Category: Interviews

Interview :: Worst over for the market, top 10 stocks to bet on in FY19

Interview with Gaurav Jain, Director at Hem Securities.

Uttaresh Venkateshwaran, Sunil Matkar | Apr 06, 2018 03:19 PM IST | Source: Moneycontrol.com

While the market may have fallen around 10 percent from its peak, experts such as Gaurav Jain, Director, Hem Securities believe that the worst may be over now.

“In the next quarter, the market should settle and then a pullback is likely,” Jain told Moneycontrol’s Uttaresh Venkateshwaran & Sunil Shankar Matkar. He expects largecaps to move ahead and midcaps will play catch-up.

He expects a broad-based pick up in the market going ahead. “In the past few days, a few stocks have risen, which have pushed the market. We should start seeing a pick-up in many more stocks. Essentially, people are not in a panic stage, while retail investors have looked to book profits and are not in a hurry to invest,” Jain further added. Edited excerpts:

The market has been trading off the previous high points. What is the outlook for D-Street going ahead?

Over the last quarter, we saw events such as the Union Budget, which introduced taxes on long term capital gains (LTCG). Global markets reacted negatively, while big IPOs also sucked liquidity from the market, among other factors. As such, the market had a good run up in the past two three quarters.

In the next quarter, the market should settle and then there could be a pullback. Next quarter should be of accumulation and positive movement.

So, what kind of returns are you expecting from this market?

We are in an election year. So, the market could behave differently with results coming on. Overall, for FY18 we are looking at 8-10 percent returns.

What can be seen as triggers for this market?

Firstly, many companies’ results were affected in one quarter on the back of Goods and Services Tax (GST). With new GST Bill coming in full flow, it should give positive flow for most sectors. Even as the e-way bill is introduced, some companies could face some issues at the start and then gradually get comfortable with it.

Secondly, look at growth visibility in the Sensex and Nifty. Several managements are hinting at positive cues. Earnings could improve and several companies have done their expansions on their side.

Lastly, we have to wait for how monsoon pans out. So, overall there is positive momentum and investors are quite bullish on India even at this point.

Does that mean we could go back to the record high levels?

Probably…

What are you hearing on private capex plans? Are they willing to spend on that front as well?

Most companies, the big ones especially, have done their share of capital expenditure. One important reason why this is happening is due to change in technology that is erupting. For instance, look at telecom sector. In case Reliance Jio comes up with a new technology, rivals also tend to counter those. In case of textiles, many things have happened and firms are adding up more technology and machines. With changing technology, fast-growing companies need to adapt to it and they are deploying resources in those areas.

Could you throw some light on the state of midcaps? How do you expect them to perform going forward?

Largecaps should start moving first, going forward, followed by midcaps. Investors currently are playing conservative as they saw their stocks bleeding all through the last quarter. Hence, the money is going into largecaps right now.

But what about valuations for several segments in the market…how did the IPO market perform in FY18?

Look at the number of IPOs that came up with multiples of 30 and 40 times. Fund managers that we spoke to are talking about large systematic investment plans (SIPs) that have to be deployed into such stocks and that is probably why such high multiples were seen.

In FY17, we saw around 37 IPOs hitting the market and this figure could be higher this fiscal, looking at the prospectuses filed and information available from merchant bankers. Also, IPO sizes are a lot larger now.

But will investors have the appetite going forward?

Institutional investors will have it. They will always look at beaten down stocks and they also do not have issues with funds.

Currently, retail investors are investing less. If they have Rs 100 with them, they are looking to invest Rs 20 right now. In fact, many retail investors have booked profits in the past quarter.

Is there much downside from the current market levels?

I don’t think so. The worst should already be over. In the past few days, a few stocks have risen, which have pushed the market. We should start seeing a pick-up in many more stocks. Essentially, people are not in a panic stage, while retail investors have looked to book profits and are not in a hurry to invest.

So, what will your advice be to a 35-40-year old investor?

They must invest in mutual funds. But you could also do it making money by directly investing in equity markets as well.

What sectors are you looking at currently?

We expect pharmaceuticals to perform, while it could be a challenge in case of information technology names.

You can look at infrastructure sector as well. These companies are flooded with orders.

On banks, it is clearly not the case that all PSU banks are bad. Right now, people are not trusting PSU banks and private banks are usually considered more transparent.

It is a play on perception and that could be seen in cases of a recent listing such as Bandhan Bank. The IPO came at a very good multiple and still listed at good returns. These are companies with professional management which are growing along with having fast execution and chasing for business. As such, we were seeing a shift to private sector banks, but currently investors also do not know about hidden concerns in PSU banks too.

LTCG tax on equities has become a reality now. Are you getting queries about it and what are you telling them?

I think the sentiment around it has been already digested in the market. People are taking in the transition in stock market. I feel that this is not an issue at this point.

How much of a risk is political scenario for the market?

The market tends to be very volatile on political instability. As soon as there are chances of dent to existing government, it starts reacting. The question is not about which government, but about a stable one. This is important from a foreign investor perspective. These would have regular impact but not larger level…the market will make a comeback once the elections are over.

As we move into end of this year (and closer to general elections), investors may hold for couple of months to understand what is happening (on the political front).

On the global front, any statement from the US with respect to protection of its own trade boundaries is a major risk for the market.

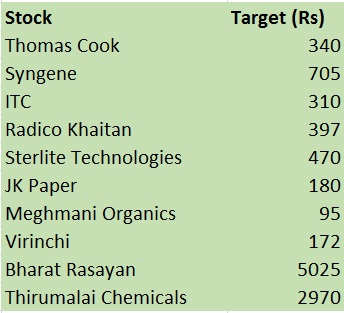

Lastly, what are your top stock picks for FY19?

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Interview :: Home loan rates likely to go up marginally, says HDFC MD

Don’t see property prices going up for now: Renu Sud Karnad, Managing Director, HDFC

ANIL URS | Published on March 14, 2018 | The Hindu Business Line

BENGALURU, MARCH 14

Renu Sud Karnad, Managing Director, HDFC, in an interview with BusinessLine, explains how the realty and home-loan sectors are shaping up as the new regulatory regime sets in. Excerpts:

How is the property market doing pan-India?

Apart from New Delhi and Chennai, where we see slow offtake, the market is good in other major cities. By good I mean, we are doing good business.

How do you see property prices moving?

As I see it now, I don’t see any increase in property rates happening.

What about interest rates, especially in the wake of rising bond rates?

Yes. Interest rates are rising a little bit. But let me put it this way. I don’t think the rates are going to come down. I think next year we will see a quarter to 1 per cent increase in rates.

Is this rise in rates low, or how do we understand it?

A quarter to half a per cent is nothing when compared to the high interest rate days, when home loans were going at 13-14 per cent. Now they are at 8.3-8.4 per cent. So they may go up to 8.9-9 per cent.

How is HDFC’s home loan growth?

At 23 per cent, our home loan growth is excellent. We have seen good growth coming from Mumbai, Bengaluru, and Pune. In the National Capital Region (NCR) it is a little slow. Otherwise, home loan growth normally is about 15-18 per cent.

Are any banks on your radar for acquisitions?

We are always on the look out whenever an opportunity arises.

How far are you in picking up CanFin Homes?

Actually, you should ask them, because five to six people are talking to them. I don’t know what pressure of time they have and don’t know when they need to announce it. Yes, we are also talking to them.

Have you firmed up your business plan for the next fiscal (2018-19)?

We are in the process. But I can tell you we are looking at 15-18 per cent growth.

How is the borrowing by property developers?

They, I think, are now looking at new avenues. PE funds are giving them money. Banks have also started to explore. Once the sector gets used to new regulatory framework, we could see good amount of lending.

Definitely the last one year had been challenging from them. But I think in the next six months, things should settle down.

Source: https://goo.gl/6PPgEz

Interview :: 2018 is 5th year of Bull market! If you have Rs.10 lakh to invest go for direct equities

Aim to add incrementally to your portfolio over time particularly when the chips are down.

Dipan Mehta | Mar 05, 2018 10:22 AM IST | Source: Moneycontrol.com

Go for direct equity with the help of an advisor or a portfolio manager because mutual funds have high expense ratio and inherent disadvantages, Dipan Mehta, Director, Elixir Equities said in an exclusive interview with Moneycontrol’s Kshitij Anand.

Q) The tables have turned in favour of bears at least in the medium term. The Indian market has become a sell on rallies kind of market. What is your assessment of the market at current juncture?

A) This the fifth year of a bull market which has been a slow steady one with very little volatility. There have been a few corrections and we are in the middle of one at present. For the long-term investor, this is still a buy on dips market.

Whether this correction will deepen or not will become evident over the next 2-3 weeks. If a lower tops/lower bottoms formation get created and broad market indices trade below their 200 DMA (which they are not at present) then we may be in for an extended sell-off or a mild bear market.

Q) What is your advise to investors who want to put Rs 10 Lakh into markets? He is in the age bracket of 35-40 years. He/she is looking at forming a portfolio with direct equities, MFs, a part of fixed income as well?

A) Go for direct equity with the help of an advisor/portfolio manager. Mutual funds have high expense ratio and inherent disadvantages. Set aside an amount of emergency plus 1 year’s salary/income into debt and put the rest into good quality stocks.

Aim to add incrementally to your portfolio over time particularly when the chips are down.

Q) What should be the ideal strategy for investors in terms of sectors? Do you think PSU banks are a good buy at current levels? What are the sectors which you think are likely to show momentum in the year 2018?

A) PSU Banks, IT and Pharma are to be avoided.

-25-35 percent should be in private sector retail banks and NBFCs.

-15 percent in auto and related ancillaries,

-15 percent in Indian FMCG stocks,

-35 percent rest in domestic consumption stocks such as building materials, appliances, aviation, retail, gaming, entertainment, media, fast food, branded apparels, and innerwear.

Q) The US Fed signalled a minimum of 3 rate hikes for the year 2018. Do you agree the global overhang is likely to weigh on Indian markets for the rest of the year?

A) No, but there will be a knee-jerk reaction whenever there is a global sell-off. With the rise and rise of domestic mutual funds, the influence of the foreign investors has reduced dramatically which means that the co-relation on a medium to long-term has weakened.

Moreover, foreigners have been investing for 2 decades and they have a more mature approach to India. We are a better-understood economy and capital market.

Q) What should be the right strategy for investors right now – sit on cash and wait for a dip or deploy cash incrementally throughout the year?

A) Nibble into the bluest of blue-chip stocks. Companies which have missed in the bull market so far must be targeted for investment. Investors must endeavour to improve the quality of the portfolio.

There are two-fold benefits. If the bull market resurges, then these will be first of the block and gain market leadership. Should a bear market evolve, then the damage will be less and investors will be able to sleep better knowing they have quality stocks in their portfolio.

Q) What will happen in the banking space given the fact that the cost of borrowing is inching higher. The RBI might keep rates on hold in its next policy but may raise rates in 2018?

A) Private sector banks and NBFCs will survive and thrive in every interest rate scenario. Growth and profitability will be temporarily impacted but the process of private sector gaining market share at the expense of PSU lenders will continue and gain traction.

Q) With Dollar gaining strength there is a higher possibility of rupee weakness. Which sectors or stocks likely to benefit the most? What is your target level for the currency?

A) Sectors which will benefit are obvious but be sure to assess the basic underlying fundamentals. No business will create value just because the currency is depreciating. Our view on the Rupee is not so negative.

Source: https://goo.gl/VM7cNE

Interview :: Guide to smart banking: ‘Credit scoring is good for both borrowers and lenders’

RADHIKA MERWIN Interview with Harshala Chandorkar, COO, TransUnion CIBIL

Published on February 25, 2018 | The Hindu Business Line

Arguably no single data point determines your credit-worthiness, or your prospect as an entity worthy of a consumer loan or a business loan, as your credit score. TransUnion CIBIL is one of four credit bureaus in India that assess you for that. There are currently about 37 crore retail borrowers and about 1.3 crore commercial borrowers on the TransUnion CIBIL Consumer and Commercial bureau. That portfolio also gives it a vantage view of the banking and economic landscape. Excerpts from an interview with Harshala Chandorkar, Chief Operating Officer, Transunion CIBIL:

What is your sense of corporate lending trends, which appear to be recovering?

The NPA woes of the banking industry in the commercial lending space indicate that the mid-corporate and larger SME segments have taken the biggest hit. TransUnion CIBIL Commercial Data analysis highlights a significant chunk of accounts that are bad in one bank but not bad in another. The latest FIBAC report on Productivity in Indian Banking states that a significant part of latent NPAs could slip in the next few quarters. The revenue pool of mid and large corporates will probably stay subdued for the next 4-5 years due to stress in the portfolio.

The banking industry needs to invest in new credit models for commercial customers that rely on commercial credit information from TransUnion CIBIL and analytics to complement banks’ capabilities in credit assessment and detecting early warning signals.

What’s the outlook on retail credit? Consumer loans seem to be driving overall lending.

With the availability of credit information and progressive policies on financial inclusion, retail lending has grown profitably. Over the past five years, there has been an estimated 16 per cent annual growth in disbursement and over 30 per cent annual growth in bureau enquiries. At the same time NPAs and delinquencies on retail lending have been historically low.

The nature of retail credit is changing rapidly in India as the share of products in new accounts opened has evolved, with gold loans and consumer durables gaining significant volumes and accounting for almost 50 per cent of all new accounts opened. This growth has been accompanied by a significant drop in ticket sizes as financial institutions are becoming more and more willing to extend low-value loans. With certain other retail products, the ticket sizes have actually increased, prominent among them being personal loans — indicative of the increasing credit-willingness of the Indian borrower and a supply-side push — and home loans and auto/two-wheeler loans – indicative of the overall increase in the values of the underlying assets funded. In addition, the share of youth in retail credit is growing: millennials’ share of accounts opened has increased to 40 per cent.

How do you see the bureau evolving in the near future?

The next stage of evolution of India’s credit information infrastructure will be the usage of credit information data, insights and solutions for further expanding access to credit, driving credit penetration and financial inclusion.

Demonetisation has paved the way for a cashless and digitised economy. Bureau solutions for instant verification and ‘decisioning’ are paving the path for driving digitised, quick, easy and affordable access to finance. Verification solution enables credit institutions to authenticate the identity of the consumer in real time at the point of application. As a result consumers are able to get the loan approval within minutes of applying. Yet another advantage is cost-effectiveness while establishing a consumer’s identity. Bringing down this cost can help banks and credit institutions make lending decisions quickly, at cheaper KYC costs, and thereby increase business growth and credit penetration.

The potential of alternative data usage for credit decisions is another significant domain. To expand and increase the breadth of information for making lending decisions even more comprehensive, we are in discussions with regulators to allow for contribution of ‘post-paid’ information on telecom customers. Several World Bank studies have indicated that inclusion of reporting of non-financial payment data (alternative data) proves extremely beneficial for making lending decisions, specifically for the segment that does not have access to credit. With access to affordable credit, new credit consumers are able to build assets. Those financially underserved consumers who have a positive payment records in non-financial obligations like telecom will have the ability to access affordable credit.

The extension of the credit information bureau to cover a larger population will enable a majority of Indians who are self-employed, or employed in the unorganised sector, to get a credit history and enhance their eligibility for credit from banks. Incorporation of telecom and electricity bill payment records into the credit information bureau can unleash this enormous potential to extend the penetration of banking in India. There is compelling business logic for utility and telecommunications firms to begin fully reporting customer payment data to credit bureaus.

But only a few banks use credit score to offer differentiated rates to customers.

Risk-based pricing in still at a nascent stage in our country. Both in the commercial as well as retail segments, pricing offers an opportunity to strengthen performance in the short term. Some progressive lenders have initiated a disciplined approach to risk-based pricing and this could improve banking profitability by 20-30 basis points. Further, at the bank level, banks need to deploy models to estimate customer price elasticity to introduce value-based pricing.

Risk-based pricing of loans helps both the lenders and borrowers alike: the lender can assess the risk value of a customer before deciding to offer a loan at a particular rate, while customers with a higher CIBIL score benefit by getting lower rates as compared to customers with a low scores. The benefits thus ensure that customers work towards keeping their scores and credit-worthiness high.

Source: https://goo.gl/tDHhyC

Interviews :: Alpha generation in large-cap funds would compress going ahead

Mahesh Patil, Co-CIO, Aditya Birla Sun Life AMC on how he is creating alpha in the large cap space, his contra calls and more.

By Morningstar Analysts | 27-12-17 |

The asset size of Aditya Birla Sun Life Frontline Equity Fund has crossed Rs 20,000 crore. Do you see size posing an issue to manage this fund going forward?

We maintain a good diversification in this fund by having exposure across sectors. We aim to beat the benchmark consistently and incrementally rather than taking very large sectoral bets. Given that the fund invests at least 80% of its assets in large cap stocks, we don’t see size posing as a challenge. Besides, the core of the portfolio has very long term holdings. That said, as the fund size increases it becomes slightly more difficult to build or unwind positions in stocks and needs more effort. But it is part of the process and does not affect the performance significantly.

We have a large number of stocks (60-70) in the portfolio as compared to other similar funds in the industry. Before deciding the quantum of exposure warranted in any stock, we take a close look at the liquidity of the stocks. This strategy allows us to manage large size.

It is becoming difficult for managers to generate alpha in the large cap space. How do you overcome this challenge?

We are seeing a huge rally in the mid and small cap stocks and large cap funds obviously can’t take exposure to such stocks. So multi-cap funds have been able to generate decent alpha by maneuvering where the opportunities are.

As markets mature and price discovery happens across stocks its going to become difficult to generate alpha in large caps. The alpha generation which we saw in the last three to four years would compress going ahead. This is because the alpha was high as compared to the historical average, especially during calendar year 2014-16.

We never target to generate superlative alpha in large cap funds. Instead, we endeavor to find some new stock ideas every year which keeps the portfolio fresh. If there is a serious underperformance, we are nimble enough to take corrective action. While everything is fairly priced in the market at this juncture, we try to continuously look out for undervalued companies. Some amount of contrarian investing and moving away from the crowd helps to spot early turning points in stocks/sectors. Similarly, we maintain a discipline to trim exposure in certain stocks that have overshot their valuation target. This strategy enables us to buy stocks which are relatively cheap in terms of valuation. So some amount of active management is also required at this juncture to generate alpha in the large cap space.

In which sectors/themes are you deploying the steady inflows coming in equity and balanced funds?

We have been overweight on banking and financial services. Financial services sector has had a good run and the valuations have moved up. Hence we are more discrete now in choosing the right segments that offer better growth. While we prefer private retail banks, we are slowly warming up to corporate banks because of some clarity emerging on resolutions of bad debts and a cyclical recovery in economy.

Besides, we are positive on consumer discretionary space. We are seeing a higher demand for discretionary consumption as the per capita income is moving up in India. Further, the implementation of GST will benefit players in the building material, consumer durables and retail space. Rural consumption is also starting to improve with normal monsoons and government focus on stepping up rural spending.

We are fairly overweight on metals. Metal prices are steady as China is cutting down capacity on the back of environmental issues which is supporting price. Indian companies are also deleveraging which will increase their equity value.

Another sector where we are taking a contrarian call is telecom. We are seeing consolidation happening faster than we expected in this sector. While there is still some pain for a few quarters, over a three-year time frame it could be a good time to look at some leading telecom companies.

We are selective in the infrastructure space. Road, railways and urban transport are some pockets where there is significant traction. Companies positioned in this sector are expected to see good increase in their order books.

Post SEBI’s diktat on scheme categorization, how are you restructuring your funds? Are you planning to merge smaller schemes?

Fortunately, we have been working on consolidating schemes much before the SEBI circular came out. Most of our equity funds are aligned as per SEBI categorization. We would look to merge some thematic funds.

Overseas fund of funds category is seeing continuous outflows. What are the reasons for the waning demand for this category.

The awareness level about this category is low. Domestic market has been doing well so people are preferring to invest in India. Overseas fund of funds have done well though.

As markets mature and you see enough ownership of domestic funds, people would look to invest outside India. There are a lot of new generation companies which investors can take exposure through these funds.

Though taxation of this category is an issue, you need to realize that if you are making good returns it should not be a problem. HNIs who already have a high exposure to India can look at these funds. Also, those wish to send their children overseas for education can consider these funds because the underlying returns are dollar based. To some extent, you are taking the currency hedge through these funds.

When do you see private-sector investment picking up?

Private sector investment has been elusive. But there are a couple of factors which indicate that investment will pick up one year down the line. Firstly, capacity utilization has bottomed out and is showing early signs of improving. Secondly, while a lot of large corporates in metals and infra space are saddled with high debt were are seeing the deleveraging cycle has started for some companies. Corporate debt to GDP which peaked out in 2016 is starting to come off. Finally, bank recapitalization would enable corporates to re-leverage and begin the next capex cycle. Sectors like Steel, Oil and Gas, fertilizer and auto are the first to see a revival.

During every budget we get to hear about suggestions to reinstate long-term capital gains (LTCG) tax on equity investments. Some say that exemption of LTCGT can lead to market manipulation. What are your views? If the government introduces LTCGT what would be the impact on markets?

The exemption of LTCGT has helped attract investors in equities. But that’s not the only reason why people invest in equities. They invest because they expect better returns. If there is money to be made in markets, I don’t think it would deter investors from this asset class. So introduction of LTCGT would not have an impact on long term investors. However, it could hurt the sentiments in the short run. We could see some curb in short term speculative money moving in stocks having weak fundamentals.

How has your investment philosophy evolved over the years?

While our broad philosophy has remained the same, we have started giving more attention to management quality while evaluating companies. Our time horizon of owning stocks has also increased and we are evaluating companies with a three-year perspective. There is a larger focus on how companies are generating free cash flows and how it is being utilized. These factors impact the PE multiples. So we are willing to pay a premium if these factors are favorable. To sum up, we have been incorporating these factors in our philosophy.

Your favorite book

One book which I found interesting is ‘Good to Great’ authored by Jim Collins. The book gives good insights into building an organization and focuses on what really matters to not only to survive and endure but to excel.

Source: https://goo.gl/i9ro1V

Interviews :: Home prices, loan rates unlikely to fall in 2018; time to buy: Harshil Mehta

Several cities under the Smart Cities initiative hold a distinct advantage and can be safe bets for ‘smart’ real estate investments, say Mehta.

Sarbajeet Sen | Retrived on 1st Jan 2018 | MoneyControl.com

The real estate sector has seen some major changes in 2017 including ushering in of RERA. It also had to bear the impact of demonetisation, which slowed down sales. In an interview to Moneycontrol, Harshil Mehta, Joint MD & CEO, DHFL, tells how he sees property prices and home loan rates moving in the New Year.

Year 2017 saw the Real Estate Regulation Act (RERA) coming into play. How has the new Act impacted the real estate market?

RERA is a well-timed effort by the government and a good step towards accomplishment of ‘Housing for All by 2022’ and other housing and housing-development related initiatives. Several states have implemented RERA and has positively impacted buyer sentiments as a result of the mandatory disclosures of project details and strict adherence to project deliverables such as the area, legality, amenities and the quality. It has also ushered a more transparent ecosystem for developers and housing finance companies. DHFL has also undertaken a drive to assist developers in various states to help them understand the regulatory implications of RERA and become RERA compliant.

How do you see home prices moving in 2018, especially in the affordable segment?

We do not foresee any reduction in prices in the affordable housing segment because of the increasing demand and the limited supply to meet this demand. To attract buyers and maintain sales volume, developers are launching attractive offers and other benefits to encourage customers to fulfill their aspiration of owning their dream home.

Home loan rates have come down substantially. Do you think there is a likelihood of further lowering of rates by lenders?

Owing to the last few monetary policies, home loan rates have stabilised and we do not foresee any further reduction.

So, for those waiting to buy property, do you think this is a good time?

Yes, it is a good time for the buyer.

What is the loan bracket that you are seeing the largest offtake?

We have been seeing a steady offtake in the affordable housing segment that ranges from Rs 15-30 lakhs. The affordable category has received a strong boost led by the government’s various incentives and efforts to stimulate the industry. All these efforts have started to show visible impact on the ground. Benefits from the recent Credit-Linked Subsidy Scheme (CLSS) under PMAY and lower interest rates have further given a boost to the consumer’s loan eligibility.

What is the home price segment DHFL is targeting?

Since inception, DHFL has always targeted the affordable housing finance segment catering to the low and middle income in the semi urban and Tier-2 and Tier-3 towns. This has remained unchanged for the last 33 years. As we mentioned earlier, we are witnessing strong uptake in the affordable finance segment driven by the incentives and conducive industry dynamics particularly from Tier 2 and 3 towns and cities which are emerging as India’s new growth engines.

Is government’s push for affordable housing having a bearing on loan offtake?

The Indian housing finance industry and, in particular, the affordable housing segment, is witnessing one of the most exciting times. Over the last few months, the Government has been taking several significant, growth-oriented steps to develop demand as well as generate greater supply through impacting policy frameworks towards greater financial inclusion. Granting infrastructure status to the real estate industry, announcing the extended CLSS to include MIG 1 & 2 and most recent announcement on RERA, are some commendable efforts to stimulate demand of affordable housing. These customer friendly measures and efforts have definitely given a strong fillip to loan offtake.

What are the market and sub-markets where you are seeing a high demand for home loan?

Affordable Housing has clearly been a central growth agenda for the Government. Initiatives such as ‘Housing for All by 2020’, PMAY, CLSS, home loan rate cuts and housing regulations such as RERA has considerably sparked interest for affordable housing options across the consumer pyramid. Most of the first-time home buyers fund their property purchase through home loans. As a result, there has been a surge in home loan demand across India specifically the Tier-2 and Tier-3 markets.

What according to you are the best emerging real estate investment destinations across the country?

Post the launch of the Smart Cities Mission in 2015, the Government shortlisted cities from all regions of India having high economic and industrial potential. Smart cities will become catalysts in improving the quality of life and give a major fillip to the real estate in urban locations. Considering the upcoming infrastructure projects and other growth drivers, several cities under the Smart Cities initiative hold a distinct advantage and can be safe bets for ‘smart’ real estate investments.

What more, according to you, needs to be done to boost the housing sector?

For all the benefits to make real impact, customer centricity is becoming key. Financial institutions and HFCs need to focus on making the entire experience of home purchase more seamless and customer friendly. Companies need to think how we can address their financial needs across their whole financial life cycle through customised products.

To further boost the affordable housing sector, external commercial borrowings (ECB) should be extended to housing finance companies to enable onward lending to developers in the segment. Also, single-window clearances is another step towards increasing development in the affordable segment and ensuring timely delivery.

Source: https://goo.gl/S2NiV6

Interviews :: Home loans slowdown driven by RERA will reverse in 8 months: ICICI Bank honcho Ravi Narayanan

Interview: Ravi Narayanan, senior general manager and head – retail secured assets, ICICI Bank.

By: Shritama Bose | Updated: November 28, 2017 12:20 PM | Financial Express

The home-loan market seems to have slowed down, first because of some postponement of demand with demonetisation, and then with the implementation of RERA. Where do you see things going from here?

The supply in the system had anyway started reducing in the last two years. Between September 2016 and September 2017, supply has dropped by over 10-12% in residential real estate in the top 40-45 cities. Till a year back, the inventory overhang used to be about 18-20 quarters in the industry. Along with supply, absorption of units was also coming down because of various reasons, one of which could be demonetisation. People expected a price correction. With RERA coming in, my estimate is that the supplies will go down still further because the act has put in various guardrails as to how the builder must manage the finances available for the project. This augurs well because inventory overhang should not be so much. The second outcome of RERA will be a rise in customer confidence. So once this whole dust settles, we will see pick-ups rising. So there will be a decrease in inventory and an increase in sales and that should be good for the industry.

Won’t that also cause asset prices to rise?

It will follow a pattern. There is an oversupply right now. If the demand-and-supply gap comes down drastically, then the prices will go up. In the next six to eight months, a lot of consolidation might happen in projects underway, which may not be amenable for prices to go up. Prices will remain, more or less, at the same level or there may be some fall in prices. Also, in the last six-seven years, real estate has seen a slight downturn. Typically, the industry follows an eight-to nine-year cycle. So in my opinion, 2018 will again see a rise in sales.

A development that followed demonetisation was the expansion of the credit-linked subsidy scheme (CLSS) for housing. Are you seeing supply and offtake picking up in that category?

Over 60% of new home launches in the industry in the first half of FY18 had ticket sizes under Rs 25 lakh. Because of this scheme under the Pradhan Mantri Awas Yojana, a lot of projects have started coming up in this category. Builders are also entitled to certain benefits if a part of their projects are of sizes below a certain threshold.

So is the phenomenon of builders allocating more space to smaller units a countrywide one?

This is happening primarily in Mumbai and Pune. Some of it is happening in Chennai and Bangalore. But, it is not happening across the country as yet. That’s partly because you have to keep operating costs and land cost under control to be in affordable housing. It is a very price-sensitive market. However, given the focus on this sector from this government, there’s bound to be more players flocking to it.

In mortgages, banks have continuously been losing market share to housing finance companies (HFCs). Have they actually weaned away bank customers for their growth?

No, because the mortgage industry is really big. The mortgage book of the country is now at Rs 15 lakh crore; over the next few years, at a CAGR (compound annual growth rate) of 20%, it should go up to Rs 50 lakh crore. When the pie is so large, everyone will have a share. It’s just a question of how each player orients themselves. Today, most banks are focused on the metros, while HFCs are operating in the peripheries (of cities). So we are not meeting each other much. But very soon, it will all become one playground. Banks venturing into the peripheries will be much faster because we anyway have branches.

Interview :: Invest cautiously, stocks over-valued: Nimesh Shah

Sidhartha | TNN | May 5, 2017, 06.22 AM IST | Times of India

ICICI Prudential Asset Management Company managing director & CEO Nimesh Shah believes in speaking his mind. While most market players are euphoric about the recent rise in stock market indices, Shah cautions investors against chasing high returns, given that the valuations are high. But he is optimistic about the medium term prospects and insists that mutual funds will be the preferred mode of investment, given the “repair work” in real estate. Excerpts:

What should someone looking to enter the stock market either with cash or via SIP do at this time?

On a price-to-earnings basis, market is over-valued at current levels. Because of the persistent flows from both foreign and domestic portfolio investors, the market is currently running a year ahead given that earnings per share (EPS) is expected to improve significantly by 2018-19. This is because we believe that over the next twothree years, capacity utilisation can increase and so can the return on equity . Currently , the macros are strong but Indian companies are facing various pockets of challenges. But consumption across the spectrum is likely to hold strong. Given this expected improvement, it is likely that there could be a consistent flow of investment from institutional investors, thereby lending a reasonable investment experience over next twothree years. But since the market is already slightly over-priced, one cannot expect abnormal returns.

For those investing via SIP , they can continue with their investments because over the next three years, the investment price will average out, thereby yielding better returns. For someone who is coming in when sensex is at 30,000 level, can consider dynamic asset allocation funds which result in lower equity exposure when the equity level is up and vice versa.

But it gives you conservative returns…

Yes, it does. But it is good to opt for conservative returns when sensex is at 30,000 level.Even if the index were to head higher say 33,000 level, the only limitation here would be that the entire upside is not captured. But when market turns volatile at higher levels, this class of funds can limit downside. As we all acknowledge, there is more pain in losing Rs 5 than the joy in gaining Rs 30.

If you are investing in equity MFs, one should consider large-caps because mid-caps are over-valued at present. Continue investing but invest with caution because returns may not be too high from current levels. Just because banking funds as a category has delivered 40% plus returns, it does not mean everyone should invest in it based on past one-year return.

A few years ago, the government was worried about the huge inflows from FIIs and feared the impact post withdrawal. But now mutual funds seem to have emerged as an effective counter-balance. Has the domestic MF industry matured?

To a certain extent domestic institutions have emerged as a strong counterbalance. Over the last few months, mutual funds and foreigners have pumped in money into stock markets, thereby pushing up benchmark indices. However, even if foreign investors were to withdraw tomorrow, Indian MF and insurance industry which is putting in over $3 billion a month, will be able to balance it out, thereby limiting any adverse shocks. Today , people refrain from investing in real estate, gold and bank FDs, which is currently yielding 6-7% return pre-tax. In such an environment, equities are becoming a TINA factor -there is no alternative. So, we believe that steady inflows may continue.

How much of small investor money is coming into the market?

Mutual fund in India is all about small investors; high net worth individuals form a very miniscule portion. We are opening nearly 120 offices across smaller towns such as Nadiad (Gujarat) and Arrah (Bihar) because we believe that MF is a viable business. We have ensured that we are present pan-India, including North East. If we can give a better alternative to unorganised investment avenues, people can invest. While people in Gujarat who are more evolved investors can move to value investing, in the East, money can be moved into mutual funds from unorganized sector, there by giving us an opportunity to show the importance of well-regulated businesses.

Will the recent change in regulations push MFs?

We are in an infinite market as the MF penetration is hardly 4% in the country . The one major challenge now is simplified onboarding process for investors. Today, 85% of our business comes from existing consumers and this shows that the market is not expanding adequately . As a fund house, we receive several queries on our website, but the conversion rate is disheartening. We have come to realize that investors are wary of the entire KYC process. Like insurance, AMCs too should be allowed to use the bank KYC details, thereby eliminating the duplication of paperwork.

The reason why bank KYC should suffice is because entire industry does not deal in cash transactions. MFs receive funds via bank accounts and at the time of redemption the funds are transferred to the same bank account. So there is absolute transparency .

Source : https://goo.gl/y2MtpW

Interview :: ‘Patience is central to success in investing’

MEERA SIVA | September 18, 2016 | The Hindu Business Line

Once invested, don’t look at the portfolio frequently

Property investments in India do not give enough inflation-adjusted return, but Indian equity and bond markets present a lot of opportunities for investors, feels Saurabh Mukherjea, CEO of Institutional Equities, Ambit Capital. Excerpts from an interview with Business Line:

How do you filter companies before you make an investment decision?

I look for good stocks with high return on capital employed and consistent revenue growth. The industry the company operates in should be attractive, that is, it should be growing at over 15 per cent annually and the top players should have sizeable market share so that profits are not eroded in competition.

Some examples are men’s shaving products, trucks and speciality chemicals. Secondly, the management has to be competent and focused on the core business.

Once invested, it is also important not to look at the portfolio too frequently. Patience is central to success in investing and money cannot be made by being hyperactive.

What red flags do you watch out for?

One must be watchful of corrupt and lazy promoters whose core competence is only making great presentations.

Even good brands in booming industries flounder due to promoter issues. Besides, in India, one in two companies has some sort of accounting issue. So we have a detailed checklist to weed out accounting problems.

Only 100-120 companies in the Indian listed universe meet these checks. I think it is best to avoid companies with governance and book keeping issues as value will be destroyed sooner or later.

What returns do you look for in your investments?

While the quoted inflation rate is a lower number, what I look at is the rate of inflation for my basket of consumption.

This is around 12 per cent. So any investment that I make must meet this cut-off for return. I invest only in products that I understand and avoid exotic asset classes and overseas markets.

What are your current investments?

Due to the nature of my job, I cannot own stocks directly. So my equity investments are through mutual funds. I also have debt investments in Government and corporate bonds.

I feel there may be some tough times ahead globally due to the negative interest rate scenario. Due to these potential uncertainties, I have invested in gold through an ETF.

What are your views on real estate as an asset class?

I own the flat we live in, but beyond that I feel property investments in India do not give enough return. I feel real estate is a silent killer in high networth portfolios insofar as such returns do not keep up with inflation experienced. A 12 per cent return, post tax, is my threshold. Rental yields are very low, at 2 per cent. So buying and renting out a residential property makes little sense.

Also, in cities such as Mumbai and New Delhi, prices went up due to huge amounts of black money. With a crackdown on that, returns will be muted.

Would you recommend direct equity investments?

There are many risks in equity investments and it is best left to experts.

So mutual funds should ideally be a good way for the average middle-class investor to get equity exposure.

However, the reality is that there are many schemes and a plethora of choices that are confusing. Investors rarely get to meet fund managers and there are no reliable filters from which one can pick fund managers.

On the other hand, you can build a portfolio of good stocks by using simple filters.

For example, companies that have seen consistent revenue growth of 15 per cent every year and 15 per cent return on capital employed.

It is possible to build a good equity portfolio with 15-20 stocks and hold it over a long-term.

Our analysis shows that the annual return of such sensibly constructed portfolios can average 25 per cent over a decade.

Buying the stocks when there is pessimism in the market is a good strategy.

One can also do systematic investments in stocks.

Source: https://goo.gl/CJD3fL

Interview :: Not every stock can perform like Sachin, try SIPs to form a balanced team

By Kshitij Anand | ECONOMICTIMES.COM | Aug 27, 2016, 03.22 PM IST

NEW DELHI: The potential for wealth creation is immense only if you follow a disciplined approach to investing instead of hunting for the one stock that can outperform every other asset class.

Investing is more like cricket, explain experts. You need players with diverse skills such as batting, bowling, fielding, wicket keeping to make a successful team. It will be foolish if you rely on just one player such as a Sachin Tendulkar to help you win matches.

In investing too, diversification is key and mutual funds create that opportunity for you. Keep investing in mutual fund via systematic investment plans (SIPs) to harness fruits of wealth creation for the future.

“Everyone cannot be a Sachin Tendulkar. To become the number one Test team, you do not require all the Sachin Tendulkars in the team. Even if you have 10 other average players and one Sachin Tendulkar, that is more than sufficient to make you wealthy,” Nilesh Shah, MD, , Kotak AMC, said in an interview with ETNow on the occasion of SIP Day.

“It is the discipline that creates wealth rather than hitting every ball for a four or a six. Whether you are keeping your money in fixed income, bank deposits, gold or cash – these are all various ways of savings, but for an ordinary investor the way to invest is through systematic investment plan (SIPs) of equity mutual funds, especially those who are not aware of the intricacies and nitty-gritty of the equity market,” he said.

If you want to create wealth without compromising on your monthly liquidity, then investing via systematic investment plans (SIPs) is your best bet. The nextgeneration retail investors understand the potential of the equity market, and that is one prime reason why we have seen a surge in average SIP investment.

Mutual funds added 12.61 lakh investor accounts, or folios, in June quarter to take the tally to a record six-year high of Rs 4.89 crore. Retail investors accounted for 95 per cent of total mutual fund (MF) folios, Amfi said in a report.

Retail folios comprising 95 per cent of total mutual fund folios expanded for the seventh straight quarter, CrisilBSE 0.14 % Research pointed in a note last month. Around 76 per cent of the total retail portfolios put money in equity-oriented funds for the seventh consecutive quarter amid an uptrend in the stock market.

Most of the mutual fund (MF) houses are mulling launch of more variants of systemic investment plans (SIPs) to attract investors. The variants include SIP topups and smart SIPs.

“No doubt, investors have started to invest in the market systematically. Approximately Rs 3,000 crore is being invested every month up from Rs 1,000 crore two years ago,” Jimeet Modi, CEO, Samco Securities, told ETMarkets.com.

“A major contribution is coming from the working class population and HNIs, as financial literacy is rapidly crossing new frontiers in India,” he said.

Modi said there were 2 million folios two years ago and now it has ballooned to 3.7 million, indicating that more and more people are investing their savings in equities through the mutual fund route.

One prime reason for the enthusiasm displayed by the fund managers is the potential of Indian economy, which can produce wealth-creating opportunities in companies.

At a time when most of the developed markets are struggling to grow, the Indian market has the potential of clocking a growth rate of above 7 per cent. The market has already bounced back 20 per cent from its 52-week low, which is a sign of strength.

“As a thumb rule, if we have tripled our economy in last 10 years, can we not double it over the next 10 years? It is not guaranteed, but possible. Now, if in next 10 years we are going to double our economy, then that economy will create companies which will create wealth for investors,” said Shah.

“If investors give money in the hands of professional fund managers, who have track records of outperforming the benchmark indices by a reasonable margin, it is fair to assume that they will continue to outperform the indices and those funds will end up creating wealth for investors,” he said.

Source: http://goo.gl/2ojvwQ

Interview :: All you need is Rs 20,000 a month for 15 yrs to be a crorepati: Nimesh Shah

By Kshitij Anand, ECONOMICTIMES.COM | Aug 10, 2016, 01.51 PM IST

The unique challenges to growth of developed markets make emerging markets, especially India, look attractive. However, a strong upside from current level looks challenging at this point in time, says Nimesh Shah, MD & CEO, ICICI Prudential AMC . In an interview with Kshitij Anand of ETMarkets.com, he shared his views on markets, GST and the behaviour of retail investors. Excerpt-

ETMarkets.com: How significant is GST reform for the economy? It looks like the market has already factored in most of the upside from the reforms? What is your take on the whole equation?

Nimesh Shah: Over the years, the goods and services tax (GST) has become a symbol of reforms in the country for both Indian as well as foreign institutional investors (FIIs). With the passage of the GST bill, sentiments have surely improved, but it is imperative to understand that the GST is unlikely to change things overnight.

As a country, we will be reaping the benefits of this reform over the next five to seven years, and not in next five months. Now the size of the organised sector in several industries is bound to go up, thanks to the improved compliance of taxation because of the nature of GST and its benefits for the economy.

At current valuation, the market seems to have fully factored in the positives of the bill. One must take cognisance of the fact that a rerating of the Indian market is likely to happen over the long run. However, if there is an immediate re-rating, solely based on the expected positives, the market is likely to see some correction.

ETMarkets.com: The domestic market is already trading at valuations that are above historic highs. Is there potential for more upside or should investors brace for a sharp fall? Some experts even call this a new normal. What is your take?

Nimesh Shah: It is premature to say high valuation is the new normal for the Indian equity market. There is a plethora of factors in the form of good monsoon, repressed oil price, bottoming of earnings de-growth, which are currently supporting market valuations.

Adding to this is the unique growth challenges of the developed markets, which make emerging markets, especially India, look attractive. However, a sharp upside from current level looks challenging at this point of time.

At the same time, one cannot completely turn a blind eye to the possibility of volatile times arising due to negative global news flow.

Historically, it has been observed that negatives on the global front have managed to trump the positives on the local front. But prudent action in times of volatility would be to use that as an opportunity.

ETMarkets.com: Has the retail investor matured in the way he invests in equities now?

Nimesh Shah: There has been a remarkable improvement over the past few years in the way retail investors invest in equities. Over the past couple of years, retail investors have preferred to approach stock market via the mutual fund route, rather than investing directly in stocks.

We see this as an acknowledgement of mutual fund industry’s robust track record, well designed and very well regulated product line and transparency.

Within the mutual fund route, the heartening feature is that increasingly funds are coming through the SIP route. As an industry, we have witnessed the SIP book swell from Rs 1,800 crore in March 2015 to nearly Rs 3,000 crore per month and growing. Other than this, the other major positive is the change in investment behaviour.

There was a time when investors used to enter at market highs and would sell in case of a correction, leading to negative investor experience. However, this has changed now, thanks to the relentless investor education initiatives by the media, distributors and fund houses. Now, the mantra is to stay invested and not be swayed by market swings.

ETMarkets.com: Can a retail investor become a crorepati by just following the SIP approach? If yes, on an average how much he needs to set aside every month to achieve that goal?

Nimesh Shah: Yes, if a retail investor invests in a diversified equity fund through a systematic investment plan over the long term, she/he can become a crorepati. For example, Rs 20,000 invested through a monthly SIP for about 15 years can grow to over Rs 1 crore, if you assume a rate of return of 12 per cent.

ETMarkets.com: Is the big bull run intact in in the domestic market? The Indian market is already up 20 per cent from its 52-week low. Do you think the current bull run is driven by liquidity rather than fundamentals? If yes, are we staring at a big slide as soon as the liquidity tap dries up?

Nimesh Shah: The current rally is fuelled by both domestic as well as global factors. One has to take into account that the current rally in emerging markets is happening after 3-4 years of underperformance vis-a-vis developed markets.

At a time when almost all the developed nations of the world are facing a zero or sub-zero interest rates coupled with muted growth, India is emerging as an oasis of growth.

Going forward, gradual improvement in demand and strong operating leverage will drive earnings in the upcoming quarters, rendering the much-required earnings support.

All these factors are likely to support the equity markets, even at a time when liquidity starts to taper down.

ETMarkets.com: What is your call on the bond market? Should investors go for debt funds?

Nimesh Shah: The Indian bond market has been an attractive bet for global investors thus far. The four factors that have worked in favour of India are a) a well-managed current account deficit (CAD), b) benign global commodity prices, c) favourable credit growth trajectory and d) non-inflationary Government policies.

Thanks to the prevailing interest rate scenario in global markets, the Reserve Bank of India (RBI) is likely to maintain an accommodative policy stance given the uncertainties on account of international factors.

We are of the view that yields will head lower in the days ahead. Therefore, we would recommend short to medium duration or accrual funds for incremental allocation.

ETMarkets.com: Fitch said the global bond market is at risk of losing $3.8 trillion. How are we placed in the global equation?

Nimesh Shah: India is far better placed in the context of international fixed income markets. In the developed markets, interest rates are at a historic low while in the case of India, interest rates are still elevated. The focus of monetary policy now is more towards managing inflation and globally it is on renewing growth.

Over the last three years, GOI and the RBI have managed to get current account deficit and domestic inflation under control, along with moderate growth and political stability. As long as this equation is not juggled with, India is well placed in the global equation.

ETMarkets.com: Can you name five stocks that you think could fetch multibagger return over the next 2-3 years. And why?

Nimesh Shah: In the current market, construction, auto ancillaries, pharma and healthcare services are the pockets that are in a position to generate attractive returns in the medium term.

ETMarkets.com: ICICI Prudential AMC has become the largest asset management company in the country. What are your five key takeaways from your journey so far?

Nimesh Shah: Our journey to the top (as the largest asset management company) has been accompanied by much learning. Primarily, as an industry, we realise when a product is transparent and is beneficial to the investor, the industry is bound to multiply several folds, with time.

Our experience shows that a fund house with a proven track record of managing investor money is bound to attract more investments.

As for investment experience, it is a noted phenomenon that investors shy away from investing in equities when valuations are cheap. Therefore, we have products like balanced, dynamic asset allocation funds that aim to benefit out of volatility and provide a better investment experience.

Lastly, one of the inherent challenges has always been simplifying the process of investing. As of now, the inflows into mutual fund schemes are limited through banking channels, thereby missing on the cash payment channel.

Once Sebi’s uniform KYC regulation is implemented, these processes are likely to be simpler, thereby aiding larger participation across financial class.

Source: http://goo.gl/04HWjP

Interview :: Top four investment mantras to beat market volatility: Madhusudan Kela

ECONOMICTIMES.COM | Jan 25, 2016, 02.54PM IST

NEW DELHI: Domestic investors may have lost close to Rs 9 lakh crore on the BSE so far in calendar 2016, largely led by a global selloff in equities, but Madhusudan Kela, Chief Investment Strategist at Reliance Capital, says the long-term bull market in India remains 100 per cent intact.

“The long-term India story is intact. I can thump the table and say that the long-term India story is intact. The bull market is 100 per cent intact. If it was not, I would not be giving you interviews,” Kela said.

Kela said what the domestic market is going through is a structural correction, and it is not in a bear market as such. The current correction across the globe might look like similar to what we witnessed in 2008, but the situation is not the same at least for India.

“This is a structural correction which may last a couple of months because once markets fall, specifically globally, a consolidation can happen,” Kela said.

“We have to watch the global events. I am not saying whether it is 2008 or not 2008. At this point of time as things stand, it does not look like 2008 at least for a country like India,” he said.

Madhusudan Kela listed four investment mantras in an interview with ET Now, which he said can steer investors comfortably in a volatile market:

Stay put in equities

One cannot evaluate performance based on six months’ return, because equity investment is not supposed to be made for six months or 12 months, specifically by retail investors. It is more of a long-term play.

“When you buy equity, why are you gauging your performance. Let us mind it, a majority of the Indian public has not yet participated in the market. We know the numbers, not even 3 per cent of the savings has come in yet to the stock market,” Kela said.

“Even though inflows to mutual funds in the past 12 months have been very good, if I take a five-year cumulative view, there is still net outflow from equities,” he said.

The absolute saving has gone up, the absolute size of GDP has gone up, the absolute size of financial savings has gone up, but net-net no money has come into equity. So this kind of a correction which has kept the medium and long-term bull market intact is a fantastic opportunity (for investors who are looking to invest in equity markets).

Buy systematically for great returns

Long-term bull markets remain intact, and investors should look at buying Indian equity systematically. “Do not be afraid. Just because Madhu Kela said that 7,200 is a good point to buy, you don’t put all your money at 7,200,” explains Kela.

“What I am saying is that markets have their own reasons and we all make our assessments and judgements based on what are the variables which are available today. If the variables change, we will change our opinion, but I am saying anyone who systematically invests through this year, he will make money in the next three to five years” he said.

Kela expects the market to be much more volatile in the first six months.

Contra call: Buy banks for next 3-4 years

Banking stocks have been on the wrong side of the market so far in calendar 2016. The S&P BSE banking index has lost nearly 10 per cent so far, with some stocks registering a double-digit cut.

“There is definitely some absolute problem in the banking space, but I think the fears are significantly exaggerated. When I meet the analyst community, even for private sector banks, they want to tell me whatever is their corporate and international book, 30 per cent will be completely written off. You take 50 per cent might be bad assets,” Kela said.

“If I take 25-30 per cent off from the balance sheet, which is to be written off over the next three-four years, some of these banks are trading at very compelling opportunities from a three-four-year perspective. Investors who have a three-four years perspective should buy bank stocks than put money in bank deposits,” Kela said.

Hope for midcap investors

The fall in the Indian market was largely led by a double-digit fall in most of the smallcap and midcap stocks, which outperformed the market in the previous calendar.

“I would not say all midcaps have a problem. Wherever there was too much euphoria, all those have corrected now,” Kela said. “Some of the midcap companies have been seeing some kind of euphoria in the last two-three years, which got built into because a number of new investors have come in,” he said.

Source : http://goo.gl/ERVnCX

The trend of rising domestic investment is likely to continue: S Krishna Kumar

Interview with CIO, Equity, Sundaram Mutual Fund

Ashley Coutinho | Mumbai | January 4, 2016 Last Updated at 22:49 IST | Business Standard

India should view the coming rate increases in the US as positive, as they show the Federal Reserve’s confidence on US growth, says S Krishna Kumar, chief investment officer, equity, at Sundaram Mutual Fund. He tells Ashley Coutinho the trend of rising domestic investment is likely to continue, reflecting a conviction in the India story. Edited excerpts:

Equity markets have seen a sustained fall since March last year. What is your outlook for the year ahead?

India stands out purely on its macro credentials. This macro strength is visible in the rupee’s resilience, fourth among a pack of 24 emerging markets(EMs). Being the largest growing economy in the world, with inflation containment and fiscal prudence, India will continue to remain differentiated in the EM space.

Will EMs such as India be in trouble if the US Fed goes aggressive on rate hikes this year?

The Fed’s December policy statement broadly clarifies three aspects — the policy stance, policy pace and balance sheet size. First, it has announced an end to an early decade-long policy of near-zero interest rates and is looking to normalise. On the pace of rate rise, it indicates a rise of around 100basis points for the year, implying 25 bps each quarter. However, a cut of 50 bps over 2016 is more likely. Third, and more important, it indicated the balance sheet size would not see a contraction and there would be a rollover of maturing treasuries and reinvestment of principal payments. This is of greater importance, as any balance sheet contraction would mean liquidity contraction and a rise in the effective Fed funds rate.

The Fed rate rise comes as a big relief for Indian markets, removing a large cloud of uncertainty. In fact, India should view the moderate rate increases in the US as positive, as this is clearly reflective of the Fed’s confidence on US growth. And, as we all know, better US growth is good for global growth and certainly positive for India.

Your assessment of the third-quarter performance of Indian companies?

We expect it to be much better than the previous quarters, from a year-on-year growth perspective. Further, the profitability improvement due to input cost savings will play a much bigger role in offsetting the deflationary impact of revenue growth. However, we see the global cyclical like commodity players continuing to suffer earnings erosion.

It’s largely the domestic institutional players that supported the market last year. Do you expect this trend to continue in 2016?

The trend of rising domestic investment is likely to continue, reflective of conviction in the India story. More important, in this volatile phase, the average investor has shown remarkable maturity and resilience. The structural increase in households’ savings rate, on the back of falling inflation, coupled with the unattractive returns from physical assets, will continue to support the domestic equity flows.

Which sectors are you bullish on?

The economy is getting back on track, while benefiting from lower inflation and rates. As investors, we are positive on cyclical sectors that feed on the economic recovery theme, such as industrials, engineering & capital goods,transportation and financials. The potential rise in disposable income, on the back of softening inflation in urban India and the seventh pay commission largesse, will definitely help consumer discretionary sectors like automobiles, lifestyle products, durables, retail and entertainment. These represent our positive bias. We remain negative on pharmaceuticals, fast moving consumer goods, telecom, information technology and metals.

Your advice to retail investors?

Retail (small) investors appear to have as much conviction in the India story asus. Still, they need constant support and reiteration in these volatile times. Invest regularly with an asset allocation that is suitable to your needs and risk appetite. Discipline, patience and diversification are important to being successful in long-term wealth creation. After the recent correction, I would recommend investors to also look at lump-sum allocation to equities.

Source: http://goo.gl/vVddGo

Interview :: Corrections have turned out to be best time for investing: Sunil Singhania

By Biswajit Baruah, ET Bureau | 2 Sep, 2015, 08.16AM IST | Economic Times

Sunil Singhania, chief investment officer – equity at Reliance Mutual Fund, said many global funds have used the current correction in the market as an opportunity to increase their India exposure. Edited excerpts from an interview with ET:

What is the mood among FIIs who have withdrawn $2.5 billion from Indian markets last month?

India continues to be a destination of high interest for all long-term global investors. August was a very volatile month for global equities, and emerging market funds got hit quite badly because of China. This has led to some redemptions from EM funds and thus there has been corresponding selling in India. There has also been arbitrage unwinding by global funds and this figure includes that also.

However, an encouraging trend is that a lot of global funds have used this opportunity to increase their India exposure. I am in New York as I give this interview, there is an increasing interest in investing in country specifics like India rather than EM, which should be very positive for Indian equity markets from a medium- to long-term perspective.

What is your outlook on growth?

The quality of numbers has been positive and improving. Government spending for the first 4 months is up sharply and there are green shoots of growth visible across quite a few industries. It’s a matter of time before the GDP numbers start to trend up above 7-7.5%.

Is the bull market over for now given the recent selloff?

We have done a study of market corrections in India over the last 15 years. Corrections in a structural positive market are the best opportunities to invest. In the past also, whether it is 2004 or 2006 or even 2011 and 2013, we have seen around 10-15% corrections. But they have turned out to be the best periods for investing.

Is the midcap party over?

A pocket of midcaps were very expensive and a correction in these stocks was a matter of time. However, typically when markets correct, the midcaps and smallcaps tend to correct slightly more. We find that even good midcaps have corrected and it’s a great time to invest in them. The uptrend in economy is near and in such situations, smaller companies do grow faster.

What’s your outlook on Fed’s rate hike?

The fear of US interest rate hikes has been there for a long time now. There is a 50:50 probability of rates being increased in September. The rate increase in this calendar year is discounted already by the markets. We have seen in the recent past that the market fears for an event for months and then when the event unfolds, the reaction is in fact positive. It happened for fear of fiscal cliff, QE tapering, Greece elections and and so on.

Chinese data continueto hurt sentiments. How should one read these indicators?

It’s difficult to analyse China. However a positive fallout of China slowing down is the sharp correction in commodity prices, including oil. Having said that, any further sharp devaluation in the yuan can definitely impact India and we should be monitoring that closely. From a global investor’s perspective, the scare of investing in China has increased and that should increase the charm of Indian equities.

Source : http://goo.gl/S0B0zL

Interviews :: ‘India to witness lower rate cycle, equities to benefit’

January 22, 2015 11:52 pm | Financial Express

Despite equity markets touching new high valuations of many stocks turning expensive, A Balasubramanian, CEO, Birla Sun Life Asset Management Company (AMC) says that one should stay invested in equities and even conservative investors should have some exposure to equity mutual funds. In an interview with Chirag Madia, Balasubramanian also says India will enter a lower interest rate regime driven largely by falling inflation and fiscal consolidation. Excerpts:

We saw a surprise cut in interest rates recently by the Reserve Bank of India (RBI). What is your outlook on debt market? Do you think we may see a ‘secular bull run’ in debt funds going forward?

We believe that directionally we will see a lower interest rate regime driven largely by falling inflation and fiscal consolidation. As a result, the bond market will continue to do well and we stay bullish on actively managed debt funds. While one cannot call this as a secular bull run,it is for certain that we are in a good period in the interest rate regime.

What are your expectations from the next RBI policy?

Bond yields and bond derivatives do reflect a significant rate cut as we move forward. We believe RBI will cut rates in a phased manner, as there are too many moving variables to track including developments in the global economy. But macro variables are favourable now for a continuous rate cut.

Where do you think the benchmark bond yield, currently close to 7.7%, will settle?

Our house view on benchmark bond yields is positive. We see intermittent volatility and movement in the range of 7.35-7.85%.

What are the key risks for debt funds in 2015?

The first risk could be a lack of improvement in the fiscal situation, second is that crude prices again start rising. In the past few months we have seen a crude price high of $110 and a low of $45, so there are chances that it might spike going forward. I don’t think there will be any major impact of hike in interest rates in the US. If that happens we might see some minimal outflows from Indian markets. But overall I don’t see any major risks which can have a big negative impact on Indian debt funds going forward.

What is your advice to investors now? Should they start investing in long term bond funds?

Investors should continue to have large exposure to debt mutual funds as they offer better returns than bank fixed deposits over time. While it offers better tax adjusted return, liquidity of such investments is also far superior. Having said so, debt mutual funds capture the real market yields on a continuous basis to provide return to investors. In terms of asset allocation, even the most conservative investor should have some exposure to equity mutual funds. I don’t think this is a time to ignore equity as it is an asset class which will help investors beat inflation over the longer period. A lot of investors have invested in chit funds for high returns. I advise them not to make the same mistake, and invest instead in equity (mutual funds) and debt mutual funds.

Birla Sun Life MF is launching an equity fund known as Manufacturing Fund. What is the basis premise of this funds? What will be the investment strategy?

The focus of this fund is investing in companies that only cater to demand in India, especially where there is supply-demand gap. Contribution of the manufacturing sector globally is around 25-28% of gross domestic product (GDP), but in India the sector still contributes only 16% of GDP. The govt is looking at a contribution of 22-25% from the manufacturing sector to GDP over the next five years. Our investment strategy will be fundamentals driven, because most of the manufacturing investments are largely driven by their own balance sheet strength. We will adopt a bottom-up approach while picking stocks for this fund. We will follow multi-cap strategy, across market capitalisation and have a diversified portfolio. I think manufacturing as a theme is a continuous one. While there may be ups and downs in domestic manufacturing, as a base it is a very sustainable theme. Given its potential to generate employment, this sector has to get a boost from the government’s point of view. There are after all over 20-22 sectors which fall within the purview of manufacturing in India.

Do you think this fund will add value to investor’s portfolio?

Birla Sun Life Manufacturing Equity Fund is a diversified equity fund and can certainly add value to the investor’s portfolio. Any investor – existing or new, should have some equity exposure. This scheme gives investors a diversified portfolio with a focus solely on the manufacturing sector. The investment principle remains the same – delivering better returns than the index. With a strong focus on this robust, sustainable manufacturing theme, this scheme provides investors a fairly sound and attractive vehicle for long term wealth creation.

Source : http://goo.gl/B4DNKi

Interview :: Fixed income & equities key investment themes for 2015: S Naren, ICICI Prudential AMC

S Naren – CIO at ICICI Prudential Asset Management Company | January 2, 2015 2:27 am | Financial Express