Category: News That Helps | NTH

NTH :: Now, get your credit score free of cost on WhatsApp

Fintech startup Wishfin has partnered with Transunion Cibil to provide credit scores through WhatsApp

Shaikh Zoaib Saleem | Last Published: Thu, Jun 28 2018. 11 15 AM IST | LiveMint.com

Over the past couple of years, credit information companies or credit bureaus operational in India—TransUnion Cibil, Equifax Credit Information Services Pvt. Ltd, Experian Credit Information Co. of India Pvt. Ltd and CRIF High Mark Credit Information Services Pvt. Ltd— have tied up with several fintech companies to provide customers credit scores, credit reports as well as monthly updates, on request.

Fintech startup Wishfin has gone a step ahead and partnered with Transunion Cibil to provide credit scores through WhatsApp.

A credit score is based on your credit history, like repayment of EMIs and credit card dues. A good credit score can boost your bargaining power when you go for a loan, especially big-ticket loans like a home loan. Some banks even offer lower rates to individuals with high scores.

How to get credit score on WhatsApp?

You are required to either give a missed call on 8287151151 or enter your mobile number on Wishfin’s website. Following this, you will get a WhatsApp message from a verified business account “Wishfin CIBIL Score”. You are required to follow the instructions and share your name, date of birth, gender, address, permanent account number or PAN and email.

Mint tried the service, and got the credit score instantly. To get a detailed report, however, you need to log in to Wishfin’s website.

You can get your report, and 12 monthly updates free of cost as of now.

How to get credit reports from other channels?

From credit bureaus: The Reserve Bank of India has mandated credit bureaus operational in India to provide one free full credit report in a year to every individual who requests for it. This will contain all the details that will be reflected in a report that a bank would get when you request for a fresh loan. You can access these reports through the websites of credit bureaus.

From fintech platforms: Fintech companies have tie-ups with credit bureaus to provide reports, mostly free of cost. In return, they get consumer data they use to cross-market products. Some fintech platforms also ask for details like salary and current employer.

Source: https://bit.ly/2tSdK4W

NTH :: Home loan: Is this right time to go for it, as banks may raise rates?

IDBI Bank has already increased its one-year MCLR rate to 8,65 percent, making its loans more expensive for customers. The bank has also increased its two-year and three-year MCLR rate to 8.7 percent and 8.8 percent, respectively

By ZeeBiz WebTeam | Updated: Mon, May 14, 2018 06:12 pm | ZeeBiz WebDesk

If you are thinking of taking a home loan then you must do it as early as possible, as banks are likely to increase their interest rates in near future. IDBI Bank has already increased its one-year MCLR rate to 8,65 percent, making its loans more expensive for customers. The bank has also increased its two-year and three-year MCLR rate to 8.7 percent and 8.8 percent, respectively. This rate has been made effective from May 12. The bank has increased MCLR in the range between 0.5 bps and 0.10 bps.

This is the base rate at which banks provide loans to its customers. If banks get cheaper loans then they also lend at cheaper rates to their customers and vis-a-vis. An increase in the MCLR means, your loans will come at a higher rate, and you will have to shell out more for auto loans, home loans, personal loans or any other loans.

The country’s largest lender State Bank of India (SBI) recently increased its home loan rate for up to Rs 30 lakh from 8.35 percent to 8.65 percent. Allahabad Bank is also providing the home loan amount up to 30 lakh at 8.35 percent.

Other banks including Axis Bank and Bank of India are giving home loans up to Rs 30 lakhs at 8.4 percent, according to Bank Bazaar. For home loans between Rs 30 lakh and 75 lakh, Allahabad Bank, Dena Bank and SBI are charging 8.35 percent. These banks are also charging the same rate for loans over Rs 75 lakhs, according to the financial services company website.

ICICI Bank, however, is charging between 8.75 and 8.95 per cent for loans over Rs 75 lakh, while HDFC Bank is providing loans at 8.6 percent for the amount exceeding Rs 75 lakh. As the banks are increasing their loan rates, this is the right time to go for home loan.

Source: https://bit.ly/2wPUABq

NTH :: Have a CIBIL score of 760? Bank of India offers home loans at cheaper rates to customers with good credit score

Bank of India will offer preferential pricing rates to borrowers with good credit scores for home loans of Rs 30 lakh and above, the state-run lender said.

By: PTI | New Delhi | Published: May 7, 2018 7:35 PM | Financial Express

Bank of India will offer preferential pricing rates to borrowers with good credit scores for home loans of Rs 30 lakh and above, the state-run lender said. Customers with CIBIL score of 760 and above will be offered loan at the minimum home loan interest rate or the marginal cost of lending rate (MCLR) for an year, the bank said in a statement. MCLR is the minimum interest rate of a bank below which it cannot lend. Those with a score of 759 and less, the rate of interest for loans of Rs 30 lakh and above will come at MCLR plus 0.10 basis points for a year.

One basis points is 100th of a percentage point. Bank of India said borrowers availing home loans of over Rs 30 lakh will be benefited from the reduced rate of interest. A consumer’s CIBIL score is a three-digit numeric summary of the credit information report (CIR) — summarising the past credit behaviour and repayment history — and ranges from 300 to 900.

The higher the score, the better are the chances of loan approval. Most banks check a consumer’s CIBIL score and report before approving a loan. “Consumers with a good credit discipline should be rewarded, as it helps propagate the importance and need to maintain a good financial history. Our preferential pricing model aims to reward high-scoring home-loan aspirants with competitive ROI, thereby helping them making their dream home a reality,” Bank of India said in a statement.

Credit information company TransUnion CIBIL’s Head of Direct to Consumers Interactive Hrushikesh Mehta said: “Bank of India’s CIBIL score-based incentive helps further highlight the need to monitor and build a positive credit profile through good credit habits.”

Source: https://bit.ly/2jES8Eg

NTH :: China’s new behaviour monitoring system to ‘purify’ its 1.4 billion population

Aakanksha Mathur | 30 April, 2018 | MeriNews

China’s new “social credit scheme” which becomes mandatory for all citizens by 2020 is designed to involuntarily rate people based on their “commercial sincerity”, “social security”, “trust breaking” and “judicial credibility”.

But what does that imply for the 1.4 billion strong Chinese population? Well, almost 11 million Chinese are no longer allowed to fly and another 4 million are barred from taking a train owing to their low personal scores. Come next week, the programme will be implemented nationwide.

According to the Chinese government, its a system to “purify” society by rewarding trust-worthy people while at the same time punishing those who are not, says a report from CBS News.

Much unlike Credit Information Bureau of India Limited (CIBIL) score which we Indians are familiar with, this new Chinese social credit score system covers a much wider scope like whether you pay your taxes on time, follow traffic rules and even on what you post online. This means that trolling someone on Twitter could severely harm your score.

Liu Hui, a journalist by profession, was recently denied an air ticket because his name featured in the list of untrustworthy people. He was asked by a court to apologize for a series of tweets that he had made and later told that his apology had been rejected on the grounds of sincerity.

“I can’t buy property. My child can’t go to a private school. You feel you’re being controlled by the list all the time,” Liu was quoted by CBS News as saying.

While getting involved in community service and buying domestically manufactured products can increase your score, indulging in acts like fraud, tax evasion and smoking in public make it drop. A low social credit score translates into the fact that you are banned from let alone buying plain or trains tickets, even a high-speed internet connection.

What makes this social credit rating system work is China’s robust network of an estimated 176 million surveillance cameras which the country plans to increase to 600 million by 2020.

In fact, in several big cities of China like Shanghai, cameras are used for tracking and catching hold of jaywalkers. The cameras first record the offence and then the recording is played on the nearby video screen to publicly shame the offender.

However, the downside of this behaviour monitoring system is that is can be abused by the government, feels Ken DeWoskin, who has studied China’s economic and political culture for over three decades.

“Well, I think that the government and the people running the plan would like it to go as deeply as possible… to determine how to allocate benefits and also how to impact and shape their behaviour,” DeWoskin told CBS News.

Not minding the collateral damage, since you were born in a communist country, being rated “trustworthy” by the government does come with fringe benefits like lower bank interest rates, discounts on energy bills and also that China’s largest online dating site reportedly even boosts the profiles of people with good credit scores.

Source: https://bit.ly/2jq1iEH

NTH :: Should EPFO subscribers hike their ETF investments?

The whole theme of EPFO providing these choices to increase and reduce equity exposure is a case of duplication of effort and design. Financial experts are advising investors to leverage existing options.

Hiral Thanawala | May 02, 2018 11:28 AM IST | Source: Moneycontrol.com

There is good news for over five crore subscribers of retirement fund body EPFO. Soon they may have an option to increase or decrease investments of their provident fund into stocks through exchange-traded funds (ETFs) in the current fiscal. In its last meeting, the Central Board of Trustees decided to explore the possibility of granting an option to increase or reduce equity allocation to subscribers contributing through ETF above the 15% cap.

The Employee Provident Fund Organisation (EPFO) had started investing in ETFs from investible deposits in August 2015. In FY16, it invested five percent of its investible deposits, which was subsequently increased to 10 percent in FY17 and 15 percent in FY18. However, subscribers were not at all pleased with this increase in exposure to equities. There were some who didn’t want to risk their retirement corpus built through the EPF route. While other subscribers were keen to increase exposure to equities for better returns in the long-term.

So, what advice do financial experts have for EPFO subscribers looking to increase their exposure to equities through the ETFs route when the option is opened up?

Who should increase or reduce investments in ETFs?

Several investors are not reasonably patient with their active investments and panic when they see volatility in the market. Chenthil Iyer, a Sebi registered investment adviser and author of ‘Everyone Has an Eye on Your Wallet! Do You?’ said these investors generally invest only in fixed deposits and post office schemes. “For such investors, increasing the equity exposure through EPF route may be a good option as it is a passive mode of investing and ensures a long-term commitment.”

For investors who manage their active investments and have a well-diversified portfolio, Iyer recommends a minimum equity exposure.

Arvind Laddha, Deputy CEO, JLT, Independent Insurance, has a word of caution. “In the past, there have been negative returns for consecutive two-to-three years or even more from equity markets and this could compromise the savings of EPFO subscribers which they are not used to.”

As not all investors understand the risk of equities and their volatile nature of returns, Kalpesh Mehta, Partner at Deloitte India, feels an investor should also consider one’s age, risk appetite, financial obligations and total net worth before increasing exposure to equities through ETFs.

Benefits of increasing investments in ETFs

Here are the benefits of increasing investments in ETFs through EPF contribution as explained by Amit Gopal, Senior Vice President, India Life Capital: 1) Regular monthly SIP because of mandatory contributions; 2) Inexpensive as employees (contributors) don’t have to pay fund management fees in the current model of EPF; and 3) Tax advantages on contributions. To this, Colonel Sanjeev Govila, CEO, Hum Fauji Initiatives lists institutional framework taking care of selection and research of equities while investing.

Drawbacks of increasing investments in ETFs

Gopal highlights drawbacks such as insufficient administrative track record, illiquidity associated with a retirement fund product, absence of choice in fund manager and products.

To this, Iyer cautions, “Putting the responsibility of equity exposure of this fund on the individual may expose it to the vagaries of the individual’s risk perception, leading to possible over-exposure.”

Make EPF more investor friendly

EPF needs to be investor friendly with additional facilities of enhancing and reducing equity allocation which is likely to be made available in the coming two-to-three months. Iyer feels periodic electronic statements should be mailed to the subscribers which clearly mentions the amount and number of units available in ETF.

“Further an automatic mode of distributing the contribution into equity and debt should be made available based on the age of the individual just like NPS.” This, he feels, will ensure minimum manual intervention in decision-making with regard to equity exposure.

According to Goyal, while EPFO have described some methods of passing on returns, nothing concrete has been implemented. “It is unclear how they will ford the system and governance challenges that could arise.”

It would therefore be good if these issues are resolved before increased allocation and employee choices are implemented. An investor needs to keep a track of this developments for their own benefit.

Leverage on existing options instead of duplicating efforts

The whole theme of EPFO providing these choices to increase and reduce equity exposure is a case of duplication of effort and design. Financial experts are advising investors to leverage existing options.

“The NPS already provides the same structure and benefit. Integrating it with the EPFO and permitting portability is a more efficient way of enhancing employee choice. NPS already has the architecture and track record of administering an employee choice model,” Gopal added.

Source: https://bit.ly/2IdyOMu

NTH :: Do not reject loan application based on CIBIL score, says HC

STAFF REPORTER | MADURAI | UPDATED: APRIL 22, 2018 04:14 IST | The Hindu

Coming to the aid of a law student who sought an educational loan from a nationalised bank, the Madurai Bench of Madras High Court has directed the bank to consider the loan application and disburse the loan within two weeks.

Justice M.S. Ramesh, hearing the plea, observed that nationalised banks had time and again rejected loan applications based on the CIBIL reports of family members.

The student being the principal borrower, the status of parents and family members could not be a criteria for rejecting the application. CIBIL score should not be a ground for rejection of an application. It was a wilful disobedience of various orders passed by the court in this regard, making this case liable for contempt of court orders. The Head of Indian Bank, which had rejected the loan, was directed to issue necessary directions to all its branches in the State to refrain from rejecting educational loan applications on such grounds.

The court was hearing the case of M.Hariharasudhan, a law student of Prist University, Thanjavur, who had sought an educational loan of Rs. 70,000 from the Indian Bank. He moved the High Court after his application was rejected based on his father’s low CIBIL score.

Source: https://bit.ly/2Ht9X3D

NTH :: Surge in self-employed taking home loans: Crisil

G BALACHANDAR | Published on April 04, 2018 | The Hindu Business Line

But delinquencies are also on the rise

CHENNAI: The share of home loans to THE self-employed has increased to a little less than a third of the overall housing loan portfolio of housing finance companies (HFCs) from one-fourth of the portfolio four years ago, points out a report of rating agency Crisil.

Primarily driven by the government impetus to affordable housing, there has been a big surge in the self-employed taking home loans. In the overall home loan portfolio of HFCs, the share of self-employed borrowers is about 30 per cent now when compared with about 20 per cent four years ago.

“Several initiatives of both the government and the regulator in the recent past have led to fast growth in home loans taken by the self-employed. We expect such mortgages to continue showing good growth because of the sharp focus of smaller HFCs and increasing interest of the larger ones,” said Krishnan Sitaraman, Senior Director, Crisil Ratings.

Loans to the self-employed segment have grown at a CAGR of about 33 per cent in the past four years, compared with 20 per cent for the overall home loan segment. Home loans outstanding in the self-employed segment are expected to have topped ₹2 lakh crore by the end of 2017-18. Though new, small and larger HFCs have been aggressively catering to the self-employed segment, banks are also strengthening their presence in the home loan segment due to subdued credit demand from corporates and asset quality pressures.

However, on the flipside, delinquencies are also rising in the self-employed segment. Gross non-performing assets (NPAs) in the segment are estimated to have inched up by 40 basis points to about 1.1 per cent by the end of 2017-18, compared with about 0.7 per cent a few years back. This trend, however, warrants caution because lending to the self-employed is largely based on assessed income. Additionally, a section of borrowers, who have a limited credit history or banking experience, are highly vulnerable to disruptions such as demonetisation, and see high volatility in cash flows in the event of exigency.

“The two-year lagged NPAs in the self-employed segment, at about 1.8 per cent, is much higher compared with about 0.6 per cent in the salaried segment, where the portfolio quality has remained largely stable over the years,” said Rama Patel, Director, Crisil Ratings.

Given that the self-employed segment is relatively riskier than the salaried segment, HFCs tend to demand higher yields to offset higher credit cost. Further, to surmount borrower data issues, HFCs are adopting practices such as offering lower loan-to-value ratio, higher in-house sourcing, and developing the expertise to assess un-documented income.

While financiers are adopting a risk-based pricing approach, long-term sustenance will depend on strong credit and underwriting practices, said the report.

Source: https://bit.ly/2Ewjvby

NTH :: Have they changed the name of your favourite mutual fund scheme? Here’s what you should do

To ensure that all schemes launched by mutual funds are distinct in terms of asset allocation and investment strategy, SEBI proposed categorisation and rationalisation of mutual fund schemes.

Nikhil Walavalkar | Mar 16, 2018 02:24 PM IST | Source: Moneycontrol.com

Mutual funds are busy changing the names of their schemes. Securities Exchange Board of India’s (Sebi) directive on the rationalisation and categorisation of mutual fund schemes has made mutual funds to drop the fancy names and fall in line. The idea is to simplify the process of understanding the mutual fund offerings and choosing schemes for investments by investors. But as the names change, there are some investors who may start worrying about their investments. If the investment you have invested into has disappeared or renamed do not get worked up. Do read on to understand how it impacts you.

What happened?

To ensure that all schemes launched by mutual funds are distinct in terms of asset allocation and investment strategy, SEBI proposed categorisation and rationalisation of mutual fund schemes. The SEBI prescription allows fund houses to offer schemes in 10 types of equity funds, 16 categories of bond funds and 6 categories of hybrid funds. Fund houses are also allowed to launch index funds, fund of funds and solution oriented schemes.

“SEBI has clearly defined norms and the asset allocation and the norms that will specify each category,” says Rupesh Bhansali, head of mutual funds, GEPL Capital. For example, a large cap fund must invest at least 80% of the money in large cap stocks. Large cap stocks are defined as top 100 companies in terms of full market capitalisation. “By introducing these norms the regulator has ensured that the apple to apple comparison of mutual fund schemes is possible,” says Bhansali.

The mutual fund houses too have started responding with change in names and investment strategy of the schemes, wherever applicable. For example, DSP Blackrock Focus 25 Fund is renamed as DSP Blackrock Focus Fund. Analysts used to treat it as a large cap fund so far. However, going ahead it will be placed in Focused Fund category.

The process of aligning with the SEBI norms will go on for a while and more fund houses will make necessary changes. The process however should not stop you from investing in mutual funds.

“Investors should first understand the category of mutual funds as each one of these has distinct characteristics,” says Swarup Mohanty, CEO of Mirae Asset Mutual Fund. Find out where your scheme is going to be placed and see what kind of investment strategy it will employ.

“If the scheme’s investment strategy and portfolio construction changes, then there is a very high possibility of changes in risks and returns associated with investing in that scheme,” Renu Pothen, head of research, FundSuperMart.com. For example, if a fund that was a primarily large cap scheme is shifted to a large and mid-cap scheme, then the risk associated with the scheme goes up as the fund manager invests minimum 35% of the money in mid cap companies. Possible higher returns come on the back of higher risks.

“The investor must assess the risk-reward in the light of his financial goals and his risk appetite before investing in that scheme. If there is a mismatch between the investor’s risk profile and the risk-reward offered by the scheme, the investor will be better off selling out his existing investments. He can look for better options elsewhere,” says Renu Pothen. While exiting a mutual fund scheme, there are implications such as exit loads and capital gains, which investors should not ignore.

“When there is a change in fundamental attribute of the scheme, the investors are given exit option without any exit load,” points out Bhansali. This exit option is not at all compulsory and should be availed if and only if there is a mismatch between your expectations and the offering. However, the capital gains will be payable in case of redemption in bond funds. Though the exits in current financial year from equity funds will lead to no tax on long term capital gains, the same will attract 10% tax after April 1, in case the gains exceed Rs 1 lakh.

Changes in regulatory framework and volatile markets may add to worries of mutual fund investors. However, mutual fund investors must take this opportunity to relook at their investment plans, say experts. If you do not understand the fine nuances of equity funds, better stick to multicap funds and let the fund manager decide what asset allocation should be within equity as an asset class.

“It is time to reassess your risk profile. Do not get carried away with high returns over last couple of years. Instead be realistic with your return expectation while building your financial plans and use short term volatility to your advantage by investing through systematic investment plan,” advises Mohanty.

Source: https://goo.gl/6FXbMV

NTH :: In a first, Citi launches T-bill rate linked home loan

PTI | March 5, 2018 | India Today

Mumbai, Mar 5 (PTI) Even as rivals continue to be reluctant about adopting external benchmarks for setting lending rates, American lender Citi today launched the countrys first market benchmark rate-linked lending product.

The bank has introduced a home loan product that will be linked to the rate of treasury bills, which is used by government for its short-term borrowings.

The lender, which already has similar external benchmark-linked products in other markets like the US and Singapore, said it does not see any impact on net interest margin (NIM), a key determinant of profitability, because of the launch of the product where a borrowers rates will be reviewed every three months.

Frustrated at poor transmission of its policy moves into lending rates for borrowers, the Reserve Bank had last October mooted the idea of moving to a market-linked benchmark and suggested three such instruments, including the T-bills rate, the rate for certificate of deposits and its own repo rate to determine the interest rate.

Bankers, led by their lobby grouping Indian Banks Association, had opposed such a move, claiming that the existing marginal cost of funding based lending rates is working well and also pointed out that deposits are not linked to any market benchmark.

Citis country business manager for global consumer banking Shinjini Kumar, said a shift to a market benchmark like the T-bill is transparent, simple and will also help with better transmission.

Loans will be sold at a fixed spread above the T-bill rate which will be maintained throughout the loan tenure, she said, adding there will be quarterly readjustments for the borrower.

There will be a range of spread above the T-bill rate which the bank will follow, its head of secured lending Rohit Ranjan said, adding the average spread will be 2 percentage points. Existing customers will also be able to move to the new product without any refinancing costs, he added.

The banks country treasurer Badrinivas NC sought to downplay concerns surrounding customers being exposed to T- bill rate volatilities, which may happen due to external events like the taper tantrum in 2013 and hinted that the rates also reflect the policy decisions at a particular point of time which get captured through the quarterly resets.

He said the bank has a diversified liability profile, including a high 60 per cent composition on the low-cost current and savings account deposits and also other retail term deposits, which will make it possible for it to offer such a product.

The bank feels the RBI will be on a long pause and may go for a hike in rates only if there is a surge in inflation, he said.

In a few cases, especially concerning top corporates, the bank has been benchmarking rates against market benchmarks but those were deals done on a one-on-one basis, and this is the first time that any lender is going to the market with such an offering, Kumar said.

The bank had a gross home loan book of Rs 9,000 crore, while the overall India book stood at Rs 57,000 crore as of December 2017. Even as rivals struggle with dud assets, its NPAs on the mortgage lending is a healthy 0.05 per cent, the bank said.

Commenting on the recent changes in priority sector lending (PSL) requirements for foreign banks, Kumar said Citi is already compliant on PSL requirements, including the sub- categories and in some cases it uses priority sector lending certificates.

The bank will be resorting to use of digital technologies and tying up with partners to comply with the new requirements, she said. PTI AA BEN BEN SDM

Source: https://goo.gl/fMCc2X

NTH :: EMIs to rise as SBI, ICICI and PNB hike lending rates

Sidhartha | Updated: Mar 1, 2018, 17:41 IST | Time of India

NEW DELHI: Several lenders, including State Bank of India, ICICI Bank and Punjab National Bank on Thursday announced an increase in lending rates, a move that may make your home loans a little expensive.

The hikes come amid tightening liquidity or cash supply in the banking system, accentuated by the year-end rush that prompted SBI, the country’s largest lender, to raise deposit rates by up to 50 basis points for retail borrowers.

On Thursday, SBI increased its marginal cost of lending rate, which is linked to the interest rate on funds raised by a bank, by 20 basis points (8.15% from 7.95%).

Like SBI, starting March 1, ICICI Bank and PNB increased their MCLR but by a slightly lower magnitude of 15 basis points. Some lenders such as HDFC Bank will review rates next week.

Typically, while extending a home loan, banks keep a spread over the MCLR which results in a higher interest rate on these loans. PNB said that its home loans will cost 8.6% for most borrowers, while women will get it at 8.55%.

SBI has a spread of 40 basis points over the MCLR for most borrowers and 35 basis points for women borrowers (100 basis points equal a percentage point).

While the government has been seeking a lower interest rate and has repeatedly prodded the Reserve Bank of India to pare policy rates, the central bank has resisted a softer interest rate regime, arguing that there is a risk of higher inflation given the recent rise in global crude petroleum prices as well as the impact of domestic measures such as higher allowances for government employees following implementation of the seventh pay commission recommendations. Besides, it has pointed to higher food prices to refrain from cutting policy rates.

With economic growth picking up, RBI may not move that path now and last month the government’s chief economic adviser Arvind Subramanian had acknowledged that the scope to lower rates may have narrowed.

Source: https://goo.gl/6yyBG9

NTH :: SBI raises interest rates on bank FD and home loans: What should you do?

After a few hikes in marginal cost based funding rate (MCLR) by some banks in past two months, banks first raised the rates on bulk deposits.

Nikhil Walavalkar | Mar 01, 2018 01:13 PM IST | Source: Moneycontrol.com

The largest public sector bank in India – State Bank of India – has decided to increase the interest rate payable on retail deposits, followed by an increase in MCLR (marginal cost of funds-based lending rate) – the rate charged on loans – by up to 20 basis points. As the largest lender revises its interest rates, should you be worried with your financial plan?

Before getting into corrective measures and means to exploit the rate action, you should spend a minute understanding why rates have gone up.

“Towards the end of the financial year the liquidity in the market has gone down. The banks are keen to raise money. The rates are hiked as a lagged response to the rising bond yields,” said Mahendra Kumar Jajoo, head – fixed income, Mirae Asset Management.

For the uninitiated, the benchmark 10-year bond yield has moved up to 7.78 percent from a low of of 6.18 percent on December 7, 2016.

Banks typically take time to raise their fixed deposit rates. After a few hikes in MCLR by some banks in past two months, banks first raised the rates on bulk deposits. Now interest rates on retail fixed deposits are being hiked. This is a sign of relief for most fixed deposit investors who were forced to consider investing in the volatile stock markets through mutual funds.

Though the interest rate hike on fixed deposits is good news for conservative investors, one should not expect fireworks in the form of aggressive rate hikes in near future.

“As of now the liquidity tightening is the cause behind the fixed deposit rate hikes. RBI has maintained its neutral stance on the monetary issues. This may change to hawkish over next six months,” said Joydeep Sen, founder of wiseinvestor.in, a Mumbai-based wealth management firm.

Though the interest rates are set to go up and others are expected to follow SBI, the process of rate hikes will be gradual. “Bank fixed deposit investors may see higher rates over next six to twelve months. You can consider opting for six months to one year fixed deposits and rolling it over at higher rates when they mature,” Sen advised.

Rising interest rates, however, ring alarm bells for both bond fund investors and borrowers. The increase in yield suppresses the prices of bonds and thereby hurts investors in bond funds as net asset values of the bond funds go down. Recent spike in bond yields have taken a heavy toll on bond funds. Long term gilt funds lost 2.1 percent over past three months, on an average.

The prevalent bond yields are a result of the market discounting RBI’s hawkish stance one year down the line, according to experts. Although opinions are divided on the extent of a further surge in yields, there seems to be a consensus when it comes to volatility in the bond market.

If you are not comfortable with the volatility, you should stay away from long-term bond funds and income funds that invest in longer-term paper.

“Short term bond funds are good investment option at this juncture as they invest in bonds maturing in two to three years, where the yields are attractive,” said Jajoo. If you are comfortable with some amount of volatility and expect a sideways move in yields, you may consider investing in income funds and dynamic bond funds.

While fixed income investors see a mixed bag in the rising interest rate regime, borrowers, especially those on floating rate liabilities, are expected to see tough times ahead. The banking sector is undergoing a situation of extreme pressure on margins due to an increase in non-performing assets like never before.

The rise in yields and fixed deposit rates will ensure that banks will be forced to raise their MCLR. This will result in an increase in the floating rate for home loan borrowers. For example, if you have a Rs 50 lakh home loan for 15 years and the rate is hiked to 8.45 percent from 8.25 percent, then the EMI changes to Rs 49,090 from Rs 48,507, an increase of Rs 583. You may ascertain the possible impact on you using EMI calculator.

“Other banks will definitely follow the MCLR hike action of SBI. The rates on home loans may be hiked by the end of this month or in early April,” said Sukanya Kumar, founder of RetailLending.com.

Banks may postpone their rate hikes to attract home loan volumes and close the financial year with good numbers. But home loan borrowers should be prepared to pay higher EMIs in the near future.

Rates will be revised depending on the MCLR time frame. For example, if your home loan is linked to 6-month MCLR, you can expect rates to change after six months from the last reset. The 6-month MCLR prevalent at that time will be applicable to your home loan at the time of reset.

If interest rates continue their journey northward, cash flows do change for you. Account for them well in advance to ensure that you do not get caught off guard.

Source: https://goo.gl/RbU7Gt

NTH :: Paytm to launch ‘Paytm Score’, its own credit rating product

Paytm will give a rating to users on its platform based on their digital transactions online.

M Devan | Monday, February 26, 2018 – 09:04 | The News Minute

The Digital India push may receive a fillip through the efforts by Paytm to launch its own credit score Paytm Score, very much on the lines of the CIBIL credit rating that has been the only parameter on which the Indian banking system has been approving loan applications.

The record of digital transactions users have carried out within the digital payments major’s ecosystem will be the basis on which it will make the evaluation of creditworthiness of an individual. Paytm has its e-wallet, Paytm Mall and also the booking platform across which customers use their digital payment modes to make payments.

These transactions will form the basic data which will be fed into the appraisal system and the ratings given. These ratings can then be shared by Paytm with lending agencies with whom it has already entered into partnerships and it has already added to its stable, a lending vertical Creditmate, which it acquired organically a few months ago.

Apart from this, Paytm has an agreement with ICICI Bank for offering short-term credits on an interest-free basis and these loans are sanctioned without any delay.

The credit rating program may itself become a financial product for Paytm and it is learnt that it has offered this to some online lending agencies and NBFCs interested in moving away from CIBIL.

The demonetization move by the Indian government, in late 2016, has helped Paytm expand its business and that has, in turn, brought in high profile investors, such as SoftBank. With that backing, the company is now able to focus its attention on growing all the verticals under its management.

With Paytm Mall and Paytm Payments Bank already doing well Paytm has expanded into new segments such as insurance, online grocery delivery with BigBasket, online ticket booking, initiatives to set up a money market fund, the partnership with PVR and more. The firm might want to evolve into a large conglomerate of services.

Source: https://goo.gl/kq6DTR

NTH :: Budget may set aside more for home-loan sop

RADHIKA MERWIN |Published on January 8, 2018 | Business Line

Despite a weak start, industry expects better response to PMAY(U) in FY19

January 8, 2018: In Budget 2018-19, the Centre may have to redo its math on the allocations to the interest subvention scheme on housing loans.

While the credit-linked subsidy scheme (CLSS) under the Pradhan Mantri Awas Yojana (Urban) [or PMAY(U)] for the middle-income group (MIG) is off to a weak start, the number of beneficiaries for the economically weaker section (EWS) and low-income group (LIG) has shot up in the past year.

MIG beneficiaries numbered a mere 9,944 and received a subsidy of ₹204.6 crore till date, Union Minister Hardeep Singh Puri told the Lok Sabha last month. However, Budget 2017-18 had allocated a larger sum of ₹1,000 crore as interest subsidy for MIG beneficiaries.

Interestingly, the number of beneficiaries under CLSS for EWS and LIG — the beneficiaries originally envisioned under PMAY(U) — rose sharply from 17,634 in 2016 to over 53,000 accounts in 2017. The ₹400 crore earmarked in last year’s Budget for this segment appears to grossly fall short of the actual disbursement.

With industry players expecting a better response to the scheme in the middle-income category, too, the Centre could end up allocating a far higher amount for CLSS in the upcoming Budget.

BUDGETARY ALLOCATION

In June 2015, the Centre had launched the CLSS under PMAY(U) for EWSs and LIGs. However, to placate the common man reeling under the impact of demonetisation, Prime Minister Narendra Modi had extended the scheme to middle-income home buyers.

Budget 2017-18 had reduced the allocation to the EWSs and LIGs to ₹400 crore from ₹475 crore in 2016-17, and instead, apportioned ₹1,000 crore to MIGs under the CLSS.

Given that a total of 80,680 beneficiaries have availed interest subsidy under the CLSS schemes for all categories until now, it would seem that a little over 53,000 EWS and LIG beneficiaries claimed interest subsidy in 2017.

This would imply a subsidy of around ₹1,300 crore disbursed against the budgeted ₹400 crore for the EWS and LIG category (assuming an average of ₹2.5 lakh per beneficiary).

The Centre had recently increased the eligible carpet area from 90 sq m to 120 sq m for MIG I and from 110 sq m to 150 sq m for MIG II.

“Based on the feedback given by industry players, the Centre has fine-tuned the scheme to cover more beneficiaries under the MIG scheme,” says Sriram Kalyanaraman, Managing Director & CEO, National Housing Bank (NHB).

He adds that there has been a significant step-up in the pace of construction of houses under the scheme, which should lead to more takers in 2018.

The NHB, one of the Central Nodal Agencies to channel the subsidy to lending institutions, has covered 42,481 accounts and disbursed ₹906 crore subsidy between April 2017 and 5 Jan 2018 under EWS and LIG.

Sudhin Choksey, Managing Director, Gruh Finance says: “The CLSS under PMAY (Urban) has been a vast improvement over the earlier schemes. Higher awareness and increase in supply of houses should see more beneficiaries being covered under the scheme”.

Gruh Finance continues to focus on the EWS and LIG segment, which constitutes 85 per cent of their loans. In 2017-18 (so far), it disbursed 25,768 loans, of which 40 per cent have availed of the interest subsidy under CLSS.

Source : https://goo.gl/PfV1mE

NTH :: Affordable home-loans next threat to banks:Moody’s-ICRA report

PTI | Updated: Jan 9, 2018, 16:01 IST | Times of India

MUMBAI: Even as a lot of thrust is being given to the affordable housing segment, a report has flagged concerns about the growing delinquencies in this segment, which are expected to continue in 2018.

Competitive pressures and larger exposure to the self-employed are the prime reasons for the build-up of stress in the segment, a joint report by Moody’s and its domestic affiliate Icra said today.

“While asset quality is expected to remain stable in the traditional housing segment, delinquencies could further build up in the affordable segment in the calendar year of 2018,” Icra’s structured finances head Vibhor Mittal said.

In a note on asset backed securities (ABS) co-written with its parent Moody’s, the report said gross-nonperforming assets in the affordable housing segment have inched up to 1.8 per cent as of September 2017.

The average cum 90+ days past due level for affordable housing was nearly seven times the level observed for traditional housing loan pools, it said.

Going into the reasons for the higher stress in the low ticket size loans, Mittal said, “this would be driven by factors like intensifying competition– resulting in some easing in lending standards — and a higher share of lending to the self-employed segment.”

It can be noted that the Modi government is targeting to ensure that there is a house for all by 2022 and has provided a lot of incentives for the affordable housing segment, including making it as a priority sector lending for banks and huge interest subvention and direct cash subsidy.

However, housing loans continue to be seen as the best performing retail loan asset class in the country, demonstrating low and stable delinquencies over the years, in 2018, it said.

This is possible because of the underlying collateral, which is self-occupied residential property, absence of steep correction in property prices and moderate loan to value ratios, the report said.

Moody’s said the impact of demonetisation and the implementation of the goods and services tax (GST) will lead to higher delinquencies in ABS for loans against property (LAP) to small and medium enterprises.

“Introduction of a GST in July 2017 and demonetization have placed stress on the SME sector,” Icra’s assistant vice- president Dipanshu Rustagi said.

The report also said auto ABS-backed by commercial vehicles loans will remain stable on the back of healthy domestic economic growth.

Icra said the microlending segment is on a “road to resurgence” after the note-ban setback with an increase in repayment rates to 94 per cent in September from the low of 87 per cent seen during December 2016 during the peak of the note-ban move.

Source:

NTH :: SBI extends home loan processing fee waiver to March-end, cuts base rate by 30 bps

PTI | Published Date: Jan 02, 2018 07:52 am | FirstPost.com

Mumbai: In a major boost to homebuyers, the country’s largest lender State Bank of India has extended the processing fee waiver till March-end and also reduced the base rate by a sharp 30 basis points to 8.65 percent.

The reduction in base rate, effective from Monday, is going to bring relief for nearly 80 lakh customers of the bank whose loans are still linked to the base rate and not the marginal cost of funds-based lending rates (MCLR).

Flushed with excess liquidity, SBI had announced processing fee waiver for auto and home loans late August. In fact, since last fiscal, and especially after the November 2016 note-ban, all the banks have been saddled with excess liquidity amidst continuing degrowth in industrial credit.

For the first time in over two years, credit uptake by corporates entered the positive terrain but with a paltry 1 percent growth in November this year. “We’ve decided to extend the ongoing waiver on home loan processing fees till March 31, 2018 for new customers and others looking to switch their existing loans to us,” SBI said in a statement on Monday.

Managing director for retail and digital banking P K Gupta said that with stability returning to the realty space after the implementation of the Real Estate Act (Rera), he sees lots of demand for home loans going ahead. “With most states having the realty regulator Rera now, stability has returned to the market in terms of project approvals. The teething troubles of the initial Rera months are behind the market. So, we foresee lots of demand for home loans. So, we think this is the right time to continue with that waiver to enable people for buy homes,” Gupta said in a concall.

The bank revised down the base rate to 8.65 percent for existing customers from 8.95 percent, while the BPLR (benchmark prime lending rate) is down from 13.70 percent to 13.40 percent.

The bank, however, did not change the marginal cost of funds-based lending rate (MCLR). The one-year MCLR of the bank stands at 7.95 percent.

“We had done the rate review in the last week of December, and based on whatever deposits rates we had, our base rate was brought down by 30 basis points to 8.65 percent now,” Gupta said.

The move is going to give nearly 80 lakh customers of SBI who were on the old lending rate regimes and have not moved to MCLR. Banks review MCLR on a monthly basis, while the base rate revision happens once a quarter.

“The MCLR was reduced earlier also as the gap between MCLR and base rate had become quite wide. This reduction will help in reducing that gap,” he said.

Due to weak transmission of policy rate by banks under the base rate system, the Reserve Bank had introduced the MCLR from 1 April, 2016.

With the banks not fully passing on the rate cuts that the central bank has done in the past two years, the regulator is not happy even with the base rate regime and has mooted an external benchmark to better reflect market realities and speedier transmission.

Gupta said the current revision of base rate will ensure transmission of the policy rate cuts in the recent past.

Source: https://goo.gl/cQ2sV2

NTH :: Will 2018 be a good time to invest in real estate?

From the past few quarters, the real estate markets in India have been going through a phase of massive change.

Kanika Gupta Shori | Retrived on 1st Dec 2017 | Moneycontrol.com

How do you time your entry in any investment channel — whether it is equities or real estate? Is it the juncture when the markets are booming and everyone is joining the fray? Does that make for a sound investment decision? Probably, not!

Most retail investors and homebuyers make this mistake. They buy when the prices are peaking. Naturally the returns are not as expected. Am I right?

Well, I am citing the basic principle of investing here. If you are on board, I would further explain why 2018 should be the year you should enter the real estate market.

From the past few quarters, the real estate market in India has been going through a phase of massive change. The regulatory reforms implemented through frameworks defined under the Real Estate Regulatory Act (RERA), and Goods & Services Tax (GST) to an extent, have led the sector in a certain direction.

It is mandatory for all the real estate projects to be in compliance with the provisions of RERA, which attempts to make sure that projects are delivered in time and the money paid by buyers for certain projects is not squandered for other purposes.

In short, RERA protects consumers’ interests. It will be impossible for fly-by-night operators to be in the market and only the most-committed players will be able to navigate the roadmap. This will benefit both buyers and sellers, in the long term.

It is a buyers’ market

The combination of excess supply, high prices and low consumption has translated into huge inventories across the country. The consumption side has also been impacted by demonetization. Clearly, it is a buyers’ market for now – and for the next few quarters. But not for long!

With RERA in place, developers are now focusing on completing their existing projects. The new home launches, across top eight cities in India, have gone down by more than 75 percent in the third quarter of the current fiscal, as per industry research reports. The overall number of project launches has gone down by more than 40 percent in the first nine months of the current calendar year. These trends imply that the supply side will gradually find some equilibrium with demand, and prices will subsequently start picking up pace.

However, in the present environment, there is a situation of excess supply and property buyers are in a better position to negotiate, and grab a great deal.

As per industry reports, the National Capital Region (NCR) and Mumbai Metropolitan Region (MMR) have around 2 lakh and 1.8 lakh unsold units respectively.

Home loan interest rates are at all-time low

The excess liquidity in the banking system have led the RBI rejig the key lending rates. Resultantly, the home loan interest rates that were recorded at around 9.5 percent a year in 2016 have now been floating in the range between 8.3-8.4 percent.

That makes for considerable savings in the EMI costs; enabling people to avail of low-cost home finance, and become a home owner. It is expected that the home loan rates will remain low for the next several quarters and may even come down further.

Considering the average annual rental yields at 5-6 percent, there is not much difference between the costs of rent and owning a home.

Steady revival of interest from global investor fraternity

The implementation of overarching regulatory mechanisms has instilled a much higher level of confidence in the global investor fraternity. The real estate sector is projected to receive Private Equity (PE) investments to the tune of US$4 billion during this fiscal year, as per industry reports.

Not just the PE funds from the US, Canada and Singapore are interested in infusing capital in the sector, but countries such as Japan, China, Qatar, Hong Kong and the Netherlands are also poised to invest in the sector.

At the same time, global sovereign wealth funds—that are otherwise known for their risk-averse, conservative approach—have been increasing their exposure to the market and it proves that the sector is headed in the right direction.

As for property buyers, it is a sign of revival on the cards.

In overall, the current environment presents an opportunity to buy property and make the best out of the coming year.

(The author is COO of Square Yards)

Source: https://goo.gl/4Vgxoe

NTH :: Home loan growth down, shows RBI data

Growth in mortgages in the banking sector slipped to 11.4% year-on-year (y-o-y) in October from 12.8% in September, data released by the Reserve Bank of India (RBI) on Thursday showed.

By: FE Bureau | Mumbai | Published: December 1, 2017 4:51 AM | Financial Express

Growth in mortgages in the banking sector slipped to 11.4% year-on-year (y-o-y) in October from 12.8% in September, data released by the Reserve Bank of India (RBI) on Thursday showed. Home-loan outstandings at banks had grown 16.6% y-o-y in October 2016. The total outstanding on mortgages in the banking system stood at Rs 9.03 lakh crore as on October 27 this year. Retail loans as a category grew 16% y-o-y in October, a shade slower than 17% in October 2016. Outstanding retail loans as on October 27 stood at Rs 17.45 lakh crore. Loans to individuals had been clocking growth figures in the mid-to-late teens since May 2015, before signs of a slowdown began to surface in November 2016.

In September, outstandings on credit cards grew the most, at 37.7%, among all categories of loans to individuals. Vehicle loans grew 7.4%, significantly slower than 23.5% in September 2016, while consumer-durable loans dropped 9.4%, as compared to a year-ago growth figure of 20.3%. Credit to industry contracted on a y-o-y basis for the thirteenth straight month in October, falling 0.2% y-o-y to Rs 26 lakh crore. In October 2016, the corresponding figure stood at Rs 26.05 lakh crore, 1.7% lower than the October 2015 level.

Industrial credit has been falling almost consistently since August 2016, with September 2016 being the only month of positive growth ever since. Credit deployment in industry fell 13.5% y-o-y in the medium industry segment. However, loans to large industry and micro-and-small industry recorded positive growth, rising 0.2% and 1.2%, respectively, over the year-ago period. Bank credit to industry has been muted for the past couple of years as lenders turned cautious amid worsening asset quality and well-rated corporates chose to raise money from the bond market.

Loan growth has been suffering partly due to capital-starved public sector banks. Analysts expect the recapitalisation of state-owned banks to fuel credit growth in the months ahead. In a recent note, Kotak Institutional Equities wrote that lenders like Bank of Baroda, Canara Bank and Union Bank of India should see loan growth improving. “Loan growth for PSU banks is also partly supported by loan buy-outs from NBFCs and private banks. Retail cycle continues to hold up well, prompting many banks to pursue this segment more aggressively,” Kotak said. Trends in the corporate loan growth appear anaemic, according to the brokerage, with few signs of a turn in the capex cycle.

Source: https://goo.gl/jbmLdS

NTH :: Tata Housing Offers 3.99% Home Loan Rate For New Buyers

By Staff Reporter | Published On: Mon, Nov 13th, 2017 | Accommodation Times Bureau

NEW DELHI: Tata Housing said they are partnered with Indiabulls Housing Finance on Friday to offer home at 3.99 percent interest rate for those home buyers who buy flat in ongoing 11 projects. In the current scenario, the home loan rates are around 8.5 percent.

On Friday ‘Monetize India’ campaign was launched by Tata Housing in partnership with Indiabulls Home Loans.

The company said in a statement, it gives more opportunity to home buyers to own Tata Housing property “at a special, one-time home loan rate of 3.99 percent. This special home loan rate would be valid for the first five years.”

“It has been an eventful year for the sector in India which is standing on the threshold of change…We hope that this will stimulate fence-sitters to act on their need or wish to invest in real estate, as it continues to be one of the best forms of security and wealth generating assets,” According to Tata Housing Head – Marketing and Sales Tarun Mehrotra.

The scheme, valid from today until December 12, 2017, would be offered across 11 projects by Tata Housing in seven cities.

Source: https://goo.gl/SNN7vP

NTH :: Seven people get Rs. 34.65-lakh home loan with fake documents in Mumbai

The police are interrogating bank employees to find out how the loan was approved despite forged documents.

Farhan Shaikh | MUMBAI | Updated: Nov 10, 2017 18:29 IST | Hindustan Times

The Santacruz police are investigating a cheating case where seven people allegedly conned Bombay Mercantile Bank to the tune of Rs. 34.65 lakh. The police registered the case after bank employee, Abuzar Rizvi, 53, lodged a complaint against seven people for fraud.

The accused allegedly forged documents to get a loan worth Rs. 34.65 lakh cleared for two flats in Malad. Senior inspector at Santacruz police station, Shantanu Pawar said, “The accused applied for a loan for two flats in Vijay Properties’ Pride Building a couple of months ago.” To find out how the loan was approved despite forged documents, the police are interrogating bank employees who were involved in the process.

The illegal nature of the documents was noticed at the Santacruz (West) branch of the bank, following which the bank officials alerted the Santacruz police station. The case was registered on Thursday under relevant sections of the Indian Penal Code (IPC) for criminal conspiracy, cheating, and forgery. The police have booked the loan applicant along with six others, including the middlemen involved in the forgery.

Bank officials at the Santacruz branch were not available for comment.

Source: https://goo.gl/Sis9UT

NTH :: Govt triples home loan limit for central govt employees to Rs 25 lakh

The government also increased the amount that a central government employee can borrow for expansion of their homes to 34 months of basic pay to a maximum of Rs 10 lakh, from Rs 1.80 lakh earlier

Sanu Sandilya | ETRealty | Updated: November 09, 2017, 18:44 IST

NEW DELHI: In a move that can give a fillip to the housing sector, the government on Thursday more than tripled the maximum amount that a central government employee can borrow from the government to Rs 25 lakh, from Rs 7.50 lakh earlier.

Revising the house building advance (HBA) rules incorporating the accepted recommendations of the 7th Pay Commission, the government also increased the amount that a central government employee can borrow for expansion of their homes to 34 months of basic pay to a maximum of Rs 10 lakh, from Rs 1.80 lakh earlier.

Cost ceiling limit of the house which an employee can construct or purchase has been increased to Rs 1 crore, with a provision of upward revision of 25% in deserving cases, from Rs 30 lakh earlier.

“People can now migrate from home loans taken from financial institutions and banks to HBA, if they so desire. This attractive package is expected to incentivize the government employee to buy house/ flat by taking the revised HBA along with other bank loans, if required. This will give a fillip to the housing infrastructure sector,” the government said in a press release.

Both spouses, if they are central government employees, are now eligible to take HBA either jointly, or separately. Earlier only one spouse was eligible for HBA.

The government has also fixed the rate of interest on HBA to 8.5%, in place of the earlier four slabs of interest rates ranging from 6% to 9.50% for loans ranging from Rs 50,000 to Rs 7.5 lakh. This rate will now be reviewed every three years. It has also withdrawn the proposal to for adding a higher rate of interest at 2.5% above the prescribed rate during sanction of HBA.

There is no change in the payment schedule. People can pay the principal first in the first 15 years, in 180 monthly instalments, and interest thereafter in next five years in 60 monthly instalments.

The house constructed or purchased with the help of HBA can be insured with the private insurance companies which are approved by the Insurance Regulatory Development Authority.

Source: https://goo.gl/WJ4uYu

NTH :: Now, BoB claims to offer the cheapest home loan

Our Bureau | MUMBAI | NOVEMBER 8 | Hindu Business Line

The clamour to be the cheapest home loan provider is getting louder. A week after SBI said it is charging the lowest interest rate on home loans following a 5-basis-point (bps) cut in its marginal cost of funds based- lending rate (MCLR), Bank of Baroda (BoB) has joined the bandwagon.

On Wednesday, BoB said it is offering the cheapest home loan rate (at its MCLR of 8.3 per cent) for ‘best rated’ customers across different categories, irrespective of the loan amount. The tenure is up to 30 years for all categories — salaried and self-employed.

‘Best rated customers’ are those with a credit score of 760 and above. For customers with a credit score below that, BoB, based on risk rating, charges a mark-up of up to 100 bps over its MCLR.

“The lowest rate of interest currently offered by other public sector banks is applicable only to a small category of customers such as salaried women seeking a loan of less than ₹30 lakh. However, a male entrepreneur with pristine credit rating seeking a home loan of more than ₹75 lakh may end up paying a rate of interest of 8.5 per cent and above at other banks,” BoB claimed in a statement.

Last week, SBI said that following a 5 bps reduction in its MCLR, its home loan rate is the lowest in the market. One bps equals one-hundredth of a percentage point.

(This article was published on November 8, 2017)

Source: https://goo.gl/1GSA7a

NTH :: State Bank of India cuts lending rates, first time in 10 months

By Sangita Mehta | ET Bureau | Updated: Oct 31, 2017, 07.48 PM IST | Economic Times

MUMBAI: Country’s largest bank, State Bank of India (SBI), announced a 5 basis point cut in its benchmark lending rates across maturity, which first cut after 10 months.

The bank has pegged its benchmark rate to 7.95% for a term of one year with effect from November 1 against 8% year charged earlier. Most banks sharply reduced marginal cost of lending rates (MCLR) in January 2017, post demonetisation exercise after they saw huge inflow of deposits.

The reduction in the lending rates also comes within weeks of Rajnish Kumar, taking charge at the helm for a term of three years. The bank will now pegged MCLR to 7.70% for overnight borrowing and 8.10% for three years. Other largest banks like ICICI Bank and HDFC Bank too may announce a token cut in the lending rates.

The new rates will immediately benefit the new borrowers. However, the existing customers may have to wait for a while since under the MCLR system the interest rates charged to the customers is locked for a fixed term.

For home loans, the interest rates are fixed for a term of one year and thus the existing borrower will benefit at the end of the lock-in period.

For salaried women borrower seeking loan of less than Rs 30 lakhs, the bank will now charge 8.30% and for loans between Rs 30 lakhs and Rs 75 lakhs it will charge 8.40%.

For non-salaried women borrower seeking loan less than Rs 30 lakhs the bank will now charge 8.40% and for loans between Rs 30 lakhs and Rs 75 lakhs it will charge 8.50%. For all other borrowers, the bank charges 5 basis points more above the rates charged to women borrower.

The reduction in rates comes at a time when the Reserve Bank of India is revising the formula of pricing the loans. An RBI committee headed by Dr Janak Raj has suggested that interest rate on loans be pegged to external benchmark rates arrived at by market trading rather than leaving it at the discretion of each bank which appear to be coming up with some formula that would defy the best rates for most customers.

While announcing the monetary policy in October 4, the RBI had said, “Arbitrariness in calculating the base rate and MCLR and spreads charged over them has undermined the integrity of the interest rate setting process. The base rate and MCLR regime is also not in sync with global practices on pricing of bank loans.”

Source: https://goo.gl/U5FNdj

NTH :: 6 ways new classification of mutual fund schemes will impact the investor

By Sanket Dhanorkar, ET Bureau|Updated: Oct 16, 2017, 11.20 AM IST

The Securities and Exchange Board of India (Sebi) has asked fund houses to classify their schemes into clearly defined categories. For long, there were no clear guidelines to categorise mutual funds. Fund houses even launched multiple schemes under each category, making scheme selection a confusing exercise for investors. To introduce clarity, Sebi has now asked fund houses to have just one scheme per category, with the exception of index funds, fund of funds and sector or thematic schemes.Mutual funds which have multiple products in a category will have to merge, wind up, or change the fundamental attributes of their products.

Simplification of choice, fewer options

At the broadest level, mutual funds will now be classified as equity, debt, hybrid, solution-oriented, and ‘other’. Equity schemes will have 10 sub-categories, including multicap, large-cap, mid-cap, large- and mid-cap, and small-cap, among others. The stocks of the top 100 companies by market value will be classified as large-caps. Those of companies ranked between 101 and 250 will be termed mid-caps, and stocks of firms beyond the top 250 by market cap will be categorised as small-caps. Debt and hybrid schemes will similarly be grouped into 16 and six sub-categories respectively.

In particular, people interested in debt and hybrid schemes will now be better placed to identify the right schemes. For instance, duration funds have been segregated into four sub-categories, based on the maturity profile of the instruments they invest in. Debt funds belonging to the broader ‘income funds’ category will now be identified as dynamic bond fund, credit risk fund, corporate bond fund, and banking and PSU fund, based on their unique characteristics. Similarly, segregation of hybrid funds—based on their equity exposure—as aggressive hybrid, conservative hybrid and balanced hybrid, will allow investors to better identify the type of hybrid fund they want to invest in.

“Now that scheme labelling is clearly linked to a fund’s strategy, the investor will clearly know what he is getting into. The fund category will define the scheme, and not its name,” says Kunal Bajaj, CEO, Clearfunds. Fund houses will also not be allowed to name schemes in a way that only highlights the return aspect of the schemes— credit opportunities, high yield, income advantage, etc.

Adherence to fund mandate

With strict classification of schemes, fund houses may not be able to alter the investing style or focus of their schemes, as they did earlier. For instance, mid-cap funds stray into the large-cap territory or across market caps, in response to market conditions, which dramatically alters their risk profile. Now, funds will be forced to maintain their investing focus. Any drastic change in style will constitute a change in the fundamentalattributes of the scheme, which would have to be communicated to the investors. For investors, this means they won’t have to worry about their chosen schemes altering mandates to something which doesn’t suit their needs or risk profile.

Better comparison with peers

Distinct categorisation of schemes will also enable a better comparison of funds within the same category. While the earlier largecap funds category had schemes with pure large-cap focus as well those with a sizeable mid-cap exposure, now such distinctly varied schemes won’t be clubbed together. This will further help investors identify the right schemes by facilitating a like-for-like comparison of funds. “All schemes of different AMCs within a similar category will have similar characteristics, which will enable customers to make a better ‘apples to apples’ comparison,” says Stephan Groening, Director, Investment Solutions, Sharekhan, BNP Paribas.

These schemes may be reclassified or merged

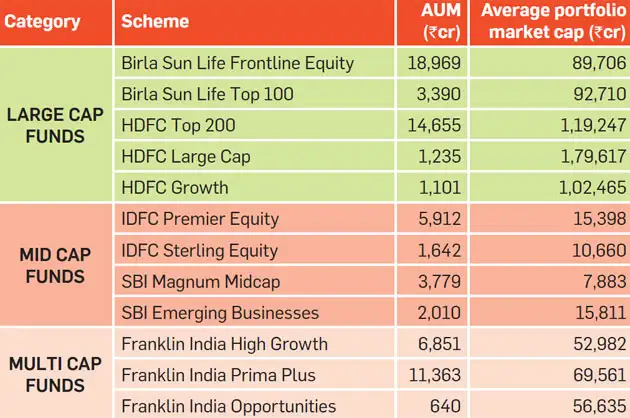

The new Sebi norms require funds to have only one scheme per category.

Note: This is only an indicative list. All schemes mentioned may be retained by the respective fund house. There may be other duplicate schemes from other fund houses also. Source: Value Research.

Sharp rise in fund corpus

Since fund houses will now be forced to merge duplicate schemes within the same categories, it may sharply increase the size of certain funds. This could hurt the scheme’s performance. “Some larger fund houses with multiple schemes will have to opt for mergers. This may lead to a sudden, sharp rise in the corpus of schemes, which could dent the fund’s returns,” says Vidya Bala, Head, Mutual Fund Research, FundsIndia. “There could also be an impact cost on the investor, as fund may rebalance or churn the portfolio to ensure the fund aligns with the category norms,” adds Bala. For instance, both HDFC Balanced and HDFC Prudence are aggressive hybrid funds, with a corpus of Rs 14,767 and Rs 30,304 crore. Merging the two will create a Rs 45,000 crore fund. However, it is more likely that the fund house may instead reposition one of the schemes in another category.

Possible fall in outperformance

While the new norms are likely to lead to better adherence to the fund style and mandate, it may result in reduction in alpha—outperformance compared to the index—for some schemes. Funds often tend to stray away from their chosen mandate in the pursuit of generating excess return over the benchmark index. Now, with limited flexibility to stray into another segment, some funds may find alpha generation more difficult than before, reckons Bala.

Need for portfolio review

Since fund houses will now have to align their product suite with these norms, there is likely to be a flurry of activity related to recategorisation of funds. In order to avoid merging certain duplicate schemes, these are likely to be renamed or reclassified into another fund category. Some funds may witness a change in scheme attributes to facilitate its repositioning. As such, over the next 5-6 months, several schemes may change colours. Investors would then have to undertake a thorough portfolio review to ensure their funds continue to meet their requirements, insists Bajaj.

Source: https://goo.gl/kEwrFg

NTH :: How your ID can be misused

Ahmedabad Mirror | Updated: Oct 17, 2017, 02.00 AM IST

This is something every Amdavadi would dread — misuse of your IT return, Aadhar card and PAN card. The email account of an officer in a private company was hacked and his IT return, Aadhar and PAN cards were recovered. Using copies of the documents, impostors tried to secure car loans from various banks in the city. The cheating came to light after an alert banker called up the officer to verify the documents.

Rajesh Panchal (33) filed an FIR at Navrangpura police station against three persons under IT Act and for misusing his documents. Panchal who resides at Sagar Apartment, near Bhavsar Hostel in New Vadaj, has been working as a team leader at a private company in Chandkheda for the past seven years. On October 7, Panchal received a call from Cosmos bank trying to verify his role as guarantor for someone seeking a car loan. A shocked Panchal said he had not stood as guarantor for anyone. Bank manager Sandeep Shah called Panchal to the bank and showed him copies of his Aadhar card, PAN card and two years’ IT returns.

The documents belonged to Rajesh but the photo and signatures on it were of another person. A person named Kaushik Shukla had applied for a car loan and had provided Panchal’s documents as his guarantor. From the bank, Panchal called up the police control room. At the time Kaushik’s friend Mahendra Chopra was also present at the bank. The bank manager, Panchal and Chopra were taken to the Navrangpura police station, where Chopra promised to produce the person named Rajesh who provided the documents.

Thereafter Panchal checked his online CIBIL score and came to know that his documents were used to secure loans from seven other banks. Panchal also found Shukla had used his name to acquire possession and allotment letter of a house, besides opening a bank account. Panchal filed an FIR with Navrangpura police against the unknown person named Rajeshkumar (resident of Amardeep Residency in Nana Chiloda), Mahendra Chopra (resident of Sayona City in Ghatlodia) and Kaushik Shukla (resident of Kulin tenament in Vasna).

Navrangpura PI R V Desai said, “On the basis of Rajesh Panchal’s complaint we have filed the offence and begun probe. Mahendra Chopra has been arrested in the past in Navrangpura and Rajasthan in a case of cheating.” Panchal said, “As my sister is a bank employee she had advised me to check my CIBIL. From there I got to know that loans under my name had been sought from seven banks. The documents had reached the bank manager which had the accused’s name and phone number on it. But the con came to light as the bank manager called on the number mentioned on the IT return documents. I believe this is the work of a gang. My documents were obtained by hacking my email id and password.”

Source: https://goo.gl/sPJdAe

NTH :: Have accounts with these banks? Your cheque book, IFSC code will become invalid from 1 October

Bindisha Sarang | Sep, 29 2017 21:22:01 IST | First Post

For the customers who hold accounts in six state-run banks, here’s a reminder. Sunday, or 1 October is an important date for you because that is the day their cheque books and India Financial System (IFS) codes of their branches would become invalid. These banks are — State Bank of Patiala, State Bank of Bikaner and Jaipur, State Bank of Raipur, State Bank of Travancore, State Bank of Hyderabad and Bhartiya Mahila Bank (BMB).

The government had in February approved the merger of these five associate banks with SBI. Later in March, BMB too got the approval to join the group. With these six banks merging, SBI now becomes a bank with total assets worth Rs 29 lakh crore.

The bank has been asking customers of all these banks to apply for SBI cheque books via net banking, mobile banking, ATM, or by visiting the home branch. Which means if you still haven’t applied for the new cheque books, you have to do it at the earliest.

This is because the cheque books issued by these six banks cannot be used. Also if you have issued any post-dated cheques, you need to take care of them. It’s better you iron out these issues beforehand, if possible today itself. This means you will have to recall the post-dated cheques and issue new ones.

In the past, most acquiring banks let the fixed deposits run their course. Which means old terms continue.

As far as mobile banking goes, you will have to make sure that you make the necessary changes there as well. Since the old IFSC code is no longer valid you will have to start using the new IFS code.

However, SBI hasn’t said a word about ECS issued by the customers of these half a dozen banks. It is safe to deduce that they SBI will take care of things at the back-end, and you need not worry about it. That’s how it has been whenever bank mergers happened. For instance, a few years ago when United Western Bank merged with IDBI Bank, the latter used an account mapping technique for ECS, without discomforting the customers.

Source: https://goo.gl/7zvjJx

NTH :: No credit or debit card of any bank restricted for payment: IRCTC

No credit or debit card of any bank restricted for payment: IRCTC Debit and credit cards of any Indian bank powered by Master or Visa, can be accepted in any of the seven gateways on the site

Press Trust of India | New Delhi | Last Updated at September 23, 2017 10:51 IST | Business Standard

Amidst reports of IRCTC barring certain banks from using its payment gateway for debit card transactions, the railways’ tourism and catering arm issued a statement denying the reports.

The IRCTC has said options to pay through payment gateway using debit/credit card and internet banking are open for all banks.

“No debit or credit card of any bank has been restricted by the IRCTC for acceptance on any of the gateway,” it said.

Debit and credit cards of any Indian bank powered by Master or Visa, can be accepted in any of the seven gateways on the site, the statement clarified.

However, it said the IRCTC has provides a value-added service of direct integration to some banks which would allow speedy transactions and reconciliations.

“Since direct integration comes at an added cost to the IRCTC, these banks were asked to share a part of their transaction charges with IRCTC,” it said.

A senior official of the IRCTC said that it was not possible for it to bear cost of individual linkage to bank websites.

“IRCTC had asked banks to share the revenue earned from online tickets because of these value-added services but some banks refused,” he said.

The IRCTC has said that if banks are willing to give the facility of zero transaction charges on their debit cards to rail ticket customers then it will give them the facility of direct debit card integration also.

The statement has further said that banks should abide by the RBI guidelines regarding transaction charges on debit cards by charging only 0.25 per cent on transactions of up to Rs 1,000 and a maximum of 0.5 per cent on transactions of values between Rs 1,000 and Rs 2,000.

Source: https://goo.gl/eKftFZ

NTH :: No homes, no EMIs! Can Jaypee home buyers seek legal recourse?

By Vandana Ramnani | Sep 14, 2017 03:54 PM IST | Source: Moneycontrol.com

Jaypee home buyers want interim relief from court that they should be allowed to stop paying EMIs until flats are delivered to them as they have no hope yet

More than 100 homebuyers, who have invested their hard-earned money in Jaypee projects, are planning to move court to grant them interim relief to allow them to stop paying their equated monthly instalments (EMIs) until completed residential units are delivered to them.