regulator Securities and Exchange Board of India (Sebi), a large- and mid-cap fund must invest a minimum of 35% each in large- and mid-cap stocks. As it turns out, MEBF has been increasing its exposure to large-cap companies over time; from an average of 20% in 2014 and 26% in 2015 to 38% so far this year, as per Value Research.

“We didn’t want to tamper our existing portfolios too much. So, whichever categories our funds fitted into naturally, we have moved our funds there,” said Swarup Mohanty, chief executive officer, Mirae Asset Global Investments (India) Pvt. Ltd. HPF, too, remains the same. Although a dynamic category fund can switch entirely between equity and debt, a person close to HPF said it can—and will—continue to invest 65-70% in equities like always. Of course, how the fund performs in falling markets in the face of its present equity allocation remains to be seen as the fund will now be compared to other dynamic funds. HPF refused to comment.

The tax implications

If your scheme merges with another or ceases to exist, there are no tax implications. If, however, you choose to withdraw, you may have to pay short-term capital gains tax of 15% (plus surcharge and cess) if you had bought the units in the past one year or long-term capital gains tax, otherwise.

The only respite is you don’t pay an exit load, if any, even if you withdraw within the exit load period.

What should you do?

Each merger and re-categorisation poses a unique situation. How one investor reacts to a change could be different from another investor’s reaction. Sit with your financial adviser to understand the ramifications of your scheme changes. But here are some broad principles you should follow.

* If your scheme’s risk profile increases a little, there is no cause for alarm. For instance, a large-cap fund becoming a large- and mid-cap fund is acceptable. If your scheme’s risk profile increases a lot, take a closer look. For instance, SBI Magnum Equity Fund (a large-cap fund) is now a thematic fund SBI Magnum Equity ESG (Environment, Social, and Governance).

* Just because the fund has changed its category or name does not necessarily mean the scheme has changed. Check if the scheme will continue with its strategy.

* But if the scheme’s objective has changed—especially due to a merger with some other scheme—evaluate it. HDFC Gilt (government securities) Fund – short-term plan will now be merged with HDFC Corporate Bond Fund. Both schemes are different.

* New investors, beware. Past performance is set to become a bit hazier, especially for those schemes that have to alter their strategies, for the next three years. In this case, check who the fund manager is, and go by his track record.

* Debt funds are trickiest to navigate in this exercise. The good news is that they’ve become sharper and each of them now comes with a well-defined objective. Revamp your entire debt schemes portfolio.

Source: https://bit.ly/2HILziu

ATM :: Essentials Young Investors Must Know Before Investing in Mutual Funds via SIP

By SiliconIndia | Tuesday, May 1, 2018

A Systematic Investment Plan (SIP) is the best investment option for many investors – especially if you’re a young person, just beginning your investment journey. A SIP is a low-risk move, ideal for those who are in it for the long haul because else, the returns tend to be low. A steady investment of even Rs.500 per month has the potential to generate decent returns in the long run without putting a major dent in your pocket. But like all other investment options, it’s never wise to put in your money unless you’re well informed. Here are some things you must keep in mind when investing in Mutual Funds via SIPs.

– What exactly is a SIP?

A SIP lets you invest small amounts regularly in equities, debts and other kinds of mutual funds. It involves you buying units of any (or many) Mutual Funds of your choosing by investing a minimum of Rs. 500 per month. It is then up to you to redeem your units at any point in time. A SIP is ideal for younger investors since it practically guarantees good returns with a lower risk of capital loss. It bridges the gap between high-risk options like equities and low-risk options which may not produce returns.

– The Power of Compounding

There is a thumb rule talking about investments. The truth is that the longer you keep your money in a fund, the more money is likely to be generated over time. This is where young investors have an edge over older ones. If you’re 40 and want to begin investing in a retirement fund, you’re 18 years behind those who began at 22. The 22-year olds are likely to generate higher returnsprimarily because of the compounding effect. Start as early as possible.

– Be Informed

No investment option is completely risk-free and investing in the wrong fund may end up being a grave error. You can never be too careful with where to put your money. It’s always better to look at the past performance of any mutual fund you decide to put your money into. Of course, this is not possible if it’s a new mutual fund. Try to ensure that the mutual fund you pick has been around for a few years at the very least before investing your money. You don’t want to be risking letting it all go to waste, do you?

Your fundsare distributed into a set of pre-decided companies from numerous sectors. These companies are usually mentioned in the prospectus, and you’re free to check up on them. In the interest of staying informed, it is advisable to check out all the companies mentioned.After all, it’s your money that will help fund its future endeavors, and you have every right to know what it’s being used for. Read up on the companies, the industries and the sectors that your mutual fund is investing in, and analyze whether they are ones you’re comfortable with, or if they’re ones you’d like your money to be invested into.

– Your Own Goals

Don’t just start investing because it’s the “in” thing and everyone around you is doing it. If you really want to gain from your investment, align it with your goals. Whether that goal is to buy your dream car after 10 years or to generate enough capital to start your own business in 15 years, or even go to the vacation you always wanted – your end goal and the money it’ll require should be fixed in your mind as early as possible. Once that’s settled, you can go about looking at what exactly to invest in and how much to put into it every month. For example, if your goal is to buy a car costing ?30 lakhs in 15 years, you can’t invest in something that’ll give you any less than that at the given time.

– Market Risks

Mutual Funds Schemes can be considered low-risk and safe to the extent that they are regulated by the Securities and Exchange Board of India (SEBI), and the fact that companies must have a minimum net worth to be eligible for mutual fund investments. However, fraud is a very real possibility and the less informed can easily be ensnared. Technicalities are everything here, so always read the terms and conditions thoroughly. Only pick a SEBI registered investment adviser.

– Choosing the Right Scheme

Mutual fund selection depends on the kind of an investor you as an individual, are. If your goals are long-term and you can handle risk, you could invest in equity schemes. If you’re more of a moderate investor with a lower of appetite for risk, you should consider investing in large cap or multi-cap mutual funds (that is, large companies or multiple companies) which tend to have lower exposure to risks. This is because such funds are channeled into companies which are comparatively stable. If you’re more aggressive and don’t mind the risk, invest in small cap or mid cap funds instead.

– Choosing the Right Bank and Date

This may not look very significant, but it’s actually pretty important. The general practice is for the plan to directly take money from your bank account monthly (or at whatever regular interval you have fixed). So, the date you fix should be keeping in mind that the account isn’t low on funds when the money is cut. Keep your balance at a minimum of at least the investment amount, and make sure you set the date of investment as one which is placed after you get your income (salary, rental income, etc.).

Be careful not to use an account that you hardly use otherwise, sincethere’s a higher chance of it running into issues of insufficient funds around the time your SIP debit is due.

Get Started Now

Once you’ve understood these essentials of mutual fund investments, it gets fairly easy to take a plunge as an investor and start crafting your investment goals. Get started now. The sooner you do, the more the returns! Remember the power of compounding?

Source: https://bit.ly/2jq1iEH

ATM :: Mutual fund investing: Basic facts to know while investing in balanced funds

Balanced Funds have an overall equity spread of almost 65% either in the large, mid or small cap stocks.

Navneet Dubey | Apr 04, 2018 11:27 AM IST | Source: Moneycontrol.com

Balance funds are the funds which have exposure to two main asset classes – equity and debt. This fund gives you exposure to stocks as well as money market instrument. These funds have the equity orientation as around 65% of your monies get invested in equity and remaining 35% in debt funds. The risk associated towards equity exposure is almost of the same amount as the risk is associated with any normal equity fund do have. So, are these balanced mutual funds really ‘balanced’ enough? SEBI has recently proposed to change the name of the balanced fund into three categories – Aggressive Hybrid Fund, Balanced Hybrid Fund and Conservative Hybrid Fund.

We bring you the main features of balanced funds and tell you how to go about making the most of your investment in them:

What does the equity spread consist of?

Balanced funds have an overall equity spread of almost 65% either in the large, mid or small cap which can be extended even towards micro-cap funds. Having flexibility towards too many categorisations, the fund manager gets the liberty to choose stocks, however, that may welcome more risk to your portfolio. Therefore, check the holdings before investing in these balanced funds as the range between mid-caps to micro-cap can be risky if you are a conservative investor.

What are new balanced funds?

As per the regulator (SEBI), the categorization of these balanced funds will get further differentiated into various sub-heads to provide more clarity to mutual fund investors. These can be termed as follows:

The Aggressive Hybrid Fund: It will invest in equities & equity related instruments between 65% and 80% of total assets and debt instruments between 20% and 35% of total assets.

The Balanced Hybrid Fund: It will invest in equities & equity related instruments between 40% and 60% of total assets and debt instruments between 40% and 60% of total assets. However, no arbitrage would be permitted in the scheme.

The Conservative Hybrid Fund: It will invest in equities and its related instrument between 10% to 25% of overall assets and debt instruments between 75% and 90% of total assets.

Other hybrid funds which investors can further look to make investments can be – Arbitrage fund, Dynamic asset allocation fund and Multi-asset allocation funds.

To provide more clarity to investors, these new categories of balanced funds termed as new types of hybrid funds will help investors to understand their funds in a much better way. Not only this, fund managers will also get clarity to structure their fund as per new rules, getting clear direction as to which stocks to select while designing the scheme. Hopefully, in future, there may be no room for confusion while selecting balanced funds for investing and switching between high risky to a less risky portfolio.

Tax treatment: Debt and equity-oriented funds

Currently, all the balanced funds today are having an average exposure of 65% to equities, they come under the ambit of equity oriented fund. However, in future the new conservative hybrid funds can get debt tax treatment as more of the exposure is tuned towards debt asset class.

However, in overall mutual fund taxation structure, equity funds and debt funds are taxed as below:

Equity Oriented Fund

LTCG: There is no long-term capital gain tax on equity funds after one year if gains do not exceed Rs 1 lakh. However, if capital gains exceed Rs 1 Lakh, the realised amount will get taxed at 10%.

STCG: Short-term gains are taxed at 15%. Where gains are realised within one year.

Debt Oriented Fund

LTCG: These mutual fund schemes are taxed at 20% long-term capital gain tax and

STCG: When realised within 3 years, these are taxed at marginal tax rate where a maximum taxation of 30% can be applied to short-term capital gain tax for both Resident Individuals & HUF.

Source: https://bit.ly/2qhYwFj

ATM :: In love with largecaps? Here are 20 stocks in which 4 top MFs are betting on

After the recent correction valuations of most of the mid & small caps as well as largecaps have come to more reasonable levels, but are still not in lucrative.

Kshitij Anand | Apr 04, 2018 09:27 AM IST | Source: Moneycontrol.com

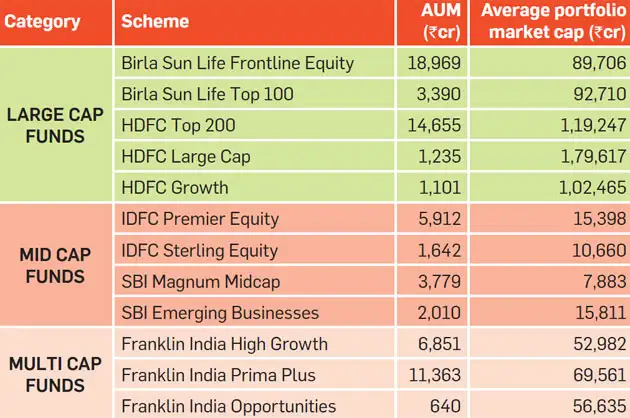

So where are fund managers betting your money in FY18? Well, a close look at the funds which outperformed benchmark indices in the largecap space suggested that fund managers are in no mood for experiments.

They stuck to quality stocks despite volatility, according to data collated from Morningstar India database. Five funds which outperformed Nifty include names like Invesco India Growth which rose 18.9 percent, followed by BOI AXA Equity which gained 18.09 percent, BOI AXA Equity Regular rose 17.13 percent, and Edelweiss Equity Opportunities Fund rose 16.46 percent.

A close look at the stocks in which some of these funds have made their investments include names like HDFC Bank, RIL, Maruti Suzuki, ICICI Bank, Graphite India, L&T, IndusInd Bank, IIFL Holdings, HDFC, Avenue Supermarts, TCS, Sterlite Technologies, and Escorts etc. among others.

The rally was not as swift among the benchmark indices which rose 10-11 percent in the last 12 months. After a blockbuster 2017 and FY18, all eyes are on FY19 which according to most experts belong to largecaps.

Mid & smallcaps outperformed largecaps by a wide margin in the year 2017, but for FY19, most analysts suggest investors not to ignore this space. One possible reason is attractive valuations compared to mid & smallcaps.

Street expectations are for at least high-teens earnings growth in large-caps and about 20 percent earnings growth in mid-caps and small-caps. But, for investors, a healthy balance of large and midcap funds would make a strong portfolio.

“Performance of stocks in FY19 will depend on the quality of companies, quality of managements, balance sheet performances and profitability. FY19 will not be as easy as FY18 when markets were at an all-time high,” Jagannadham Thunuguntla, Sr. VP and Head of Research (Wealth), Centrum Broking Limited told Moneycontrol.

“The year 2018 will differentiate men from boys. We recommend that 50-60% of capital should be parked in large caps, 20-40% in mid& small caps and 10-20% in thematic stocks,” he said.

After the recent correction valuations of most of the mid & small caps as well as largecaps have come to more reasonable levels, but are still not in lucrative. The best strategy for investors is to use the mutual fund route to invest in quality largecaps as well as midcaps.

“On a broader portfolio basis, for a person in the age bracket of 35-40 years, the exposure to direct equity should also ideally be around 50-60% while the rest could be spread across other avenues of investments,” JK Jain, head of equity research at Karvy Stock Broking told Moneycontrol.

“A mixture of flagship mutual funds schemes from different segments like Largecap, Midcap, Balanced and Multicap funds, which have delivered in the past must be a part of one’s portfolio,” he said.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Source: https://bit.ly/2v4u3iG

NTH :: Have they changed the name of your favourite mutual fund scheme? Here’s what you should do

To ensure that all schemes launched by mutual funds are distinct in terms of asset allocation and investment strategy, SEBI proposed categorisation and rationalisation of mutual fund schemes.

Nikhil Walavalkar | Mar 16, 2018 02:24 PM IST | Source: Moneycontrol.com

Mutual funds are busy changing the names of their schemes. Securities Exchange Board of India’s (Sebi) directive on the rationalisation and categorisation of mutual fund schemes has made mutual funds to drop the fancy names and fall in line. The idea is to simplify the process of understanding the mutual fund offerings and choosing schemes for investments by investors. But as the names change, there are some investors who may start worrying about their investments. If the investment you have invested into has disappeared or renamed do not get worked up. Do read on to understand how it impacts you.

What happened?

To ensure that all schemes launched by mutual funds are distinct in terms of asset allocation and investment strategy, SEBI proposed categorisation and rationalisation of mutual fund schemes. The SEBI prescription allows fund houses to offer schemes in 10 types of equity funds, 16 categories of bond funds and 6 categories of hybrid funds. Fund houses are also allowed to launch index funds, fund of funds and solution oriented schemes.

“SEBI has clearly defined norms and the asset allocation and the norms that will specify each category,” says Rupesh Bhansali, head of mutual funds, GEPL Capital. For example, a large cap fund must invest at least 80% of the money in large cap stocks. Large cap stocks are defined as top 100 companies in terms of full market capitalisation. “By introducing these norms the regulator has ensured that the apple to apple comparison of mutual fund schemes is possible,” says Bhansali.

The mutual fund houses too have started responding with change in names and investment strategy of the schemes, wherever applicable. For example, DSP Blackrock Focus 25 Fund is renamed as DSP Blackrock Focus Fund. Analysts used to treat it as a large cap fund so far. However, going ahead it will be placed in Focused Fund category.

The process of aligning with the SEBI norms will go on for a while and more fund houses will make necessary changes. The process however should not stop you from investing in mutual funds.

“Investors should first understand the category of mutual funds as each one of these has distinct characteristics,” says Swarup Mohanty, CEO of Mirae Asset Mutual Fund. Find out where your scheme is going to be placed and see what kind of investment strategy it will employ.

“If the scheme’s investment strategy and portfolio construction changes, then there is a very high possibility of changes in risks and returns associated with investing in that scheme,” Renu Pothen, head of research, FundSuperMart.com. For example, if a fund that was a primarily large cap scheme is shifted to a large and mid-cap scheme, then the risk associated with the scheme goes up as the fund manager invests minimum 35% of the money in mid cap companies. Possible higher returns come on the back of higher risks.

“The investor must assess the risk-reward in the light of his financial goals and his risk appetite before investing in that scheme. If there is a mismatch between the investor’s risk profile and the risk-reward offered by the scheme, the investor will be better off selling out his existing investments. He can look for better options elsewhere,” says Renu Pothen. While exiting a mutual fund scheme, there are implications such as exit loads and capital gains, which investors should not ignore.

“When there is a change in fundamental attribute of the scheme, the investors are given exit option without any exit load,” points out Bhansali. This exit option is not at all compulsory and should be availed if and only if there is a mismatch between your expectations and the offering. However, the capital gains will be payable in case of redemption in bond funds. Though the exits in current financial year from equity funds will lead to no tax on long term capital gains, the same will attract 10% tax after April 1, in case the gains exceed Rs 1 lakh.

Changes in regulatory framework and volatile markets may add to worries of mutual fund investors. However, mutual fund investors must take this opportunity to relook at their investment plans, say experts. If you do not understand the fine nuances of equity funds, better stick to multicap funds and let the fund manager decide what asset allocation should be within equity as an asset class.

“It is time to reassess your risk profile. Do not get carried away with high returns over last couple of years. Instead be realistic with your return expectation while building your financial plans and use short term volatility to your advantage by investing through systematic investment plan,” advises Mohanty.

Source: https://goo.gl/6FXbMV

ATM :: These are best equity mutual funds to invest in 2018

TIMESOFINDIA.COM | Updated: Jan 10, 2018, 14:44 IST

NEW DELHI: Markets in 2018 are continuing its bull run with both BSE Sensex and NSE Nifty crossing the psychological levels. The 50-share barometer Nifty on Monday breached the 10,600-mark and the 30-share Sensex rose above the 34,350-mark. With the markets outperforming, investments in equity funds are also giving pretty good returns, a data from Value Research showed.

Let us take a look on which funds can be your best bet amid this bull run:

As per the data, these are top bets in equity funds:

Equity: Large cap

* Mirae Asset India Opportunities Fund: With 36.6 per cent return for a year followed by 15.17 per cent and 20.17 per cent in three and five years respectively. (Note: Three-year and five-year returns are annualised.)

* JM Core 11 Fund: 38.91 per cent in the first year along with 14.76 per cent and 17.31 for the third and fifth year.

* Kotak Select Focus Fund: Returns of 31.99 per cent for one year. 14.21 per cent and 19.84 for three and five years respectively.

Equity: Mid Cap

* Mirae Asset Emerging Bluechip: 46.22 per cent for the first year. 23.22 per cent and 30.19 for three-year and five-year respectively.

* L&T Midcap fund: 1-year investment fetched 50.13 per cent returns, while three-year and five-year drew 22.24 per cent and 28.53 per cent returns.

* Aditya Birla Sun Life Pure Value: 52.46 per cent in first year. 20.59 per cent and 29.65 for three-year and five-year respectively.

Equity: Multi Cap

* Motilal Oswal Most Focused: 40.2 per cent returns for a year and 20.06 per cent for three-year.

* Reliance ETF Junior BeES: One-year investment garnered 43.92, while three-year and five-year fetched 18.41 per cent and 20.05 per cent respectively.

* ICICI Prudential Nifty Next 50: 43.3 per cent returns in the first year. 18.06 per cent and 19.77 per cent in the third and the fifth year.

Equity: Tax Planning

* Tata India Tax Savings Fund: 42.95 per cent in the first year followed by 17.9 per cent in third year and 21.17 per cent in fifth year. Also, the fund has given 18 per cent returns in the past three years and its three-year is the highest in the category.

* IDFC Tax Advantage Fund: 51.71 per cent in one-year, while 17.56 per cent and 21.48 per cent for three-year and five-year respectively.

* L&T Tax Advantage Fund: Returns of 42.43 per cent in one-year. 16.36 per cent and 19.47 per cent in the third and fifth year.

Hybrid: Equity-Oriented

* Tata Retirement Savings Fund: 36.56 per cent, 16.09 per cent and 20.05 per cent returns in first, third and fifth year.

* Principal Balanced Fund: Returns of 35.65 per cent, 15.56 per cent and 17.26 per cent for one, three and five-year.

* L&T India Prudence Fund: 26.52 per cent in the first year, while 13.27 per cent and 18.01 per cent returns in three and five-year respectively.

Debt: Income

* Franklin India Income Builder: 7.52 per cent, 8.39 per cent and 9.03 per cent for one, three and five years.

* SBI Regular Savings Fund: Returns of 7.35 per cent, 9.28 per cent and 9.56 per cent in first, third and fifth year.

* Invesco India Medium Term: 7.1 per cent, 8.17 per cent and 8.12 per cent for one-year, three-year and five-year respectively.

Source: https://goo.gl/LyPuJJ

ATM :: How to become rich fast at a young age in India: 5 amazing investment strategies to follow before you turn 30

Everyone wants to be financially secure and well off by the age of 35-40. However, when we are in our 20’s, we tend to live life in the moment and forget saving for the future.

By: Sanjeev Sinha | Updated: November 27, 2017 2:25 PM | Financial Express

All of us have various financial goals in life. Everyone wants to be financially secure and well off by the age of 35-40. However, when we are in our 20’s, we tend to live life in the moment and forget saving for the future. This is not the right approach towards creating wealth. Therefore, to ensure that you are financially secure and on the right track with your money, here are 5 important investments that you must make before you hit your 30-year milestone:

1. Investment towards tax saving

Considering that you are working and earning, it is important for you to assess your tax liability and take advantage of tax deductions available under Section 80C of the Income Tax Act. “By proper tax planning, you can not only reduce your tax liability but also save some more to invest towards your other goals. One of the best tax-saving instruments is Equity-Linked Savings Schemes (ELSS). It is a type of open-ended equity mutual fund wherein an investor can avail a deduction u/s 80C up to Rs 1.50 lakh for a financial year,” says Amar Pandit, CFA and Founder & Chief Happiness Officer at HapynessFactory.in.

2. Investment towards emergency corpus

There are various events like accidents, illnesses and other unforeseen events that we may encounter in our lives. These events should never occur, but if they do, one needs to be adequately prepared for the same. In critical cases, such events may hamper one’s ability to work and may even lead to a loss in earnings for a few months or years. Hence, “it is advisable to build a contingency corpus, which is equivalent to at least 5-6 months of living expenses. Further, your emergency fund should be safe and easily accessible (liquid in nature) at short notice, in case of an emergency. Hence, savings bank accounts and liquid mutual funds are two options for setting aside the emergency corpus. However, considering that liquid and ultra-short term mutual funds are more tax efficient in nature, it is advisable to park a major portion of your corpus in the same,” says Pandit.

3. Investment towards long-term goals

It is very important to save and invest towards your long-term goals such as marriage, buying a house, starting your own venture, retirement, and so on. You must start with determining how much each goal will need and the savings required to achieve the goal. Once the corpus is fixed, you can invest towards the goal regularly. As an investment strategy, start fixed monthly investments – SIPs (Systematic Investment Plan) in mutual funds. Always remember, the earlier you start investing towards your goals, the longer time your investments will have to grow and the more you will benefit from the power of compounding. Equity mutual funds which are growth oriented are a preferable investment option for long-term goals.

4. Investment towards short-term goals

There are many short-term goals that are recurring in nature, such annual vacation, buying a car or any asset in the near term and so on. For such goals, you are advised to park your funds in liquid or arbitrage mutual funds rather than a savings account. “Mutual funds are more tax efficient than savings accounts and also there are different funds for different time horizons. For example, for goals to be achieved within a year, you can opt for liquid or ultra-short term funds whereas for goals to be achieved post one year, you can opt for arbitrage funds,” advises Pandit.

5. Investment towards health and life cover

Life and health insurance typically are not supposed to be considered as investments. However, both are very important and must be considered as one of the priority money move to be made before turning 30. If you are earning and have a family dependent on you, you must assess and buy the right life insurance term cover for yourself. Further, with costs of health care and medical on the rise, any untoward illness without sufficient cover will have you dip into capital which is unnecessary. Hence, there cannot be any compromise on health insurance. Thankfully, there are various health covers available in the market today. You should opt for the right cover for yourself, depending on your needs and post considering all the options.

Source: https://goo.gl/Abf7TR

ATM :: How to choose Mutual Funds or Stocks for your investments

By pooling a lot of stocks or bonds, mutual funds reduce the risk of investing.

By ZeeBiz WebTeam | Updated: Wed, Nov 29, 2017 12:59 pm | ZeeBiz.com

Both stocks and mutual funds market are booming in India, but as an investor, we are often confused to choose between the two for our investment plans.

Investment in equity, bonds or funds comes with higher risk and higher reward, therefore, it is always better to first study about the scheme we plan to invest.

Mutual funds:

Mutual fund scheme is a pool of savings contributed by multiple investors. The term ‘mutual’ fund means that all risks, rewards, gains or losses pertaining to, or arising from the investments made out of this savings pool are shared by all investors in proportion to their contributions.

There are wide-range of mutual funds in India like – equity, debt, money market, hybrid or balanced, sector-related, index funds, tax-savings fund and lastly fund of funds.

Stock Market

Stock market are usually interesting source of income for both companies and share holders. Under the stock market, anyone can buy stakes of a company in whom they have faith.

Companies which have received better ratings by agencies are generally preferred the most. No matter what may be the circumstances, an investor holds on to the company’s stake for their regular source of income.

Which one is better for investment?

According to Motilal Oswal, if you are typically in your 20s to 30s belt, you can start building your investment portfolio with the help of mutual funds. You need to start off with a very minimum capital and you can find that your investment keeps growing at a gradual space.

The agency believes that for first-time investors, the mutual funds offer a tremendous scope for growth as your funds are invested in diversified forms of revenue generating sources.

On the other hand, Motilal believes that if an investor belongs to late 40s up until 70s of their age and are also seasoned investors, then investing in stocks is a good idea.

It further said that decades of exposure to the financial market helps you gauge the right type of equities, shares or stocks, you need to invest your money in.

Among many advantages of investing in mutual funds is that you can appoint fund managers to select funds, track performance, make appropriate asset allocations and cash-in your profits for you.

These managers try to ensure that an investor’s portfolio consists of well-performing funds, rather than those that might drag down the overall investment returns.

In case, you are stock market investor, and sell your holding within a period of one year, then you have to pay 15% as short-term capital gains tax.

As for mutual funds, there are no gains tax levied on the stocks that are sold by the fund. But one needs to remember that an investor must hold equity funds for a minimum of one year (the longer, the better, really) if they want to avoid paying capital gains tax on the investments.

If you venture into stock investments on your own, brokerage costs of 0.5-1% will be a common expense. Apart from this, you will also have to pay for demat charges.

BankBazaar stated that mutual funds pay only a fraction of the brokerage costs compared to what is charged to individual investors. Investors in Mutual Funds do not need demat accounts.

A well-diversified investment portfolio ideally has around 25-30 stocks, and this kind of portfolio is only achievable with a sizable corpus.

With investment in mutual funds, an investors can buy a certain number of funds which can be invested in various stocks.

Source: https://goo.gl/8BtHrp

ATM :: Mistakes to avoid while investing in ELSS mutual funds

The primary objectives of ELSS investments are long-term capital growth and tax saving.

Navneet Dubey | Nov 10, 2017 09:47 AM IST | Source: Moneycontrol.com

Most investors who invest in equity-linked savings scheme (ELSS) do so to save taxes under Section 80C of Income Tax Act. However, they tend to forget that the ELSS schemes can also help them to achieve their financial goal if they remain invested for a long time.

“The primary objective of ELSS investment is long-term capital growth and tax saving. Superior long-term growth is facilitated by the power of compounding. Power of compounding works best over a long investment horizon when gains are reinvested every time they accrue,” said Rahul Parikh, CEO, Bajaj Capital.

The schemes under ELSS category also gives you high inflation-beating returns, similar to PPF they also provide you EEE (exempt-exempt-exempt) benefit.

However, make sure you don’t commit the usual mistakes while investing in ELSS. Here are some of the common mistakes investors make while investing in these schemes:

Trying to time the market: Do not try to time the market when you are investing. Unless you have seasoned investors with a phenomenal understanding of the market, the chances are that you might not be able to identify the precise time to invest.

Ajit Narasimhan, Head – Savings and Investments, BankBazaar said that there is a high amount of uncertainty which makes it next to impossible to correctly predict events or their impact on the market and hence to time the market. Instead, focus on identifying a few good funds. Once you invest, have the patience to ride through the rough and tumble of the stock markets. “Equity investments grow by staying systematically invested for the long run. This is what makes SIP a good option as it averages the cost of investment over time and cancels out the effect of price fluctuation in the market,” he said

Not understanding the fund category: It very important to understand that most of the AMC’s design their ELSS tax saving mutual fund scheme on the basis of large cap, mid cap/small cap and accordingly their risk and returns vary. Here it is vital to first know your risk taking capacity that whether you will be able to risk or not. Take help from your financial adviser to know all holdings mentioned in your scheme and then choose the fund accordingly.

Investing at the last minute: Investment should be a planned activity and not at the spur of the moment.

Narasimhan points out for investments to be successful and provide the required returns, investors should have a financial goal in mind and a plan to work towards it. Leaving it to the last minute can lead to insufficient time to set your goals or create a viable investment plan. “Lack of time may imply that you may have to cut down your research and depend on someone else’s research and opinion to base your investment. This can be very dangerous as the goals, requirements, and risk appetite may not match. It may also cause the investor to invest in one go instead of small regular SIPs. This is an important factor as SIPs provide price averaging and take away the need to time markets,” he said.

Redeeming soon after the lock-in period ends: Minimum investment time period in equities should ideally be for 5-7 years and when you take a decision of redeeming your units before time as mentioned thereon, you may not gain much from it. The longer you remain invested, the more you gain from compounding effect and rupee cost averaging principle. You should always link your investment with a long time horizon financial goal.

Investing in too many funds: ELSS funds have a lock-in of 3 years, If you are investing in too many funds of the same category then it may become difficult for you to review your portfolio since you cannot exit before 3 years. Moreover, too much of diversification may also not help you in proper asset class analysis.

Choosing the dividend option: You should opt for growth option while investing in ELSS mutual fund schemes because if you opt for the dividend, you can lose on gaining from compounding effect. Parikh also said that investing in a growth option ensures that gains are reinvested and grow at the same rate as the principal investment. “However, in dividend payout option, the gains are not reinvested but are paid out and hence not available for compounding, resulting in lower long-term returns. When investing for long-term capital growth in any of the equity mutual fund, one should opt for the growth option,” Parikh said.

Source: https://goo.gl/C2WCyP

NTH :: 6 ways new classification of mutual fund schemes will impact the investor

By Sanket Dhanorkar, ET Bureau|Updated: Oct 16, 2017, 11.20 AM IST

The Securities and Exchange Board of India (Sebi) has asked fund houses to classify their schemes into clearly defined categories. For long, there were no clear guidelines to categorise mutual funds. Fund houses even launched multiple schemes under each category, making scheme selection a confusing exercise for investors. To introduce clarity, Sebi has now asked fund houses to have just one scheme per category, with the exception of index funds, fund of funds and sector or thematic schemes.Mutual funds which have multiple products in a category will have to merge, wind up, or change the fundamental attributes of their products.

Simplification of choice, fewer options

At the broadest level, mutual funds will now be classified as equity, debt, hybrid, solution-oriented, and ‘other’. Equity schemes will have 10 sub-categories, including multicap, large-cap, mid-cap, large- and mid-cap, and small-cap, among others. The stocks of the top 100 companies by market value will be classified as large-caps. Those of companies ranked between 101 and 250 will be termed mid-caps, and stocks of firms beyond the top 250 by market cap will be categorised as small-caps. Debt and hybrid schemes will similarly be grouped into 16 and six sub-categories respectively.

In particular, people interested in debt and hybrid schemes will now be better placed to identify the right schemes. For instance, duration funds have been segregated into four sub-categories, based on the maturity profile of the instruments they invest in. Debt funds belonging to the broader ‘income funds’ category will now be identified as dynamic bond fund, credit risk fund, corporate bond fund, and banking and PSU fund, based on their unique characteristics. Similarly, segregation of hybrid funds—based on their equity exposure—as aggressive hybrid, conservative hybrid and balanced hybrid, will allow investors to better identify the type of hybrid fund they want to invest in.

“Now that scheme labelling is clearly linked to a fund’s strategy, the investor will clearly know what he is getting into. The fund category will define the scheme, and not its name,” says Kunal Bajaj, CEO, Clearfunds. Fund houses will also not be allowed to name schemes in a way that only highlights the return aspect of the schemes— credit opportunities, high yield, income advantage, etc.

Adherence to fund mandate

With strict classification of schemes, fund houses may not be able to alter the investing style or focus of their schemes, as they did earlier. For instance, mid-cap funds stray into the large-cap territory or across market caps, in response to market conditions, which dramatically alters their risk profile. Now, funds will be forced to maintain their investing focus. Any drastic change in style will constitute a change in the fundamentalattributes of the scheme, which would have to be communicated to the investors. For investors, this means they won’t have to worry about their chosen schemes altering mandates to something which doesn’t suit their needs or risk profile.

Better comparison with peers

Distinct categorisation of schemes will also enable a better comparison of funds within the same category. While the earlier largecap funds category had schemes with pure large-cap focus as well those with a sizeable mid-cap exposure, now such distinctly varied schemes won’t be clubbed together. This will further help investors identify the right schemes by facilitating a like-for-like comparison of funds. “All schemes of different AMCs within a similar category will have similar characteristics, which will enable customers to make a better ‘apples to apples’ comparison,” says Stephan Groening, Director, Investment Solutions, Sharekhan, BNP Paribas.

These schemes may be reclassified or merged

The new Sebi norms require funds to have only one scheme per category.

Note: This is only an indicative list. All schemes mentioned may be retained by the respective fund house. There may be other duplicate schemes from other fund houses also. Source: Value Research.

Sharp rise in fund corpus

Since fund houses will now be forced to merge duplicate schemes within the same categories, it may sharply increase the size of certain funds. This could hurt the scheme’s performance. “Some larger fund houses with multiple schemes will have to opt for mergers. This may lead to a sudden, sharp rise in the corpus of schemes, which could dent the fund’s returns,” says Vidya Bala, Head, Mutual Fund Research, FundsIndia. “There could also be an impact cost on the investor, as fund may rebalance or churn the portfolio to ensure the fund aligns with the category norms,” adds Bala. For instance, both HDFC Balanced and HDFC Prudence are aggressive hybrid funds, with a corpus of Rs 14,767 and Rs 30,304 crore. Merging the two will create a Rs 45,000 crore fund. However, it is more likely that the fund house may instead reposition one of the schemes in another category.

Possible fall in outperformance

While the new norms are likely to lead to better adherence to the fund style and mandate, it may result in reduction in alpha—outperformance compared to the index—for some schemes. Funds often tend to stray away from their chosen mandate in the pursuit of generating excess return over the benchmark index. Now, with limited flexibility to stray into another segment, some funds may find alpha generation more difficult than before, reckons Bala.

Need for portfolio review

Since fund houses will now have to align their product suite with these norms, there is likely to be a flurry of activity related to recategorisation of funds. In order to avoid merging certain duplicate schemes, these are likely to be renamed or reclassified into another fund category. Some funds may witness a change in scheme attributes to facilitate its repositioning. As such, over the next 5-6 months, several schemes may change colours. Investors would then have to undertake a thorough portfolio review to ensure their funds continue to meet their requirements, insists Bajaj.

Source: https://goo.gl/kEwrFg

ATM :: Why active funds beat the markets in India

On an average, the gross returns by active funds exceed returns from Nifty by more than 11%. This outperformance is after accounting for the costs of managing an active fund

Nilesh Gupta & G. Sethu | First Published: Mon, Oct 02 2017. 01 59 AM IST | Live Mint

In 1975, John Bogle launched the first ever passive fund, Vanguard 500 Index Fund, and heralded an era of passive investing. Bogle was influenced by Eugene Fama’s view that the capital market was informationally efficient and that sustained success in stock picking was impossible. Since then, trading has increased; more and better investment research is being undertaken; high-speed communication networks have taken away the advantages to a privileged few; and most importantly, institutional investors dominate the markets. In this environment, it is not easy to pick stocks or enter and exit the market successfully and consistently. The torchbearer for passive investing today is the exchange-traded fund (ETF).

In the US, during FY 2003-16, total net assets of equity index funds increased by 3.5 times (from $0.39 trillion to $1.77 trillion), while that of active equity funds increased by just 0.7 times (from $2.73 trillion to $4.65 trillion). More importantly, during this period, a net amount of $1.29 trillion moved out of active equity funds while $0.46 trillion moved into index equity funds. Why is passive investing gaining over active investing? It’s because active investing has not been able to deliver returns (net of costs) that are more than from passive investing. Passive funds posted an expense ratio of 0.09% in 2016 while active equity funds were seven times more expensive with an expense ratio of 0.63%.

The FT reports that over a period of 10 years, 83% of active funds in the US underperform their benchmark, with 40% funds terminating before 10 years.

This global trend prompted us to examine the India story. Since 1992, Indian stock markets have seen many developments. Trading has increased; there are more institutional investors; regulations have improved; transactions have become faster; settlements have become shorter; number of analysts covering the market has increased; communication networks are good. We should expect active funds to struggle to beat the market, right? You could not be more mistaken.

We examined the returns and expense ratios of 448 actively managed mutual fund schemes from the period of FY 1996 till FY 2017, a total period of 21 years. We used their net asset values (NAVs) to compute the returns from holding these schemes for each financial year. Remember that the NAVs of mutual fund are published after deducting all the costs incurred in running the scheme.

In most of the years, when the market booms the active funds beat the index (such as Nifty) by a wide margin. When the market is bearish, their performance is mixed. In some bearish years, they beat the index, but often they lose much more than the index.

On an average, the gross returns by active funds exceed returns from Nifty total returns index by more than 11%. Remember that this outperformance is after accounting for the costs of managing an active fund. What about the costs of managing a mutual fund? The expense ratio for active funds from FY 2008 to FY 2017 averaged 2.32% per annum and for ETFs it was 0.61%, leading to a difference just greater than 1.7%. On an average, in India the extra returns provided by actively managed mutual funds have been much higher than the extra cost charged for delivering the return.

This is in contrast to the data from the US. Even in the halcyon 1960s, active funds in the US beat the market only by about 3%. What are the possible reasons for this outperformance? Some market experts argue that several quality stocks are not part of the index and hence index funds or ETFs cannot invest in them. Some note that the evolving nature of the market is not reflected in the index.

It may also be possible that the relatively smaller size of the mutual fund industry in India could be helping active fund managers get such high returns. In India, the mutual fund industry has only 13% of market capitalization as compared to 95% in the US. It is possible that in the past, mutual fund managers had better information available. If either of the reasons turn out to be true, we might find that, in the future, the actively managed mutual funds do not outperform the market by such large margins.

So, should Indian investors invest their savings in actively managed mutual funds? Irrespective of what the data says, the answer is not so simple. Here we have only considered the average returns of all actively managed mutual funds. A retail investor who is likely to invest only in a limited set of schemes would be concerned about choosing those schemes that give better returns in the future.

This analysis has not considered the risks taken by the mutual funds to get returns. A fund can easily beat the market by taking more risks. We need to compute the risk-adjusted returns to answer this question. On doing that, we may understand how the active funds in India generate such high returns compared to the market index. Is it a story of great fund management skills? Or is it inefficiency of the market? Or is it a case of taking high risks? Investors and the regulator have a responsibility to understand this.

Nilesh Gupta is assistant professor and G. Sethu is professor at the Indian Institute of Management, Tiruchirappalli

Source: https://goo.gl/1BK5FJ

ATM :: How is your mutual fund performing? Triggers that should alert you to exit

Sarbajeet K Sen | Sep 14, 2017 11:37 AM IST | Source: Moneycontrol.com

Poor performance of a fund must set the investor thinking on whether to continue with the investment.

When did you last review your mutual fund portfolio? Maybe a long time ago. Many investors might feel relaxed after investing in mutual funds with the thought that their money is safe with experts trained in investing and stock selection.

However, the mutual funds landscape is a mixed lot. There are good, high-performing funds and there are laggards who are unable to keep up with performance of the leaders.

Did you check which of these category of fund you have invested? If it is one of the top-performing ones, giving you good returns, you need not worry. But if it is one of the funds that have not performed well in comparison, it might be time to think of a switch to another fund.

So when did you last review your mutual funds investment portfolio to know whether it needs a change? If you do it periodically, well and good, but if you have not reviewed for a long time, you should assess how your various fund investments have been performing.

“Investors should review their mutual fund portfolio at least once in 6 months. They should look at the performance of the fund, the sectoral allocation that they chose and whether there have been any big changes,” S Sridharan, Business Head, Financial Planning, Wealth Ladder Investment Advisors

Sridharan says if the review shows that the fund has performed poorly, it should signal a possible exit and switch to another fund. “Poor performance of a fund must set the investor thinking on whether to continue with the investment. However, exit decision should not be based only on performance of the fund. Investors should look at other parameter like what went wrong and whether the fund manager has the capability of revising the portfolio to the positive side in the near future,” he said.

Vikash Agarwal, CFA & Co-Founder, CAGRfunds, says one should avoid unnecessary churn in portfolio. “The essence of money-making is regular investments in well-managed diversified equity mutual funds. One should avoid unnecessary churns in the portfolio which may enhance cost in terms of exit load and tax implications,” he said.

However, Agarwal says there can be multiple reasons which might merit a review and change of one’s mutual fund holdings. Some of these are:

–Continued underperformance of the fund such that the fund is unable to beat its benchmark

-The fund is able to beat the benchmark but the returns are not commensurate with the levels of risk being taken by the fund

-A particular stock/debt instrument holding which forms a significant holding of the fund is likely to underperform due to a fundamental issue. Example: If a fund has significant exposure to a company which has acquired a loss making company, it might merit a deeper review of the fund

–Change of fund manager: In case there is a change in fund manager, then it is useful to review the fund as the fund style and philosophy might undergo a change and it might not be suitable to investment objective anymore

“If your fund is showing such characteristics then it is ideal for you to exit and switch to a better managed fund,” Agarwal said.

Source: https://goo.gl/dKawWa

ATM :: How equity mutual funds can pave your way to becoming a ‘crorepati’

Navneet Dubey | Sep 19, 2017 04:18 PM IST | Source: Moneycontrol.com

Equity mutual funds can give you good returns if you keep your money invested over a long period of time to overcome market cycles.

Your dream of becoming a ‘crorepati’ may seem difficult. But in reality, if you plan your finances and invest in the right instruments someday you will have your dreams realised someday. One of the best ways to try and achieve the crorepati dream could be investing in equity mutual funds for good returns over a long period of time. There is a definite correlation between the time and money. If you have less money to invest then you have to wait for a longer time to get your goal accomplished and if you have more money to invest you might reach your goal earlier if you plan and invest properly.

However, before investing in mutual funds, especially –equity MF’s, you should ask yourself two questions:

how much you have to invest and over how long to reach your Rs 1 crore destination.

Here we try to get you answer to both the questions.

How much to invest monthly?

As a young investor, you may easily take a higher risk by saving less amount and gain more returns to achieve your financial goals. While being in the middle of the age, you can take the moderate risk to head toward becoming a crorepati.

Thus, at an early age even if you have less money to invest, you can become crorepati by investing Rs 700 per month (which is the least amount) for 35 years, at an assumed 15% rate of return to accumulate the desired amount.

However if you start later, you need to invest more money to reach your financial goal. For instance, you will need Rs 5500 per month for 25 years, at an assumed 12% rate of return, you will be able to make Rs 1 Crore approximately.

A larger amount of Rs 13,500 per month for 20 years, at an assumed 10% rate of return, will enable you to make Rs 1 Crore.

How to select a fund?

To earn 12-15% of return on your investment, you need to select good equity stocks or one can go for equity mutual funds to mitigate the risk to an extent. While selecting, equity MF, you need also check that your portfolio should have mid-cap/small-cap funds for around 30-40% and the remaining 60-70% should have a diversified fund, a large-cap fund, etc. to maintain an aggressive portfolio with right asset mix.

Whereas to maintaining a return of around 10-12%, you should invest in balanced fund/hybrid fund, etc. to maintain a moderate risk portfolio. In such case, one can avoid or reduce the investment amount in mid-cap/small-cap funds or avoid making investments in risky stocks.

Are there alternatives?

Investing money in pension plans, NPS can also help you achieve this financial goal. However, the returns offered under such schemes are not stable and market linked. Moreover, in some instruments, returns are subject to change as per the government rules. Also, investing in an instrument like fixed deposits, national savings certificate, etc. may not help you achieve the goal within the maximum time period as mentioned thereon.

One should also have to remain invested for a longer time period and follow proper asset allocation strategy to achieve the target amount. It is must to take the help of a financial adviser before making such financial decisions.

In the grid given above, make sure you know that any investment made in equity mutual fund or equity stocks are not guaranteed. The returns are also volatile and not fixed as they are dependent on the financial market.

Source: https://goo.gl/3sQvvt

ATM :: Explained: You should invest in following debt mutual funds based on your risk profile

While debt funds, unlike fixed deposits and small saving schemes are also subject to market risk, though less than equity funds, the return expectation is commensurately higher than traditional products over the same tenure.

Kirtan Shah | Aug 24, 2017 10:19 AM IST | Source: Moneycontrol.com

Lately I have been meeting a lot of relatives, friends & acquaintances, grappling about a common concern of what to do now with the new normal of low interest rates on fixed deposits & small saving schemes. It is very disturbing for many because of their investment style and return expectations from the past. Invest in mutual funds, I said. ‘Don’t mutual funds invest in stocks?’, ‘Aren’t mutual funds risky?’, ‘Will I get fixed returns?’ they asked. Mutual Funds as a product offering which can invest in equity, debt, commodities and even a combination of them depending on the objective of the fund and hence investors across risk profiles, goals & time horizon will find a suitable product, I said.

Why Debt Funds

(1) Tenure of investment – Regardless of your time horizon, there is a suitable debt mutual fund available.

(2) Tax Efficiency – This is the reason why most FD investors will appreciate debt mutual funds. If you invest for less than 3 years, the gains are taxed at the income tax slab rate like in an FD but if you hold the investment for more than 3 years, the gains are taxed at 20% (even if you are in the 30% tax bracket) and that too not on the full gains but only on the gains that exceed inflation. So if you earn 8% on the debt fund and inflation (measured by CII) increases by 5% in the same period, you pay 20% tax only on 3% (8%-5%), which is 0.6% (20%*3%) versus 2.4% (8%*30%) 4 times higher in an FD investment. The post tax return on a debt mutual fund is far superior to a FD, even when we are assuming that the debt fund will generate returns similar to the traditional products.

(3) Possibility of higher returns – Return is a function of calculative risk taken. It is not that FD does not have any risk. It is presumed to have no risk, which may not be entirely true.

Let me highlight a couple of risks that all fixed income instruments have.

(a) Interest Rate Risk – Lets assume you have invested in a FD paying 7.5% return over 3 years. What if interest rates in the market move up? The same institutions will then pay 8% to the new depositor vs you still receiving 7.5%.

(b) Reinvestment Risk – In the same case above, if the interest rate moves down, you will get a lower rate from the same institution, when you try and reinvest after 3 years. This is the challenge most traditional product investors are currently facing and will continue to face in the future. Over the last 15 years, investors have seen bank FD’s paying as high as 12% as well but the average over the last 15 years is 8.5% on the bank FD.

(c) Inflation Risk – While the above investment matures after 3 years, you realize that inflation has moved up by 5% in the same period. The net result on your investment is not 7.5% but only 2.5%, which we call as the real rate of return. Most of the times you will observe that inflation is increasing at a pace faster than the returns offered on the FD, generating negative real return.

All the above are risks that one has to take irrespective of the fixed income instrument they invest in. While debt funds, unlike fixed deposits and small saving schemes are also subject to market risk, though less than equity funds, the return expectation is commensurately higher than traditional products over the same tenure. In the below chart you will see how various debt fund categories have performed over the last 3 years.

Risks in a Debt Mutual Fund

Interest Rate Risk – Debt funds invest in various fixed income instruments issued by the government, banks & financial institutions, RBI, corporates etc., which are mostly traded on the exchange helping the fund to generate higher returns over the interest (coupon) committed. The price of the traded fixed income instrument is inversely proportional to the market interest rate. Lets say the debt fund bought a government bond paying a coupon (interest rate) of 8% and is now trading in the market. In the future when interest rates drop, government would issue a new bond at a lower interest rate, say 7.5%. Everything else kept constant, it’s logical to buy the old listed bond, which pays higher interest rate of 8% than the new bond and hence the price of the old bond increases because of higher demand, generating capital gains for the debt fund over and above the 8% coupon. Interest rate risk in the bond fund is captured by modified duration. Higher the modified duration, higher is the risk and higher are the return expectations. If a fund has a modified duration 2, it means for every 1% drop in market interest rate, the debt fund will generate positive 2% returns over and above the YTM (investors can understand this as the coupon/interest rate). The table below will help you understand the interest rate risk profile of various debt funds.

Conclusion – If you want to take lower risk, select funds with lower modified duration.

Credit Risk – The fixed income instruments in which the debt funds invest are credit rated. Credit rating agencies give a rating to all these instruments showcasing the credit worthiness of the issuer to pay interest and return the principal. Higher the credit rating, lower the risk and hence lower is the coupon the issuer pays and vice versa. So let’s say, if the debt fund buys an instrument, which is highly credit rated at AAA, fund will receive a lower coupon rate, as the risk is low. Unfortunately, in the future if the credit rating agency reduces the credit rating to AA, the debt fund will still receive the same coupon that was committed earlier but the risk has increased and hence this fixed income instrument will start trading at a lower price on the exchange, incurring capital loss to the debt fund. The inverse is also true. The point to be noted is that the capital loss is only notional. If the debt fund does not sell the fixed income instrument in the market and continues to hold, it still receives the coupons committed as normal. The table below will help you understand the credit risk profile of various debt funds.

Conclusion – To reduce the risk, select funds, which invest in high credit rated products.

The right debt fund for you

The answer to which debt fund you should invest in, depends on your goal and risk profile. If your investment horizon is less than 3 months, the most ideal option is investing in a liquid fund. Having said that, you can invest in any other scheme from the list below, but the risk profile of the fund may increase if invested for less than the ideal investment horizon. Lets say you choose to invest in corporate bond funds for 3 months to generate higher returns, you have to understand that the risk will be higher than normally holding the corporate bond fund, which is medium if held for more than 2 years. The below table will give you a clear snapshot of which fund debt fund suits your requirement.

The writer is CEO – Sykes & Ray Financial Planners

Source: https://goo.gl/wwfZMx

ATM :: 5 reasons why mutual funds have tanked up on banking stocks

Despite the red flags staring at most Indian banks, mutual fund managers do not seem to bother about them. Reports say that the allocation to the banking sector by mutual funds has reached an all-time high of Rs 1.47 lakh crore at the end of June.

Shishir Asthana | Moneycontrol Research | Jul 28, 2017 06:14 PM IST | Source: Moneycontrol.com

In a recent survey conducted by Moody’s Investor Service, 70 percent of market participants pooled said that India’s banking system was the most vulnerable in South Asia. Stress in the banking system has made headlines for over three years now. Analysts, experts, and economists have all predicted doomsday which has not yet come. However, to be fair to experts the balance sheet numbers of the banks have continuously deteriorated in most of the cases.

Despite the red flags staring at most Indian banks, mutual fund managers do not seem to bother about them. Reports say that the allocation to the banking sector by mutual funds has reached an all-time high of Rs 1.47 lakh crore at the end of June.

Why would funds like to invest in banks which everyone fears will implode? Here are five reasons we think banks are on mutual funds’s radar.

Valuation: Given the current valuation in markets, very few sectors offer a good risk-reward bet. With Nifty over 10,000 and market price-to-earnings in the top quadrant, there are few sectors and stocks that offer value. While Bank Nifty has touched a new high of 25,030, there are stocks in the sector, especially in the public sector space, that offers better valuation but higher risk.

Liquidity: Mutual funds in India are witnessing heavy inflows. New investors and higher investment through systematic investment plan (SIP) is compelling mutual funds to take more risks. Despite record investments in the banking sector, mutual funds are still sitting on cash levels of 5.7 percent on an aggregate basis. Some funds have cash positions ranging between 8-18 percent. Peer pressure and rising markets compel them to invest.

Index weightage: One parameter that every fund manager is ranked on is his performance with respect to the index. As weightage of banking stock in the index is high at near 30 percent, fund managers are compelled to buy banking stocks in order to be close to the index performance.

Too precious to fail: Though asset qualities of most banks are questionable these banks are all too big to fail. For the government and the central bank, it will be very embarrassing to allow a bank to fail. Both the central bank and the government have been trying to recapitalise banks, tweaking the rule books, bringing in new schemes to help banks clean up their books. Bankruptcy law is now cleared and cases are registered. This is expected to go a long way in recovery and solving the problem with bigger non-performing assets. Apart from these measures, the government has also initiated merging of weaker banks with the stronger ones, in turn, creating a bigger and stronger bank.

Proxy for growth: The banking sector has traditionally been considered as a proxy for the economy. Every activity in the economy requires money. Banking sector credit growth has historically been between 2-2.5 times GDP growth. However, with the toxic asset problems and other sources of non-banking finance available in the market, the ratio has fallen to nearly 1.6 times the GDP. This ratio is expected to improve as banks start lending again in line with the growth in the economy.

Source: https://goo.gl/fRA8CU

ATM :: Want to invest in companies like Google, Facebook, Coca Cola from India? Here’s how you can do

Global Fund investment options albeit limited have been around for a decade, with options to invest into US, Europe, ASEAN, country specific funds like Brazil & China and even funds investing into natural resources companies like Gold mining companies or Energy companies.

By Kaustubh Belapurkar – Morningstar India | Jul 15, 2017 11:02 AM IST | Source: Moneycontrol.com

International Funds from an Indian investor’s perspective have been a little bit of a hit and miss.

Global Fund investment options albeit limited have been around for a decade, with options to invest into US, Europe, ASEAN, country specific funds like Brazil & China and even funds investing into natural resources companies like Gold mining companies or Energy companies.

The greatest amount of investor interest has typically been in Gold mining funds and US funds. In fact in 2013, when the Indian equity markets where going through a prolonged lull phase, domestic equity funds too were witnessing stagnating growth.

At the time investors increased allocation into US Funds on the back of strong 1-year historical returns of these funds. Post that, though the story has been very different, with the start of the domestic equity market rally in 2014, domestic fund flows are reaching new highs, but Global funds are witnessing a slow trickle of redemptions.

As an effect of this global funds currently forms a minuscule proportion of investor’s portfolio at 0.28 percent from a high of 1.56 percent in Jan 2014.

Why Invest in International funds

Investors should consider adding international funds in their portfolios from the perspective of diversifying risk in their portfolios.

Investments should be made for the long term on an overall portfolio allocation basis rather than a decision based on short term historical performance.

By adding international funds in your equity portfolio, you can potentially reduce the overall volatility in your portfolio by as much as 5-10 percent.

It is important to acknowledge that markets go through cycles and no market will be a top performing market year after year as is visible in the table below.

In addition, Indian markets display a lower correlation with developed markets like the US, thus the addition of such exposures helps reduce overall portfolio volatility.

The calendar Year Index Returns (INR)

Another factor to consider is the ability to take exposure to sectors or companies that you would ordinarily not have exposure to.

Global Companies like Amazon, Google, Facebook, Coca Cola, etc. are widely known and used brands in India, they derive a fair share of the revenues/users from countries such as ours. By investing in these funds, you can potentially gain exposure to such stocks.

Investors should certainly think about adding an international flavor to their portfolio and stay invested for the long term. You can consider investing 15-20% of your overall equity exposure into global funds.

Disclaimer: The author is Director of Fund Research at Morningstar Investment Adviser. The views and investment tips expressed by investment experts on Moneycontrol are their own and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Source: https://goo.gl/MUx88e

ATM :: So far, a rocky road for closed-end funds